Brief Synopsis:

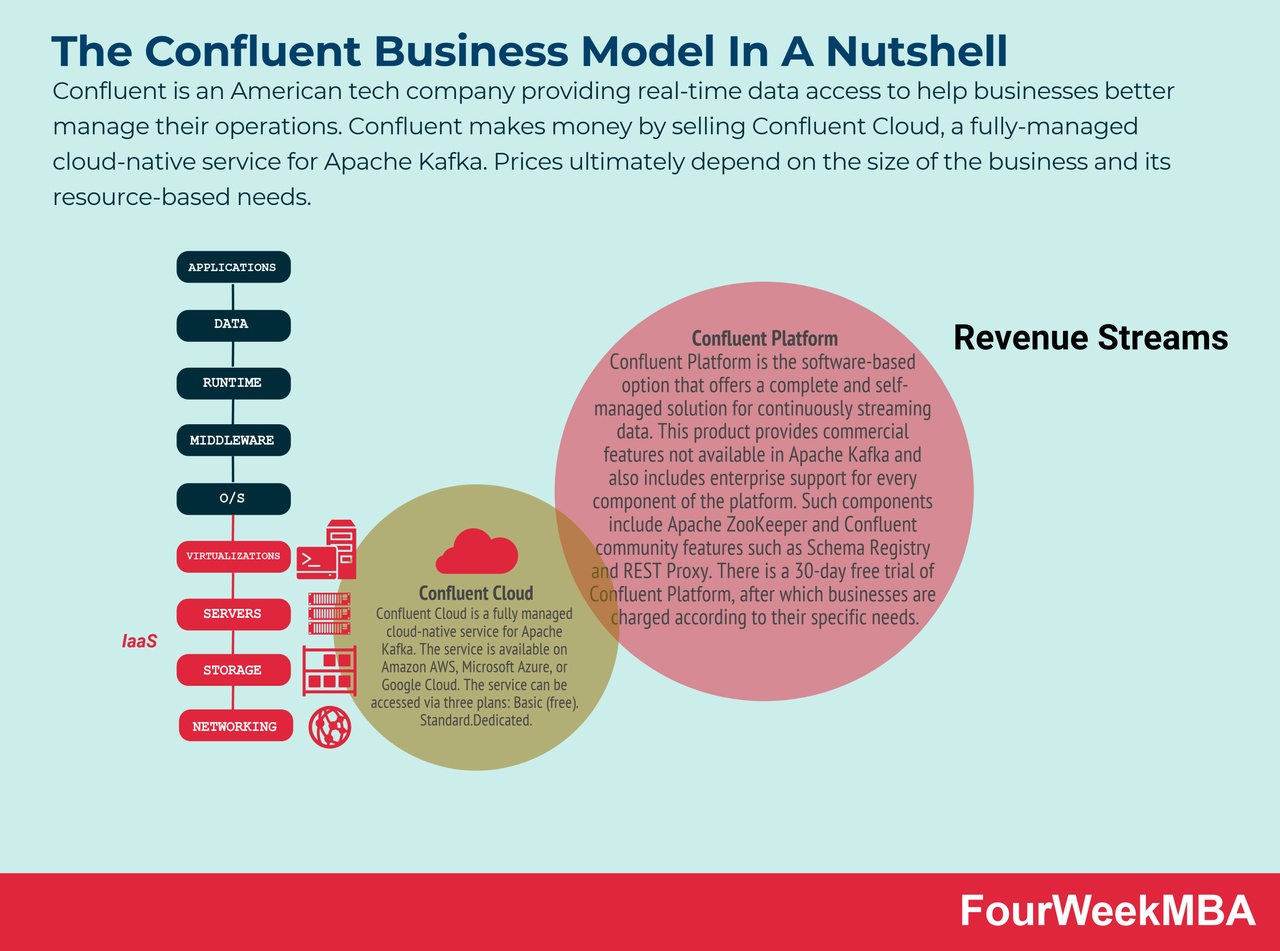

Confluent is an American technology company that provides real-time data access to help organizations better manage their operations¹. Confluent is based on the **Apache Kafka platform**, an open source distributed storage system developed by former LinkedIn engineers Jay Kreps, Jun Rao and Neha Narkhede¹. Confluent makes money selling **Confluent Cloud**, a fully managed cloud-native service for Apache Kafka, and **Confluent Platform**, a software solution for installing and managing Apache Kafka on its own servers¹². Pricing is ultimately based on the size of the business and its resource-based needs¹. As of March 2021, Confluent served approximately **2,540 customers**, 136 of which are companies on the Fortune 500 list¹. Confluent's stock has been listed on the NASDAQ under the symbol **CFLT** since June 2021²³.

Source: conversation with Bing, 6/14/2023.

(1) How does Confluent make money? The Confluent business model in a nutshell .... https://fourweekmba.com/de/wie-verdient-confluent-geld/.

(2) Confluent SHARE | Share Price & News | A3CS43 - boerse.de. https://www.boerse.de/aktien/Confluent-Aktie/US20717M1036.

(3) CONFLUENT, INC. : Share Price Stock Exchange | A3CS43 - MarketScreener. https://de.marketscreener.com/kurs/aktie/CONFLUENT-INC-124047168/.

Own Opinion:

I work in the IT industry and see Apache Kafaka everywhere and it is used as a central "control center" for all traffic (AI data pots are also built with it) with a huge ecosystem, making it difficult to migrate away from.

The tool is being used more and more and because of its central importance in the IT infrastructure, everyone is buying it managed by Confluent.

However, is a growth company and has come under the interest wheels.

When interest rates drop, this thing will continue to go through the roof.

A little food for thought for your own research,

Peace