𝐁𝐥𝐚𝐜𝐤𝐫𝐨𝐜𝐤-𝐀𝐧𝐚𝐥𝐲𝐬𝐞

Another interesting company that I get to analyze for you today.

𝐙𝐮𝐚𝐥𝐥𝐞𝐫𝐞𝐫𝐬𝐭 𝐌𝐚𝐥: Each of you who invests in stocks or ETFs, but has never heard of BlackRock, should urgently look into the company at least a little bit! Because BlackRock is the largest asset manager in the world!

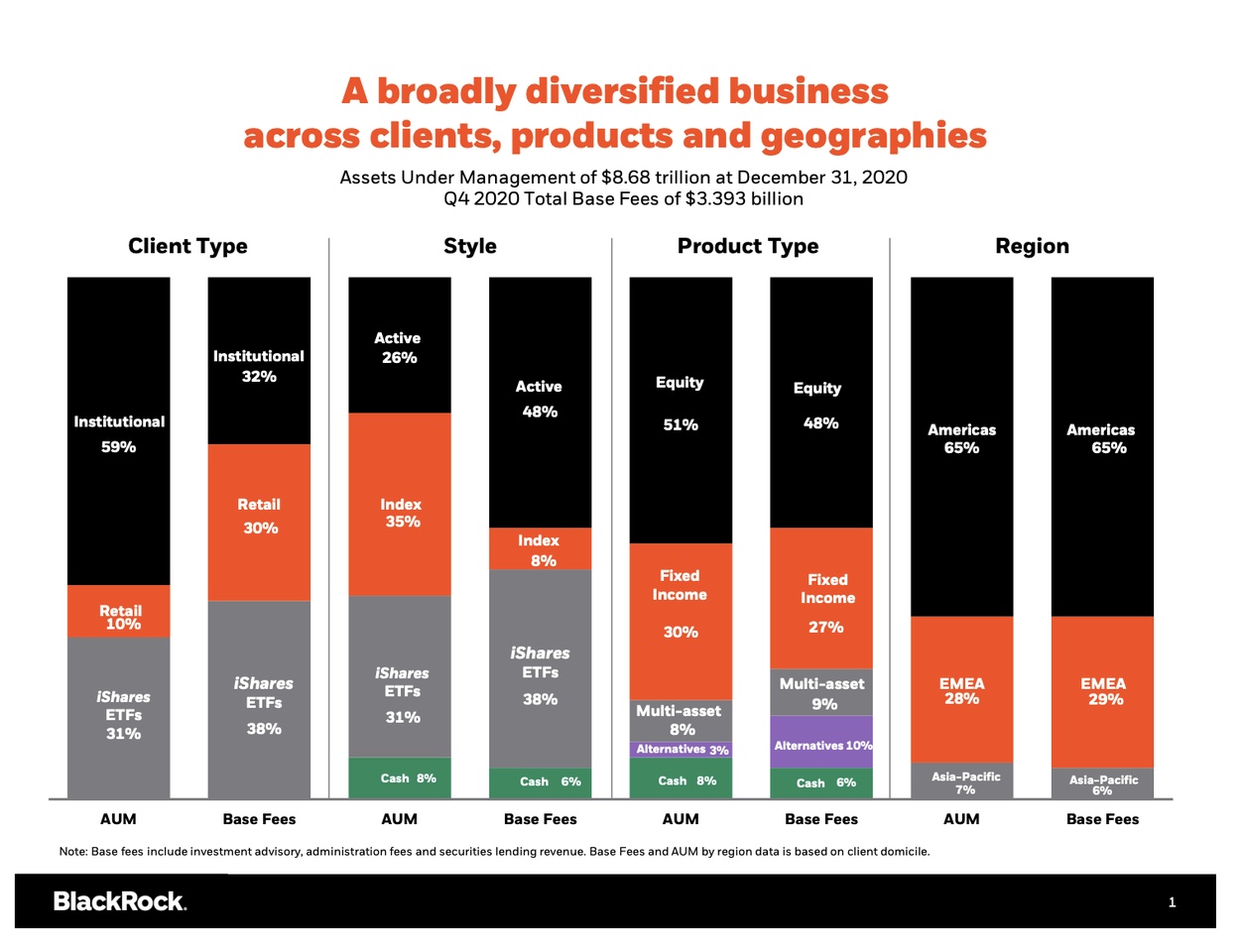

What does asset manager mean and what does it have to do with your stocks? Well - Blackrock is the provider of the iShares products that so many of you have in your portfolio. This makes BlackRock the largest ETF provider in the world!

And when it comes to its products, the company values the utmost transparency - at least according to its own statement. We would probably say: Compared to other providers, BlackRock acts more transparently - yes. Thanks to its business model, BlackRock profits the most when its customers (i.e. you!) generate a good return.

Do I have your attention now? Very good! Because BlackRock has a lot more going for it than "just" the iShares products. In fact, the largest part of its income comes from the fund business, where it is one of the most reliable partners for pension funds and banks. The management is also competent: founder Laurence Douglas Fink is still on board as CEO. But more on that later.

𝐙𝐮 𝐝𝐞𝐧 𝐅𝐚𝐤𝐭𝐞𝐧:

Founded in 1988 in the U.S., the company is headquartered in the U.S., has about 16,300 employees and a market capitalization of $136.97 billion with 152,530,000 shares. Blackrock came on 1.10.1999 at an issue price of just 14 USD per share (the current price is 921.33 USD - the share has increased more than fivefold).

The P/E ratio is about 24.42 (average) and the KUV is 7.63.

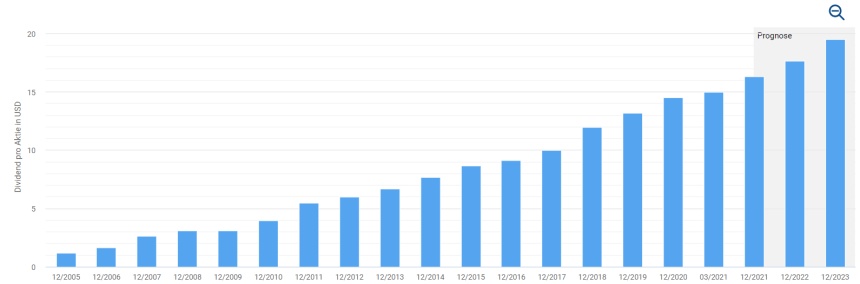

Blackrock pays dividends four times a year (1.83% dividend yield).

In total, the company manages a proud $8,700 billion!

Furthermore, the company has no debt, with consistent profits.

The profit margin is 39% and the return on equity is 15%.

𝐃𝐞𝐧 𝐉𝐚𝐡𝐫𝐞𝐬𝐛𝐞𝐫𝐢𝐜𝐡𝐭 𝐟𝐢𝐧𝐝𝐞𝐭 𝐢𝐡𝐫 𝐡𝐢𝐞𝐫: https://www.blackrock.com/corporate/investor-relations/2020-annual-report

We had said above that a brand of BlackRock is called iShares and it is the largest ETF provider in the world.

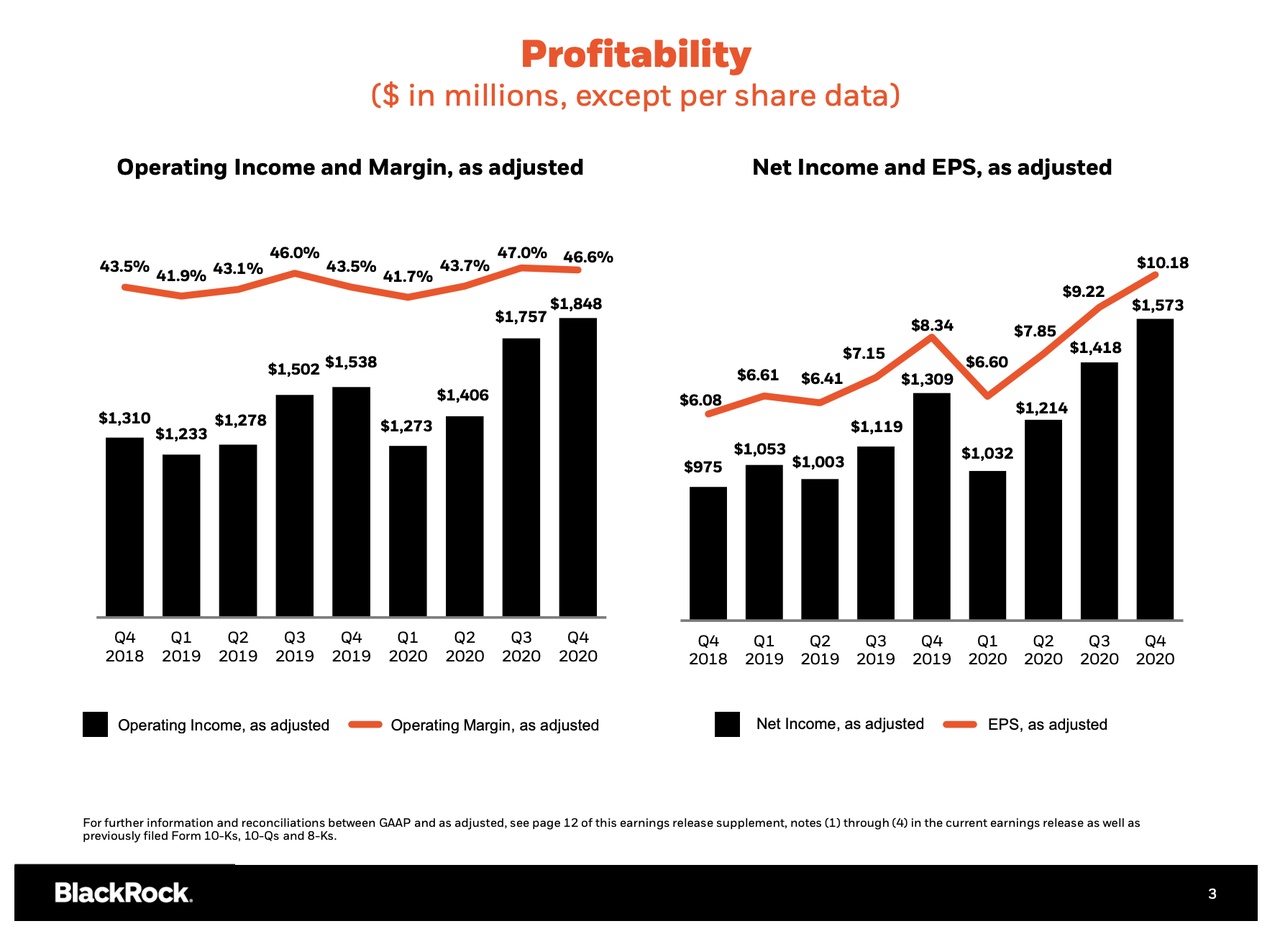

What's exciting about this is that BlackRock benefits from the growing equity market over the long term and is hugely profitable with a net margin of 30%. This, of course, provides a high degree of security in the business model. In addition, the company is growing steadily. Revenue growth has increased by an average of 6-7% over the last three years. Profit has also increased over the last few years.

Of course, it is also worth noting that BlackRock is involved in an extremely large number of companies - among other things, Blackrock is involved in virtually all DAX companies.

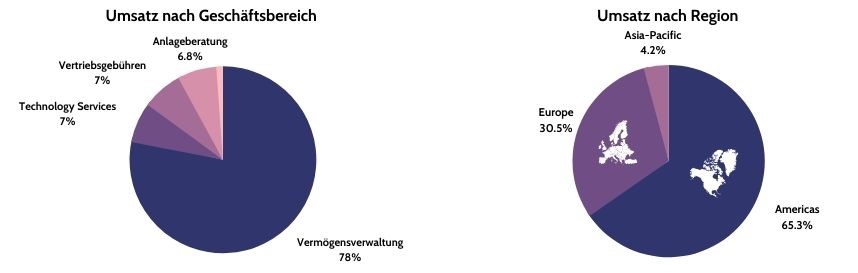

We have already established that BlackRock manages other people's money and charges fees for this. These fees make up a little over 70% of its revenues.

In addition, the company still makes money from performance-based fees, securities lending, technology services, distribution fees, and through advisory services.

BlackRock also sells an investment and risk management platform called Alladin. With this, BlackRock has been relatively successful and also has impressive competitors. The software is market-leading and a good 10% of the world's assets are monitored with it. What makes it extremely profitable is that the software runs on a subscription model and generates stable revenues.

Customers using Aladdin include CalPERS (California Public Employees Retirement System) with $260 billion in assets, Deutsche Bank with about 900 billion, and Prudential plc with about $700 billion.

𝐊𝐨𝐧𝐤𝐮𝐫𝐫𝐞𝐧𝐳:

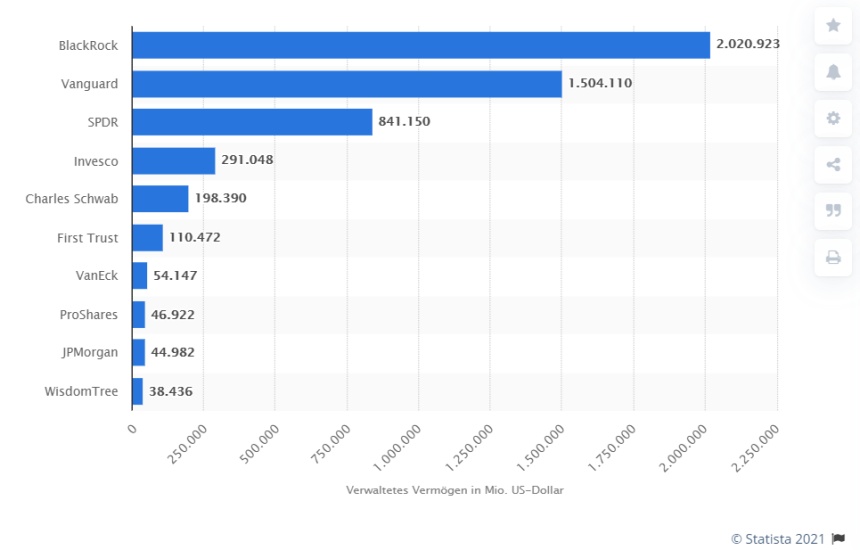

While there are some competitors, BlackRock remains the clear market leader due to its size. Especially since they are able to charge significantly less than others.

Some notable competitors include Vanguard, SPDR, Invesco, First Trust, VanEck, ProShares, JP Morgan, Wisdom Tree, and Charles Schwab.

𝐊𝐫𝐢𝐭𝐢𝐤:

Not only the extensive meddling in other companies criticized , but also other points:

The involvement during the world financial crisis has long been criticized, because the company was involved in virtually all bailouts in 2007 and has earned heavily from it. In addition, BlackRock holds shares in several competing companies from the industrial sector, which has also been criticized because this approach is supposed to lead to competition-reducing effects (= common ownership).

Furthermore, one could mention some systemic risks with the ETFs and Alladin, as well as the criticisms of US lobbying (2019), the violation of the reporting obligation in several cases, as well as greenwashing.

𝐅𝐚𝐳𝐢𝐭:

Actually, a pretty clear buy, one would think. BlackRock's brands are known worldwide, and Alladin is a unique software solution, which gives the company a deep moat and makes it the market leader. Due to BlackRock's subscription models in the different areas, the revenues are very predictable and stable and the business model is also still promising. Furthermore, there is also still a lot of potential in the Chinese market, where BlackRock is just arriving, and there is also a lot of potential in the stock market itself, as many private investors are just starting to invest in ETFs for their retirement.

However, the share price has of course risen enormously in the last 1 ½ years (a good 100% since the Corona Crash) - but whether one should wait here if necessary, everyone must consider for themselves. In addition, it is questionable how much growth is now really still possible.

Which brings me to the next topic: BlackRock is dependent on the stock market - at least to some extent. If prices go down and investors get scared for their money, a lot will be sold, leading to a drop in profits for BlackRock. In addition, regulations could hit the company, as BlackRock is becoming more powerful, and not everyone is likely to like that. After all, the criticism is not without and that should definitely be kept in mind. That BlackRock is powerful is no question. Especially since it had a stake in so extremely many companies through the ETFs.

Overall, though, it has to be said that the opportunities really do exceed the risks, and I still think the valuation is fair.

𝐐𝐮𝐞𝐥𝐥𝐞𝐧 𝐮𝐧𝐝 𝐯𝐞𝐫𝐬𝐜𝐡𝐢𝐞𝐝𝐞𝐧𝐞 𝐋𝐢𝐧𝐤𝐬:

https://www.alleaktien.de/quantitativ/aktie/US09247X1019/928193/BLK/BlackRock-Aktie

https://www.boerse.de/historische-kurse/BlackRock/US09247X1019

https://www.boerse.de/fundamental-analyse/BlackRock-Aktie/US09247X1019#kennzahlen

https://de.wikipedia.org/wiki/BlackRock

https://de.statista.com/statistik/suche/?q=blackrock&qKat=search

https://www.aktiencheck.de/exklusiv/Artikel-BlackRock_Dauerlaeufer_Aktienanalyse-13375450

https://www.deraktionaer.de/aktien/kurse/blackrock-us09247x1019.html

𝐌ö𝐠𝐥𝐢𝐜𝐡𝐞 𝐃𝐨𝐤𝐮𝐦𝐞𝐧𝐭𝐚𝐫𝐟𝐢𝐥𝐦𝐞 ü𝐛𝐞𝐫 𝐁𝐥𝐚𝐜𝐤𝐑𝐨𝐜𝐤 (𝐚𝐮𝐬 W𝐢𝐤𝐢𝐩𝐞𝐝𝐢𝐚):

1. money rules the world | the power of financial corporations, documentary by Tilman Achtnich and Hanspeter Michel, Germany 2014, production: SWR, first broadcast on January 13, 2014.

2. BlackRock. The uncanny power of a financial conglomerate. Directed by Tom Ockers, Germany 2019, 90 min. (Arte on September 17, 2019; Arte Mediathek until July 1, 2020,

3. BlackRock - Die unheimliche Macht eines Finanzkonzerns | Doku | ARTE on YouTube, April 7, 2020, accessed May 8, 2020. - the film was also shown under the title: Schattenmacht Blackrock on October 17, 2019 on ZDFinfo and on March 5, 2020 in Phoenix. programm.ard.de

phoenix.de)

4. in addition, there was still on October 15, 2019, the 10.14 minutes long Frontal 21 contribution Schattenmacht BlackRock influence on business and politics. by Joachim Bartz and Tom Ockers on ZDF (available until October 15, 2020).