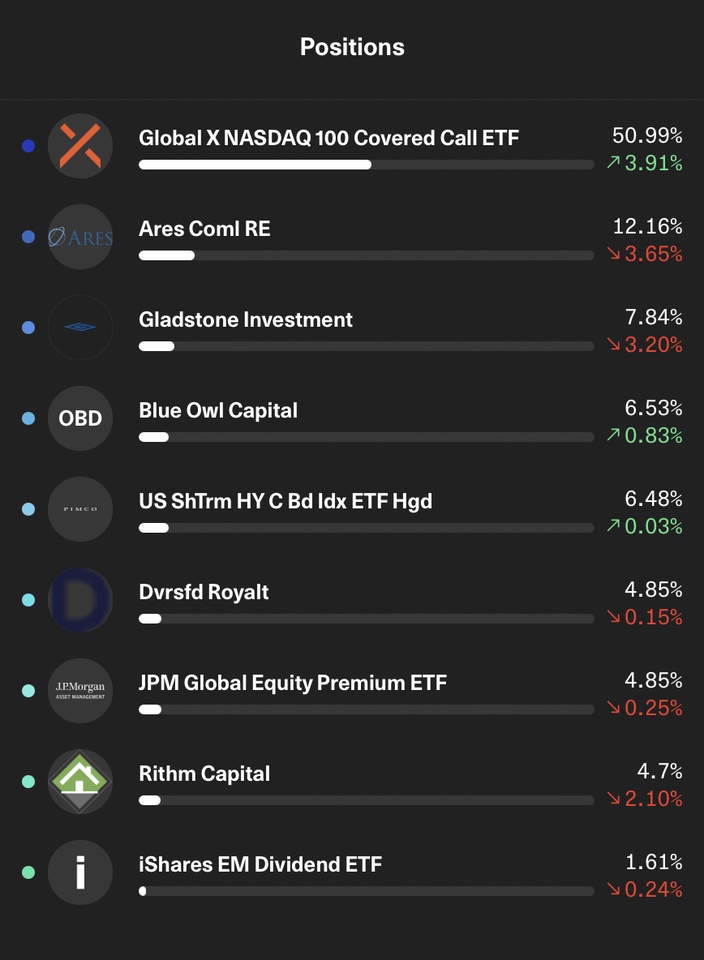

High Yield Income Portfolio

Disclaimer: I know that this is not an optimal strategy (I also have a real portfolio). I also know that very few people are interested in this type of portfolio, so feel free to skip the post, you won't miss anything.

I started building this HY Income portfolio about three months ago.

The first position was $QYLE (-1.41%) and now I've gradually added more stocks.

$QYLE (-1.41%) is pretty much the classic when it comes to covered call ETFs and is in my opinion a must have for every portfolio of this type.

$ACRE (+3.72%) I have great confidence in the management of Ares and the company is one of the few MREITs that I trust with my money. ACRE's portfolio is currently being restructured to be more defensive.

$GAIN (-1.01%) Solid monthly dividend payer with some growth. The management seems pretty solid to me.

$OBDC (-0.96%) Since the company has changed its strategy a bit and is now investing more in equity to increase NAV, it is my favorite BDC.

$STHE (+0.32%) PIMCO specializes in high yield funds, in my opinion it is especially important in the high field area that you trust the management, which is why I chose this product.

$DIV (+1.09%) I like the portfolio of royalties and it offers further opportunities for diversification.

$JEGP (-0.04%) I really like the JP Morgan Covered Call ETF strategy, but will possibly exchange it for $JEPI as soon as it is tradable at TR.

$RITM (-0.58%) I like the vision of the CEO and the dividend is double covered.

$SEDY (+0.91%) was recommended to me by a friend.

QYLE is now being saved less, the focus is on the other stocks.

What are your favorite high yield stocks?