Hello all,

after a long time again a stock analysis, this time not a "hype stock" but an outsider: $TUI1 (-0.28%)

Hardly any stock has suffered as much as TUI in recent years.

The web version can be found here: TUI Aktienanalyse

Downfall or back to old strength?

Foreword

The TUI share has repeatedly been in the spotlight of negative headlines over the past 3 years. Government aid, bailouts, credit lines, substantial losses in the billions and capital increases characterized this period. Particularly in the context of the recent pandemic developments, the historically low share valuation and the volatility in the travel sector, TUI repeatedly came into focus. However, this long-lasting losing streak apparently came to an end with the publication of the current quarterly figures. People's unbroken desire for vacation and relaxation after all the years of pandemic and crisis once again pulled the TUI share into the headlines, but this time in a positive light.

This analysis takes a detailed look at the current situation, relevant key figures, recent news and developments and the medium to long-term share valuation of the TUI share. The aim of this analysis is to present a balanced overview of the TUI share and to enable an independent assessment of the future development of the TUI share, as well as a TUI share forecast 2025.

TUI the world's largest tourism group

The history "Zeitreise durch die Geschichte des Konzerns" of TUI dates back to 1923, when the company was founded as Preußische Bergwerks- und Hütten-Aktiengesellschaft (Preussag). In the 1990s, Preussag AG began to focus on the tourism business. Several acquisitions of tour operators, airlines and hotels followed. Among them, to name a few: Hapag-Lloyd, Nouvelles Frontières, Thomson Travel Group and Fritidsresor.

In June 2002, Preussag AG was renamed TUI AG and launched the TUI brand as the umbrella brand for all tourism activities. TUI AG became the largest tourism company in the world, with travel agencies, incoming agencies, hotels, airlines, cruise ships and tour operators.TUI has become one of the largest tourism companies in the world, offering a wide range of services. Among them package tours, hotel operations, cruises, airlines and tour operating. The company operates in numerous markets worldwide and serves millions of travelers annually.

In 2014, TUI AG merged with its British subsidiary TUI Travel PLC to form TUI Group, which is listed on the London Stock Exchange. TUI Group pursued a strategy of vertical integration, operating its own hotels, cruise ships and aircraft, and focusing on the experience offered to its customers.

However, the tourism industry is vulnerable to external influences such as geopolitical events, natural disasters and global health crises. The COVID-19 pandemic had a particularly severe impact on the travel business, resulting in massive drops in revenue of up to 98.5 percent when travel was banned with travel restrictions and lockdowns in Q2 2020, following the outbreak of the pandemic. In fiscal 2020/21, sales halved.

TUI responded to these challenges by strengthening its cost-cutting measures, taking advantage of government aid and loans, and developing new strategies to adapt to changing market conditions. With the end of the COVID 19 pandemic, the desire to travel also returned. With rising sales and several capital measures, TUI has repaid a large part of the government aid in the last two years.

The future outlook for TUI shares depends on several factors, including the recovery of the travel and tourism sector after the pandemic, the company's ability to adapt to new travel trends, and general economic developments.

This analysis will look in more detail at current developments in the company, economic factors and technical chart analysis of TUI shares. This should help to get a comprehensive picture of the potential opportunities and risks of the TUI share and answer the question about the TUI share forecast 2025.

Facts, figures and data

The king is dead, long live the king

During the pandemic and following the almost 99% drop in revenue in Q2 2020, as well as the government loans and capital measures taken, the TUI share and other representatives of the tourism industry were repeatedly declared dead.

To be sure, TUI is severely battered and historically undervalued, with a share price of 6.1 euros almost 84% from the last high of 2019. Nevertheless, the company is still present and is working its way back to profitability in 2023.

Sales on the rise, travel enthusiasm unbroken

TUI's sales in 2023 are almost back to pre-pandemic levels, and people's desire to travel is unexpectedly high despite inflation and the energy crisis.

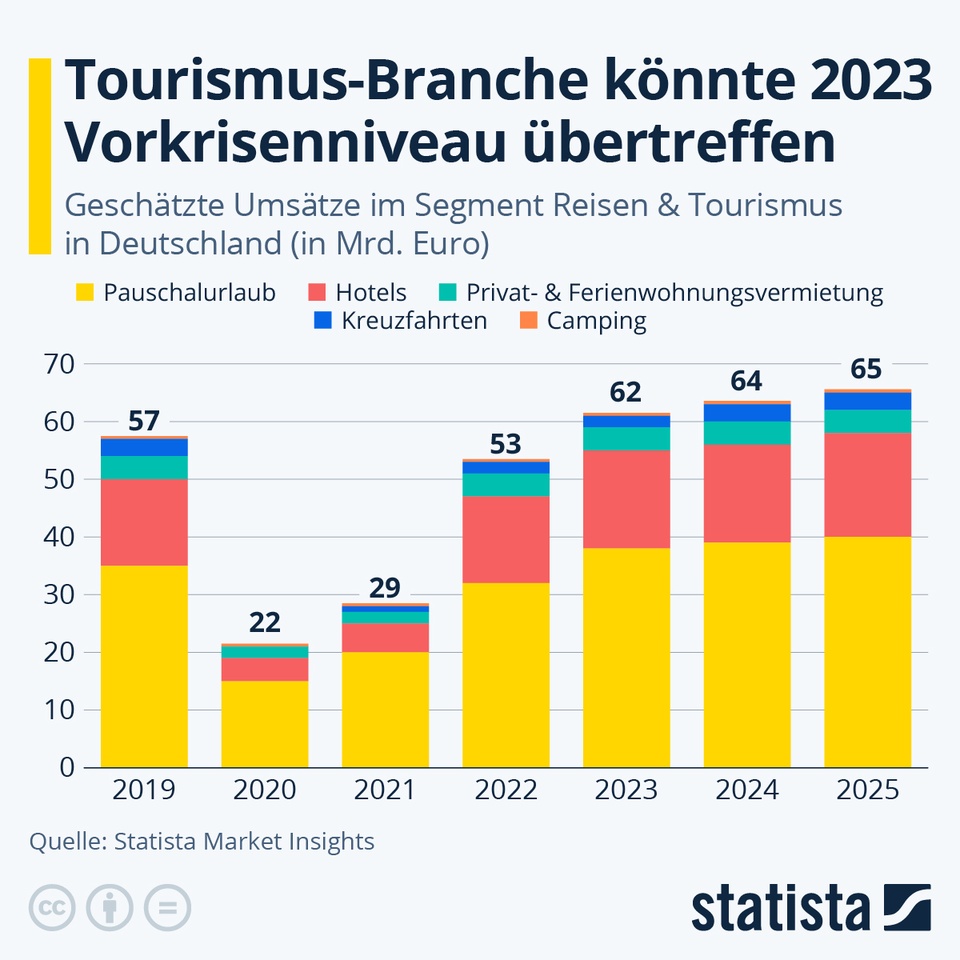

In 2021, Statista's forecast was still:

Pauschaltourismus erst 2024 wieder auf Vorkrisenniveau But the current figures show the old forecasts were too pessimistic.

Tourism is experiencing an unexpectedly strong boom despite inflation and the energy crisis. The pre-crisis level has already been exceeded. The largest share of sales is generated by package tours, where TUI is No. 1. This is not without consequences. TUI is already back in the black. Financial Times berichtetHedge funds that had bet on further years of travel slump and bankruptcies in the tourism industry are posting losses in the billions.

In view of the already upwardly corrected forecast for estimated sales in the tourism industry, it is reasonable to assume that future sales will continue to rise. After all, the current inflation and energy crisis will sooner or later come to an end. If TUI is already profitable again in this environment, then it is only a matter of time before the recovery sets in and profit margins increase.

TUI relies on AI

The Tagesschau quotes TUI's CIO on the subject of AI in a recent article. According to the article, TUI manager Pieter Jordaan estimates that Generative Artificial Intelligence (AI) will have a major impact on the tourism industry. "Those who use the technology will be faster and more productive than those who do without it" says the CIO (chief information officer)

of the travel group.

TUI is working to integrate AI into its applications. This makes it clear that TUI is not a sleeping giant that is sleeping through digitization and the triumph of AI, as Nokia was at the time with the development of smartphones. I also keep saying that companies that don't work with AI will be replaced sooner or later.

Quarterly figures Q2 2023

The figures published on 09.08.2023 Quartalszahlen FY23 Q3/9M were positive and exceeded expectations.

Both profit and sales were above the results of the previous year and also above forecasts.

Sales:

- 2023 earnings: 5.3 billion euros

- Forecast 2023: 4.94 billion euros

- Expectations exceeded: +7,3 %

- Growth compared with prior-year period: +19 %

EBIT (operating profit):

- Q3 2023 earnings: 169 million euros

- Forecast Q3 2023: 145 million euros

- Expectations exceeded: +16,55 %

- Outlook to September 2023: +409 million euros

- Prior-year period: -2.08 billion euros

Earnings are gradually returning to pre-crisis levels. The outlook is positive again, the order books are full.

With the figures positive again and the growth forecasts of the industry, the figures for TUI are extremely promising, a look at the price-earnings ratio according to MarketScreener:

P/E ratio 2023e: 8.6 / P/E ratio 2024e: 6 / P/E ratio 2025e: 5.

With a valuation of just over €6.1, the stock is at an all-time low and trading at an 84 percent discount to December 2019 levels (Corona pandemic outbreak).

The rapid descent resulted from many successive crises and setbacks. In January 2020, the COVID-19 pandemic broke out, leading to an absolute halt in travel and causing TUI's revenue to plummet by nearly 99 percent in the first quarter of 2020. No sooner had the Corona pandemic been overcome than the inflation and energy crisis followed, with considerable financial burdens both for customers and for the company itself. It was not until 2023 that the pandemic was officially declared over, leading to significant sales growth at TUI. However, the inflation and energy crises continue to be a burden, but at the same time offer opportunities for further recovery in the future.

The Corona pandemic was most likely the worst the travel industry had to endure. Assuming that the pandemic is finally over and that the inflation and energy crises will also subside in the coming years, we can expect a further continuation of the current positive trend and higher share prices.

Government aid

To survive the COVID19 pandemic and the loss of revenue, TUI has had to take out several billion euros in loans and government aid in recent years. This came at a price. Suspension of the dividend, as one of the conditions of the state, as well as high interest payments.

By April 2023, TUI had fully repaid the last tranche of state aid totaling 4.3 billion euros, including 381 million euros in interest, thus reducing its own net debt to pre-crisis levels:

Süddeutsche: Thanks to recent steps and increased demand for travel, the executive board led by TUI CEO Sebastian Ebel believes the group is in stronger shape to further expand its vacation business. "We are thus reducing our debt and interest costs and already expect a better net gearing ratio for the current fiscal year than in 2019," said Chief Financial Officer Mathias Kiep.

Capital increases

The rescue measures and the repayment of state aid cost the Group a lot of strength and the shareholders a lot of money, patience and staying power.

Four capital measures were carried out during the crisis years. In the last capital increase at the beginning of 2023, shareholders were offered 8 new shares for 3 existing shares; this resulted in a dilution of the share price and significant share price losses.

Russian oligarch and major shareholder Alexei Mordashov, who is subject to sanctions, was excluded from the capital increase. This led to additional pressure on the supply side, as his shares ended up on the market (with other major shareholders) and thus placed an additional burden on the share price in accordance with the supply and demand principle. As a result of the capital increase, his share fell from over 30% to 10%.

Dividend

The dividend was eliminated as one of the conditions of the state aid:

TUI Pressemitteilung: In connection with the COVID-19 crisis, TUI has agreed with the German government on three stabilization packages. One of the conditions for this support is TUI's de facto waiver of dividend payments for the term of the credit lines and as long as the economic stabilization fund remains invested.

With the full repayment of the state aid, the option for TUI to resume dividend payments is again open.

Nine analyst opinions on the TUI share

The current analyst sentiment on FactSets as of 08/20/2023 is as follows. Out of a total of 9 analysts rate:

- 3 buy

- 0 overweight

- 5 hold

- 0 underweight

- 1 sell

The analysts' sentiment is neutral with a slightly positive trend (3 buy > 1 sell).

The price potential for the year is currently seen at EUR 7.39 with 18.42%.

Chart analysis

Since the outbreak of the COVID 19 pandemic, the TUI share price has fallen sharply. The fluctuations in the chart are decreasing noticeably over time, and the range of movements both downward and upward is narrowing. The falling wedge has only limited room to maneuver and will be resolved in one of the directions in the foreseeable future.

Downward trend since 2019

Currently, the chart technique does not provide any clear signals, but this will change in the near future. Currently, fundamental uncertainty still has the upper hand.

The RSI indicator points to an oversold situation, a countermovement to the upside is likely. The MACD is positive in the weekly chart, in the daily chart, the MACD is still negative, but could provide a positive signal in a few days, provided that no strong downward movement strengthens the downward momentum again.

Indicators

In the long-term weekly chart, the RSI indicator is in the oversold territory. The MACD shows a positive signal in the long-term chart.

Short-term weakness

In the daily chart, with a candle duration of 1 day, the RSI indicator is after at the oversold area with a value of 34. MACD is negative but losing momentum, so a reversal signal should follow in the next few days. The price is running towards the end of a falling wedge and has fallen out of a short-term uptrend at the top of the wedge to the downside.

Simply summarized: the share is looking for a direction and is still undecided.

Summary of the analysis

Environment and news

After years of bad news, the environment for TUI is gradually starting to improve. Customers' appetite for travel is returning and slowly exceeding pre-crisis levels. Government aid has been repaid. The pandemic has ended. The inflation and energy crisis continues to be a burden, but in return also offers scope for possible further easing in the future.

TUI is working on digitalization and integrating artificial intelligence into its services. "Those who use the technology will be faster and more productive than those who do without it", says the CIO (Chief Information Officer)

of the travel company on the subject of AI. This one sentence shows me that TUI has recognized the signs of the times in good time and is on the right track.

The energy crisis continues to affect profitability. Jet fuel prices peaked in May 2022 and have been declining since, but still above pre-crisis levels. Should TUI become profitable in this challenging environment, the profit margin is expected to increase additionally once the energy crisis is overcome.

The current quarterly figures, which were above expectations, give TUI renewed hope of a return to former strength or at least a return to profitability and growth. However, there is still a long way to go until then. After all, the state aid has been repaid and, in perspective, there is nothing standing in the way of the dividend being reinstated.

With the current figures and forecasts, according to MarketScreener, the TUI share has a KGV 2023 of less than 9, for 2024 an expected P/E ratio of 6 and for 2025 a P/E ratio of 5. This would be a very favorable valuation if the forecasts materialize.

On the other hand, of course, the risks must not be neglected. The competition is not sleeping either. Booking.com is often mentioned here. Currently, however, Booking.com is valued at a P/E ratio of 23, which is significantly more expensive than the ailing TUI. In addition, energy prices could continue to rise. Headwinds due to rising CO2 prices could also have a negative impact on the situation.

Sentiment of the analysts

The analysts' sentiment is neutral to cautiously positive. At 7.39 euros, the target price for the year is a rather cautious 18.42 percent. In view of the turbulent times and losses of the previous years, the restraint of the analysts is understandable. Before the mood here turns for the long term, TUI has to perform in advance and present good results.

TUI Share Chart Analysis

The chart analysis currently does not provide any clear signals. The indicators point to an oversold situation. Should the price recover soon, an upward breakout from the wedge would create a technical signal that would give the price additional tailwind.

Outlook

The TUI share has fallen on hard times and is close to its all-time low. Trend-following investors are unlikely to enjoy the share at the moment.

However, both the environment and the figures give hope for a possible improvement of the situation. Based on the current figures, the share appears undervalued, although market confidence has suffered noticeably as a result of the four capital increases in recent years. As the share price is driven by supply and demand and current demand is limited, the share price is showing indecision at a historically low level.

Looking at the big picture, I see potential for an upward move in both the environment, the numbers, and the chart. With a projected P/E ratio of 5 in 2025 a noticeable increase in the share price in the next few years would not be out of the question.

There is no reason to buy the stock at present, but there is certainly potential for rising prices as long as TUI is not hit by any new bad news.

No investment advice. No buy recommendation.