High dividend, low Rendite🤷♂️

For many, the dividend is one of the main reasons why they invest in a company. To make it really worthwhile, they should have a high and preferably constant dividend yield.

In my view, the potential total return is far too rarely taken into account. There is no other explanation for the numerous investments in companies like BASF. They have always underperformed the S&P and there is no reason why this should change soll🤷♂️

If you want to have some additional security and diversification you choose an ETF.

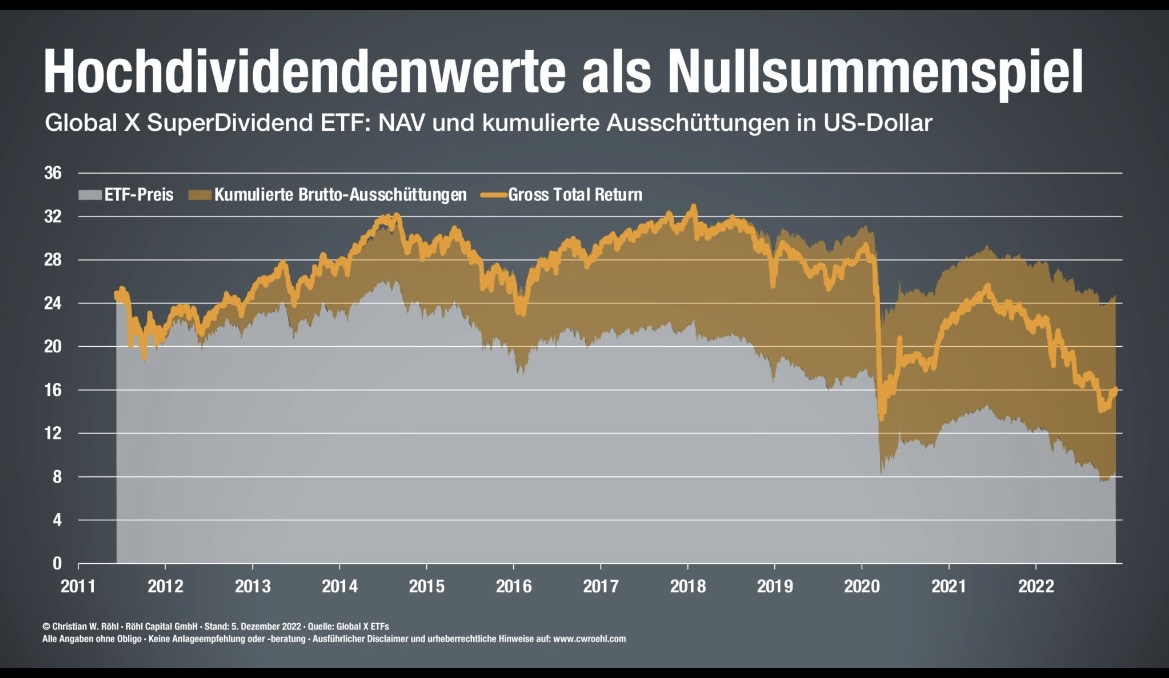

Where this can lead you can see well in the picture. The global X SuperDividend has the goal to find the companies with the highest dividend yield and to invest in them.

Since 2011, unfortunately, exactly these companies have constantly underperformed the market, while the dividends have increased. After 11 years one is out with +/- 0. At the same time the MSCI World has doubled. 😅

However, the chart does not include taxes on dividends. In such a case, the return might even be negative.

what does it mean now?

Of course, you can't lump all companies together, but I maintain that most companies that have a high dividend can attribute this to share price losses. These in turn result from operational problems or poor prospects for the future.🥲

source: C.W Röhl