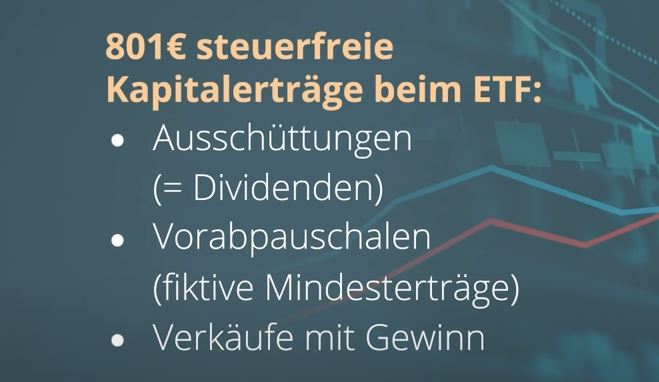

As a supplement to today's Vanguard post, a very good comparison video from Finanztip, in my opinion, is already 3 years old, but still valid! Apart from the old allowance of €801, nothing has changed.

A post to bookmark, and whenever you are faced with the decision between accumulating and distributing - watch the video as a refresher! Then finally the eternal compound interest discussions, tax deferrals, advance lump sums and dividends.

The conclusion up front: If the dividends are regularly reinvested, a distributor has no disadvantage compared to an accumulator, both receive approximately the same net payout in the end.

The main difference is:

The accumulator is a "carefree package without expense" in contrast to the distributor, where you reinvest the dividends again and again.

Financial tip: https://youtu.be/eAY6iZ6mlyw

Vanguard Post: https://app.getquin.com/activity/lMJYvsxvOT?lang=de&utm_source=sharing

#Thesaurierer

#ETF

#Ausschütter

#Dividenden

#reinvestieren