RIDING OR CONCRETE GOLD?

Dear Quinner,

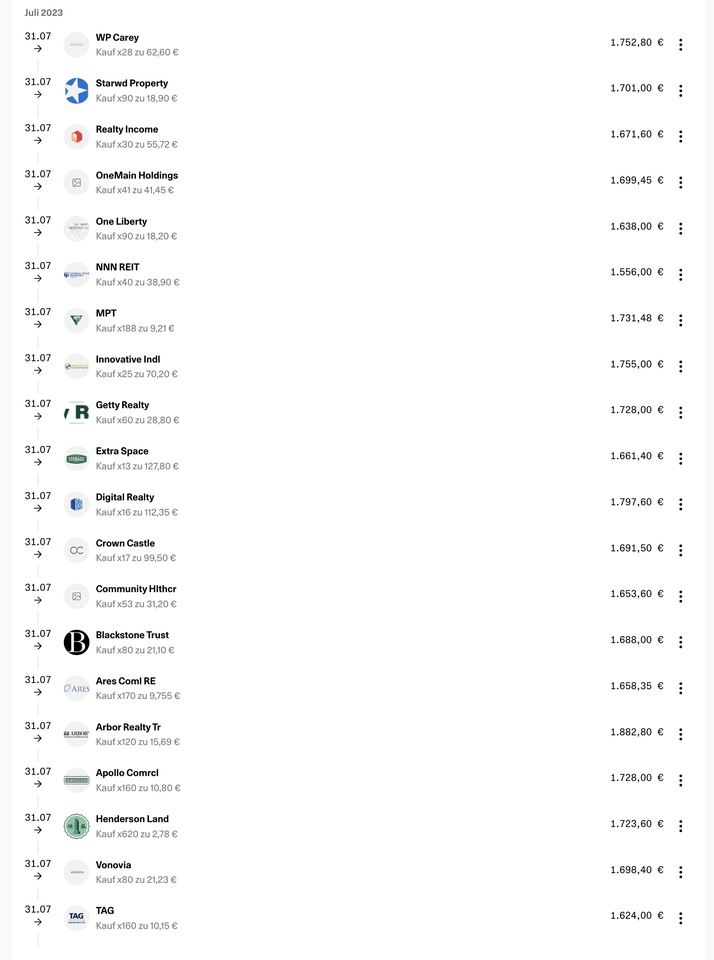

the next round of my insights into my investment strategy starts today. As you can see, on 07/31 I added another 50% of cost value to all my REITs/real estate positions. But why did I do that?

I have been invested in real estate for well over 10 years, but with the arrival of the Green Party as the governing party and the foreseeable end of the low interest rate period, I parted with just under 60% of my real estate - fortunately all above the 10 year holding period.

Now, of course, I have shopped heavily in the Corona low and with the high of the interest rate phase to position myself alternatively in the real estate sector and so currently 18% of my portfolio are real estate/REIT stocks. But why do I invest here?

I firmly believe that housing companies around the world generate higher returns than the average 4.6% I was getting from real estate. In addition, rental income must be taxed at the maximum tax rate, with shares I am with 26%, do not have to make any investments and do not worry about heat insulation and energy renovation, which can run the return from the properties for a decade to zero.

With these investments, which I will double one last time in the coming weeks during the setback, I have a dividend of 6.67% on average with an annual growth of 6% and an average spread to the last high of 141%. All in all, rosy prospects for me over the next 10 years, with 10 years of monthly dividend income at around 11.2% thanks to growth. No real estate can keep up with that.

In this sense - stay invested!

Your Emanuel