Hello everyone! I'm in my mid-20s and would like to start investing and would like some feedback on my planned portfolio. In addition to the planned shares, I have the main amount in the FTSE All World $VWCE (+0.42%)

I also plan to add (buy and hold!):

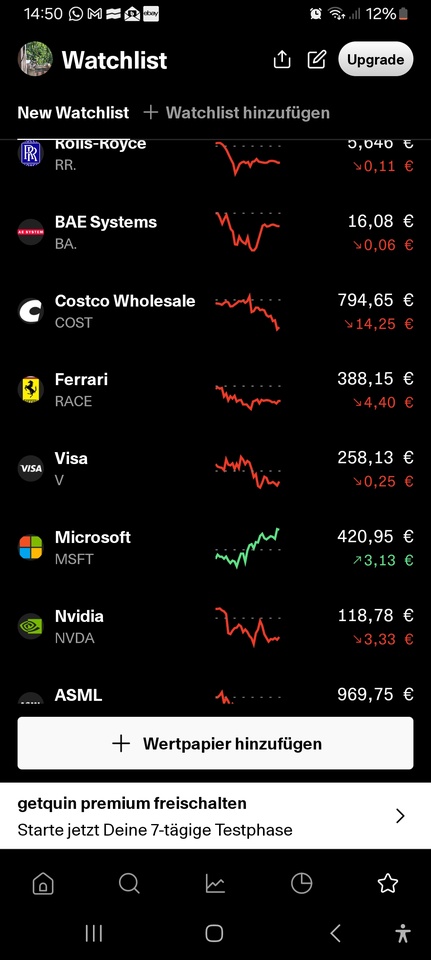

BAE Systems $BA. (+0.36%)

Visa $V (+0%)

Ferrari $RACE (+0%)

ASML $ASML (+0.81%)

Rolls Royce $RR. (+0.97%)

Costco $COST (+0.3%)

Microsoft $MSFT (+0.8%)

Nvidia $NVDA (+1.75%)

- What do you think?

- Would a value or quality ETF be an alternative?

- Should any of these be left out?

I would appreciate any constructive suggestions/feedback.

Many thanks in advance!