Let's have a backup on my annual targets.

(Target for 2022- 2000€ dividend+ option premium)

Started was in Febuar man sehn kann (had made on the depot zockoptionen.)

Currently 1.3k (withholding tax must still be deducted).

Why 700$ in July? To make a long story short I run out of stock option ideas, so I wrote options on Indzesfuture and ETFs as I always do in my main portfolio. With a very strong move in the S&P500, I could close out my options faster at a profit. I wanted to write here actually only stock options but you can clearly see the development by the ideelosikeit also explosively rises into the positive.

A small warning I would like to express here nevertheless. Just because the development was so POSITIVE for me, options are still a risky investment as a derivative. So you have to understand what you are doing and therefore not for everyone.

How will it go on now? The plan is now still for this year, so the missing 700€, about the same way into the depot flow allow the "more" profit is also invested further to have a small advantage for the next annual target (is paid from 1.1-31.12)

I would like to say however again a warning concerning the options. Please do not jump into the options inexperienced, first learn, then practice, then write.

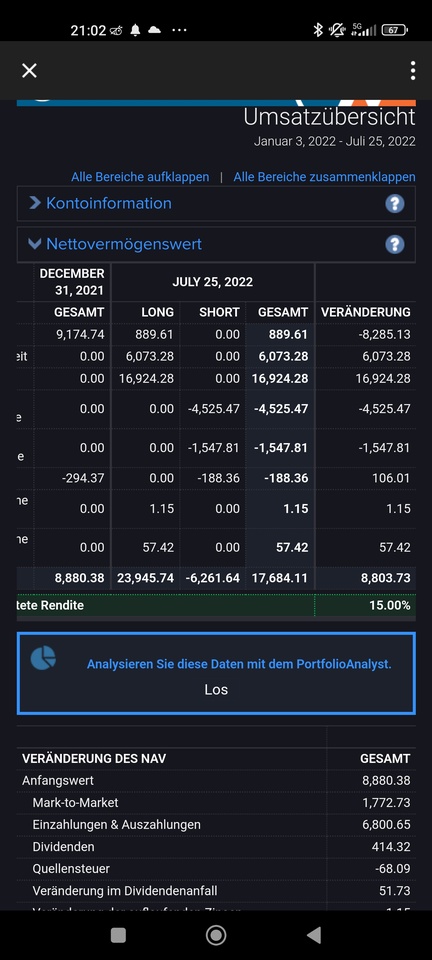

Enclosed is my YDT return to show that even in the current time (high inflation) you can still make money.

And a small tip for a small yield bonus, lend your shares if your broker allows it. This brings in interest and you still get your dividend, because the lender must reimburse you.

#ziele

#koksundnutten

#motivation

#börse

#dividende #optionen