Hello everyone.

Person: I am in my mid-21s and have been on the stock market since April 2024. Earn 2.3k net (accountant with further training next year to become a business administrator)

+ 520 euros part-time job in the stable and on the tractor with my aunt since I was 14 and still live at home.

History:

I was already at Scalable in 2022, burned 100 euros in penny stocks and put 50 euros in Bitcoin, but took it out again straight away at around 20k. After that, the stock market was quiet again until April 24 (if you had been more interested back then...many people probably think so).

Well... nevertheless, I was fired up for the stock market and went full throttle straight away. Since I had done a lot of "crap" with my money before (car for 25k + 5k burned at tipico with the money I earned during my training and on the side), this was a turning point where I wanted to be more frugal.

I invested the rest of the money accordingly.

Investing:

In the beginning, I was so extremely curious that I read all the media I could get my hands on. In addition, I sometimes asked questions 20 times, which is why many people were annoyed with me. I'm sorry about that. It was curiosity and the desire to invest well that drove me.

As I found the dividend strategy interesting, I sometimes had savings plans for 30 shares with 10-20 euros (I felt I always wanted a new one that I found exciting and rediscovered).

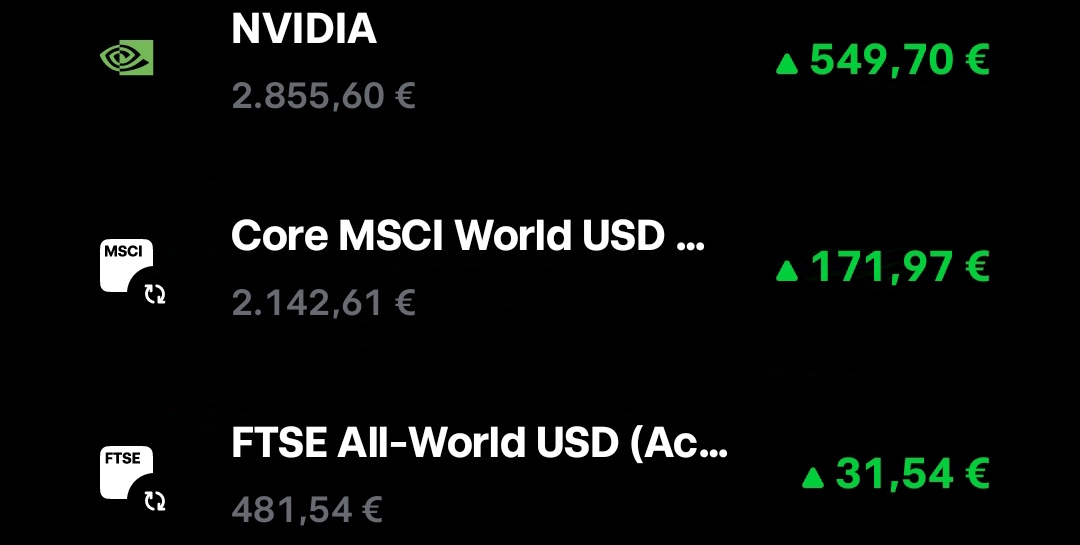

At some point it became too much for me and the amounts were too small, so I sold them all.... except for Nvidia. I stuck with the $SPYI (+0.26%) ACWI IMI and the $CSNDX (-0.01%) as I am convinced of the future returns. However, as this would be "too boring" for me, I have decided to add a handful of shares in the long term when a very good opportunity arises. So after a long time it was $ASML (-1.59%) that has prevailed. With the hope of achieving good long-term returns after a major correction.

$BTC (-1.69%) was a topic that I kept my hands off for ages because I never understood it...I still haven't got that 100% now, but I see it as a good alternative and I'm behind it.

The $CSPX (+0.32%) S&P 500 is saved to have equity for a house in 10 years. That's why I look at it separately.

The weighting of equities, ETFs and cryptos is currently as I had planned.

I invest €500 a month in the S&P 500

800€ in the ACWI IMI

In the NASDAQ 100 100€

In Bitcoin 100€

I also save 50 euros separately with TR in the $IWDA (+0.23%) for my parents' pension in 10 years to give something back as a thank you and €100 in the $VWRL (+0.18%) which is intended for the pension. (Another €220 goes into Rürup and the insurance company's private pension plan).

I also currently have Nvidia there with €2900, which will soon be liquidated and deposited at TR with interest as a nest egg.

Any money that is left over will either be divided up or used to buy something.

I've already reached my annual target of €15,000, which makes me pretty happy. The next step is €35,000 by the end of 2025.

The deposit with Scalable + Bitcoin is intended to last forever, in case I can manage without touching it with my family, children, house, etc.

Thank you very much!