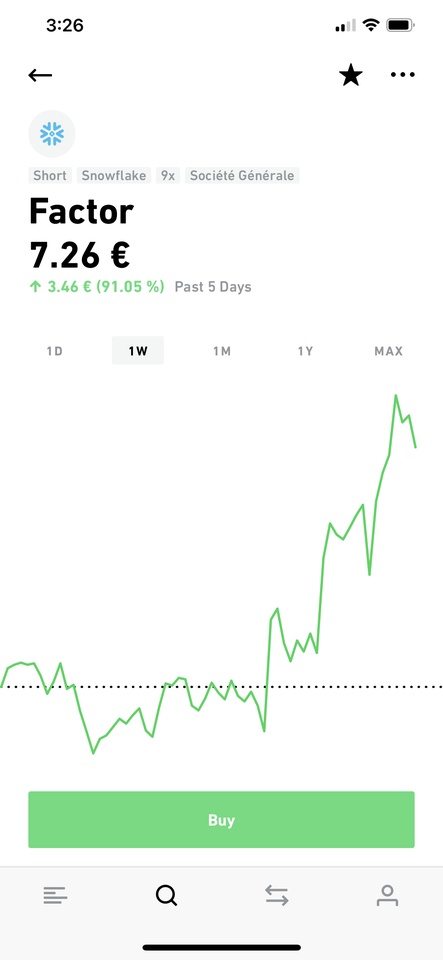

On Wednesday I had my first experience with a derivative in this case "factor" on Trade Republic (Shot Factor 9x snowflake $SNOW).

I invested very little because I wanted to know how it works.

Learnings:

A. There is a "buy in" in this case it was around 4 euro which is of course quite high if you have invested only 35$. So that means I had to make up for my lost percentages yesterday, so that I can get back into the plus again.

B. The warrant moves not only with the price change of the course, but also with other factors. The price of an option is influenced by the price of the underlying, the strike price, the time value, the volatility and the interest rates.

C. The price had also moved in and out all day yesterday, even with very small change. Of course, also because of the nine factor.

D. It has filled up like in the casino, which can be very dangerous. One should always be aware of his risk and never have too much!

Who of you is long/short expert here? Do you guys have any tips?

#longshort #factor