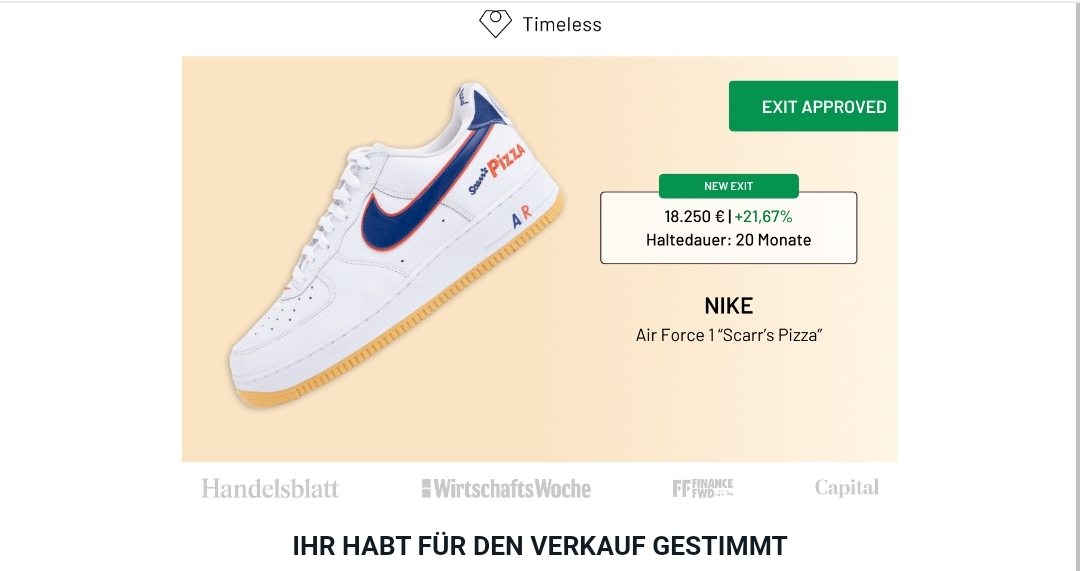

Some time ago, I explained my strategy for Timeless. Today I can tell you about my experience after my second exit.

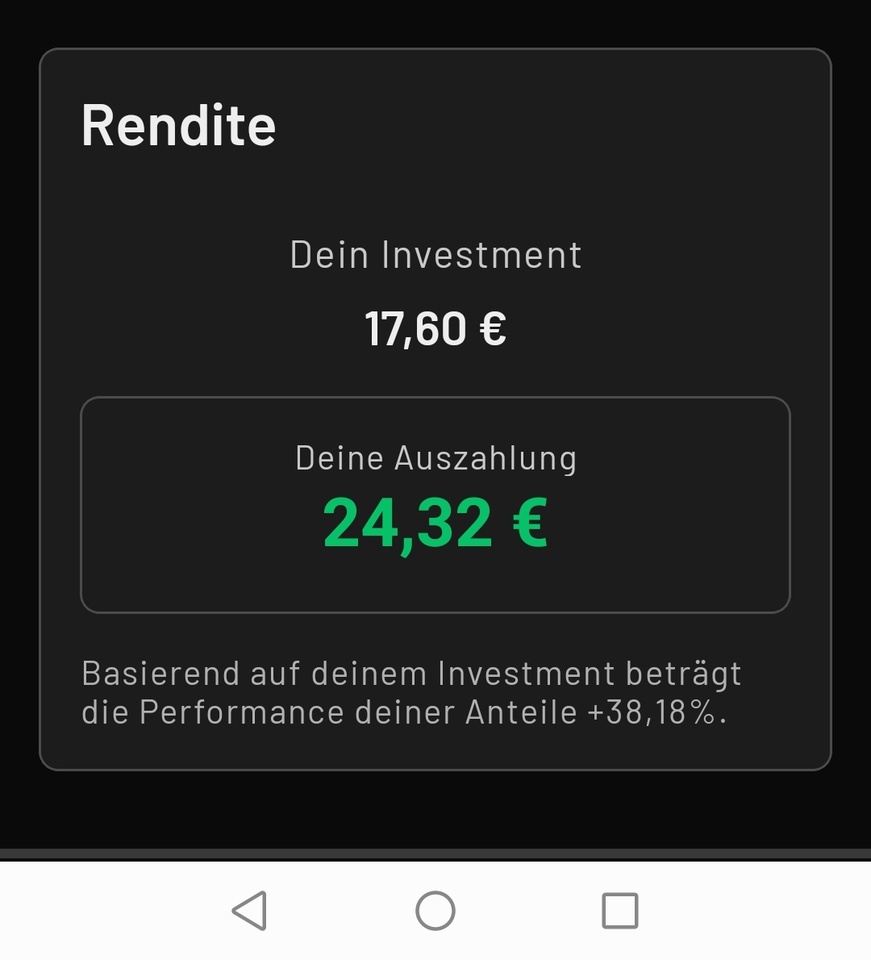

At the time, I was looking for an asset that had already been available for trading on Timeless for some time. I was looking for assets that were trading below market value. This was 10euro per share, so I was looking for 2 shares under 9 euros. Now the shares were sold for 12,16/per share. This corresponds to an increase of 38%. Of course, many will say that this is only a profit of 6 euros. But in the end it's the return that counts...