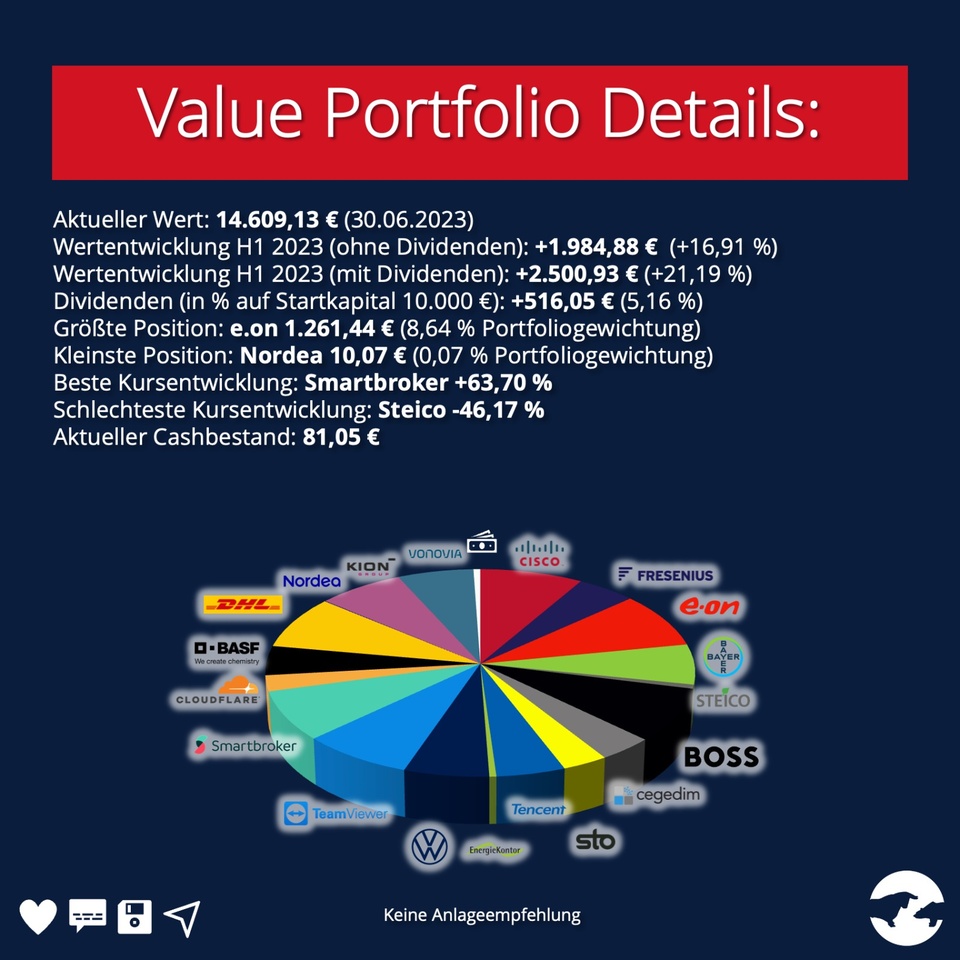

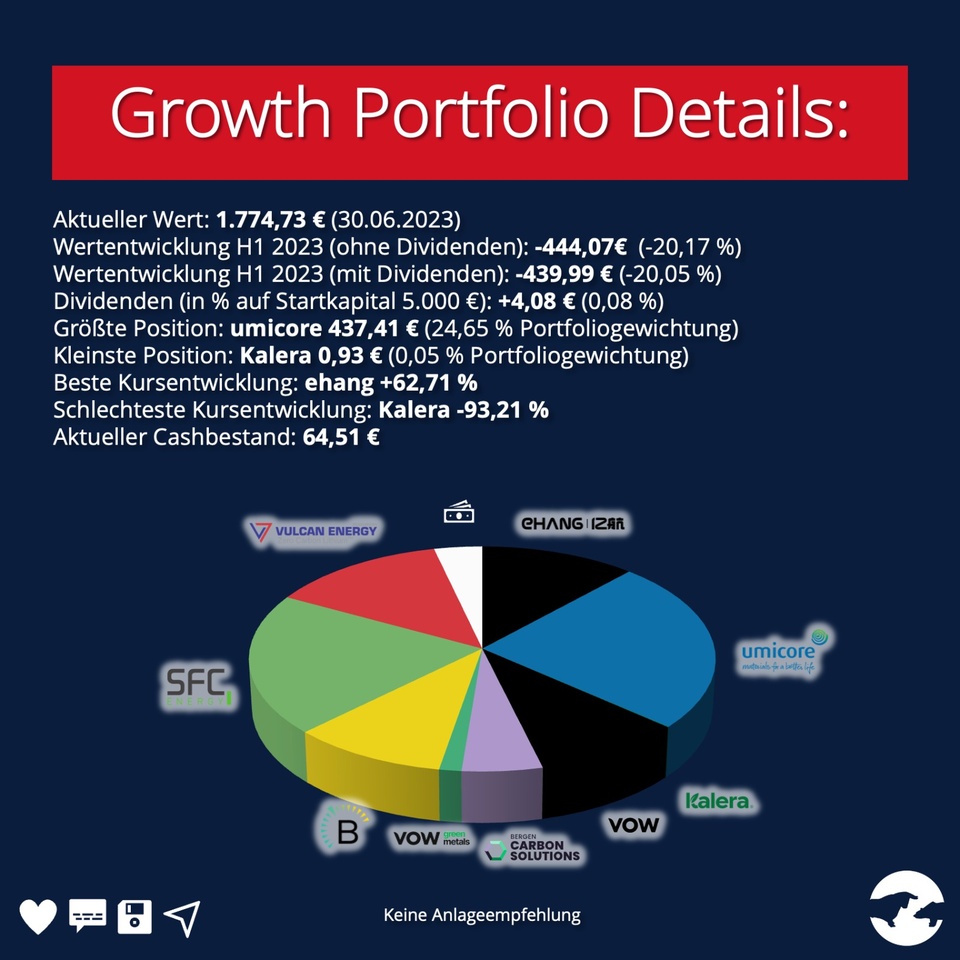

The development of our growth and value portfolios could not be more different. Our growth portfolio is still on the decline; with Kalera and Quantafuel, we had two quasi-insolvencies here. This reduces the chances for a tenbagger. In the Growth Depot, we pursue a venture capital approach, we hope that a company will really take off and accept the failure of the other investments. Our approach is completely different in the Value Depot, where we buy stocks that are undervalued from our point of view. With this approach we have been able to beat the market so far. We are curious how long our portfolio will perform better than the MSCI World. In the long run, very few fund managers manage to beat this benchmark.

Conclusion: With our value portfolio we have a presentable record and have been able to beat the market, our growth portfolio continues to suffer from the strict monetary policy of the central banks, and startup financing has also slumped. There is less venture capital available, therefore valuations are falling.

#aktienstudieren, the #finanzblog, mediated #aktienwissen, #finanzbildung, #bildung and #finanziellebildung to #passivinvestieren to #studieren. Each #aktie is traded at the #börse market and ideally pays #dividende at a #dividendenstrategie. Then #verdient one #geldimschlaf has a #passiveseinkommen with #etfs, #rendite and #einkommen a #altersvorsorge with #aktien. Today is #zahltag, there is #einkommen, #geld because #geldtutgut