DBS Group: The best bank in the world?

Reading time: too long to start the clock

Part:1

Company presentation: $D05 (+0.1%)

Bank Limited

DBS Bank Limited, originally founded as The Development Bank of Singapore Limited, is the leading financial services company in Southeast Asia and one of the largest banks in Asia. Headquartered in Singapore, DBS has assets of 739 billion Singapore dollars (as at end 2023). The bank offers a comprehensive range of services to retail, small and medium-sized enterprises (SMEs) and corporate clients and operates in 18 markets, including major regions such as Greater China, Southeast Asia and South Asia.

Historical development

DBS was established on July 16, 1968 by the Singapore government to take over the industrial financing functions of the Economic Development Board. Initially, the bank's focus was on financing Singapore's industrialization and the government's urban development projects. Over the years, DBS evolved from a pure development bank to a global financial services provider and adopted its current name in 2003, underscoring its transformation and international focus.

Business Model

DBS's business model is based on providing comprehensive financial services that include consumer banking, SME services and corporate finance. The bank is known for its innovation leadership in digital banking and has been recognized as the "World's Best Digital Bank" multiple times. DBS takes a "phygital" approach that seamlessly integrates physical and digital services to ensure high customer retention and increased profitability.

Core competencies

The core competencies of DBS include:

- Digital transformation: DBS has established itself as a leader in digital banking and continuously invests in advanced technologies to optimize banking processes and enhance customer experience.

- Strong market presence in Asia: With deep roots in Asian markets, DBS has an in-depth understanding of regional business dynamics which it leverages for sustainable growth.

- Customer focus: The bank's customer-centric strategy aims to comprehensively understand its customers' needs and offer customized solutions that go beyond standardized banking services.

Future prospects and strategic initiatives

DBS plans to further expand its presence in key markets such as China, India, Indonesia and Taiwan. The bank is focusing on a strategy that combines digital expansion with physical services to consolidate its market position and tap into new growth opportunities. In addition, DBS is investing in artificial intelligence and digital ecosystems to develop new business areas and improve the experience of its customers and employees.

Overall, DBS remains committed to further strengthening its position as a leading financial institution in Asia. Through the targeted use of emerging technologies and a focus on sustainable banking, the bank aims to meet both the current and future demands of the global financial market.

Insider

If you believe in the concept of "skin in the game", you might be disappointed with DBS. The board members together only hold around 0.28% of the shares, which is relatively small. On the other hand, there is no dilution, as there is hardly any stock-based compensation.

Shares held by board members:

- Li Ming-Nee-Ong Lee: 0.18%

- Piyush Gupta: 0.08%

- Lim Huat Seah: 0.01%

- Tse Ghow Lim: 0.01%

- Sai Choy Tham: 0%

- Tian Yee Ho: 0%

- Bonghan Cho: 0%

- Weng Kin Lim: 0%

- Punita Lal: 0%

- Judy Lee: 0%

- Hing Yuen Ho: 0%

Total percentage of board members:

0.18%+0.08%+0.01%+0.01%=0.28%0.18\% + 0.08\% + 0.01\% + 0.01\% = 0.28\%0.18%+0.08%+0.01%+0.01%=0.28%

In comparison, the top 20 investors hold a significant share of DBS:

Shares held by the top 20 investors:

- Temasek Holdings (Private) Limited: 28.74%

- The Vanguard Group, Inc.: 2.78%

- BlackRock, Inc.: 2.24%

- Capital Research and Management Company: 1.96%

- Government Pension Fund Global: 1.44%

- Norges Bank Investment Management: 1.44%

- JP Morgan Asset Management: 1.31%

- Massachusetts Financial Services Company: 1.08%

- Vanguard STAR Funds - Vanguard Total International Stock ETF: 0.98%

- Capital Income Builder: 0.76%

- Harding Loevner LP: 0.61%

- Geode Capital Management, LLC: 0.60%

- Harding, Loevner Funds, Inc. - International Equity Portfolio: 0.60%

- Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF: 0.59%

- Franklin Resources, Inc.: 0.55%

- Davis Selected Advisers LP: 0.54%

- abrdn plc: 0.51%

- Schroder Investment Management (Singapore) Ltd: 0.51%

- State Street Global Advisors, Inc.: 0.51%

- New Perspective Fund: 0.50%

Total share of the top 20 investors:

28.74%+2.78%+2.24%+1.96%+1.44%+1.44%+1.31%+1.08%+0.98%+0.76%+0.61%+0.60%+0.60%+0.59%+0.55%+0.54%+0.51%+0.51%+0.51%+0.50%=51.24%28.74\% + 2.78\% + 2.24\% + 1.96\% + 1.44\% + 1.44\% + 1.31\% + 1.08\% + 0.98\% + 0.76\% + 0.61\% + 0.60\% + 0.60\% + 0.59\% + 0.55\% + 0.54\% + 0.51\% + 0.51\% + 0.51\% + 0.50\% = 51.24\%28.74%+2.78%+2.24%+1.96%+1.44%+1.44%+1.31%+1.08%+0.98%+0.76%+0.61%+0.60%+0.60%+0.59%+0.55%+0.54%+0.51%+0.51%+0.51%+0.50%=51.24%

The top 20 investors therefore hold a total of 51.24% of the shares in DBS Group Holdings Ltd, which represents a significant concentration of capital.

Share performance

Over the year, DBS shares are up 25.45%, which is remarkable, especially given the current challenges in the Asian region. Since the IPO, the share price has risen by 518%, which is a rather moderate performance compared to other large financial institutions. However, it is important to remember that historical performance does not necessarily reflect future performance.

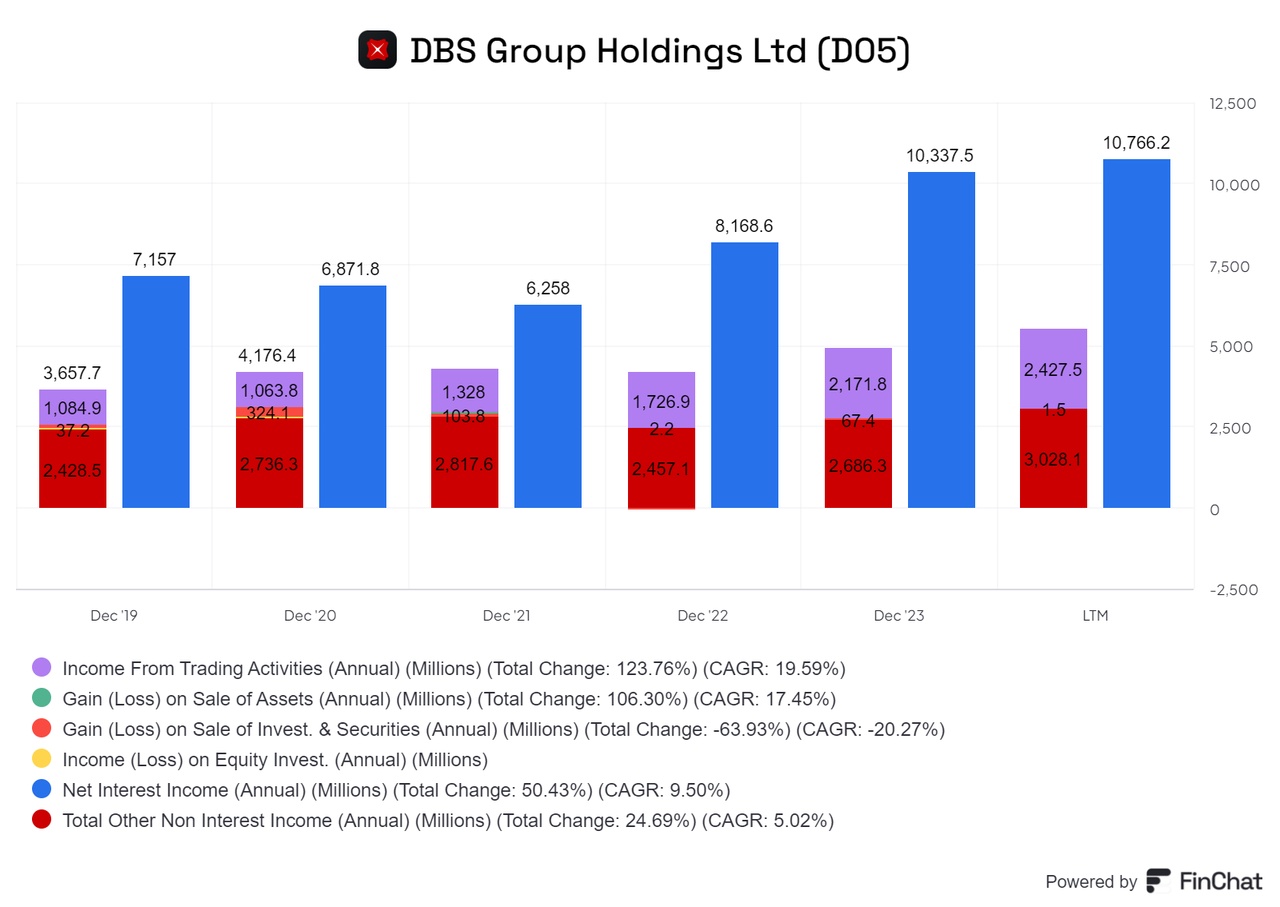

Turnover distribution

A significant proportion of around 75% of revenue comes from interest income, indicating a clear need for diversification. This heavy reliance on interest income makes DBS vulnerable to fluctuations in the interest rate markets and it may make sense to diversify its revenue streams to increase long-term stability.

(Image )

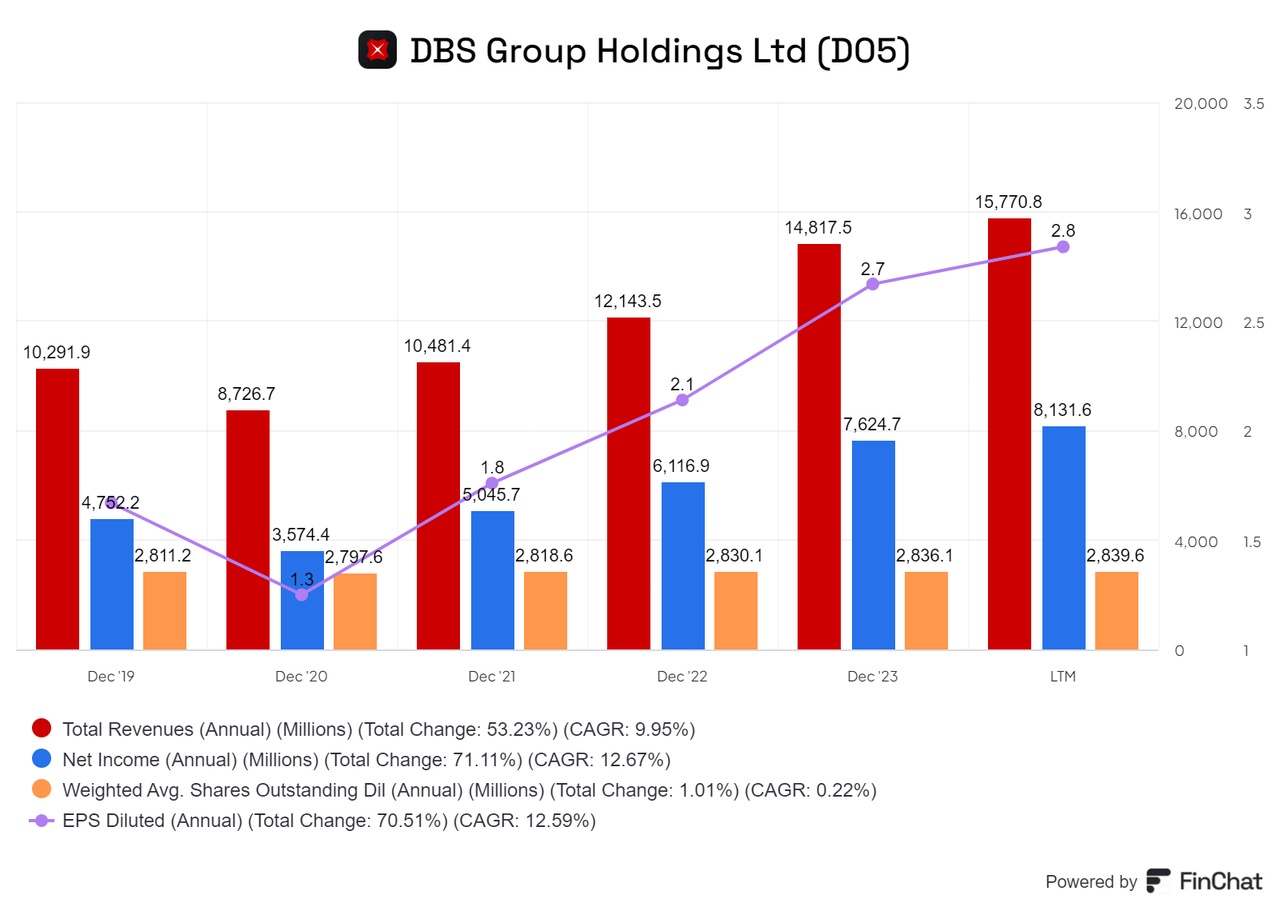

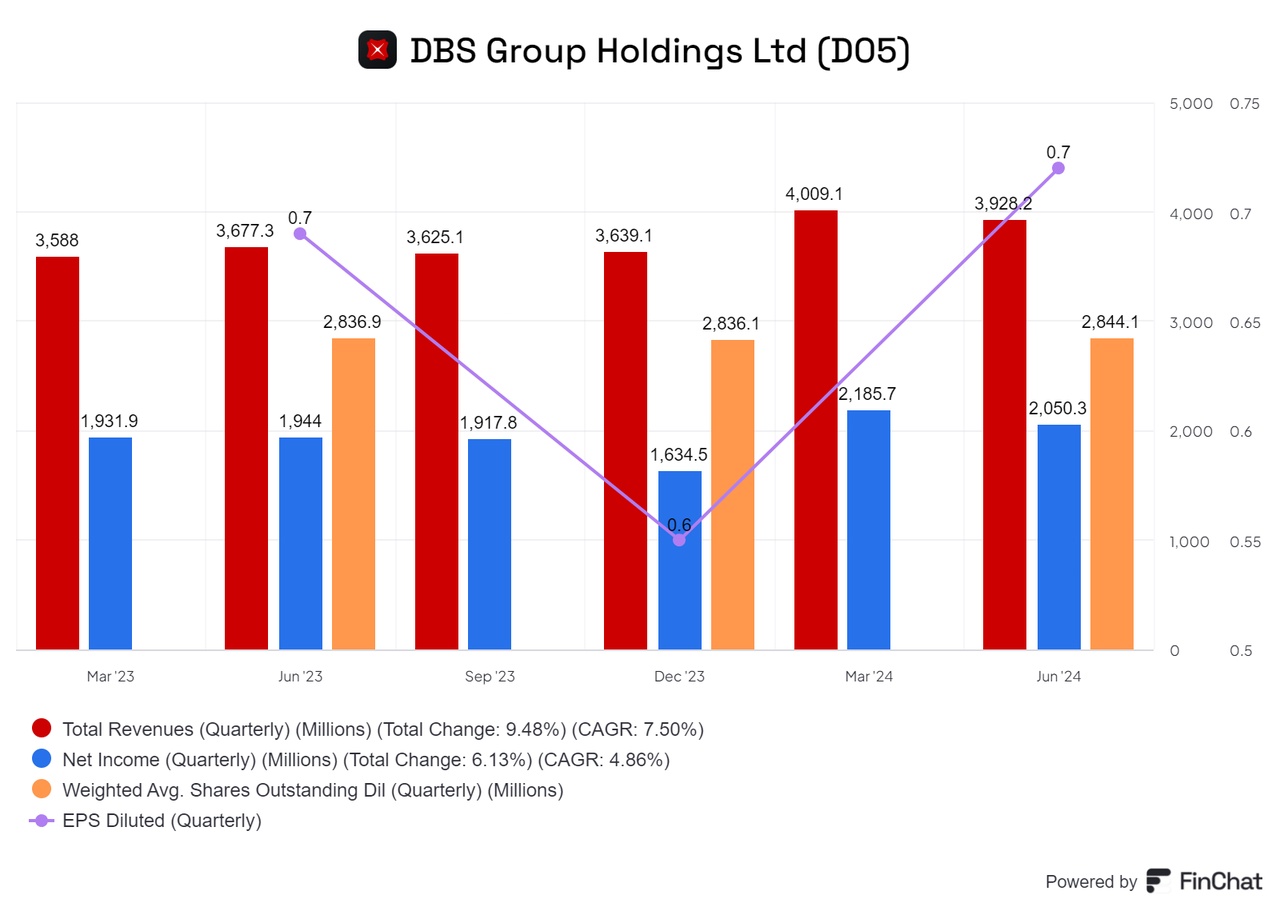

The numbers

Since 2020, DBS's key figures have shown a solid upward trend: turnover, net profit and diluted earnings per share (EPS) have risen continuously, accompanied by only minimal dilution. In addition, further shares were issued as part of a special dividend, which is essentially equivalent to a capital increase. In balance sheet terms, these funds were booked as new subscribed equity and in the capital reserve, which further strengthens the financial basis of DBS.

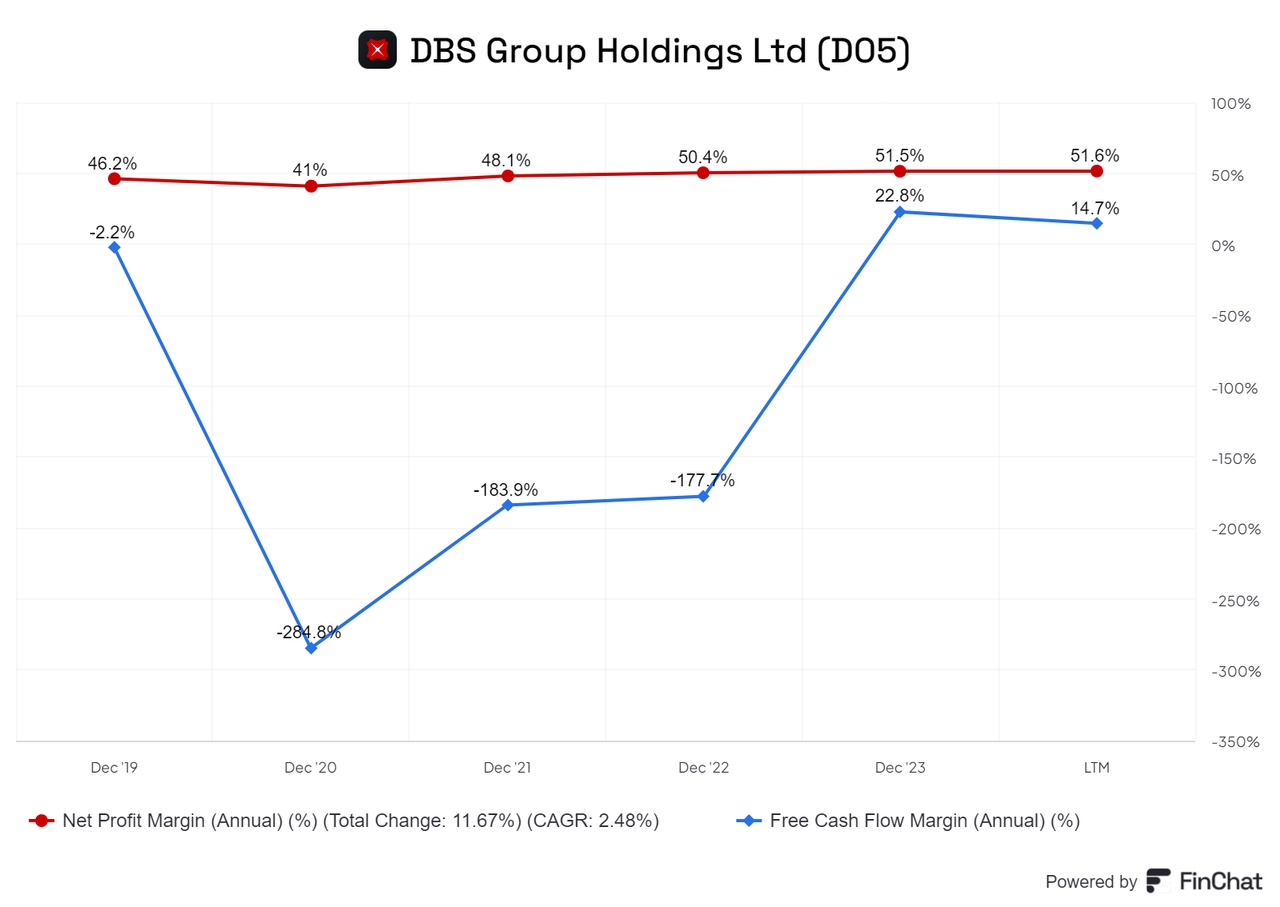

Margin development

DBS's profit margin has risen steadily in recent years, underlining the company's efficiency and profitability. The free cash flow (FCF) margin has also recovered well after a decline, indicating improved liquidity and stronger cash generation. This positive development strengthens DBS's financial flexibility and creates scope for further investments and distributions to shareholders.

(Image )

Balance sheet

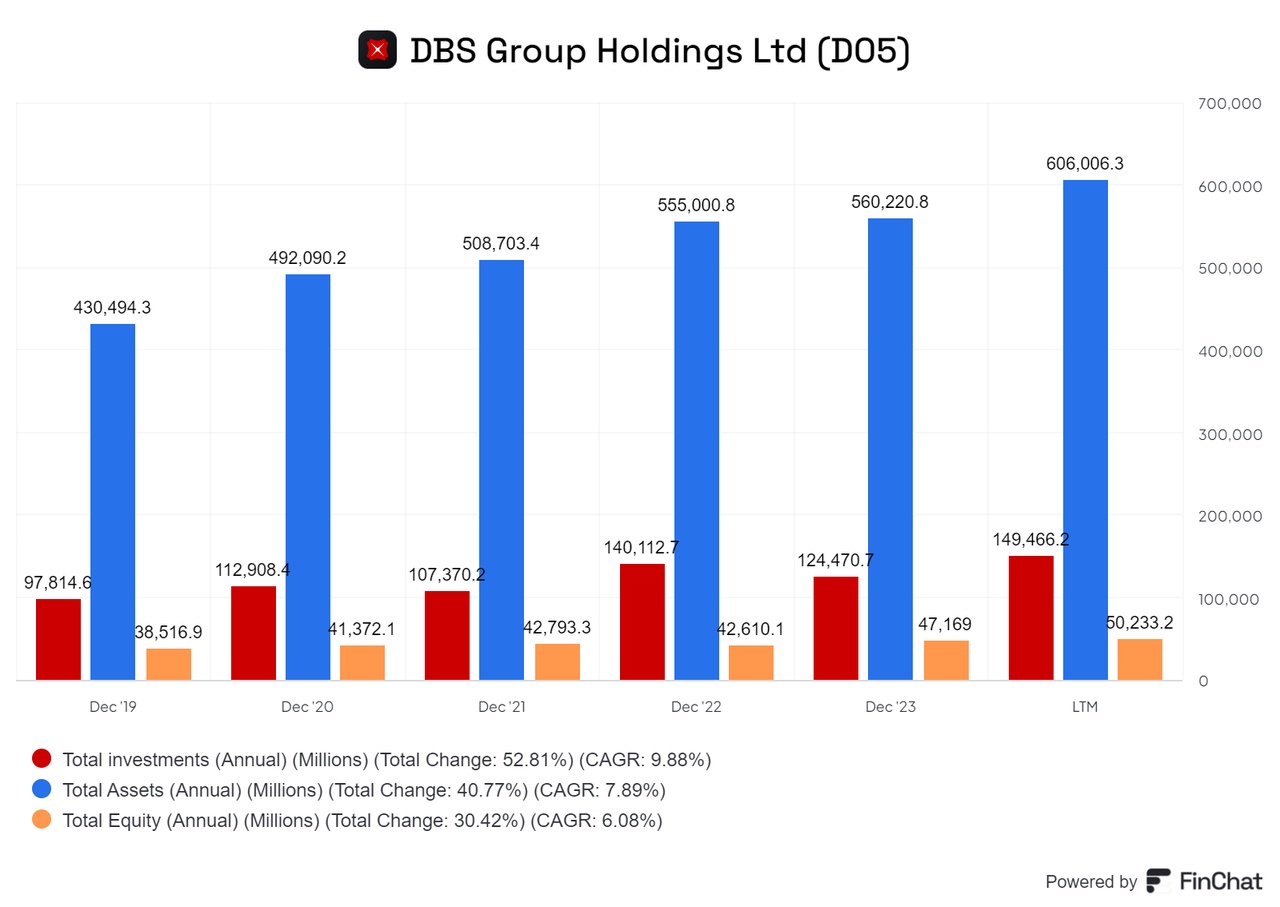

A look at the asset structure shows: Total investments account for around a quarter of total assets. The comparatively low proportion of equity is striking, although this is often the case with banks. However, it is pleasing to see that this is growing steadily from year to year.

(Image )

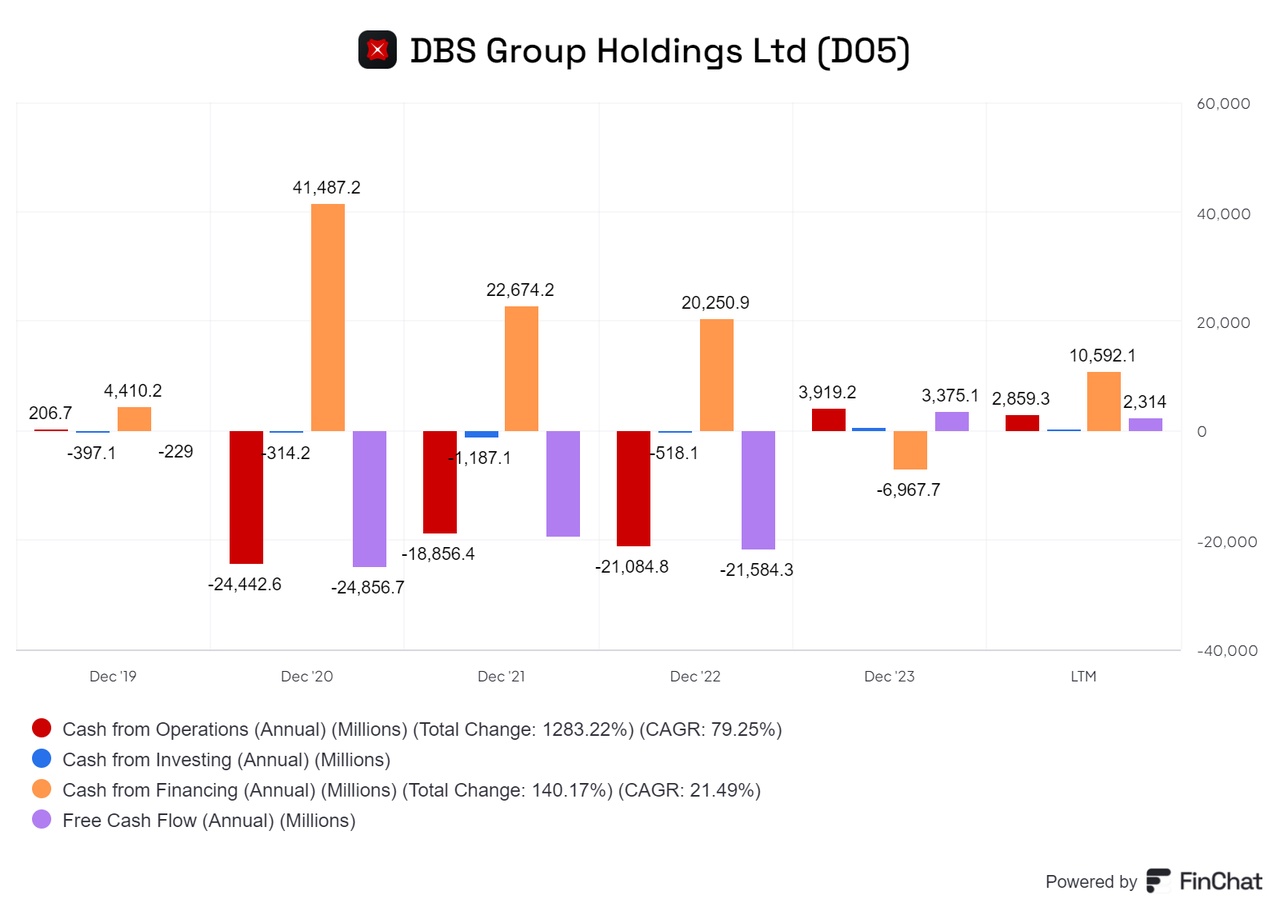

Cash flow

The financial situation is currently encouraging: DBS has positive cash flows. However, caution is advised as this situation can change rapidly. It is worth noting that the free cash flow has been solidly positive again for two years now.

(Image )

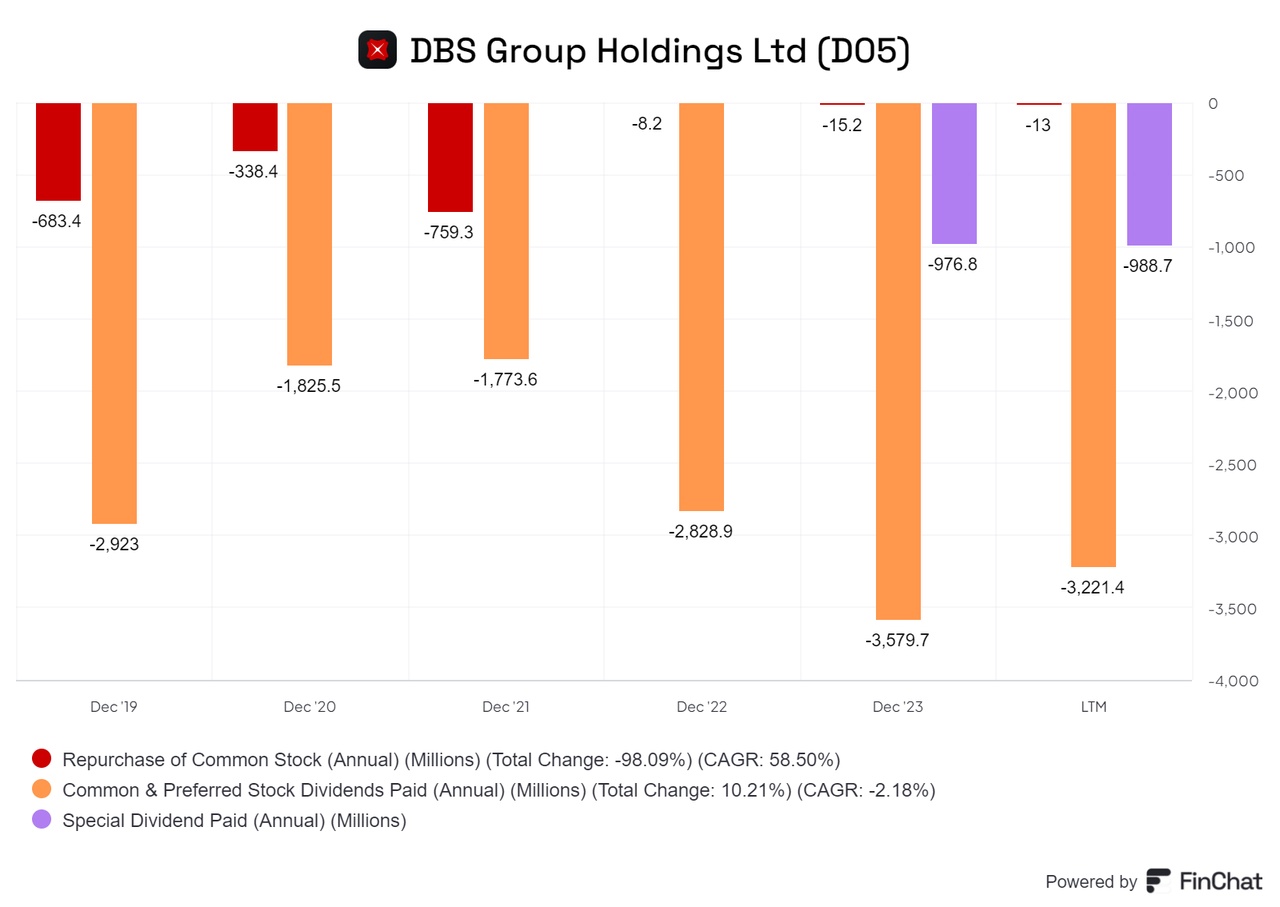

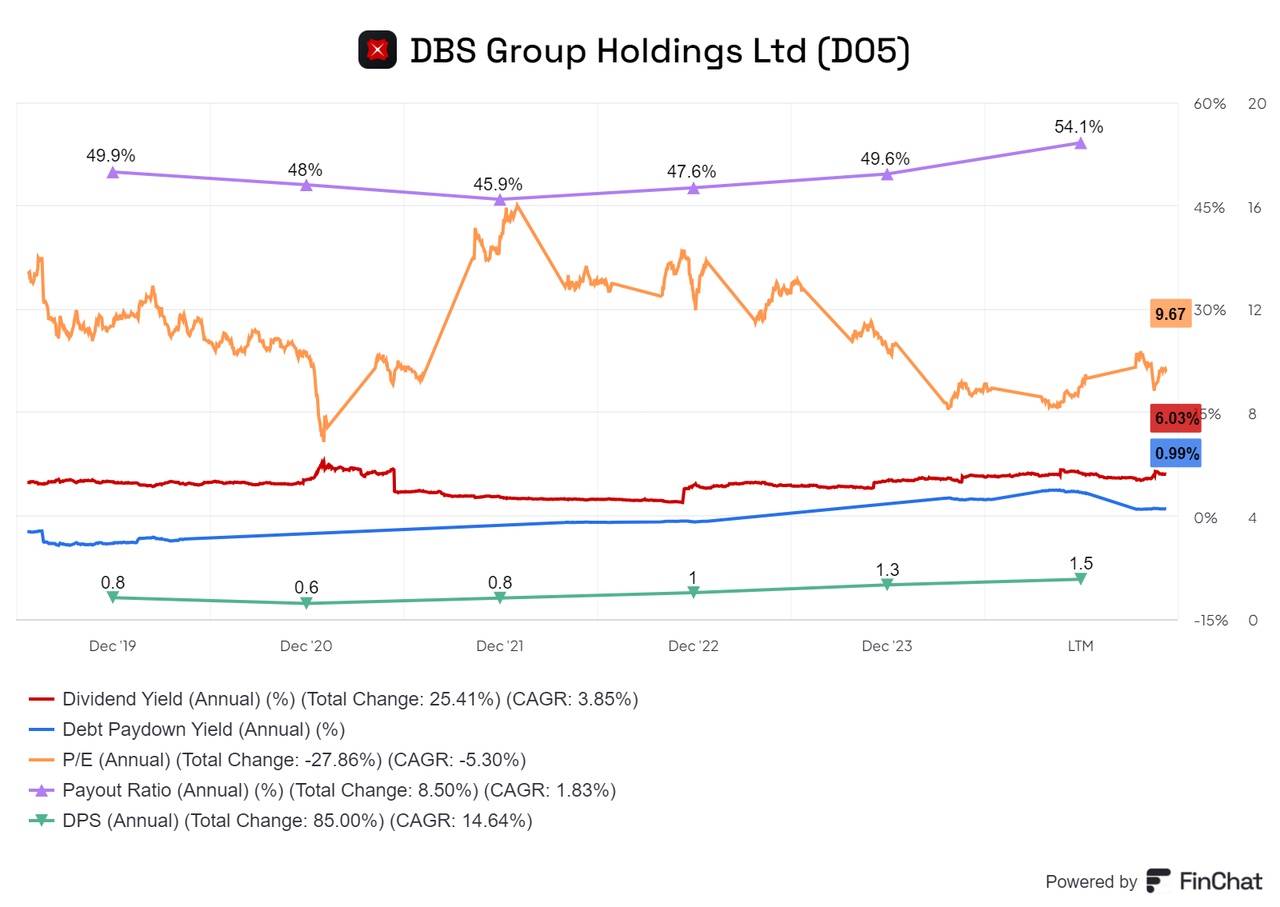

The company's dividend policy is proving to be extremely shareholder-friendly. Investors can currently look forward to an attractive dividend yield of 6%. With a payout ratio of around 50%, the company strikes a good balance between profit sharing and reinvestment. In addition, it carries out share buybacks on a modest scale. The special dividends of the past two years deserve special mention. These were exceptionally high, which is impressive at first glance. However, it should be noted that these generous distributions were accompanied by a capital increase. As a result, the actual capital outflow was limited - an important aspect when assessing the company's financial stability.

(Image)

The DPS is on the rise and the P/E ratios have fallen steadily in recent years.

(Image )

KPI

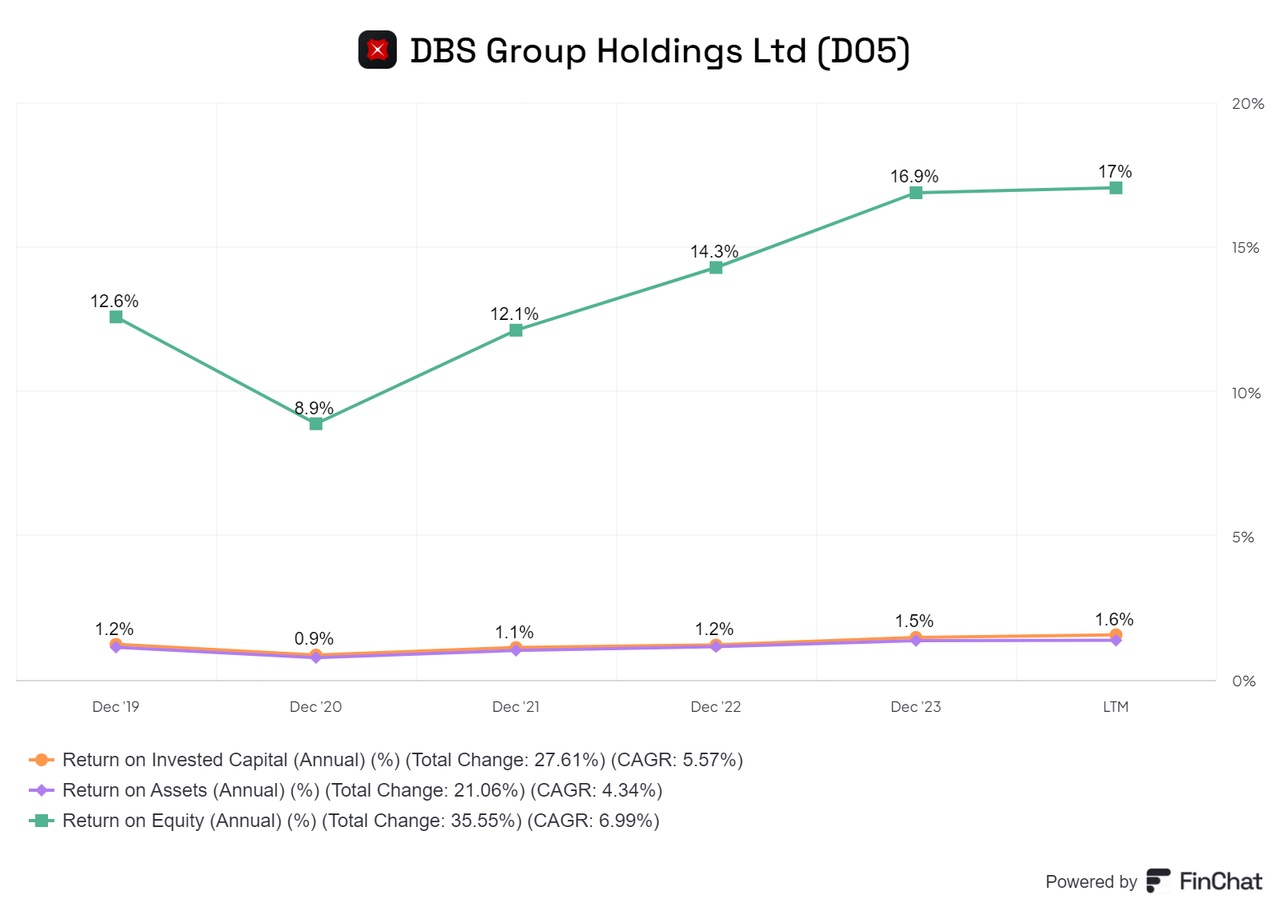

(Image )

The company's key figures present a differentiated picture. The return on equity (ROE) stands out positively and demonstrates an efficient use of equity, which is mainly due to the fact that the company has little equity.

However, there are clear weaknesses in other performance indicators, which could initially give rise to skepticism. However, it is important to consider these figures in the context of the banking sector. In this comparison, the company performs quite respectably. The specifics of the sector, such as strict regulations and the challenging interest rate environment, set natural limits to profitability. Against this backdrop, it can be said that the investment in this financial institution has proven to be sound. It is clear that a differentiated view, taking into account sector-specific characteristics, is essential in order to recognize the true value of this investment.

There seems to be a limit to the number of pictures, so let's move on to the next part. @christian and by the way we can see if the pictures work again.

Part 2: https://getqu.in/luwqQR/

$JPM (+1.21%)

$DBK (-1.71%)

$HSBA (-0.91%)

$BAC (+1.1%)

$UBSG (+0%)