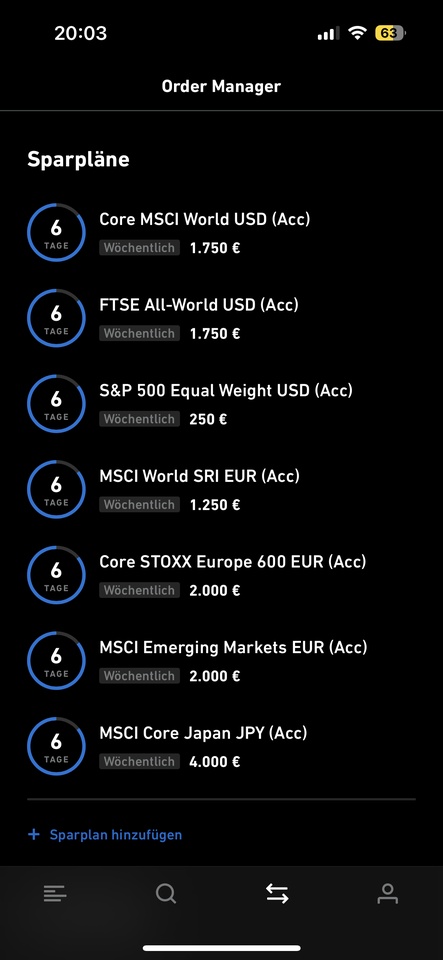

What do you think of the savings plans ? I already have some individual stocks and wanted to increase the share of broadly diversified ETFs with a low TER.

The relative underweighting of US stocks is intentional, especially with the ETF savings plans - there is simply too little room for improvement in my opinion.

I am also aware that Germany is hopelessly overweight.... this is largely due to home bias & not strategy :)

Japan I trust quite a bit although they also have some obvious problems....

The goal is to profit broadly from the development of the country.

India and Africa are also still quite missing for my feeling but am curious about your opinion :)

On the question between dividends / accumulating ETFs, I also drive a kind of middle ground, but now more in the direction of accumulating, as this makes absolute sense for ETFs.

With single stocks I appreciate dividends & buybacks very much, since a certain cash flow would be quite convenient for me later, when my income from the commercial enterprise is lower or dries up completely.

In addition, unfortunately, the money is not always carefully managed and tempts managers to sometimes so insanely stupid ideas (Mercedes Chrysler merger), which is why a regular transfer is useful - especially in weak phases on the stock market great. #portfoliofeedback