Conclusion 2021

The year 2021, as we all know, just like 2020, has not been such a great year, but at least the stock market has satisfied me on balance and I would like to share my personal conclusion with you here.

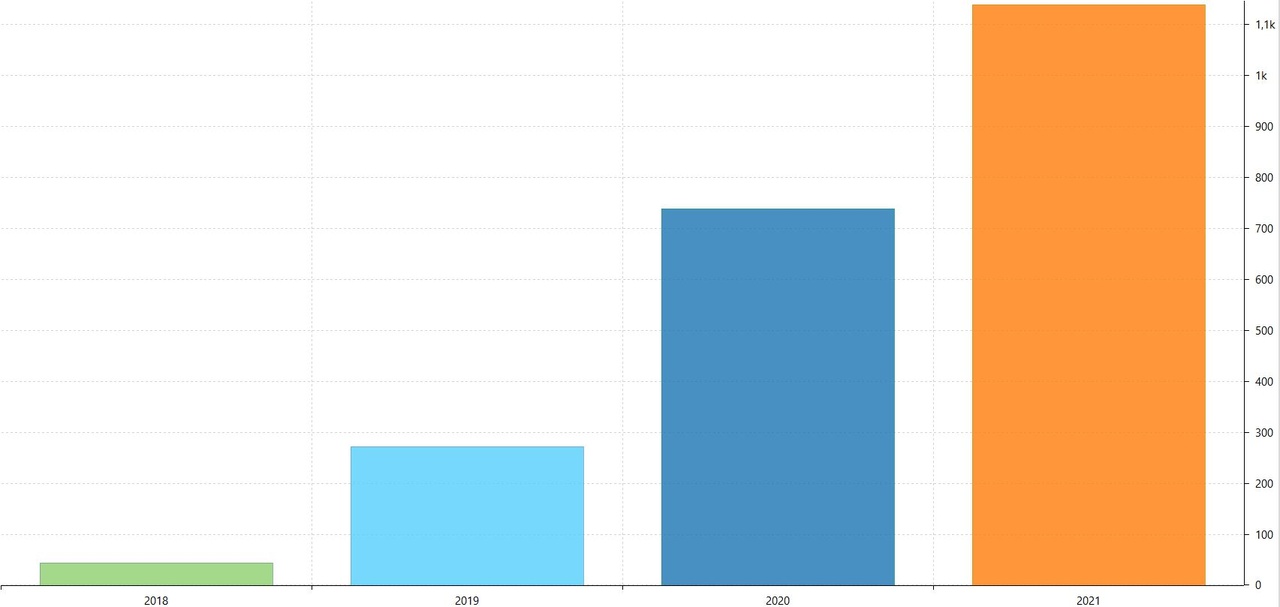

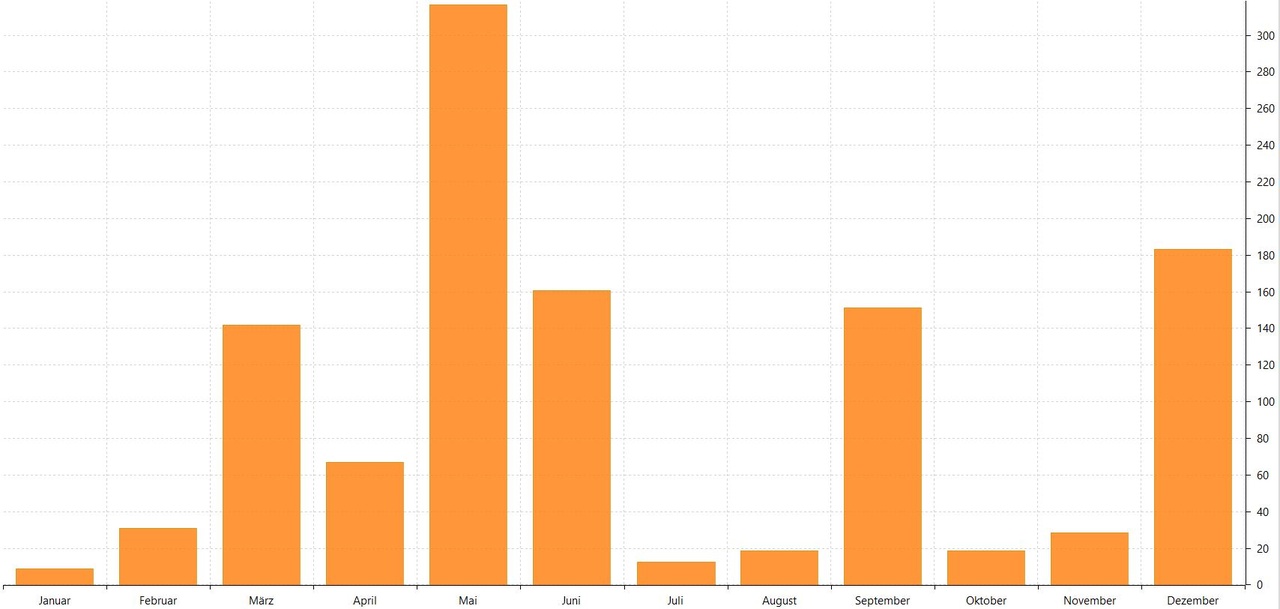

Dividends:

I just missed my personal dividend target of 1,200 euros gross by 61.73 euros this year, but I am still very satisfied with the development, as I was able to increase my dividend income by 54.22% compared to 2020.

There are sometimes serious differences between the months.

The worst month was January with 8.94 euros, the best was May with 316.41 euros.

The swing in May is due to German companies, which mainly pay out in May. The otherwise strongest month by far is always the third month of the quarter, as this is when most US companies pay out their dividends.

The company I received the least from was a sweet 0.12 euros Mastercard ($MA (+0.22%)), which is no longer in my portfolio. Of those that are in my portfolio as of today, Sixt paid out the least with 0.50 euros.

I received the most with 160.74 euros from Unilever ($UN), followed by Lockheed Martin ($LMT (+0.27%)) with 135.73 euros.

For the year 2022 I have set myself a target of 1,500 euros in dividends and I am very confident that I can meet the target this time.

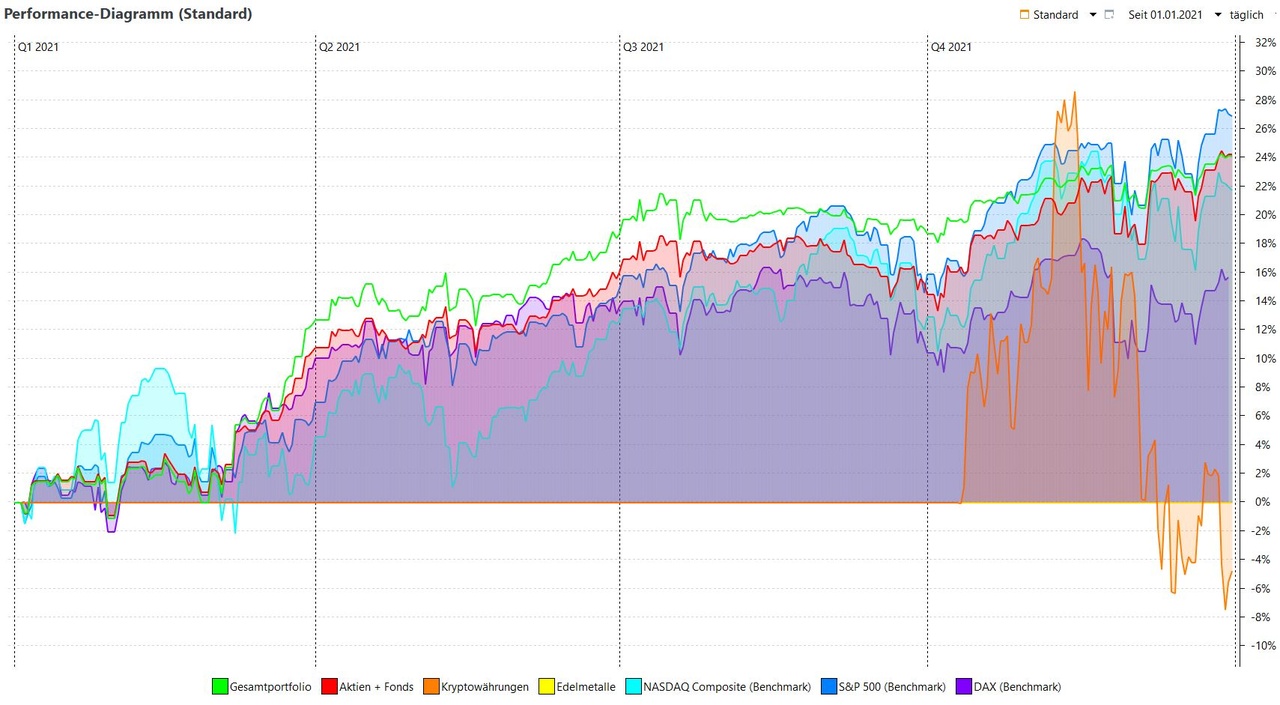

Share price performance:

In the chart you can see the price performance of my shares (and my FTSE All-World ETF ($VGWL (+0.41%)), which is only 0.69%) in the form of the red line.

I finish the year with a performance of 24.40%, which is far ahead of the DAX (15.79%) and also just ahead of the NASDAQ (22.14%).

I have to admit defeat to the S&P500 with 27.23%.

The investment which disappointed me the most and which also achieved the worst performance is Palantir ($PLTR (+3.25%)) with -20,57% (-310,50 Euro). The Flop 5 also includes:

PayPal ($PYPL (+0.72%)) with -12.86% (-372.01 euros)

Nintendo ($7974 (-0.56%)) with -6.67% (-178.46 euros)

Walt Disney ($DIS (+0.62%)) with -3.21% (-11.92 euros)

BASF ($BASFY (+0%)) with +0.52% (+12.23 euros)

My top investment, of which I would have had to buy much more and which I would not have thought would rise so strongly, is Home Depot ($HD (+0.38%)) with +67.58% (+298.96 euros). Following closely in the top 5 are:

Microsoft ($MSFT (+0.8%)) with +61.50% (+1,742.70 euros)

Cisco System ($CSCO (+0.32%)) with +56.81% (+471.16 euros)

Waste Management ($WM (+0.01%)) with +56.64% (+559.88 euros)

ADP ($ADP (+0%)) with +55.99% (+80.22 euros).

In total, 20 of my stocks made more than 25%, 11 others made more than 10%, and 7 made between 0% and 10%. The four stocks mentioned above had a negative performance.

Unfortunately, exactly these four stocks had a relatively high weight, so it did have some impact on the overall performance.

For some of them, I would not have thought that they could rise so strongly again this year.

At this point I would also like to thank my friend Tobias for pushing me to buy Apple ($AAPL (+0.53%)) again properly after-buy. It currently makes up 2.99% of my portfolio and brought me +44.05% (+643.30 euros).

So I am very satisfied with the performance of most of my shares.

Cryptos:

I resisted investing in cryptocurrencies for (too) long, but was persuaded to add this asset class to my portfolio in October this year.

As you can see in the chart, this also started very well, so that I reached my personal high of 28.79% on November 14, after just under a month.

However, due to last month's price losses, I'm closing this year with -4.9% in cryptos.

Shiba Inu ($SHIB (-0.5%)) -2.34% (-1.56 euros)

Ethereum ($ETH (-0.31%)) -5.17% (-14.77 euros)

Bitcoin ($BTC (-0.82%)) -14.77% (-78.74 euros)

Ripple ($XRP (-2.01%)) -16.85% (-3.00 euros)

Litecoin ($LTC (+1.51%)) -17.55% (-12.01 euros)

Chainlink ($LINK (+0.77%)) -21.96% (-15.15 euros)

However, I am very sure that we will reach new highs next year, which is why I am particularly $ETH (-0.31%) will continue to expand.

Overall conclusion:

As I mentioned above, I am very satisfied with this year overall. Of course, there is still room for improvement in many places, but I am very much looking forward to the stock market year 2022. :)