✨ Who is the beauty king? A look at the stars of the cosmetics stocks ✨

Company presentation

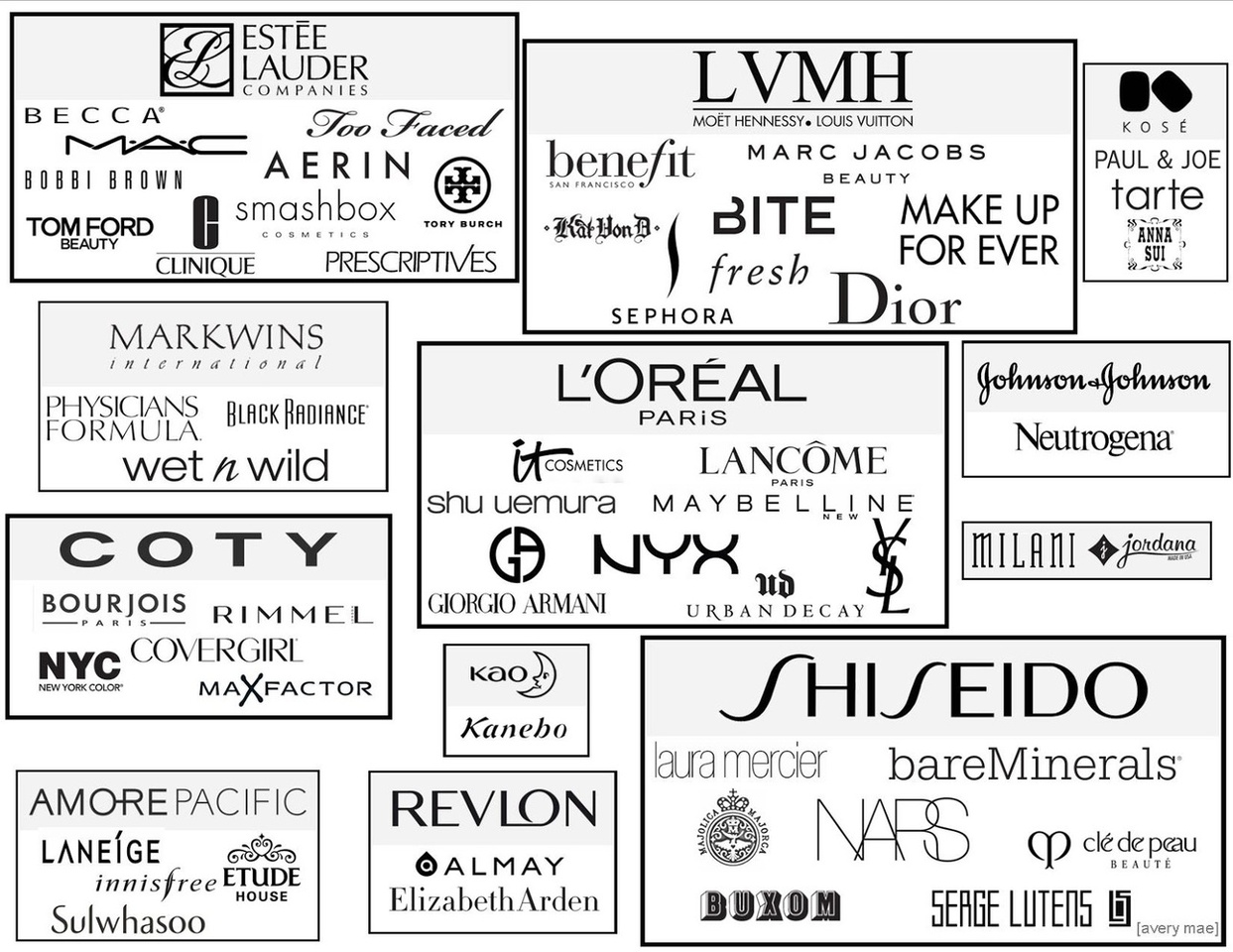

L'Oréal, the world's leading cosmetics group, is based in France and can look back on a history of over a hundred years. Founded in 1909, its portfolio today comprises more than 35 brands covering skin care, make-up, hair care and fragrances.

e.l.f. Beauty is an up-and-coming US cosmetics company that has stood for affordable yet high-quality products since it was founded in 2004. The brand is particularly popular with younger consumers.

Beiersdorf, a traditional German company founded in 1882, specializes in skin care products. The company is particularly well known for its NIVEA brand, which is synonymous with skin care worldwide.

Estée Lauder was founded in New York in 1946 and has developed into a leading provider in the prestige beauty segment. The company owns over 30 luxury brands and is an established player on the international market.

Historical development

$$OR (-0.24%) has grown through constant innovation and strategic acquisitions and is now represented in over 150 countries.

$ELF (-3.15%) has experienced rapid growth in recent years, driven by digital strategies and the development of new sales channels.

$BEI (-0.41%) NIVEA has developed from a small pharmacy into a global company. The NIVEA brand was launched in 1911 and is now one of the best-known skin care brands in the world.

$EL (-0.11%) NIVEA grew from a small family business into an international cosmetics giant. Through international expansion and acquisitions, the company was able to diversify and constantly expand its portfolio.

Business model and core competencies

L'Oréal is based on a broadly diversified brand portfolio, intensive research and development and a strong global presence. The company operates in four divisions: Consumer Products, L'Oréal Luxe, Active Cosmetics and Professional Products.

e.l.f. Beauty focuses on affordable, trendy products and is increasingly using digital marketing strategies and e-commerce to appeal to young target groups.

Beiersdorf focuses on skin care and has extensive expertise in the development of innovative formulations. The company also operates a successful adhesives business with Tesa.

Estée Lauder specializes in prestige beauty products and excels in product innovation, luxury marketing and global distribution. The company is active in four main categories: Skincare, Makeup, Fragrance and Haircare.

Future prospects and strategic initiatives

L'Oréal is investing heavily in sustainability, digitalization and personalized beauty solutions. The company is also increasingly focusing on AI-supported technologies and expanding its portfolio in the area of "clean beauty".

e.l.f. Beauty plans to further develop its digital presence and expand into new product categories and international markets.

Beiersdorf is focusing on innovations in the area of skincare, particularly sustainable and natural products, while also investing in the digitalization of its brands.

Estée Lauder is aiming to expand into growth markets, particularly in Asia, and is focusing on strengthening its digital presence. The company is also investing in sustainable packaging solutions and "clean beauty" products.

Market position and competition

L'Oréal maintains its leading position in the global cosmetics industry with a market share of over 14%.

e.l.f. Beauty has established itself as a strong challenger in the mass market and continues to gain market share, particularly among younger consumers.

Beiersdorf is a leading player in the European skincare market and competes directly with companies such as Unilever and Procter & Gamble.

Estée Lauder is the second largest cosmetics group in the world and dominates the prestige beauty segment. Its main competitors are L'Oréal Luxe and LVMH.

Total Addressable Market (TAM)

The global cosmetics market was estimated at around 430 billion US dollars in 2022 and is expected to grow to over 700 billion US dollars by 2030. This growth is being driven by rising demand in emerging markets, the boom in e-commerce and the trend towards natural and sustainable products.

For the development (company figures), a better view and more, check out the free blog :https://topicswithhead.beehiiv.com/p/wer-ist-der-beauty-k-nig-ein-blick-auf-die-stars-der-kosmetik-aktien

Conclusion

L'Oréal is undoubtedly the best value in the comparison. The company shows solid growth, has an attractive net debt to EBITDA ratio and is valued roughly in line with other companies in the cosmetics sector. Although it is unfortunate that the location in France leads to additional costs due to financial transactions and withholding taxes, this disadvantage is mitigated for long-term investors by the strong positioning. Looking at the industry, which is growing by around 5% annually, L'Oréal is in an excellent position. Moreover, the company does not shy away from M&A activities and the acquisition of brands. The capital efficiency of these transactions also appears positive, especially when considering the non-declining returns on capital. Overall, L'Oréal is the best approach to be invested in the cosmetics industry. However, L'Oréal does not have to be the only stock in the portfolio. A mix of L'Oréal and possibly Unilever or P&G could provide a good mix of different industries in the consumer goods sector.

I don't want to speak against the other companies.

Estée Lauder has a strong brand, but it remains to be seen how well the company can recover from its recent difficulties. Especially in the luxury cosmetics segment, such weakness leaves the impression that something is wrong.

Beiersdorf, on the other hand, is lagging behind the market. In my opinion, the company does not have the strongest brands and is also heavily dependent on Tesa. Nevertheless, Beiersdorf is growing sufficiently to offer good prospects for the future. However, as make-up is heavily dependent on brands, I do not see Beiersdorf as a convincing investment, even if there is perhaps more potential than I would expect.

Elf Beauty is aligned with the hype and trends in the industry and has proven that they are able to actively manage this. However, the company is a little too small for me. Personally, I would prefer a broader range of brands in the cosmetics industry, which Elf does not offer to this extent.

For me, this means that an entry into L'Oréal at around 340 euros would be interesting. The value that came out of the DCF.