#depot

#depotupdate

#vorstellung

$WIE (-0.16%) Wienerberger is a company that few people know and yet the Group plays at the top worldwide.

Wienerberger AG is a 🇦🇹 Austria-based company with around 20,000 employees worldwide. Field of activity... construction, i.e. it produces roof tiles, pipes, walls, facades and is the largest tile producer 🌎 worldwide and the number 1 for clay roof tiles in 🇪🇺Europa.

In summary, a business that can be described as more than solid. Building houses, tiling roofs, laying terraces and surfaces, and laying pipes. As long as mankind is building, demand will not diminish.

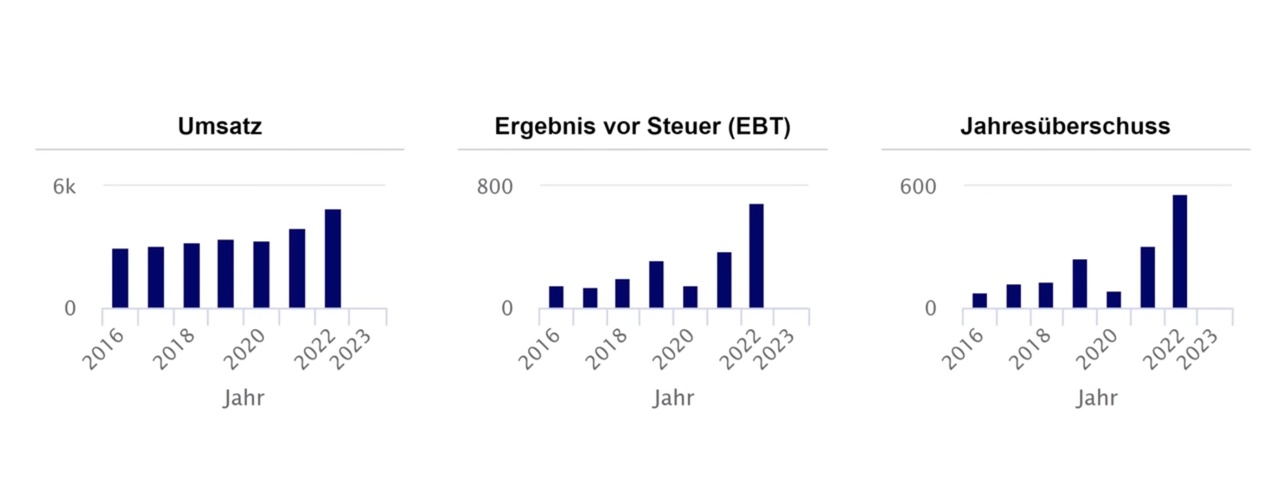

The figures are rising year after year, there was a slight dip during the coronavirus crisis, but then the figures picked up again. (Image)

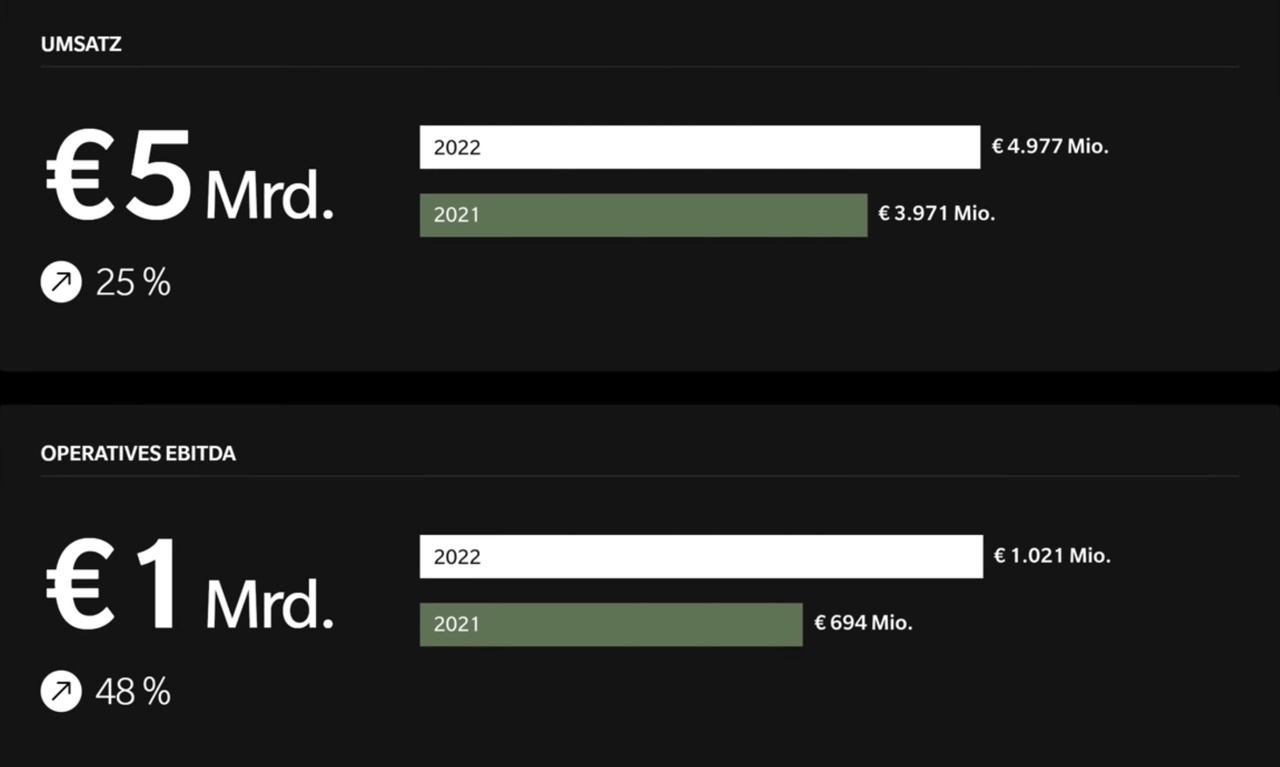

Sales growth 25% to €5 billion, operating EBITDA 48% to €1 billion (image)

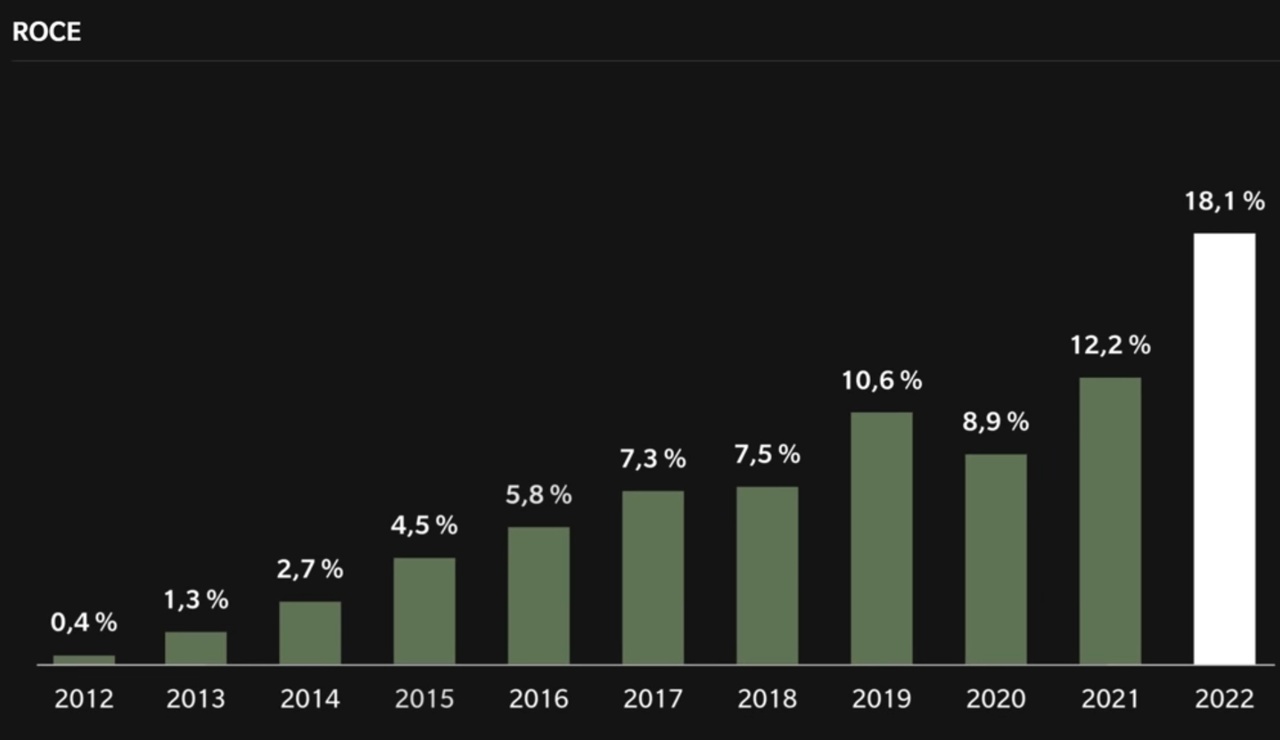

ROCE, return on capital employed (a key figure that illustrates how much return can be achieved by using a certain amount of capital) is also increasing year on year.

To our dividend hunters, yes, the company pays dividends year after year.

- Dividend yield 3.3%

- Pay-out from profit 20%

- Average increase 5 years 29%

- Average increase 10 years 24%

Market capitalization EUR 2.89 bn

P/E RATIO 7.72

Strong growth, solid market environment, strong market position, strong dividend profile.

Perhaps there will be another small update as soon as the new figures for 2023 are published.

Source: https://www.wienerberger.de/

https://de.marketscreener.com/kurs/aktie/WIENERBERGER-AG-6492024/