Nestle Q3 2024

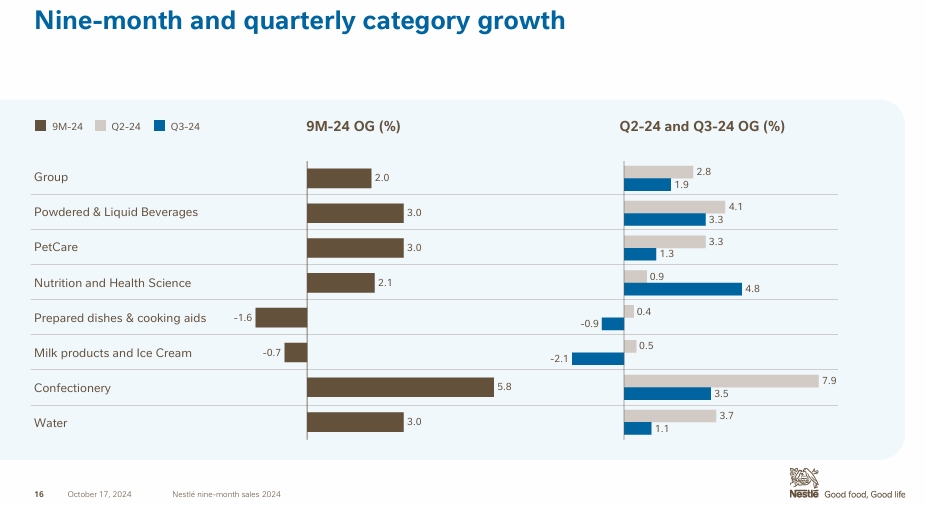

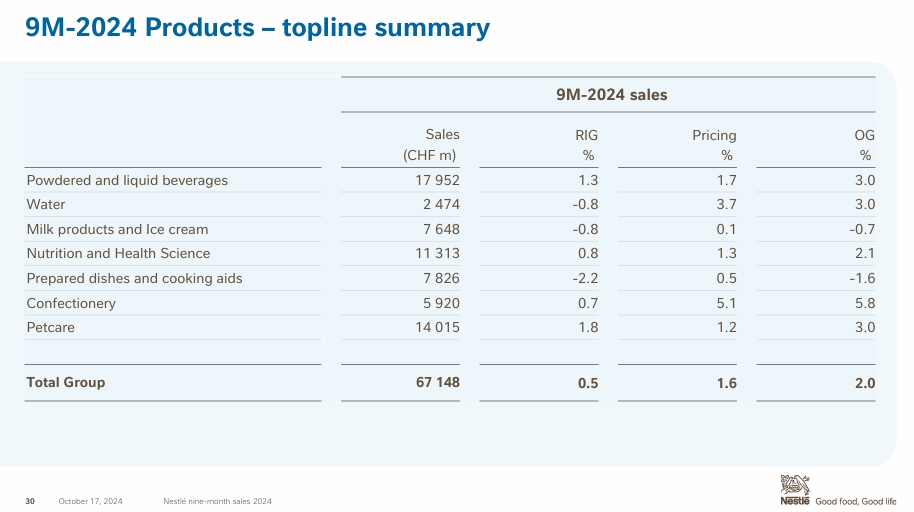

Nestle recorded organic growth of 2.0%, driven by real internal growth (RIG) of 0.5% and a price increase of 1.6%. However, total revenues decreased by 2.4 % to CHF 67.1 billion, mainly due to a negative currency effect of 4.1 % and net divestitures of 0.3 %.

The individual business segments presented a mixed picture: Zone North America recorded a 0.3 % decline in organic growth due to a 0.9 % decrease in RIG and a 0.6 % increase in prices. Sales in this region fell by 2.6 % to CHF 18.5 billion. By contrast, Zone Europe achieved organic growth of 3.3 %, driven by an RIG of 0.8 % and price increases of 2.5 %, although reported sales fell by 1.8 % to CHF 13.9 billion.

Zone Asia, Oceania and Africa (AOA) achieved organic growth of 3.6 %, supported by an RIG of 0.8 % and price adjustments of 2.8 %. Nevertheless, reported sales fell by 5.2 % due to a strong negative currency effect of 8.7 %. Organic growth of 1.9% was achieved in Zone Latin America, despite a negative RIG of 0.7%, which was offset by price increases of 2.5%. Reported sales here fell by 2.3 % to CHF 8.9 billion.

The Greater China zone recorded organic growth of 2.5 %, driven by a strong RIG of 3.9 %, which was slightly dampened by negative price adjustments of 1.5 %. Sales decreased by 2.0 % to CHF 3.6 billion. Nestlé Health Science reported organic growth of 3.8 %, supported by a RIG of 3.0 % and price increases of 0.8 %. Reported sales in this segment increased by 1.3 % to CHF 4.9 billion.

Nespresso achieved organic growth of 1.8 %, supported by a RIG of 1.3 % and a price increase of 0.5 %. Nevertheless, reported sales fell by 0.7 % to CHF 4.6 billion.

Nestlé also updated its guidance for the full year 2024, expecting organic sales growth of around 2%, with an underlying trading operating margin of around 17.0%. Underlying earnings per share growth in constant currencies is expected to remain broadly stable.

The situation remains tense at Nestle