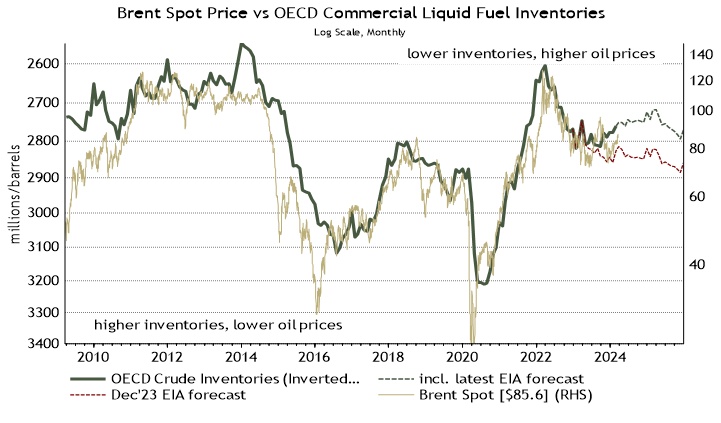

All eyes are currently on oil ($IOIL00 (+0.51%) ), as the prices for future oil supplies are lower than the current spot price, which is called backwardation. Normally, backwardation means that traders estimate that prices will fall in the future, but currently it is different, as traders expect oil inventories to fall in the course of the year 2024 will continue to fall and the price will therefore rise.

One of the reasons is the extension of the production cuts by the OPEC. Saudi Arabia etc. have decided to reduce their oil production in order to stabilize prices. This has led traders to believe that oil supplies could become scarcer in the future.

- [HQ, Vienna]

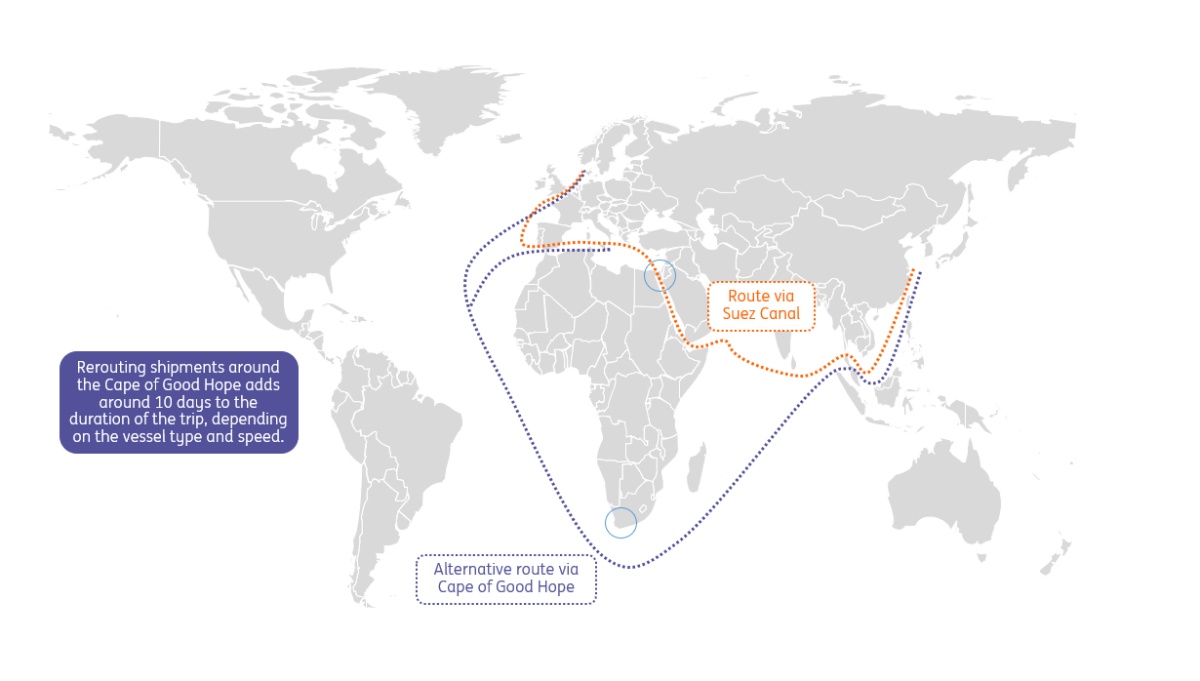

In addition, there is a shipping agreement between China and Russia with the Houthi rebels in Yemen. Houthi rebels are currently disrupting important sea routes through which a lot of oil is transported. In other words, the geopolitical factor will remain relevant in the long term. Around 12% of the global oil is transported through the Red Sea.