Capital One reports 1.6% profit increase in third quarter due to higher interest income

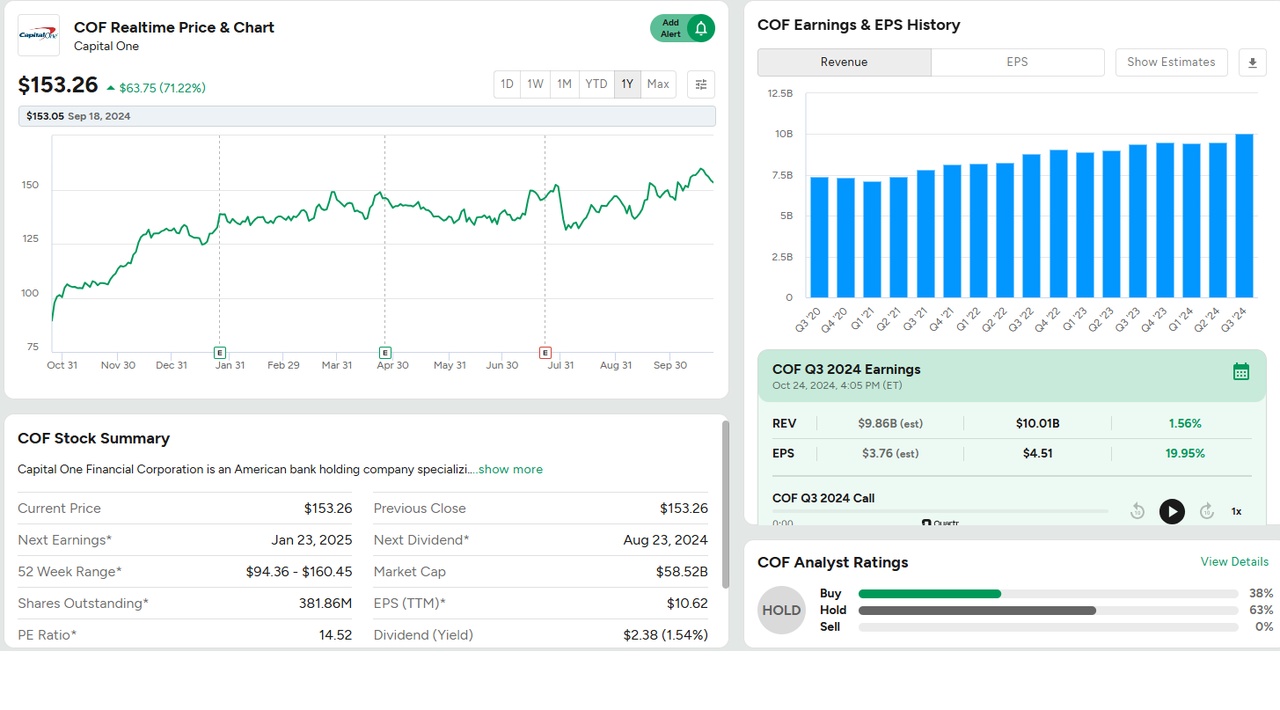

Capital One Financial Corp. reported a 1.6% increase in third quarter earnings. This increase was due to higher interest rates, which boosted the company's income from credit card debt repayments. The company's net interest income, which reflects the difference between interest earned on loans and interest earned on deposits, rose by almost 9% to around USD 8.1 billion in the third quarter.

The consumer lender thus outperformed in a sector that generally recorded a decline in interest income. This was thanks to higher interest rates on credit card debt compared to mortgages and other types of loans. Discover Financial Services $D1FS34 which is to be acquired by Capital One in a $35 billion transaction announced earlier this year, also reported a 10% increase in quarterly interest income.

Despite the positive revenue figures, the company is preparing for potential consumer charges. These could result from high interest rates, slower wage growth and reduced household savings. Capital One's provision for loan losses rose to $2.48 billion in the third quarter, an increase from $2.28 billion a year earlier.

Capital One's net charge-off rate, which indicates the percentage of loans considered uncollectible, rose to 3.27% from 2.56% in the same period last year. However, this increase in delinquencies is seen by executives and analysts as a return to pre-pandemic norms rather than an indicator of worsening economic conditions.

Capital One's adjusted net income for the quarter ended Sept. 30, 2023, was $1.73 billion, or $4.51 per share, compared to $1.71 billion, or $4.45 per share, a year earlier. Total net sales also increased 7% to $10 billion.

Source: investing.com