🌐 Kalshi - The future for futures?

We read here all the time discussions of possible FED decisions, the possible occurrence of Black Swan events, such as China's attack on Taiwan or other topics. Of course you can make abstract bets on such events, an example is the following:

Scenario: A possible interest rate hike:

I assume that the increase will be higher than assumed by the market. So I go short the Nasdaq 100, since the technology stocks with their high multiples have to be discounted with a higher interest burden than previously assumed. Of course, that's just one of the ways to play this.

But Kalshi now offers a much more simplified way to bet directly on results without having to deal with the uncertainty of whether something is priced in or not. Even though we all know here that aLleS is eIngEpReiSt. In addition, one saves the perverse spreads on derivatives of TR and Co.

Event Contracts

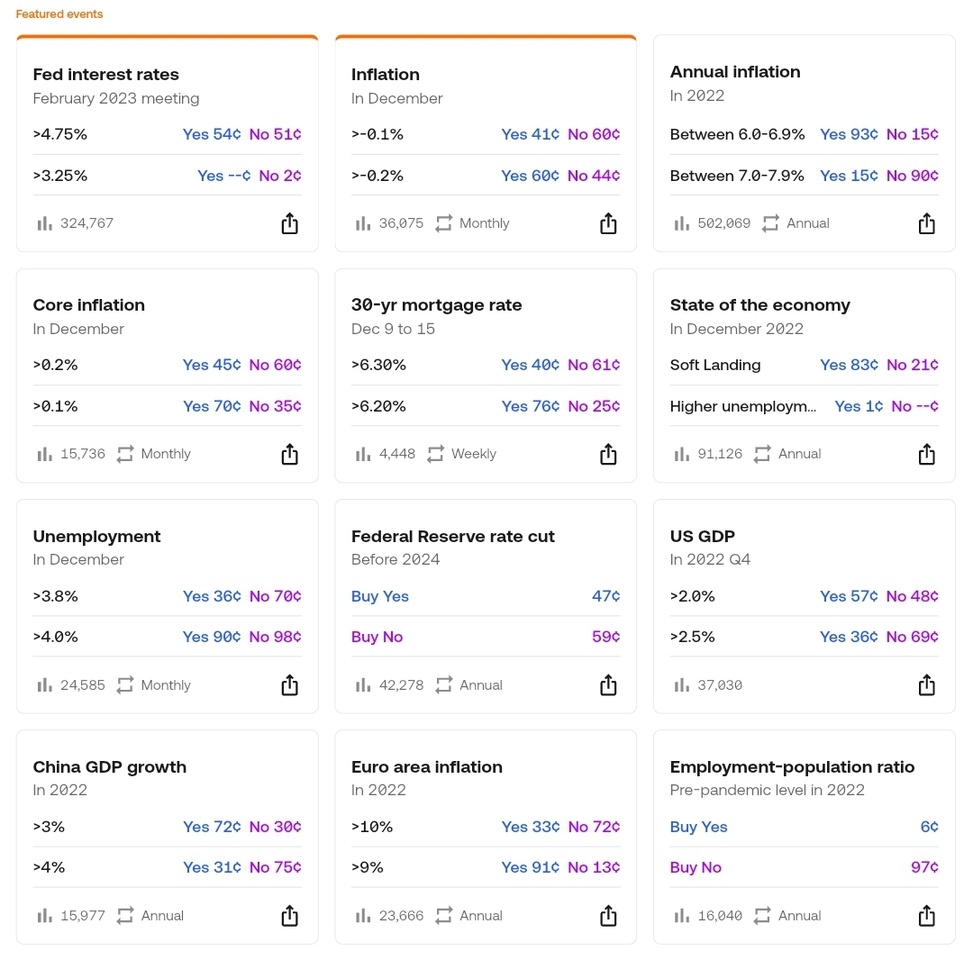

For these bets there are so called "Event Contracts", which make it possible to bet on a yes/no question or certain values like inflation rate. The price of the respective side is regulated by supply and demand. This is a good indication of the mood of retail. Kalshi provides interfaces (APIs) that in theory make it possible for hedge funds to tap another source to determine sentiment. Or you can take a look here: https://kalshi.com/forecasts

Examples of event contracts might be the S&P 500 level at the end of the year or whether rents in New York will rise next month.

Markets

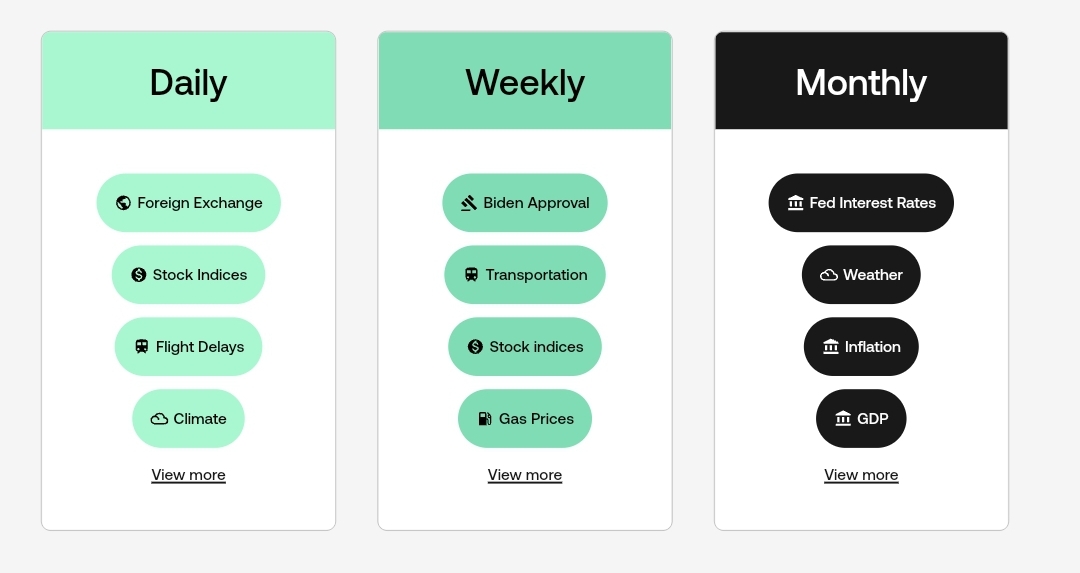

There are different markets that cover different topics and come with their own limits. Here you can choose one of the event contracts, betting on the opposite side in parallel is not possible. You can trade a maximum of $25,000 per market if no other rules apply. There are markets that expire daily, weekly, monthly or annually. In total, the pool of markets consists of 7000 units, but most of them are only available for a certain time.

Suggest your own markets

You can also contact Kalshi if you have an idea for a market or event you could bet on. If you want to do that you can do it here: https://kalshi.com/suggest-market

However, it is important to note that one has to go through a review process, which is rather complex in nature.

In itself, there are the following rules of thumb:

- The market should provide minimal risk for manipulation

- The market should not reward infringing behavior

- The data used for the market should be trustworthy and reliable

Fun Fact: It is illegal to sell Future Contracts on onions in the USA. So you can save the proposal 🌚

If these points all fit, Kalshi's Contract Team will create a product certification. All the processes that have been successfully passed so far can be found here: https://kalshi.com/regulatory/product-certifications

In the next point we come to who would like to have this.

Regulation and infrastructure

Kalshi is regulated by the CFTC (Commodity Futures Trading Commission) which is a US institution that has been monitoring the derivatives market since 1972 and is itself audited by Congress. The deposits from the clearinghouse (LedgerX LLC) are thus also secured. All money flows from banks are processed via the Fintech Plaid and deposited with the Silicon Valley Bank. LedgerX LLC has been part of FTX since the 2021 acquisition, but the deposits are not affected by FTX's bankruptcy and enjoy regulatory oversight in a separate account, unlike FTX's other businesses.

Fees

Event Contracts

Fees = (0.07 x C x P x (1-P))*

P = The price of the contract in USD (50 cents is 0.5)

C = Number of contracts

*rounded up to the nearest cent

There is also a flat fee for withdrawals of 2$.

Trading hours

Monday, Tuesday, Wednesday, Friday and Sunday from 2pm - 11:59pm CET

Thursday and Saturday from 2 pm to 10 pm CET

Margin

Trading on margin is not possible through the platform. Of course, you can still get a completely overpriced personal loan at the savings bank you trust to become a leverage hero 🤡

Liquidity

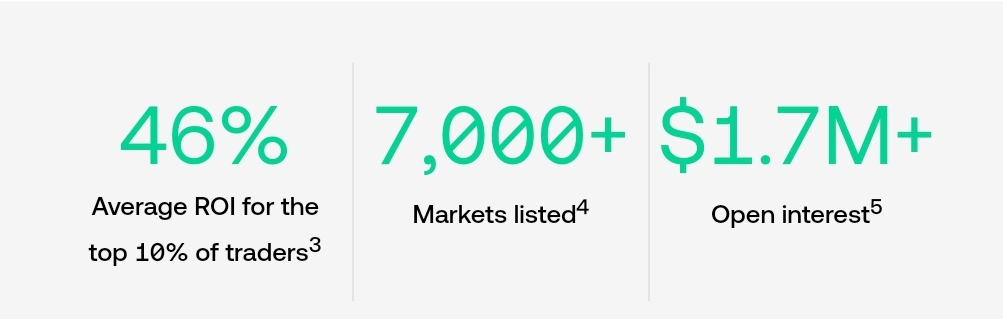

According to the official site, the Open Interest should have been 1.7 million USD on July 31, 2022. Open interest is defined by the number of outstanding event contracts that can be traded on the exchange at any given time. Liquidity is also a determinant of how long an individual market is maintained. This can be guessed from the abundance of the respective order book.

Order types

The order types cover pretty much the basics and are available as follows:

- Market Order

- Sell Order

- Limit Buy Order

- Limit Sell Order

An order book is also available.

Comparison to other investments

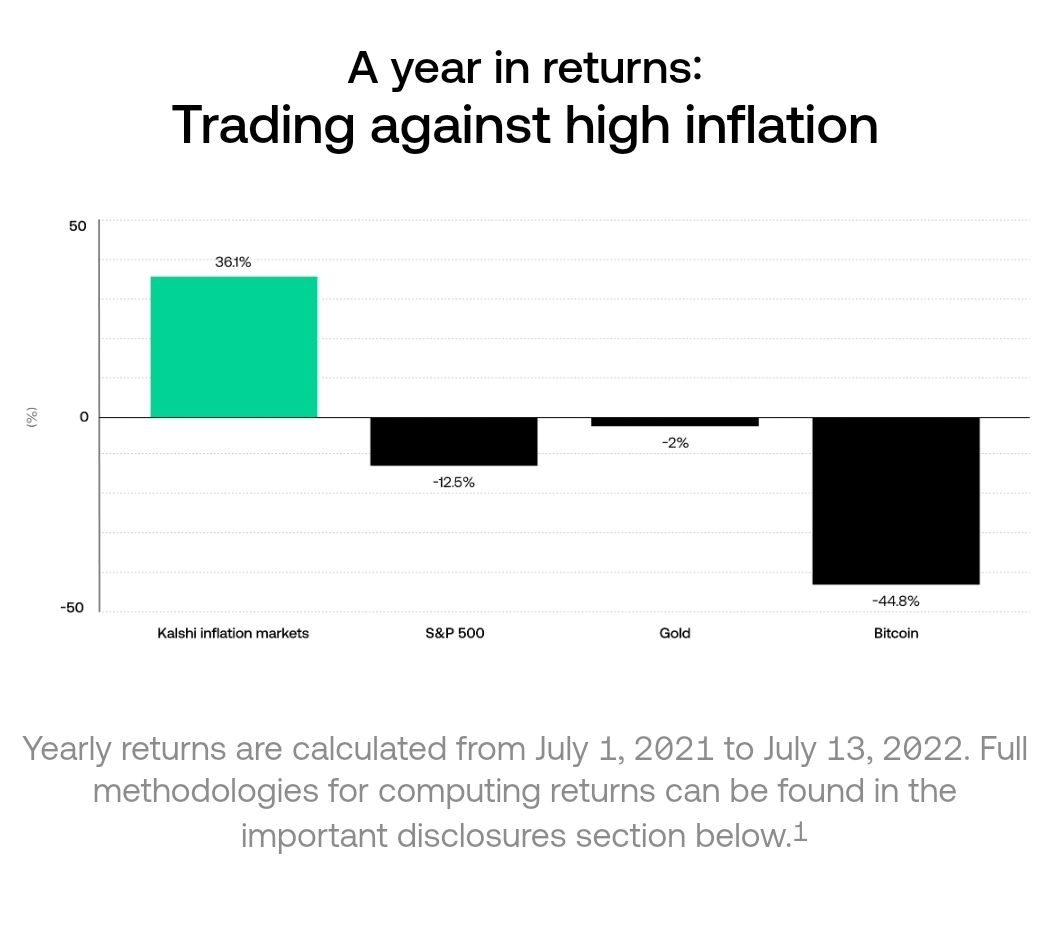

Strikingly on the side is the: "Trade against high inflation". There, the returns from July 1, 2021 to July 13, 2022 were sent into the comparison. With what, one would have bet on rising inflation: 36.1% return had compared to the S&P 500 with -12.5%, gold with -2% and Bitcoin with -44.8%. Also, the top 10% of users are said to have an ROI of 46%, our top users do that in their sleep 😎

Conclusion and Takeaways

I let myself be put on the Waitinglist, but doubt that the product will get to the German market so quickly. It is only available in the US and only as a US citizen and they are still in beta and I guess the VC money for opening up new markets is rather limited at the moment. Even if they are backed by YC and should be doing quite well. But the concept has something in my eyes and you could integrate these prediction markets without real money in Getquin. It would be a cool gamification factor and would provide another means for more interaction. Maybe even betting between users on who will have more ROI etc. @Koenigmidas would definitely like something like that 👀

I'll go ahead and write before GPT-3 or 4 replace me. If you have any questions I can support@kalshi.com recommend 🌚

#derivate

#predictions

#vorstellung

Bonus

3 months Kindle Unlimited for € 0.00

Redeemable until 31.01.2023*

Maybe one of you can use this, I can not read anyway 🤡