Depot review May 2023 - Sell in May and... oh shit 🚀🚀🚀

"Sell in May and go away" - One of the most famous stock market sayings par excellence and following it would have cost me a lot of money this year.

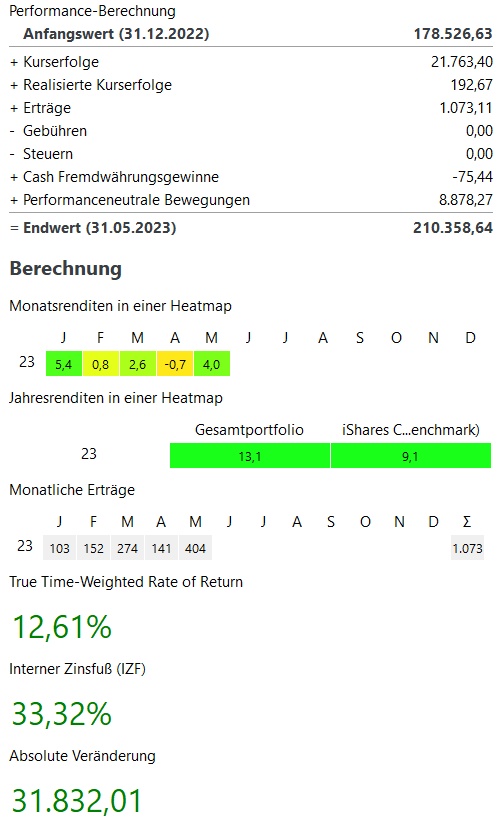

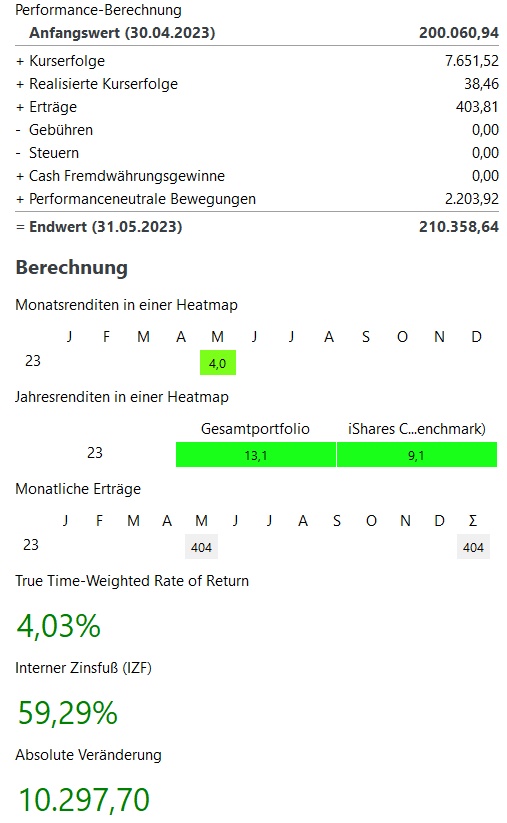

In the depot May was with +4,0% the strongest month after January. Compared to May 2022 with -5.1% an extreme difference.

In the current year, my performance is currently +13,1% and thus significantly above my benchmark (MSCI World +9.6%).

Not surprisingly, of course, extremely strongly driven by NVIDIA $NVDA (-2.33%) with +41% / + 2.700€. This accounts for almost one third of the price gains in May. Also strong Alphabet $GOOG (+0.05%) and Palo Alto Networks $PANW (-2.93%)

On the losing side, in May it was mainly Starbucks $SBUX (+3.28%) Nike $NKE (+3.44%) and Sartorius $SRT (+4.99%)

In total my portfolio stands at over 210.000€ even though I only broke the 200,000€ barrier in April.

Dividend:

- Dividend +16% compared to prior year

- Current year dividends are +32% above first 5 months 2022 after 5 months

Purchases & Sales:

- Bought in May for approx. 3.200€

- Executed mainly my savings plans:

- Blue Chips: Caterpillar $CAT (+2.62%) NVIDIA $NVDA (-2.33%) TSMC $TSM (+0.44%) Amgen $AMGN (+2.38%) Procter & Gable $PG (+2.31%) Johnson & Johnson $JNJ (+0.25%) S&P Global $SPGI (+1.42%) and as a new investment Hershey $HSY (+0.38%)

- GrowthBechtle $BC8 (-0.12%) and Palo Alto Networks $PANW (-2.93%)

- ETFsMSCI World $XDWD (+1.02%) Nikkei 225 $XDJP (+1.38%) and the Invesco MSCI China All-Shares $MCHS (-2.02%)

- Crypto: Bitcoin $BTC (+0.28%) and Ethereum $ETH (-0.21%)

- Sold with the x-trackers MSCI Emerging Markets my complete holdings of the ETF.

- Reasons for this are many, especially the weak performance

- Since I also have a pure China ETF monthly and China makes up about 30% of the MSCI EM I am still invested here. In addition, I have TSMC in my portfolio, which makes up about 7% of the MSCI EM. So in total I have over 35% of the index covered in my portfolio anyway. In addition, the Samsung share $005930 with a share of 5-6% in the Emerging Markets Index on my watchlist.

In the next month I will probably follow the current trend and try with an Itochu $ITC in the savings plan to increase my Japan share a little.

How did your portfolio perform in May? And what do you think of stock market wisdom like "Sell in May and go away"?

#dividende

#dividends

#personalstrategy

#depotupdate

#performance

#update

#rückblick