*Interest rate cuts the death knell for our portfolio

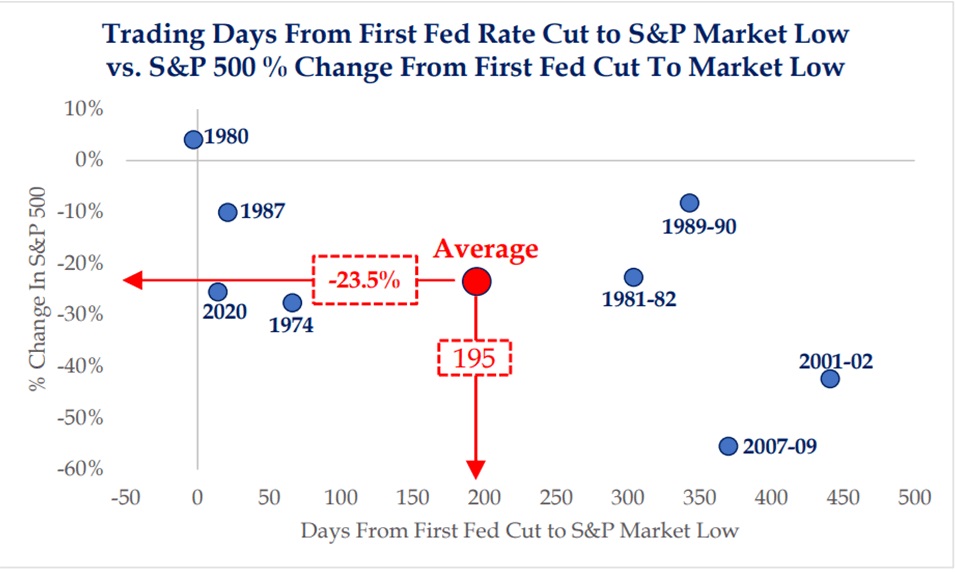

I don't want to beat around the bush, the past has shown that after the first interest rate cut, statistically after 195 days the low of the "correction" on average of 23,5 % was formed.

How are you preparing for it? What is your exit strategy?

My thoughts on this:

- Keep an eye on GDP, inflation data, unemployment numbers to spot recession

- If first rate cut comes in September then:

- Most of the portfolio will be sold at the beginning - middle of December.

- Watch further and then gradually get out of the market by March

Crypto:

I am very concerned that this will also cause major problems in the crypto sector and that the bull run could suffer massively.....

What is decisive?

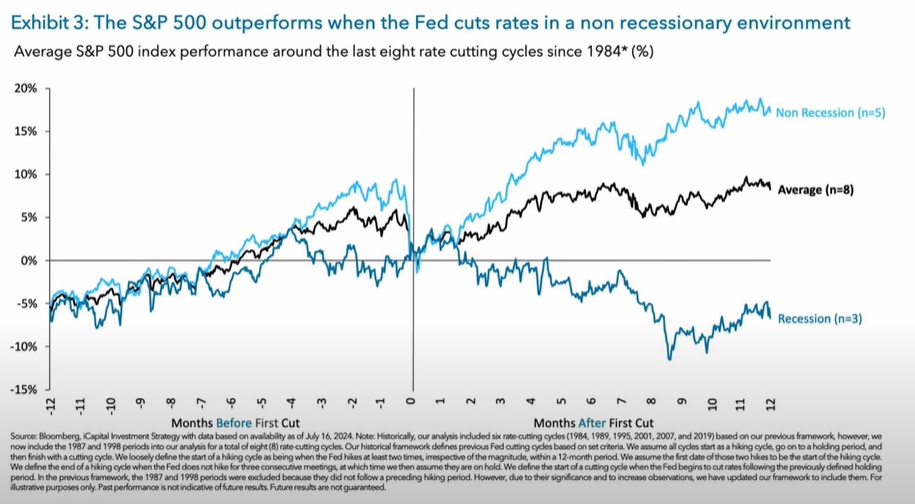

Soft-landing or recession... That is the crucial question in the whole affair!!!!

What is your opinion?