Depot review April 2023 - The 200k cracked, at the end of the month again just under it

April is over and with it already a third of the year 2023 - madness, how fast time flies.

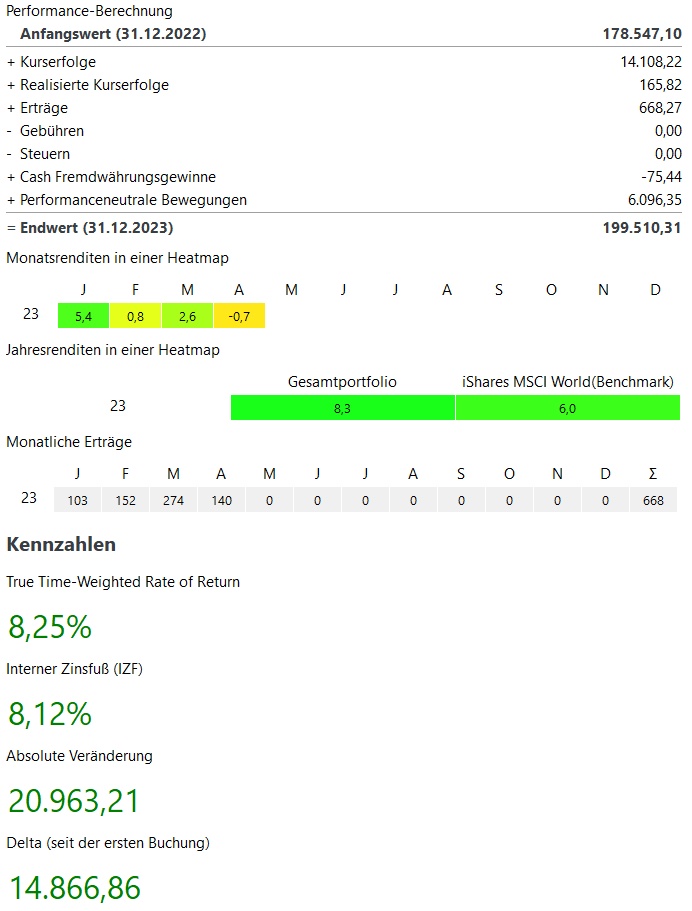

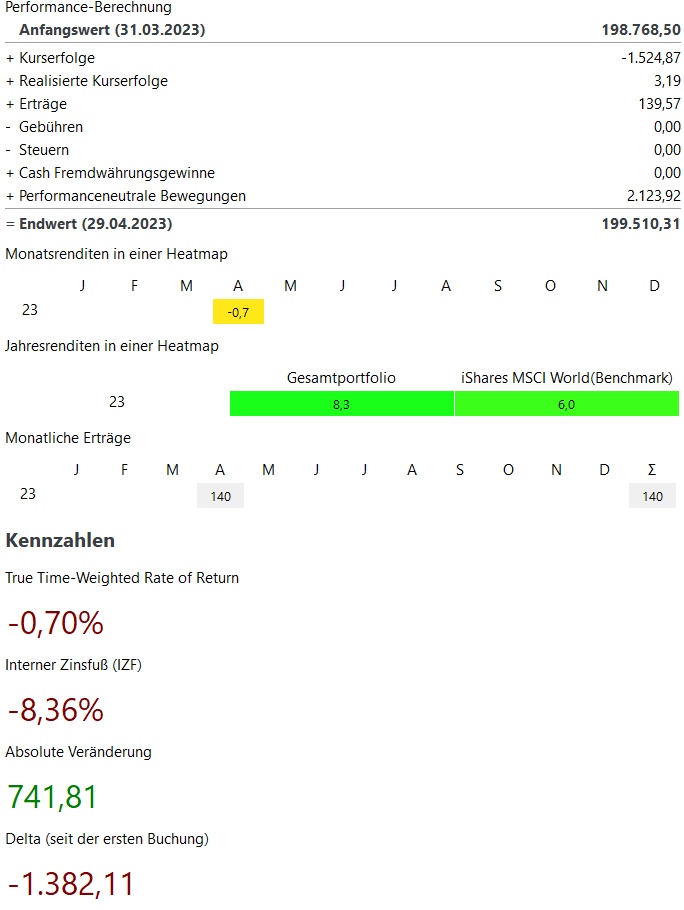

In the depot, April was the first negative month in 2023 with -0,7%. Compared to April 2022 with -4.8% the month was nevertheless significantly better.

(Fun Fact: April is generally considered to be the best month on the stock market).

Nevertheless, I was able to break the 200k mark for the first time in April after almost 10 years on the stock market. At the end of the month the portfolio closes nevertheless scarcely under it with 199,5k.

In the current year my current performance is +8,3% and thus above my benchmark (MSCI World +6%).

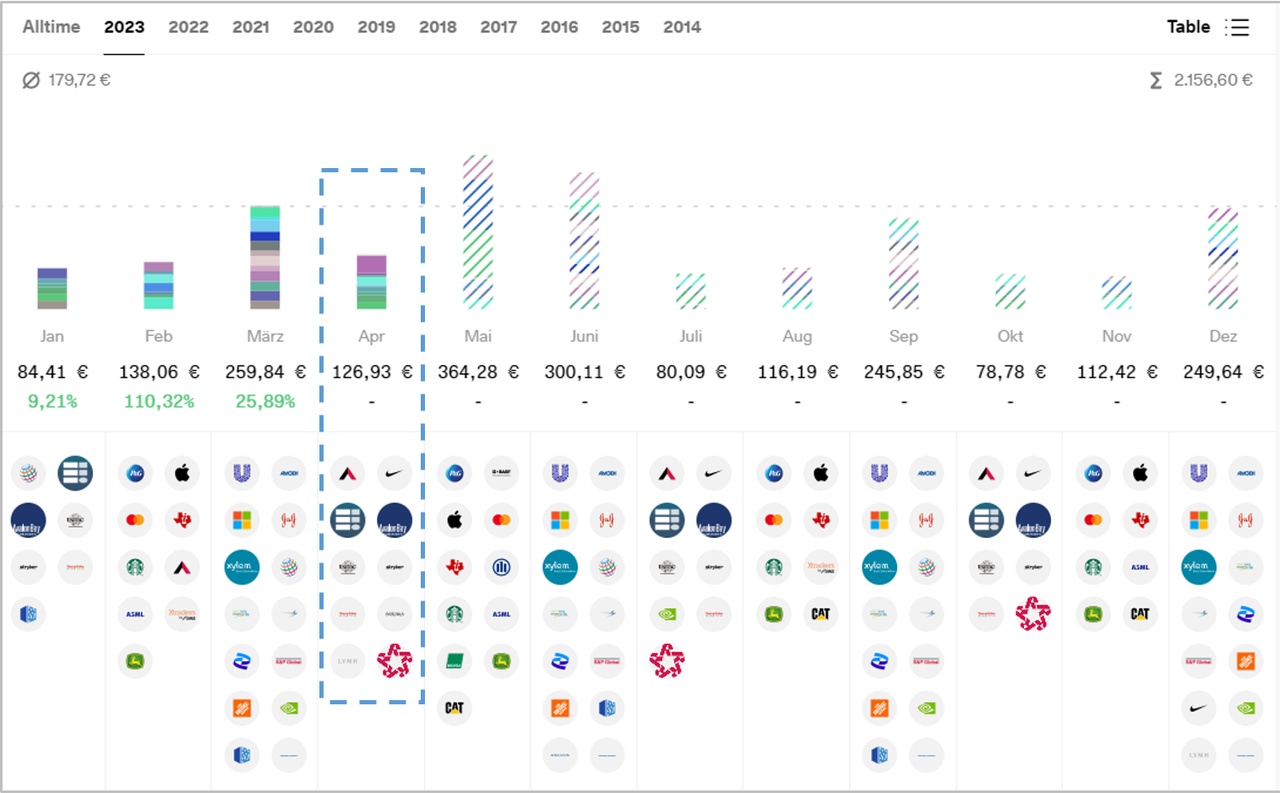

Dividend:

- Dividend +50% compared to the previous year - However, Sartorius $SRT (+4.99%) paid out in March last year, this year in April.

- "Adjusted" for the Sartorius dividend, distributions were nevertheless +33 +33% above the previous year

Purchases & Sales:

- I bought again for approx. 2.500 Euro

- Executed mainly my savings plans in (shares always quarterly - In total 30 share savings plans divided into 3 months):

- Blue ChipsLVMH $MC (+1.27%) Apple $AAPL (+1.26%) Home Depot $HD (+2.91%) Lockheed $LMT (-65.78%) Microsoft $MSFT (+1.55%) Nike $NKE (+3.44%) Starbucks $SBUX (+3.28%) Stryker $SYK (-0.47%) Texas Instruments $TXN (+1.13%)

- GrowthCrowdstrike $CRWD (+4.74%) and Mercadolibre $MELI (+2.36%)

- ETFs: x-trackers MSCI World $XDWD (+1.02%) Nikkei 225 $XDJP (+1.38%) and Invesco MSCI China All-Shares $MCHS (-2.02%)

- Crypto: Bitcoin $BTC (+0.27%) and Ethereum $ETH (-0.3%)

- Sold was with Teladoc $TDOC (+3.33%) a stock that has long been on the hit list

In the next month, Hershey will be added to the $HSY (+0.38%) a new stock in the savings plan (consumer staples with growth prospects and a very capital market affinity - share buybacks & high dividend growth).

BASF $BAS (+1.22%) is still very much on the brink of being sold.

How did your portfolio perform in April? And how long do you hold a stock in the savings plan before adding a new one?

#dividende

#dividends

#personalstrategy

#depotupdate

#performance