Investor AB: A Swedish investment powerhouse with vision

Company presentation and historical development

$IVSA Founded in 1916, Investor AB is one of Sweden's leading investment companies and can look back on an impressive history. As one of Sweden's most traditional companies, Investor AB has its roots in the renowned Wallenberg family, one of the country's most influential industrial families. Over the decades, the company has evolved from a family-run investment vehicle into a globally active, listed investment company that manages a broadly diversified portfolio.

Business model and core competencies

Investor AB's business model is characterized by an active and long-term ownership approach.

- Long-term commitmentInvestor AB pursues a long-term investment horizon and invests strategically in companies in order to promote sustainable growth.

- Active supportThe company actively supports its portfolio companies in adapting to dynamic market conditions and changing industry landscapes.

- Structured approachInvestor AB takes into account the specific challenges and phases in which each company and industry finds itself, despite a uniform management framework.

One of Investor AB's core competencies is the recruitment of highly qualified board members for its portfolio companies. Investor AB always strives for a strong board presence and ensures that boards are filled with the best available talent and experience. This strategic approach contributes significantly to the positive development of the portfolio companies.

Future prospects and strategic initiatives

Investor AB has a clear, future-oriented strategy and focuses on several key areas to ensure the growth and competitiveness of its portfolio companies:

- Digitalization and Artificial IntelligenceThe company promotes the digital transformation of its portfolio companies and the integration of innovative AI technologies.

- Sustainability: There is a strong focus on implementing sustainable business practices to create long-term stability and social value.

- Talent managementInvestor AB places great emphasis on selecting the right leaders and effective succession planning to ensure the long-term viability of the companies.

- Portfolio optimizationInvestor AB ensures optimal portfolio performance through continuous evaluation of company structures and targeted strategic adjustments.

Market position and competition

Investor AB occupies a leading position in the Scandinavian and European investment sector. Compared to other major Swedish investment companies such as Latour and Industrivärden, Investor AB has a consistently strong performance, underpinned by solid portfolio performance and strong management expertise.

Investments

List of companies in Investor AB's portfolio, sorted by their net asset value (NAV) as of June 30, 2024, from highest to lowest:

(tables do not go peposad)

| Company | NAV (SEK million) |

| Atlas Copco | 164,958 |

| ABB | 155,968 |

| AstraZeneca | 85,687 |

| SEB | 71,364 |

| Epiroc | 43,665 |

| Saab | 41,300 |

| Nasdaq | 37,198 |

| Sobi | 34,769

| Wärtsilä | 21,233 |

| Ericsson | 20,522 |

| Husqvarna | 8,210 |

| Electrolux | 4,458 |

| Electrolux Professional | 4,112 |

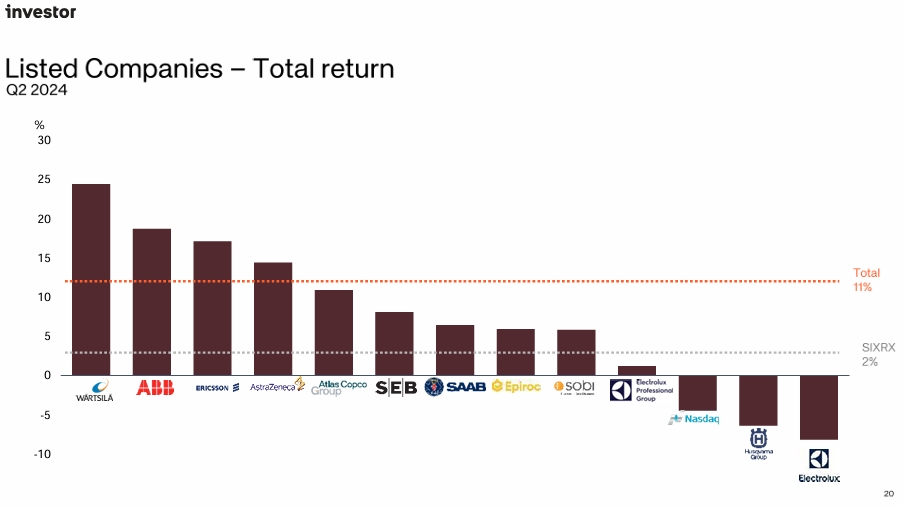

Portfolio development Q2 2024

These values represent the adjusted values as of June 30, 2024 and belong to the portfolio of listed companies, which accounts for 71% of Investor AB's total assets.

The remaining 29% of Investor AB's total assets are made up of Patricia Industries and the investments in EQT. Specifically, Patricia Industries accounts for ~21% of total assets, with a value of SEK 205 billion, while the investments in EQT account for ~9% of total assets and are valued at SEK 89 billion.

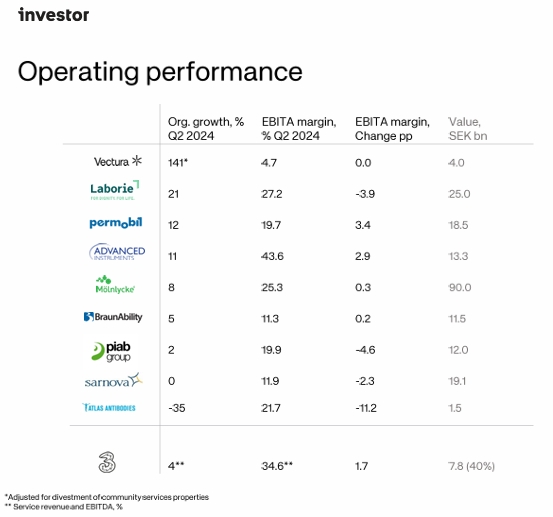

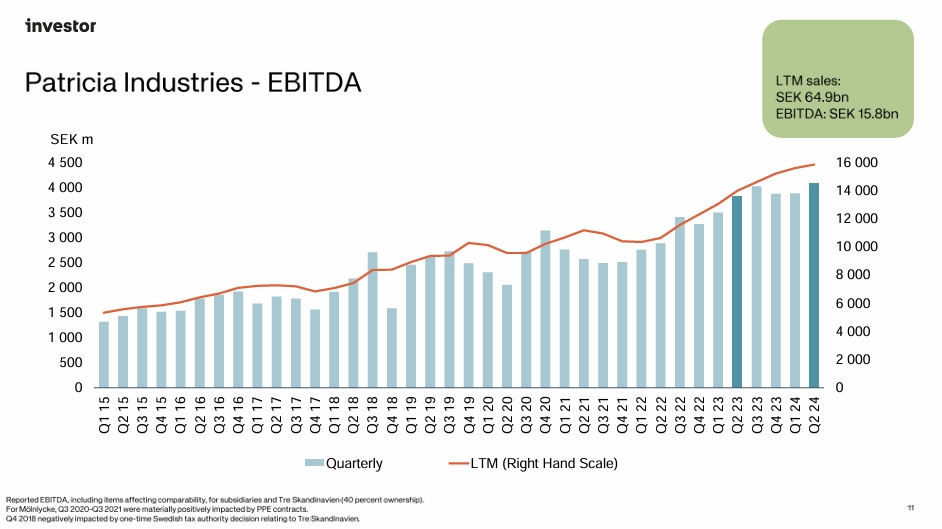

Patricia Industries

Portfolio development

EBITDA development

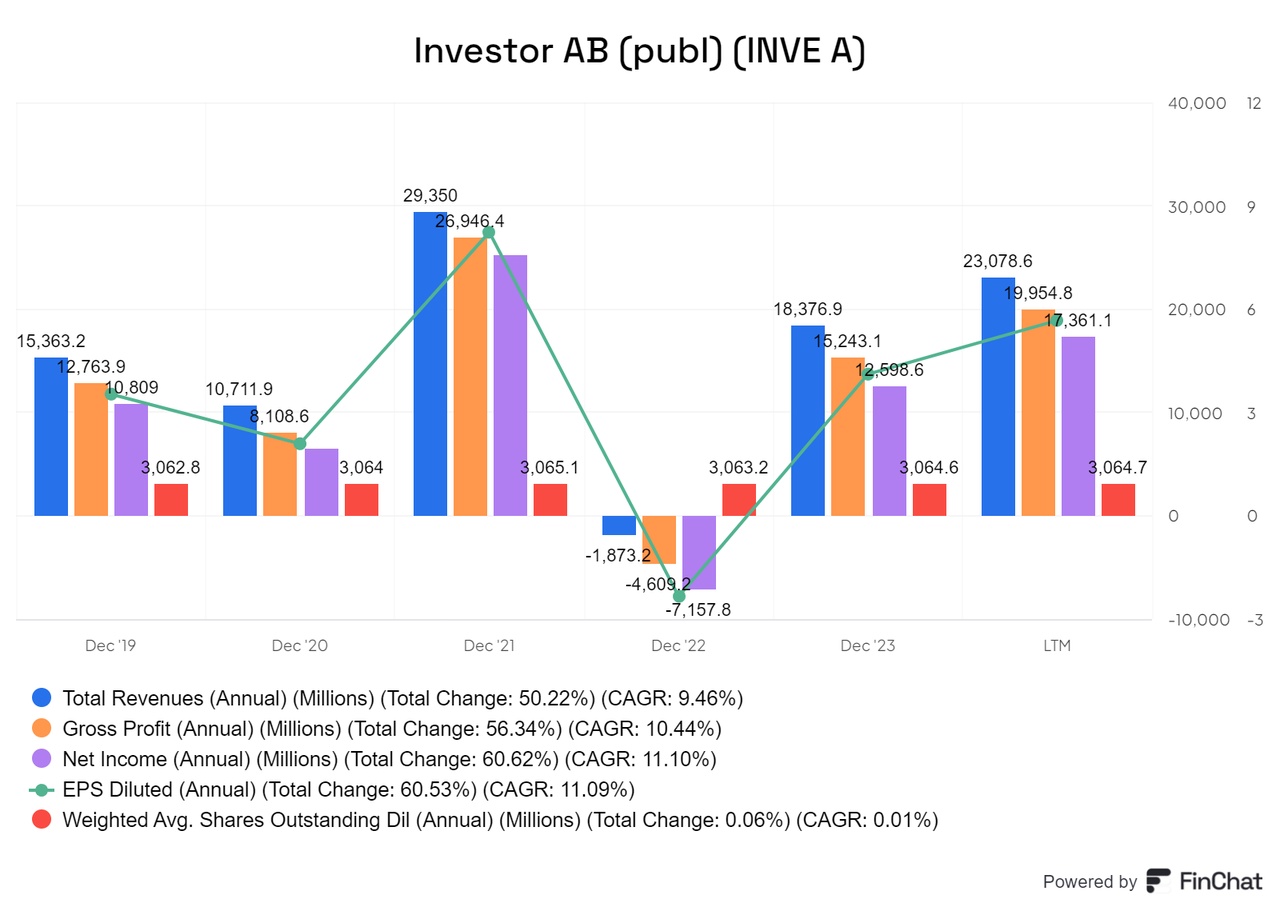

Development of Investor AB

Although sales are largely stagnant, as they are heavily dependent on the income and cash flows of the individual investments, they are trending upwards. The same applies to net and gross profit, as Investor AB only has low operating costs as an investment holding company. The number of shares issued remains basically stable, which positions the company well in terms of share dilution.

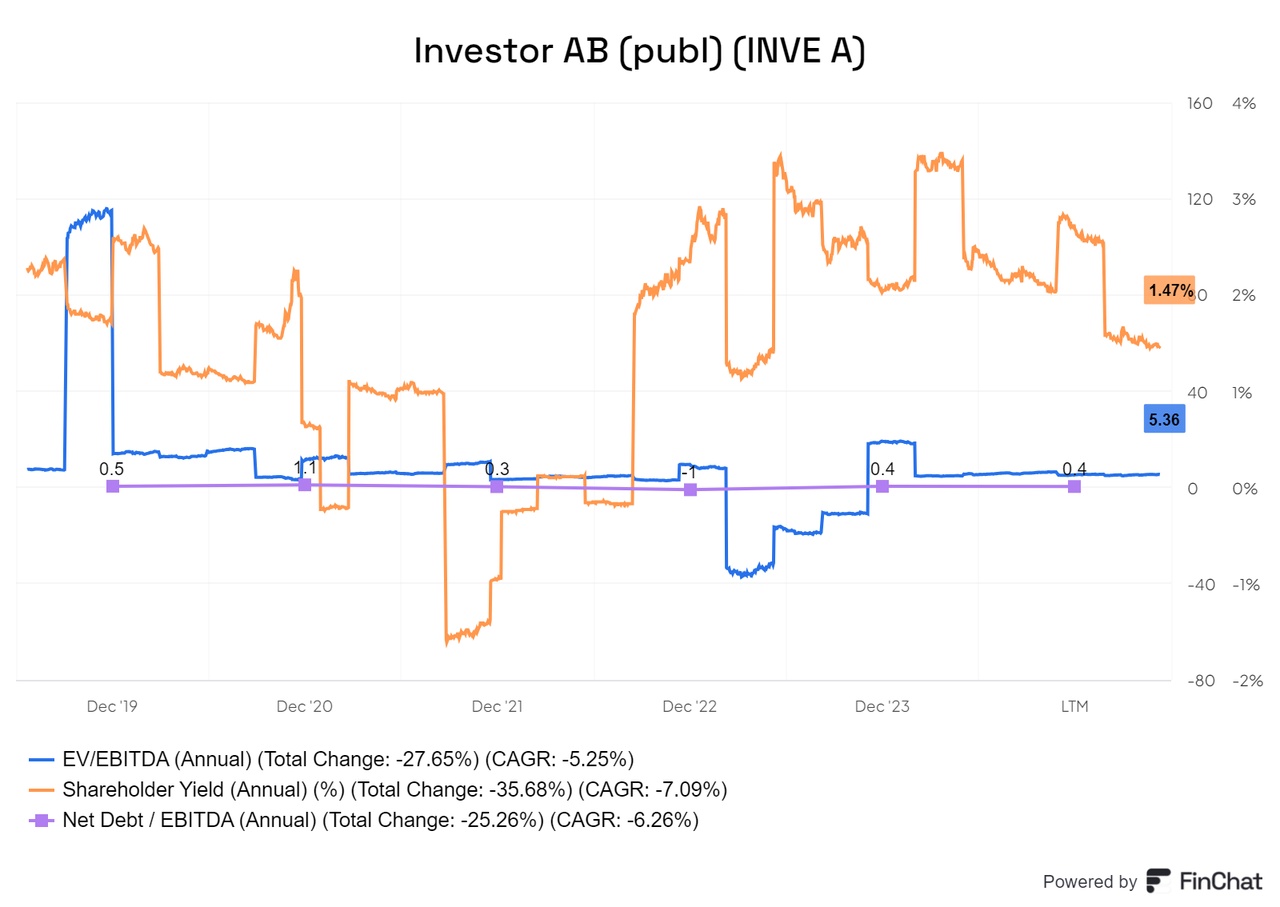

The current shareholder yield is 1.47%, which indicates a solid but not exceptionally high payout. With an EV/EBITDA of 5.4 and a Net Debt/EBITDA of 0.4, Investor AB shows a very healthy balance sheet structure with hardly any debt. Although these key figures are not particularly exciting in terms of high-risk growth opportunities, they stand for stability and continuity, which is attractive for long-term investors.

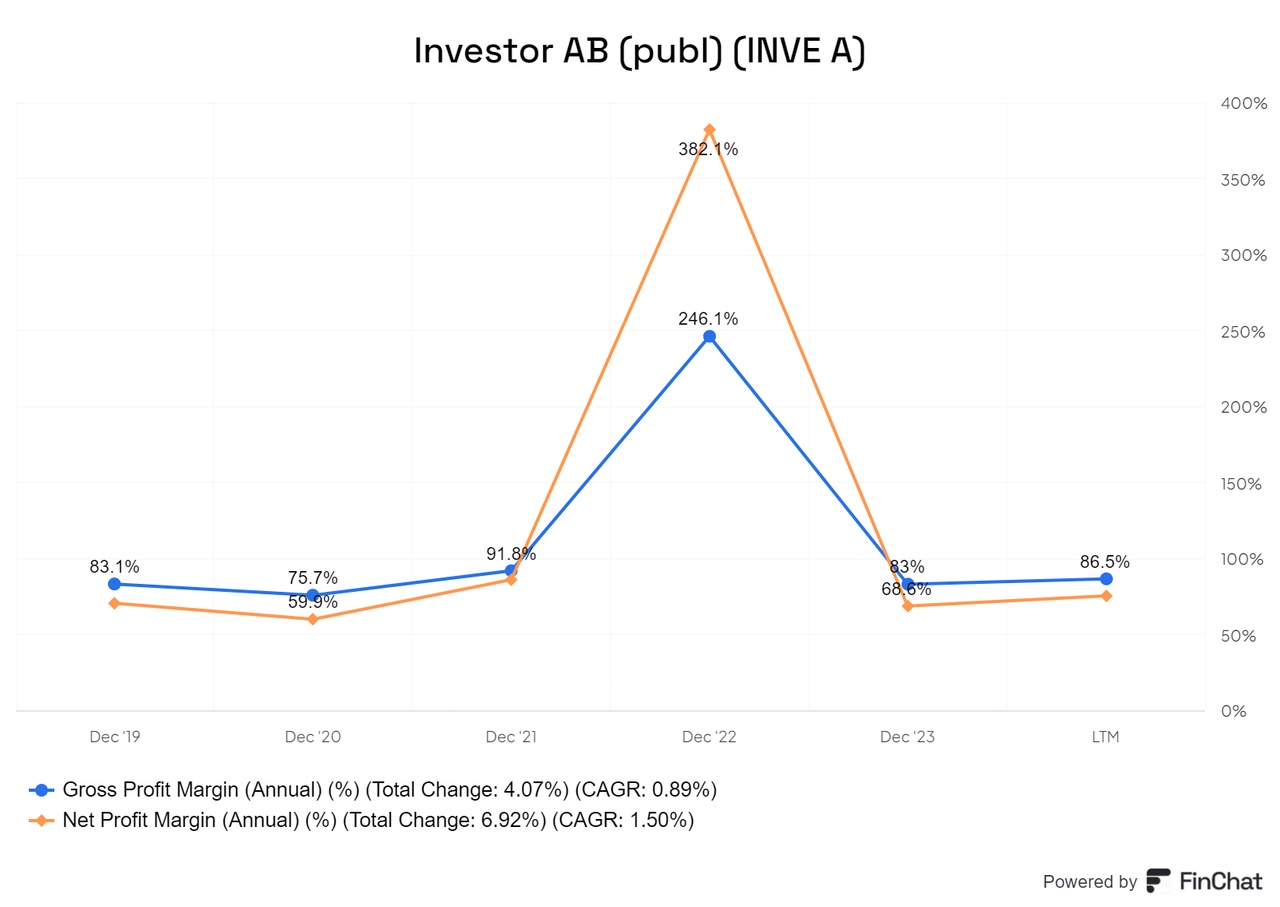

The gross margins are almost identical to the net margins and are roughly on a par with sales, which we have already seen before.

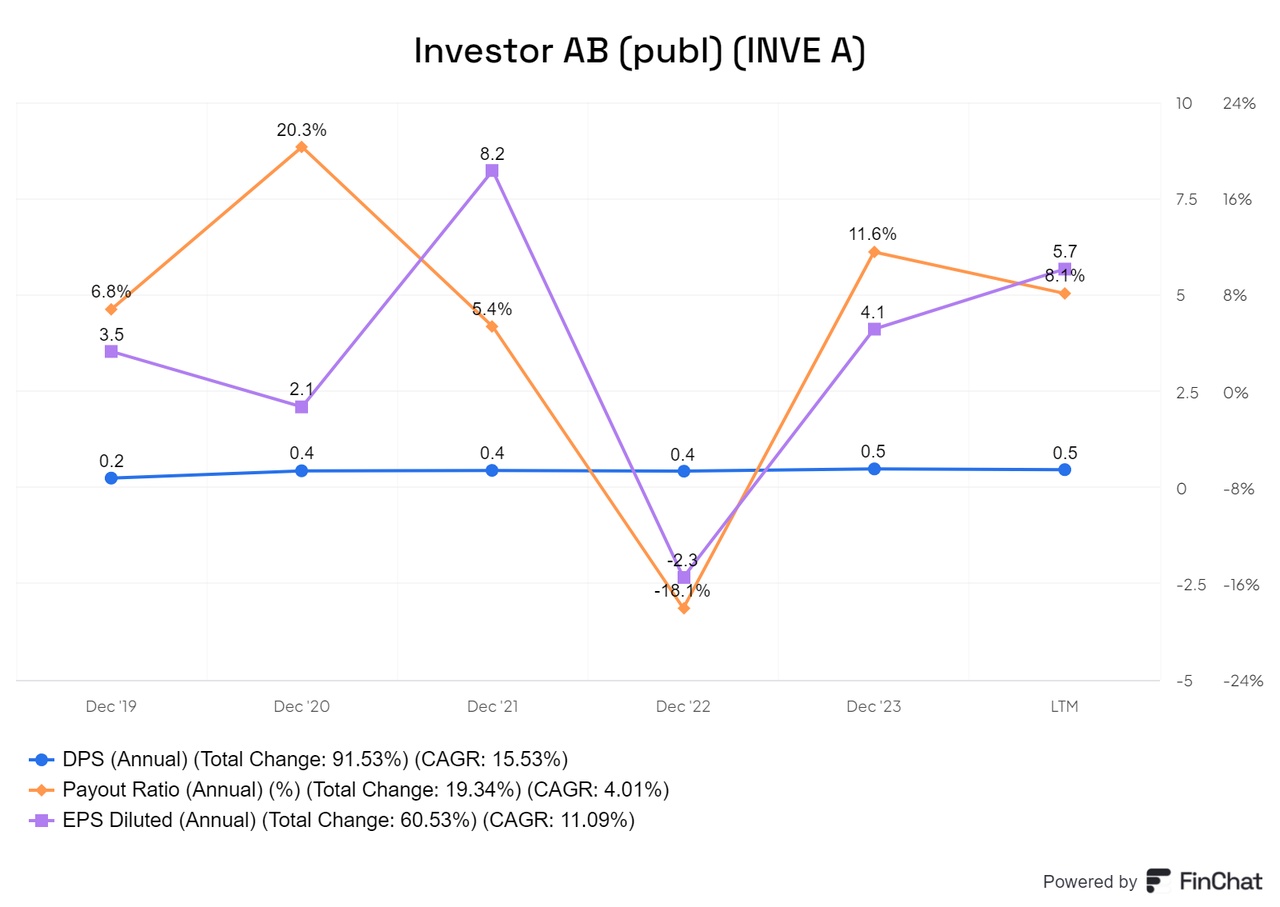

The DPS (dividend per share) is relatively stable and is only being increased slowly. The payout ratio remains low, which allows Investor AB to use a large part of the profits to expand and diversify the portfolio. This conservative approach gives the company sufficient leeway to remain capable of acting even in weaker times. Even with negative earnings, Investor AB could continue to pay dividends, which speaks for a sustainable and prudent financial strategy.

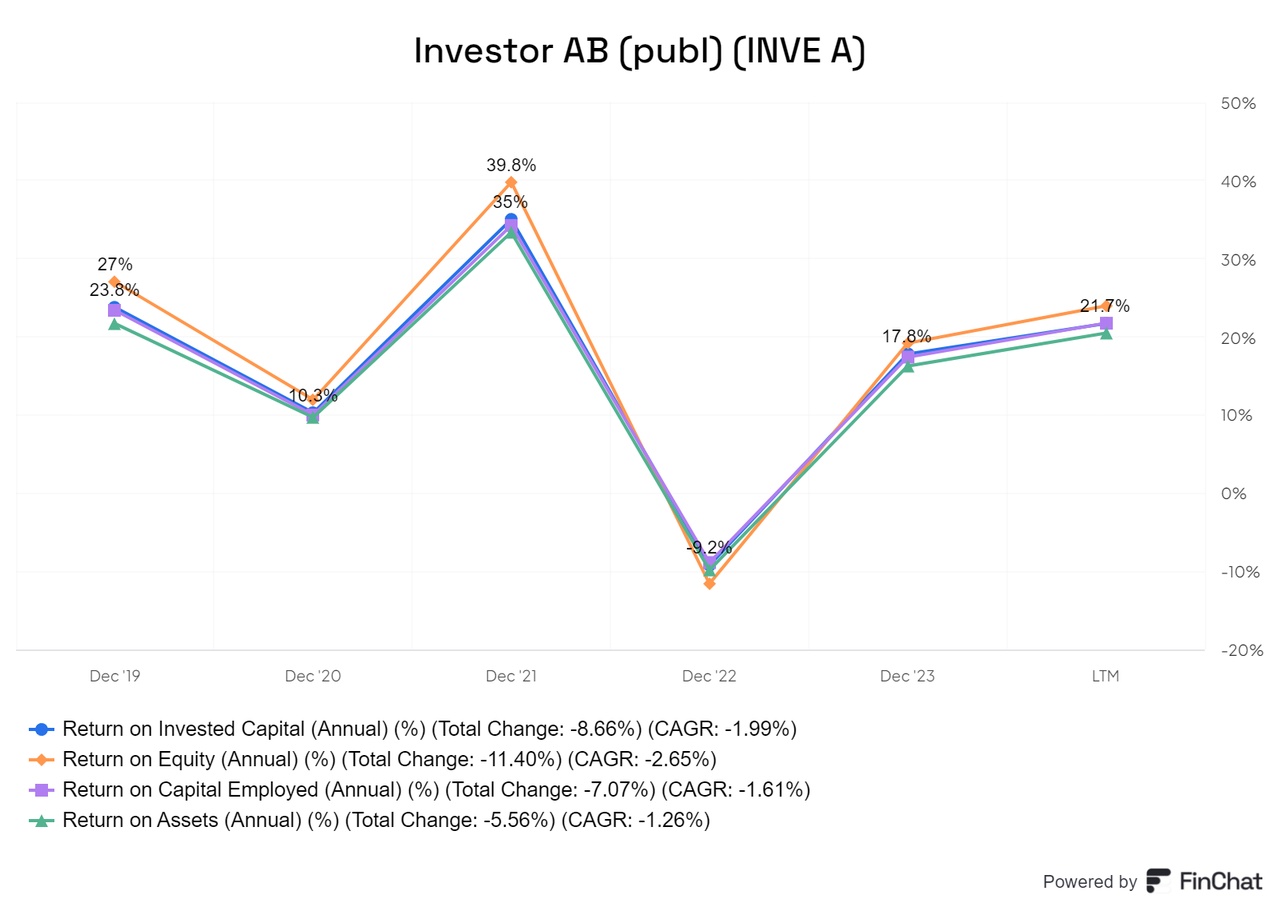

The key figures ROA (Return on Assets), ROE (Return on Equity), ROCE (Return on Capital Employed) and ROIC (Return on Invested Capital) also leave little room for criticism. Apart from a few exceptions, the values are clearly above the 10% mark, which indicates an efficient use of resources and return on capital. These robust returns show that Investor AB is able to manage its assets and investments effectively and generate high returns for its shareholders.

Conclusion

Investor AB is of course primarily of interest to those who attach importance to the underlying portfolio. Those who hold few of the holdings should refrain from investing in Investor AB. For all others, as with many holdings, there is the possibility of accessing the assets more cheaply through the so-called holding discount. Although this discount is not as large with Investor AB as with some other holding companies, it still enables investors to acquire attractive companies below their individual value.

For me personally, Investor AB is extremely exciting because of my preference for this investment model. The company has a net debt position in negative territory, so is financially very solid, and has an excellent return on capital. It also invests in a number of highly attractive companies at a discount, which can be very advantageous for long-term investors.

In my case, I find companies like ABB, AstraZeneca, EQT and Nasdaq particularly attractive, so I would add them to the portfolio. Ericsson and Atlas Copco are also interesting, but not attractive enough for me personally to buy them individually - here I like to benefit from diversification via the holding company. I also find the investment in Patricia Industries exciting, and I am curious to see how Investor AB will manage this part of the business in the future. All in all, this is a solid investment company that fits well into a diversified portfolio.

I'll wait for the Q3 figures and hope that the discount widens.