A plea for the Magnificent 7: Or why big tech is still NOT too expensive

Now that Big Tech and the Magnificent 7 in particular have done incredibly well in 2023, the question naturally arises as to how things will continue in 2024. I have found some very interesting data and information on this:

Who are the Magnificent 7 anyway?

Most people know them, but I would nevertheless like to list them at the beginning and divide them according to whether I have them in my portfolio or not:

In my portfolio:

Not in the portfolio:

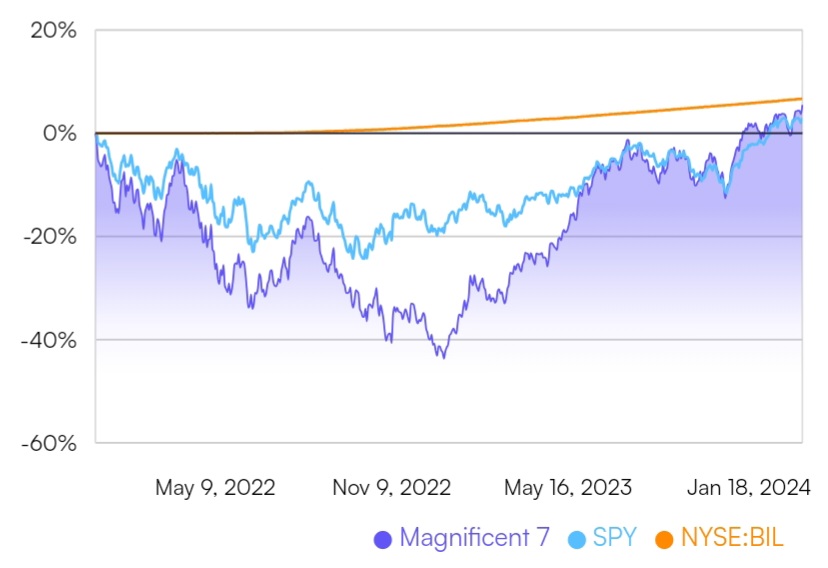

Performance 2023 (see attached chart):

In total, the performance in 2023 was ~80%. Of course, NVIDIA was at the top with over 230%, Meta was also extremely strong with ~200%.

Tesla also doubled. Next came Amazon (+80%), Alphabet (+60%) and Microsoft (+57%). Apple brought up the rear with "only" +48%.

The S&P 500 gained ~25% in the same period and also benefited greatly from the aforementioned heavyweights - excluding these 7 companies, the remaining 493 S&P 500 companies only gained 10% on average.

-> Inevitably, these stocks must have run hot after such a performance - or did they?

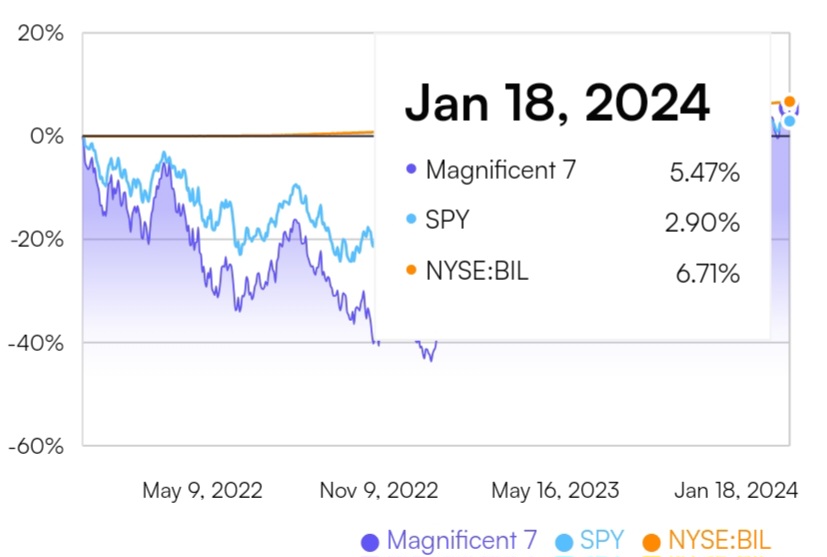

Let's take a closer look at this matter and not in isolation for the year 2023, but since the beginning of 2022 (also attached as an image):

Over the last two years (01.01.2022 - 18.01.2024), the performance of the Magnificent 7 is only a measly 5% and was even negative before the 2023 year-end rally. Over the same period, the S&P 500 only posted a slightly lower performance of 3%.

An investment in short-dated US Treasurys (1-3 months) would have generated a performance of 7% would have been achieved.

-> Over the last two years, an investment in short-dated US government bonds would therefore have been more lucrative than in the Magnificent 7

-> In summary, this means one thing above all: Yes, Big Tech performed phenomenally in 2023, but above all it made up for the massive losses from 2022. This does not necessarily mean that they are overvalued, as a lot has changed since the end of 2021. On the one hand, these companies have continued to grow massively and the topic of AI has played an increasingly important role since the end of 2022

What does this mean for 2024 and the current valuation?

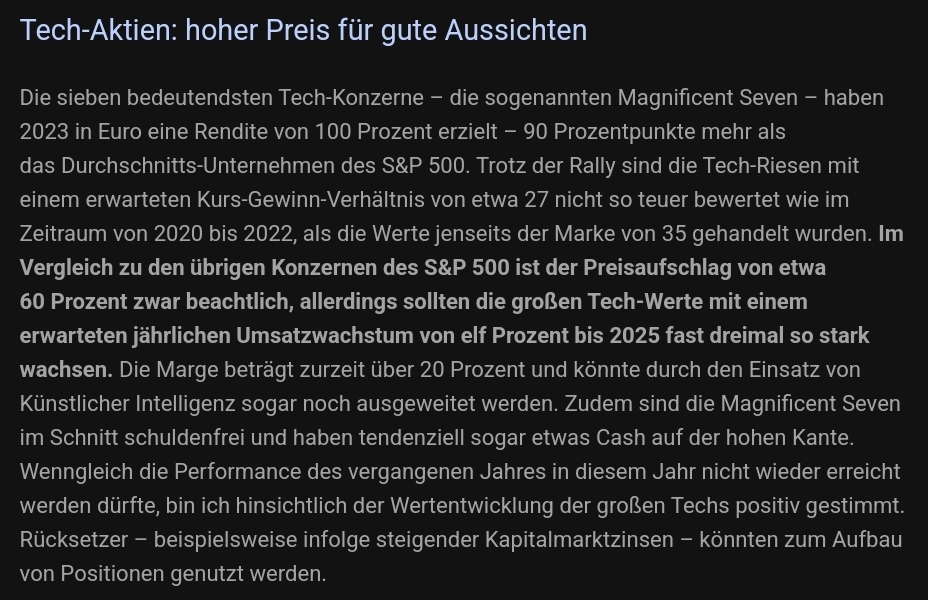

I have included a screenshot from today's Deutsche Bank newsletter "Prospects for tomorrow" is attached. It provides some reasons why these companies can continue to perform strongly:

- Magnificent 7's expected P/E ratio is currently ~27, which is well below where it was in 2020-2022, when the expected P/E ratio was over 35

- Compared to the other companies in the S&P 500, this is a premium of 60%! However, the Magnificent 7 sales are expected to grow by 11% p.a. until 2025 - That is almost three times as much as the other companies in the S&P 500

- In addition, the companies have extremely strong margins that could grow even further due to AI

- On average, the companies are virtually debt-free and even have net cash available. While other companies have to worry about interest payments and refinancing and may also be able to invest less money in acquisitions or research/development, the 7 companies are not burdened by this. On the contrary, this even offers opportunities to widen the gap even further and to benefit from the problems and weaknesses of the others (more research, interesting takeovers, etc.)

As mentioned in the newsletter, there will certainly not be another +80% in 2024. However, I still see these stocks outperforming the S&P 500 and the MSCI World.

I have a total of 5 of the 7 companies in my portfolio and continue to buy regularly in 4 of them (Apple, Microsoft, Alphabet & NVIDIA). Meta is a classic hold position for me, as I want to continue to monitor the development of the group (Metaverse), but will not continue to buy here for the time being.

I do not have Tesla and Amazon in my portfolio and will not add them for the time being. Tesla has too many controversies for me personally, between "it's just a car company" and "Tesla will soon control the world" there are too few shades of gray for me. Amazon is too divided a company for me: I wouldn't buy the e-commerce business on my own and I have the cloud business AWS covered with Microsoft and Alphabet as well. For e-commerce, I have a MercadoLibre $MELI in my portfolio, which is growing even faster and covers a completely different region with South America. In addition, with the developments in Argentina and Javier Milei, I see hope that the continent will develop even more towards capitalism and away from socialism.

How do you see the Magnificent 7 performing in the future?

And what do you see as companies that could become the next Magnificent 7 or complement them?

For me, the topic is cybersecurity is one of the key issues for the next few years and I see the threat posed by AI, autonomous driving and geopolitical "opponents" such as Russia and China continuing to grow. With regard to the last point in particular, defense companies such as Lockheed Martin are of course also benefiting $LMT but they are far less able to scale their business.

A software company in the cybersecurity sector, on the other hand, can scale massively and relatively easily. This is why companies such as Palo Alto Networks $PANW or Crowdstrike $CRWD are high up on my list, in the portfolio and candidates for the next Magnificent 7.

#stocks

#etfs

#tech

#stockanalysis

#performance