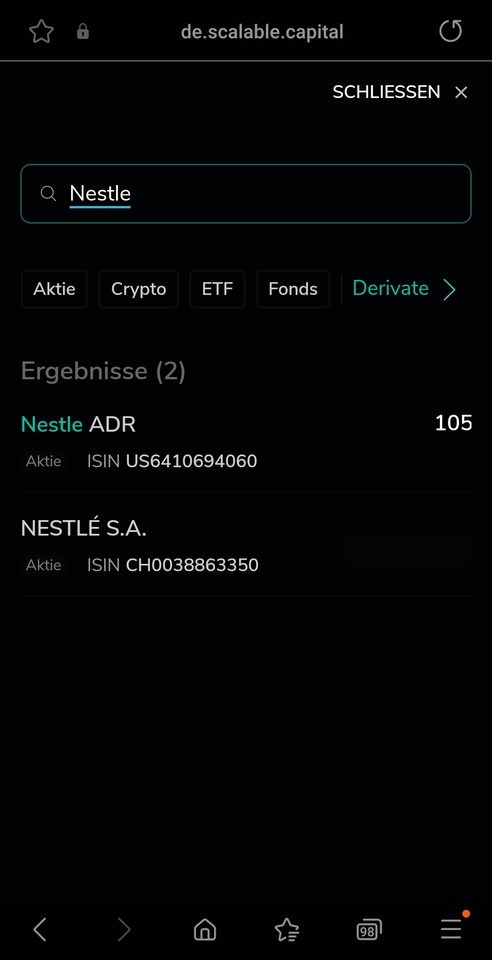

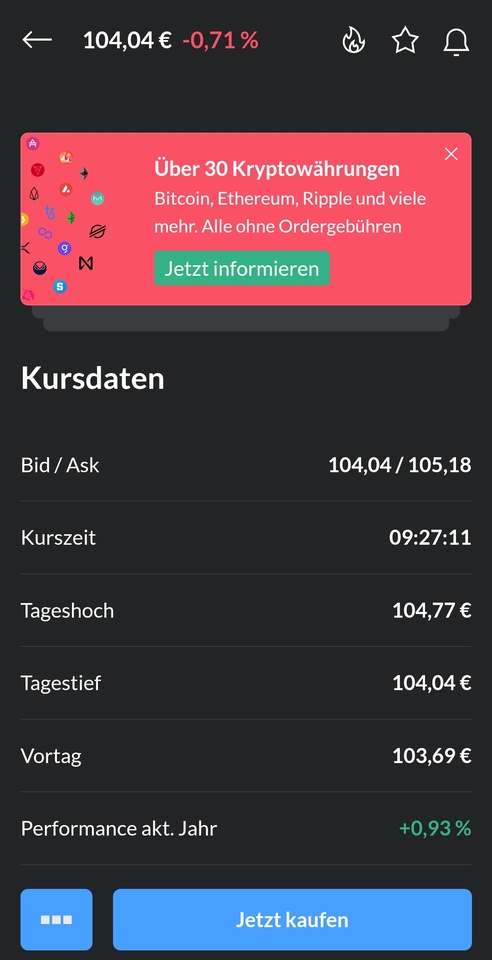

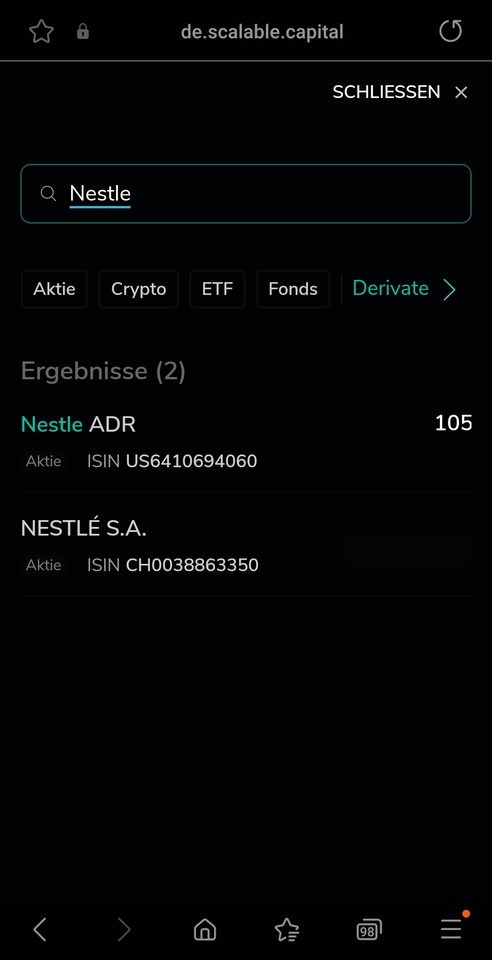

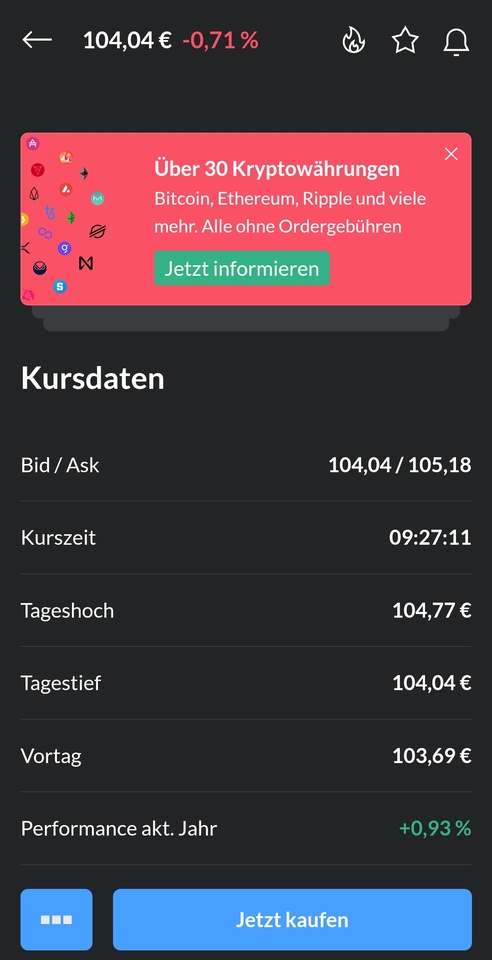

Info for Scalable users:

Apparently Swiss shares will also be tradable.

They can already be found in the search but currently without a price.

Info for Scalable users:

Apparently Swiss shares will also be tradable.

They can already be found in the search but currently without a price.