Diabetes injection: miracle cure or economic injection?

For a better view & outline, the conclusion and the summary, please have a look here:

https://topicswithhead.beehiiv.com/p/diabetesspritze-wundermittel-oder-wirtschaftsspritze

1.1 Types of diabetes

As the drugs were mainly developed to treat diabetes, here is an overview of the different types of the disease, in particular type 2 diabetes. The treatment of type 1 diabetes is not covered here, as the drugs mentioned are not suitable for this form of the disease. In contrast to type 2 diabetes, which is often promoted by an unhealthy lifestyle and obesity, type 1 diabetes is independent of such factors and often occurs in childhood and adolescence. In type 1 diabetes, the pancreas fails completely so that insulin is no longer produced. Those affected must therefore inject insulin for the rest of their lives. This form of diabetes is currently incurable and is also known as insulin-dependent diabetes mellitus.

In contrast, type 2 diabetes is caused by insulin resistance. Although the body produces insulin, the cells are no longer sensitive enough to use it effectively. Not all people with type 2 diabetes are dependent on insulin therapy. As type 2 diabetes is caused primarily by an unhealthy lifestyle with a lack of exercise, in addition to genetic factors, and often progresses gradually, it can often be treated with a change in diet and more exercise. Medication is only required in advanced stages. Initially, oral medication such as metformin is used, but insulin injections may also become necessary as the disease progresses (BMG, 2024). Type 2 diabetes is therefore an acquired disease that is closely linked to lifestyle, even if genetic factors play a role. This type of diabetes can therefore often be successfully treated through lifestyle changes. If this is no longer sufficient, medication such as metformin must be used. Patients with severe type 2 diabetes may also require insulin. GLP-1 injections are another treatment option.

1.2 What similar medications have been available to date?

In 2009, the product Victoza was launched on the market, which is approved for the treatment of type 2 diabetes. Saxenda, also launched in 2009, is a slimming product. Both products are manufactured and marketed by Novo Nordisk and contain liraglutide as the active ingredient. This binds to the GLP-1 receptors and has similar properties to the newer preparations. Liraglutide stimulates insulin secretion in a glucose-dependent manner and inhibits glucagon secretion when blood glucose levels are elevated, which curbs appetite and provides a longer-lasting feeling of satiety. It is important to emphasize that this medication is not an insulin substitute. Patients treated with liraglutide must continue to inject insulin and the medication must be used daily (Pharmaindex, current status 09.05.2024). Insulin or metformin are also among the classic medications used in diabetes therapy, but not all type 2 diabetics are dependent on these medications.

1.3 What distinguishes the new GLP-1 syringes from other diabetes medications?

The different diabetes injections work in different ways. GLP-1 drugs, also known as incretin mimetics, act directly on insulin secretion, which is often reduced in type 2 diabetics (Pharma Index 2024). Novo Nordisk's Wegovy uses semaglutide, which is similar to the body's own hormone GLP-1, as its active ingredient. By binding to the GLP-1 receptors, it promotes the release of insulin and thus lowers blood sugar levels. It also makes you feel fuller for longer and slows down gastric emptying (Sartori 2024).

Another drug from Novo Nordisk is Ozempic, which is approved in Germany and the USA for the treatment of type 2 diabetes. It also contains semaglutide and can be used as monotherapy, especially if metformin is not tolerated. In addition, Ozempic can be used in combination with other antidiabetic drugs (Pharmainfo Yellow List, current status 09.05.2024). While Wegovy is also approved for weight loss, Ozempic is only approved in Germany for the treatment of type 2 diabetes (Sartori 2024, Steiner 2024). Another difference concerns the dosage: the maximum dose of Ozempic is 1 milligram, while Wegovy is 2.4 milligrams. However, doctors can issue the drug on private prescription, which occasionally leads to bottlenecks in the supply of diabetics. There is also a lack of long-term studies on the effects and consequences for obese patients without type 2 diabetes.

Other active ingredients include tirzepatide, which is marketed by Eli Lilly under the brand name Mounjaro (Sartori 2024). This drug also binds to the GIP receptors and thus has a dual effect. It improves both the glucose sensitivity of the beta cells of the pancreas and the insulin sensitivity, which leads to a prolonged feeling of satiety (Pharmaindex, current status 09.05.2024).

1.3.1 What are its advantages and disadvantages compared to other diabetes treatments?

A major advantage of these drugs compared to traditional diabetes treatment with insulin or Victoza is that the injections do not have to be administered daily. Ozempic, for example, only needs to be injected into the subcutaneous fatty tissue once a week (Steiner 2024). With conventional insulin therapy, patients are dependent on having insulin syringes to hand at all times and an insulin pump must be worn, which can be inconvenient. Metformin, on the other hand, must be taken orally. After appropriate training, patients can use the diabetes injections independently and therefore enjoy more flexibility than with other treatment methods. However, this flexibility only applies if the injections are used as monotherapy. Nevertheless, it should not be overlooked that there is a long list of possible side effects that should not be underestimated.

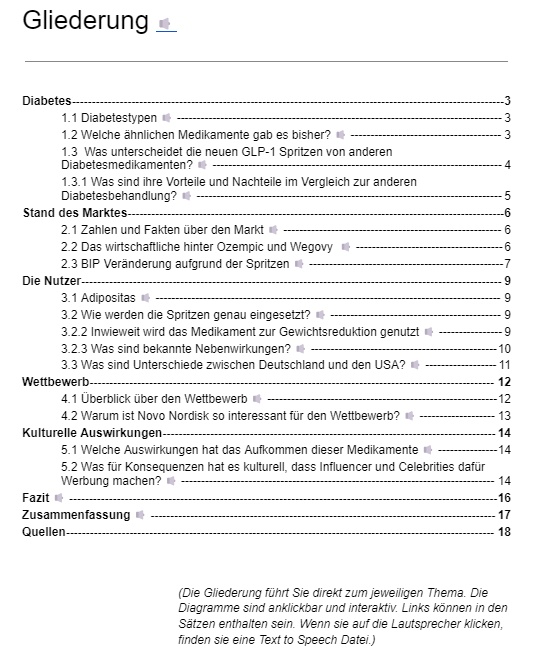

2.1 Facts and figures about the market

The International Diabetes Federation (IDF) predicts that by 2045 around one in eight adults, i.e. around 783 million people, will suffer from diabetes. The situation in the area of obesity and pre-obesity is similarly alarming. International organizations such as the World Health Organization (WHO) and the International Osteoporosis Federation (IOF) estimate that up to 45 to 55 percent of the world's population will be affected by overweight or obesity. This development will have a significant impact on the diabetes market, with the global market for diabetes drugs expected to reach a volume of around EUR 70 billion by 2024 and exceed the EUR 100 billion mark by 2030. In addition, the cost of treating obesity is forecast to rise to 3.3 trillion US dollars by 2030. This does not yet include the consequential costs of associated diseases such as cardiovascular problems or orthopaedic operations (e.g. knee replacements). Against this backdrop, the fight against obesity could become one of the most important and economically significant markets of the future.

2.2 The economic potential of Ozempic and Wegovy

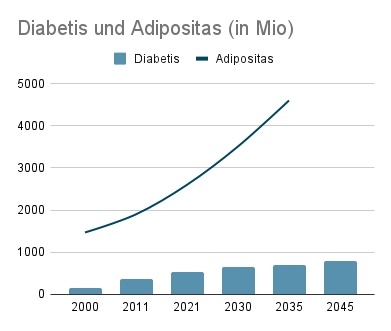

A central question that quickly arises is the economic potential of Ozempic. The development of the product shows how rapidly the business has grown. After Ozempic was launched on the market in 2017-2018, it initially needed time to establish itself among the competition. Usage gradually increased and sales rose, even during the coronavirus pandemic. However, the hoped-for profit did not materialize at first, as the expected hype had not yet materialized and off-label use was hardly relevant.

In 2022, the picture changed dramatically: rumors about the effectiveness of Ozempic as a slimming product led to enormous demand, although this application had not yet been empirically proven at that time. Despite the lack of scientific evidence, both sales and profits increased considerably. The turning point came in 2023, when studies were published confirming the positive effect of Ozempic on weight loss. This scientific backing sparked massive hype that helped Novo Nordisk achieve record profits - a trend that continued in 2024, with no sign of waning demand.In light of the sharp increase in demand, Novo Nordisk decided to acquire pharmaceutical supplier Catalent for USD 16.5 billion in March 2024. This strategic acquisition illustrates the company's ambition to significantly expand its production capacity to ensure the availability of Ozempic and continue to respond to demand.

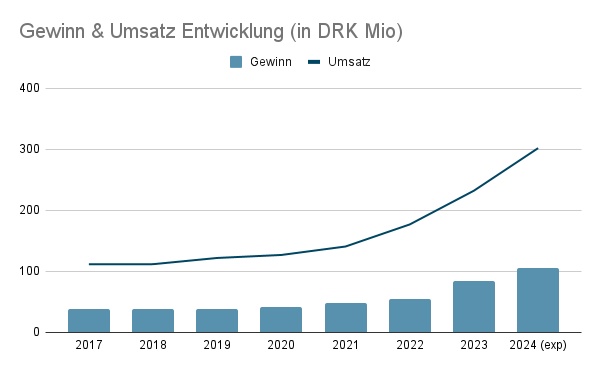

Novo Nordisk's success is also reflected in its market capitalization. Over the last ten years, the company's share price has increased approximately sevenfold, making Novo Nordisk one of the largest companies in Europe. In addition, the Group is now one of the 15 most valuable listed companies in the world. This development has a significant impact on Denmark, which now has one of the most important and influential companies on a global level.

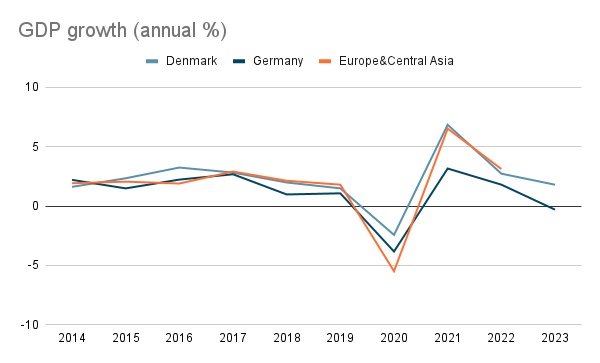

2.3 GDP change due to the syringes

The economic importance of Novo Nordisk becomes particularly apparent when considering the size of the company in the context of Denmark's gross domestic product (GDP). While it is not methodologically correct to compare a company's market capitalization directly with a country's GDP, it is worth noting that Novo Nordisk's market capitalization exceeds Denmark's GDP. This fact not only underlines the extraordinary size of the company, but also has profound economic implications.

A look at Denmark's GDP growth rate shows that the country is performing above average in a European comparison. This is not only due to the fact that Denmark's GDP fell less sharply during global economic downturns, but also to the rapid economic recovery that the country is experiencing. A key driver of this recovery is the pharmaceutical industry, above all Novo Nordisk.

The users

3.1 Obesity

Although the injections were not originally intended primarily to treat obesity, i.e. morbid obesity, it is important to briefly define this condition. The Obesity Society describes it as "a chronic disease characterized by an increase in body fat that exceeds normal levels." The classic treatment methods for obesity include services such as nutritional counseling and exercise therapy. In cases of persistent and pronounced obesity, gastric bypass surgery can also be considered to reduce the morbid excess weight.

3.2 How exactly are the injections used?

These drugs are primarily used to treat diabetes mellitus. Nevertheless, some doctors also prescribe them on a private prescription, which enables so-called "off-label use" - the use of a drug for a purpose other than that for which it was originally intended. In Germany and the USA, many patients want injections such as Ozempic or Mounjaro exclusively for weight loss. However, this demand has led to repeated shortages and supply problems, including in Germany. The situation has worsened to such an extent that pharmacists are advised to ask for a diabetic ID card and only give the injections to diabetics (Leyke-Hess 2023).

The injections can therefore be used both for the treatment of type 2 diabetes and for weight reduction. They can be used either as monotherapy or as part of a comprehensive diabetes therapy, especially for diabetics who also want to lose weight.

3.2.1 To what extent is the drug used for weight loss?

Ozempic is explicitly approved for the treatment of type 2 diabetes and can therefore not be reimbursed by health insurance companies as a weight loss medication. In contrast, the Mounjaro injection is not only approved for the treatment of type 2 diabetes in Germany. According to an official statement from the manufacturer Eli Lilly, the drug can also be used to treat severe obesity without diabetes. However, studies on possible side effects or long-term consequences of this application are currently lacking (Leyke-Hess 2023).

3.2.3 What are the known side effects?

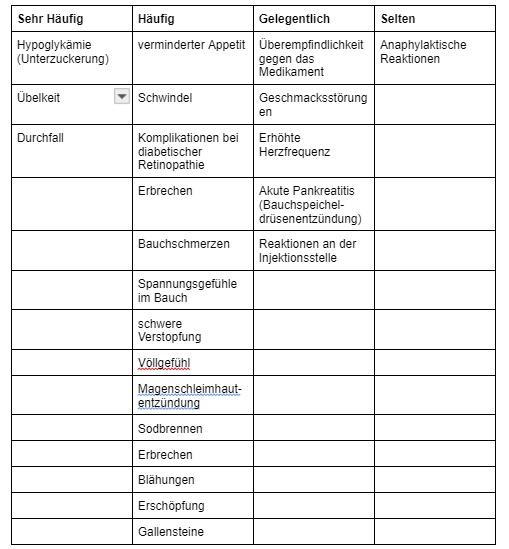

Side effects of Ozempic according to EU Zulassung:

The side effects of Wegovy are similar, but cold symptoms may also occur (Wegovy.com 2024). Mounjaro also has a similar list of side effects (European Commission 2024).

It goes without saying that all medications have potential side effects. Ultimately, it is the responsibility of each patient to decide, in consultation with their doctor, whether the benefits outweigh the risks.

3.3 Differences between Germany and the USA

In Germany, these drugs are only approved on medical prescription (see, for example, the consumer information on the Eli Lilly website). The prescription is subject to strict guidelines and can be refused by health insurance companies. Nevertheless, it is not only in the USA that there are doctors who advocate off-label use and prescribe the drugs on private prescription. However, this trend should be viewed critically, as the long-term consequences of off-label use have not yet been researched (SOURCE).

In general, it can be said that it is much easier to obtain a prescription for these drugs in the USA, even if they are also subject to prescription there. In addition, there are other weight loss injections, such as Trulicity, which are not approved in Germany (Superdrug.com). Drug approvals in the EU are subject to different guidelines compared to the USA. For example, Trulicity is only approved in the EU for the treatment of type 2 diabetes in children, despite the increased risk of developing thyroid cancer. A warning to this effect can be found as a fixed banner on the manufacturer's US website. Meaningful long-term studies are still lacking for the entire range of these drugs, as they are still too new on the market (Jacobi 2023).

Competition

4.1 Overview of the competition

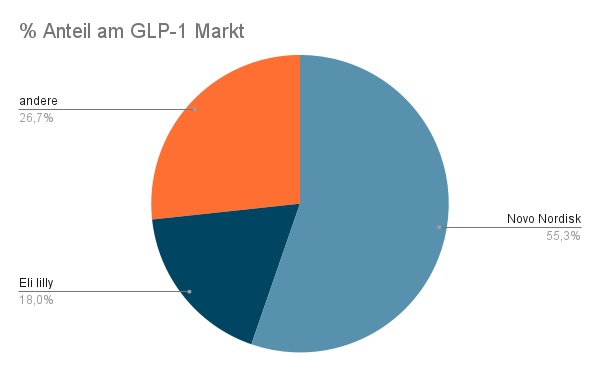

Novo Nordisk, the leading manufacturer of Wegovy and Ozempic, holds a dominant position in the diabetes and obesity market with an impressive 55.3% market share. Eli Lilly follows with 18%, while the other competitors together account for only 26% of the market. Market analyses indicate that this distribution will hardly change in the near future. It is expected that Novo Nordisk and Eli Lilly will continue to hold over 60% of the total market for diabetes drugs, although overall market shares could diversify.

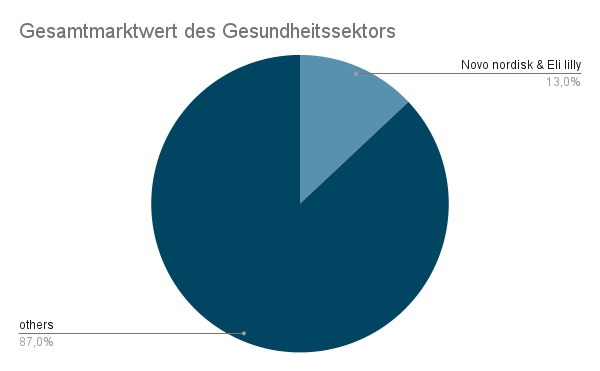

The outstanding importance of Novo Nordisk and Eli Lilly is illustrated by a pie chart: together they represent more than 13% of the healthcare market capitalization. Due to their enormous revenues, both companies are expected to grow continuously as they consistently invest in research and development. In 2023, Eli Lilly's investments amounted to 9.3 billion dollars, while Novo Nordisk invested 4.7 billion dollars in innovative projects. If you add these sums together, they rank among the largest listed companies in Germany.

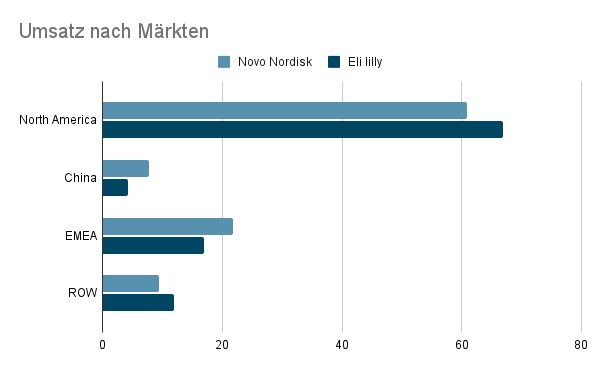

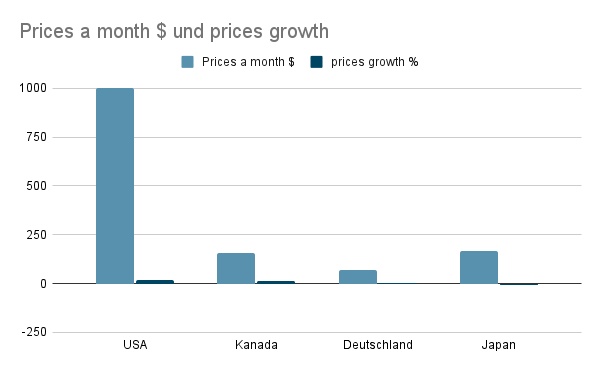

A look at the regional turnover reveals that North America (NA) is clearly the market with the highest turnover at over 50%. This is due to various factors. Firstly, North America has one of the highest overweight rates in the world, and secondly, consumers are significantly more profitable here. In contrast to Europe, where the pharmaceutical market is subject to intense competition, prices in North America have a different dynamic. While negotiations on prices do take place, there are no uniform health insurance schemes as in Germany. A striking example of this is the pricing of medicines: At a price of 1,000 dollars per month, treatment in the USA is almost twelve times more expensive than in Germany. This price trend shows that demand exceeds supply and thus favors pricing. In Japan, prices are falling, which is less due to falling demand than to the weak yen. In contrast, the price in Germany is the lowest at around 69 dollars (it should be noted that prices can vary greatly depending on conditions).

Against the background of this enormous income, the question arises as to why only two companies dominate the market and where the competition is. The latter is currently developing its own products and faces the challenge of developing them and getting them approved, which takes a lot of time. Consequently, it can be concluded that prices should tend to fall in the long term.

4.1 Why is Novo Nordisk so interesting for the competition?

The analysis of the available data impressively illustrates Novo Nordisk's strong market position. But what makes the company, which sets standards with its products such as Ozempic, so special? Although we cannot explore the full complexity of its history here, it is clear that Novo Nordisk's central goal has always been the treatment of diabetes, an aspect that is deeply rooted in the company's internal structures.

Novo Nordisk's voting rights are in the hands of a foundation, Novo Holding A/S, which holds 77.1 percent of the voting rights and 28.1 percent of the capital. This structure ensures that the foundation has a decisive influence on the Group's strategic decisions and thus ensures that Novo Nordisk remains true to its original purpose. Historical events and the repeated emphasis on this mission prove that Novo Nordisk is firmly committed to prioritizing the fight against diabetes, and this clear focus on the core business, coupled with a stable governance structure, positions the company not only as a market leader but also as a reliable player in the healthcare sector, continuously working to improve the quality of life of people with diabetes.

5.1 Impact of the emergence of these drugs

The emergence of Ozempic led to a significant increase in the use of injectable weight loss drugs, particularly in the US. The drug gained widespread attention after numerous influencers and celebrities promoted it as an effective weight loss aid. Initially, many users tried to conceal the use of Ozempic for weight loss, but over time its use became increasingly openly discussed. Celebrities such as Khloé Kardashian, Kelly Osbourne and Rebel Wilson openly admitted to using injections for weight loss (Hogan et al. 2024).

The increasing popularity of Ozempic and similar drugs has led to a societal debate about the ethical and medical implications of their use. On the one hand, the potential of these drugs to treat obesity is emphasized, especially for people who do not respond to conventional weight loss methods. On the other hand, there are concerns about availability and security of supply for diabetics, as increased demand is leading to supply shortages worldwide (TGA 2024). Novo is also reporting ongoing supply shortages in Germany for 2024, with starter kits also affected. As a result, the manufacturer Novo Nordisk, for example, is asking that Ozempic only be prescribed to diabetics by GPs (Burger 2024).

5.2 Cultural consequences of advertising by influencers and celebrities

Not all influencers and social media creators advertise the medication without reflection. One YouTuber who regularly draws attention to the dangers and side effects of Ozempic is ObeseToBeast. This YouTuber has been running his channel for many years and has achieved significant weight loss himself. He uses his platform to educate about various aspects of weight loss and hopes to provide a realistic perspective on these drugs through his reach. D'Angelo Wallace, a more popular YouTube channel, published a critical video on the topic a month ago, which has already garnered 1.5 million views.

Unfortunately, the drugs are often promoted by influencers without reflection. Under the hashtag #Ozempic there are over 190,000 posts on Instagram, almost 87,000 videos on the topic on TikTok, and there are also numerous posts on X. Ozempic is now such a big topic, especially in the USA, that it is even being addressed by series such as South Park. The episode "The End of Obesity" deals with how the American healthcare system deals with the drug.

The demand for these drugs is so high that the Federal Institute for Drugs and Medical Devices (BfArM) has issued an official warning about counterfeit drugs. The BfArM update makes it clear that these counterfeits have been discovered. This example illustrates the serious consequences of an extreme increase in demand. The use of counterfeit medicines can not only be harmful to health, but also life-threatening.

It gives the impression that weight loss is easily achievable without side effects if you have access to these drugs. Celebrities like Kelly Osbourne also reinforce a class image that creates the impression that these drugs are elitist because of their price - an expression of wealth and luxury. Statements such as that critics of the drugs either take them in secret or are just jealous because they can't afford them (Schultz 2024) promote a clear class image that further stigmatizes obesity. Such statements contribute to an unreflective approach to these drugs and give the impression that there are no side effects.

After the body positivity movement was propagated by influencers in recent years, this ideal is now being reversed. Being slim at all costs is once again becoming the ideal of beauty. When normal-weight celebrities take up weight loss injections that are actually intended to treat severe obesity or diabetes, this has a negative impact on the self-image of teenagers and young adults. The impression is created that being thin is the only value worth striving for and that achieving this goal is only a question of money. The negative consequences are mostly kept quiet, and those who speak out critically are sometimes publicly attacked by other celebrities.

For the conclusion, the summary and a better view, have a look here: https://topicswithhead.beehiiv.com/p/diabetesspritze-wundermittel-oder-wirtschaftsspritze

Sources

Chapter 2.1

https://idf.org/about-diabetes/diabetes-facts-figures/ (08.05.2024)

https://ourworldindata.org/obesity#all-charts (08.05.2024)

https://diabetesatlas.org/data/en/world/ (08.05.2024)

Chapter 2.2

Financial results and events overview - Novo Nordisk 2017-2024 Q1

https://www.catalent.com/catalent-news/novo-holdings-to-acquire-catalent/

https://companiesmarketcap.com/novo-nordisk/marketcap/#google_vignette

Chapter 2.3

https://www.imf.org/en/Home (08.05.2024)

https://companiesmarketcap.com/novo-nordisk/marketcap/#google_vignette

https://fortune.com/europe/2024/03/05/novo-nordisks-wegovy-and-ozempic-boom-saved-denmarks-gdp-from-a-no-growth-2023/ (09.05.2024)

Chapter 4.1

https://investor.lilly.com/ 2022-2024 Q1

Financial results and events overview - Novo Nordisk 2017-2024 Q1

https://www.healthline.com/health-news/heres-how-much-more-ozempic-costs-in-the-u-s-compared-to-other-countries# (09.05.2024)

https://www.msci.com/www/fact-sheet/msci-world-health-care-index/08721816

Chapter 4.2

Financial results and events overview - Novo Nordisk 2017-2024 Q1

https://www.novonordisk.com/investors/stock-information/share-and-ownership-structure.html

Sources chapter 1,3 & 5:

1. @bijans. "Ok this clip about navigating the American Healthcare System from the recent South Park ozempic special (which was brilliant) needs to be the opening of every healthcare conference panel." X, 26 May 2024, https://x.com/bijans/status/1794770258177478803?s=52 Accessed 27 May 2024.

2 @D'Angelo Wallace. "The Ozempic Olympics: Hollywood is Ruining Our Health." YouTube, 2024, https://www.youtube.com/watch?v=Gj5uEr0Lh-k Accessed 27 May 2024.

3. @ObeseToBeast. "The Devastating Impact of Ozempic in Pop Culture." YouTube, 2024, https://www.youtube.com/watch?v=ZnWMO1nyvQ4&t=486s Accessed 27 May 2024.

4. "Common Side Effects of Wegovy." Wegovy, n.d., https://www.wegovy.com/taking-wegovy/side-effects.html Accessed 27 May 2024.

5. "Definition of Obesity." Obesity Society, https://adipositas-gesellschaft.de/ueber-adipositas/definition-von-adipositas/ Accessed 27 May 2024.

6. "Diabetes." Federal Ministry of Health, https://www.bundesgesundheitsministerium.de/themen/praevention/gesundheitsgefahren/diabetes Accessed 27 May 2024.

7 European Commission. "Mounjaro, INN-Tirzepatide - Annex 1 Summary of product characteristics." https://ec.europa.eu/health/documents/community-register/2022/20220915156773/anx_156773_de.pdf Accessed 27 May 2024.

8 European Commission. "Ozempic, INN-Semaglutide - Annex 1 Summary of Product Characteristics." European Commission, https://ec.europa.eu/health/documents/community-register/2020/20200930149037/anx_149037_de.pdf Accessed 27 May 2024.

9 Herbel, Jan Niklas. "GLP-1 receptor agonists (incretin mimetics)." Yellow List - Pharma Index, 2021, https://www.gelbe-liste.de/wirkstoffgruppen/glp-1-rezeptoragonisten-inkretinmimetika Accessed 27 May 2024.

10. Hogan, Kate, et al. "Stars Who've Spoken About Ozempic - And What They've Said." People Magazine, 15 May 2024, https://people.com/celebrities-ozempic-wegovy-what-theyve-said-7104926 Accessed 27 May 2024.

11 Jacobi, Barbara. "What's the Truth About the Weight Loss Shot?" Radio interview, 25 Sept. 2023, SR Radio, https://www.sr.de/sr/mediathek/audio/SR3_SR3_BF_5292.html Accessed 27 May 2024.

12 Leyke-Hess, Ute. "Mounjaro: All about the new diabetes drug and its effect on weight loss." Qunomedical, 12 Oct. 2023, https://www.qunomedical.com/de/blog/mounjaro-diabetes-medikament-und-wirkung-auf-gewichtsverlust Accessed 27 May 2024.

13. "Liraglutide." DocCheck Flexicon, https://flexikon.doccheck.com/de/Liraglutid Accessed 27 May 2024.

14. "Metformin." Profile, https://www.profil.de/ueber-diabetes/metformin#:~:text=Metformin%20ist%20ein%20Medikament%20zur,und%20die%20Insulinwirkung%20wird%20verbessert Accessed 27 May 2024.

15. "Metformin." Profile, https://www.profil.de/ueber-diabetes/metformin Accessed 27 May 2024.

16. "Common Side Effects of Wegovy." Wegovy, n.d., https://www.wegovy.com/taking-wegovy/side-effects.html Accessed 27 May 2024.

17. "Professional information Victoza." Novo Nordisk, 2023, https://www.novonordiskpro.de/content/dam/Germany/AFFILIATE/www-novonordiskpro-de/de_de/diabetes/fi/FI_Victoza.pdf Accessed 27 May 2024.

18. "GLP-1 receptor agonists (incretin mimetics)." Yellow list, https://www.gelbe-liste.de/wirkstoffgruppen/glp-1-rezeptoragonisten-inkretinmimetika Accessed 27 May 2024.

19. "Information for patients." Wegovy, n.d., https://www.wegovy.de/ Accessed 27 May 2024.

20. "Insulin." Netdoctor, https://www.netdoktor.de/krankheiten/diabetes-mellitus/insulin/#:~:text=Insulinpflichtige%20Diabetiker%20injizieren%20sich%20das,Pumpe%20die%20h%C3%A4ndisch%20verabreichten%20Spritzen Accessed 27 May 2024.

21 Ahrafi, Babak. "Ozampic." Superdrug Online Doctor, 9 Feb. 2024, https://onlinedoctor.superdrug.com/ozempic.html#:~:text=Can%20you%20buy%20Ozempic%20over,%2Donly%20medicine%20(POM) Accessed 27 May 2024.

22 Australian Government - Department of Health and Aged Care. "About the Ozempic (semaglutide) shortage 2022 and 2024." https://www.tga.gov.au/safety/shortages/information-about-major-medicine-shortages/about-ozempic-semaglutide-shortage-2022-and-2024#:~:text=it%20is%20not%20known%20when,strengths%20of%20Ozempic%20throughout%202024 Accessed 27 May 2024.

23 Burger, Ludwig. "Novo says Ozempic starter kits still not available in Germany Q2." Reuters, 3 Apr. 2024, https://www.reuters.com/business/healthcare-pharmaceuticals/novo-says-ozempic-starter-kits-still-not-available-germany-q2-2024-04-03/ Accessed 27 May 2024.

24. "Ozempic." n.d., https://www.ozempic.com/ Accessed 27 May 2024.

25. "Ozempic - Type 2 diabetes." Yellow list, https://www.gelbe-liste.de/neue-medikamente/ozempic-diabetes-typ2 Accessed 27 May 2024.

26. "Ozempic Prescription Free." Zava, https://www.zavamed.com/de/ozempic-rezeptfrei.html Accessed 27 May 2024.

27. "Semaglutide." Yellow list, https://www.gelbe-liste.de/wirkstoffe/Semaglutid_55565 Accessed 27 May 2024.

28 "The Devastating Impact of Ozempic in Pop Culture." YouTube, https://www.youtube.com/watch?v=ZnWMO1nyvQ4&list=WL&index=6 Accessed 27 May 2024.

29 "Trulicity." Lilly, https://trulicity.lilly.com/ Accessed 27 May 2024.

30 Leyke-Hess, Ute. "Semaglutide - The syringe to lose weight?", Qunomedical, 9 Jun. 2024, https://www.qunomedical.com/de/blog/semaglutid-die-spritze-zum-abnehmen Accessed 8 May 2024.

31. "Prescription News No. 4." Association of Statutory Health Insurance Physicians Berlin, Apr. 2023, https://www.kvberlin.de/verordnungs-news-nr-4-april-2023 Accessed 27 May 2024.

32 Sartori, Christina. "The weight loss injection: breakthrough or risk?" Quarks, 24 Apr. 2024, https://www.quarks.de/gesundheit/medizin/abnehmspritze-semaglutid-ozempic-wegovy/ Accessed 8 May 2024.

33 Steiner, Anna-Kristin. https://zanadio.de/adipositas-behandlung/ozempic/ Accessed 27 May 2024.

34. "Obesity therapy - An effective weight loss drug for the first time." Medical Journal, https://www.aerzteblatt.de/archiv/233456/Adipositastherapie-Erstmals-ein-wirksames-Abnehmmedikament Accessed 27 May 2024.

$NOVO B (+1.22%)

$LLY (+0.26%)

$ROG (+0.51%)

$VRTX (+6.64%)

$AMGN (+0.58%)