I got in today at the 52-week low.

In my view, a quality share.

Maximum is 1.0:

Stability Turnover 0.95

Profit stability: 0.95

Stability dividend: 0.96

Stability of cash flow: 0.98

Debt ratio has increased compared to the last 5 years: 17.3%

Repayment period: 3 years.

Profit development: a positive return can be expected in the long term.

+This is not investment advice.

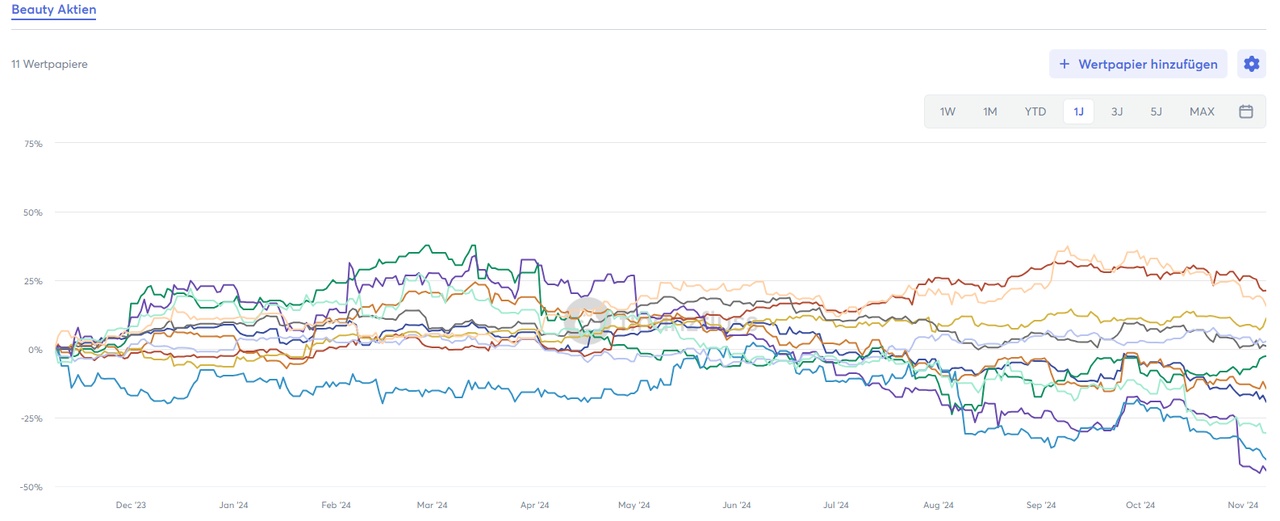

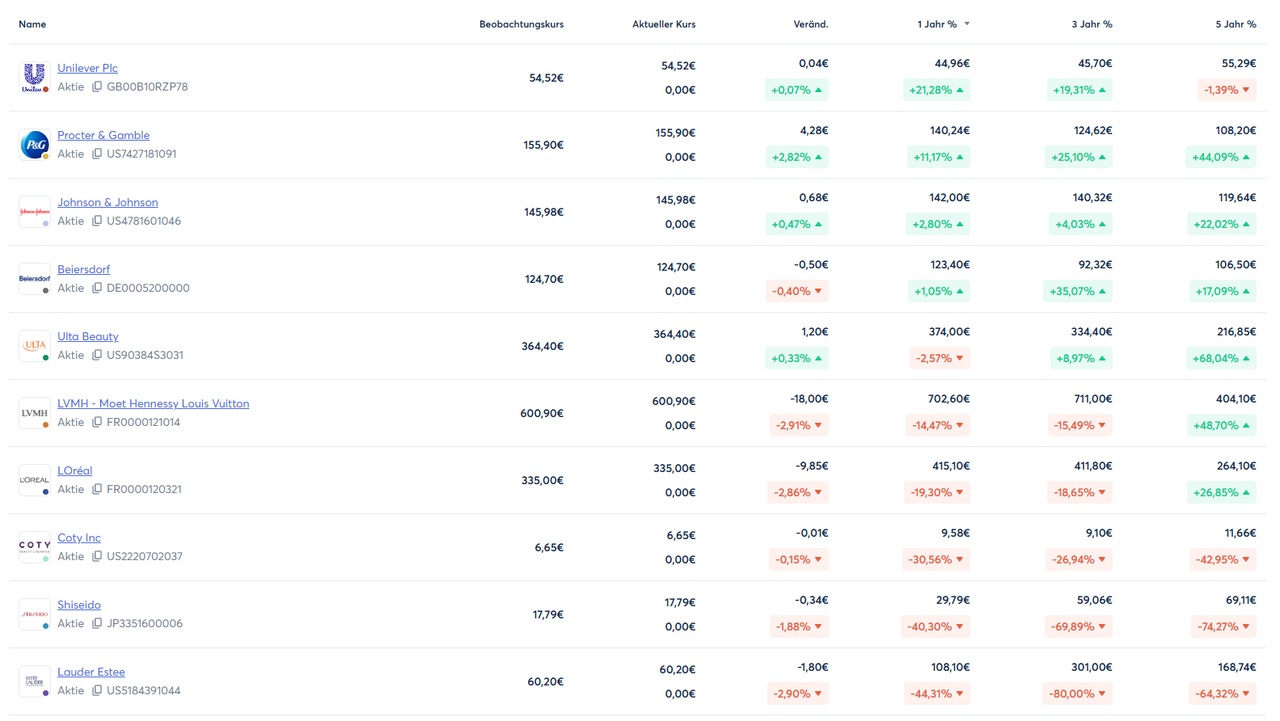

The price performance in % of the beauty shares in comparison.

The price development in % of beauty stocks in comparison.