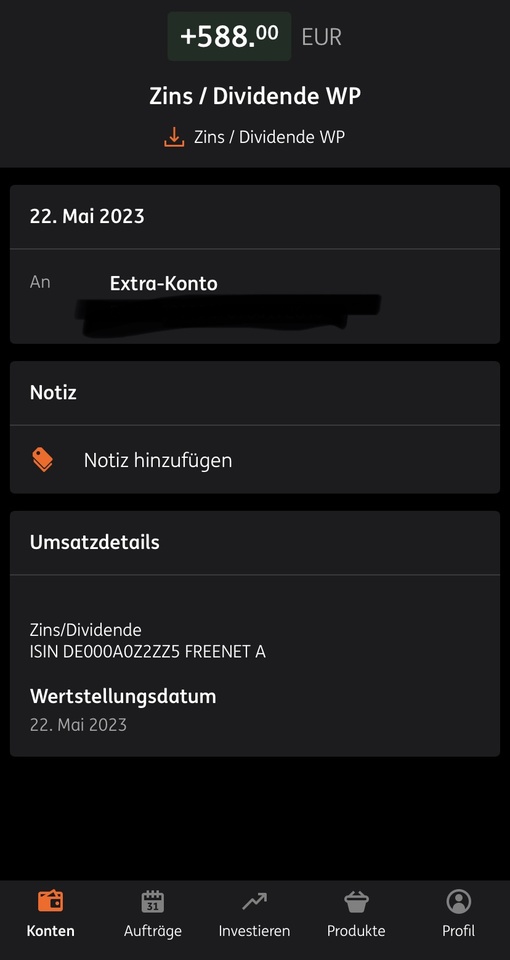

There is the $FNTN (-1.23%) dividend. Once again, this one is special because gross=net 🥳

I've had Freenet in my portfolio since 2016. The pure performance is ... always striving I would say. Including dividends, it looks significantly different. In 7 years 3400€ income and done nothing for it except free phone calls, as @Simpson thinks 😉

So slowly the question arises, what do I do with my Euros? I miss Asia somehow, I do not like trends. Just by the way, I have heard the topic of water since my beginnings on the stock market many times.

Maybe an ETF on the EM or even on APAC 🤔 First World Problems 🤷🏻♂️