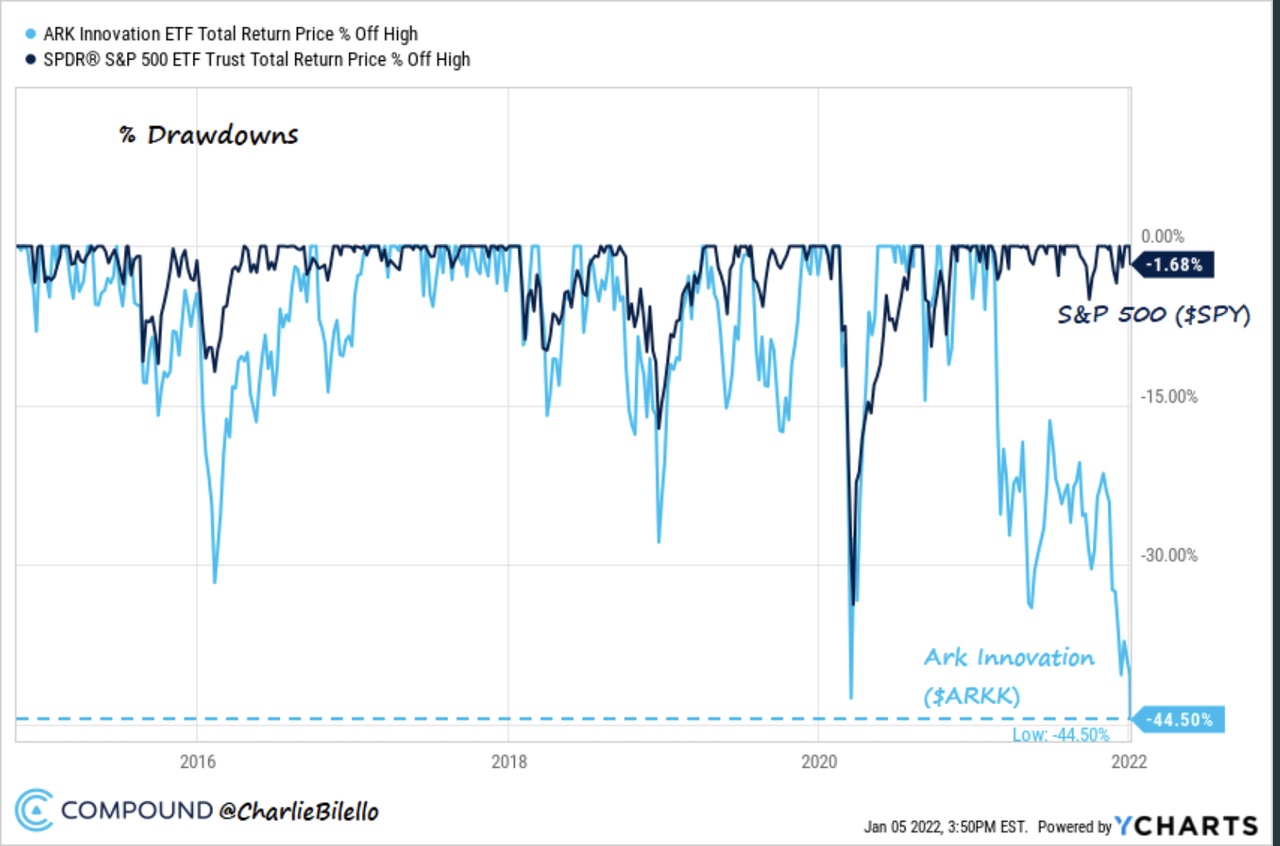

The ARK innovation ETF has lost a lot of strength in recent months. I don't see much improvement in sight for 2022. At the moment, I'm leaning more towards EU Value. I find Katie Wood's approach interesting. However, ARK Innovation is not an investment for me, even if it could recover in the short term.

Chart by Charlie Bilello.