Depot review August 2023 - The rainy summer 2023 is coming to an end, in the depot as well as in nature everything green. Will a red September follow?

The August 2023 was like the summer in general a rather mixed affair.

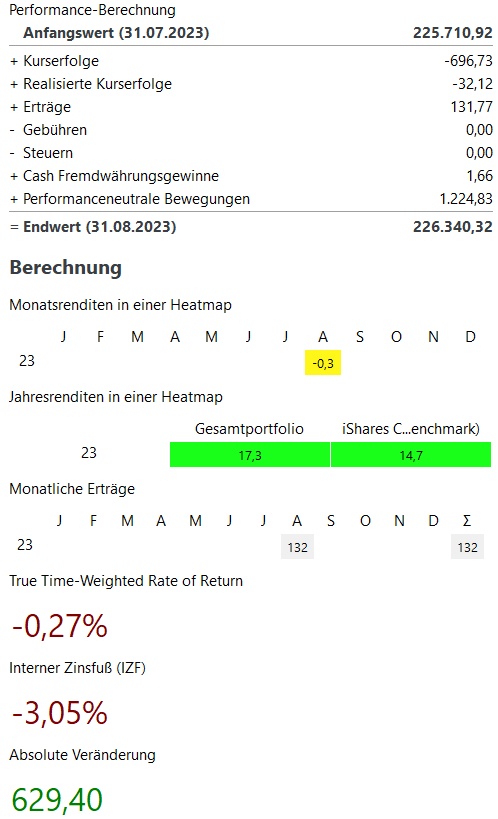

The portfolio stood in between at almost -5%, to then close at the end virtually unchanged

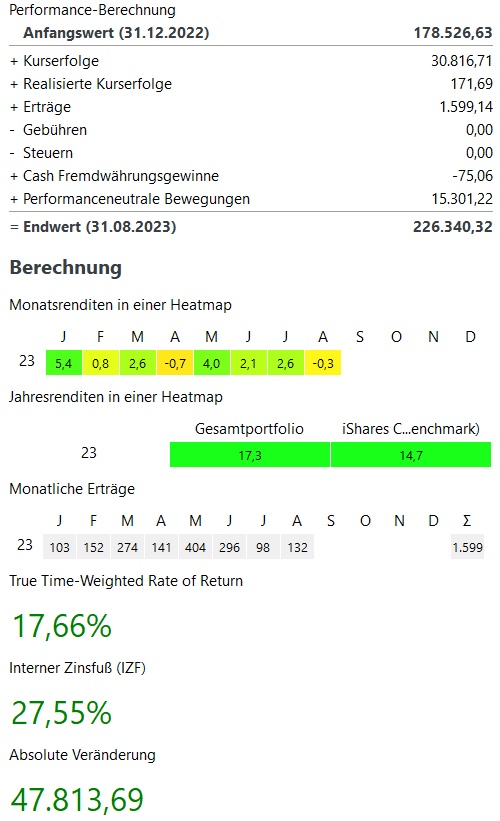

In August, my portfolio closed with -0,3% virtually unchanged. In contrast to August 2022 with -2.4% but a better development.

In the current year, my performance is currently +17,4% and thus still above my benchmark (MSCI World +14.8%).

In August, NVIDIA again $NVDA performed extremely strong with +7% / + 800€. In percentage terms, however, some stocks performed even stronger in August, right at the top with +18% each Novo Nordisk $NOVO B and Atlassian $TEAM (+1.34%)

On the losing side, there were a few classics in August with, among others. $SE (-1.3%) and Block $SQ (+1.31%) - But both rather smaller positions. In addition, the uncertainties around China have also weighed on my China ETF $MCHS (-0.07%) burdened with about 500€ price losses.

In total, there are almost 700€ price losses in August.

1,200€ were invested by me net, which results in a small absolute increase of just over 600€.

In total, my portfolio still stands at ~226.000€. This corresponds to an absolute increase of ~48.000€. in the current year 2023. ~31.000€ come from price increases, ~1.600€ from dividends / interest and ~15.000€ from additional investments.

Thus, there is still a shortfall of ~€6,000 in price gains to make up for the ~€38,000 in price losses from 2022.

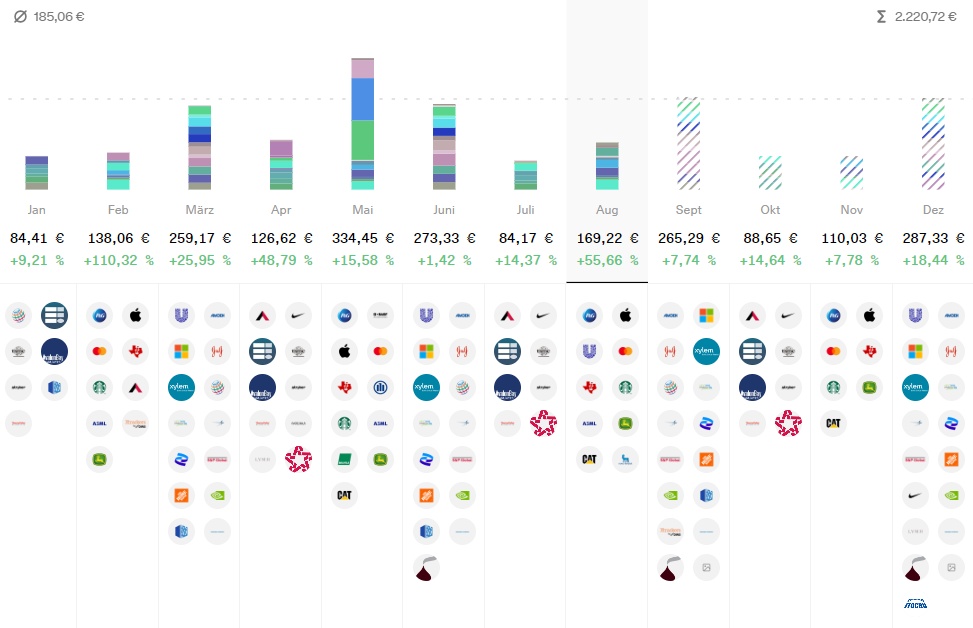

Dividend:

- The dividend comparison to the previous year is slightly more difficult this month, as Unilever distributed in August instead of September as usual and my Japan ETF will distribute in September instead of August.

- Therefore the dividend is +56% above the previous year. Without the Unilever dividend, it would be about +19% and +40%, respectively, if my Japan ETF had paid out in August as before

- In the current year, dividends are up +22% after 6 months over the first 8 months of 2022 at ~€1,500

Purchases & Sales:

- Bought in May for ~3.500€

- Executed mainly my savings plans:

- Blue ChipsTSMC $TSM (+0.43%) S&P Global $SPGI (+0.02%) Procter & Gable $PG (-1.24%) Johnson & Johnson $JNJ (+0.03%) Hershey $HSY (+0.03%) Caterpillar $CAT (+0.86%) Amgen $AMGN (+0.51%) Alphabet $GOOG (+1.03%) and Alimentation Couche-Tard $ATD (+1.09%)

- GrowthPalo Alto Networks $PANW (-2.12%) and Bechtle $BC8 (+0.82%)

- ETFs: MSCI World $XDWD Nikkei 225 $XDJP and the Invesco MSCI China All-Shares $MCHS

- Crypto: Bitcoin $BTC and Ethereum $ETH

- Sales occurred in August with the iShares Healthcare Innovation

- $2B78 only one. Here I have more confidence in the individual stocks I have selected. This means that the only sector ETF has now also been removed from my portfolio.

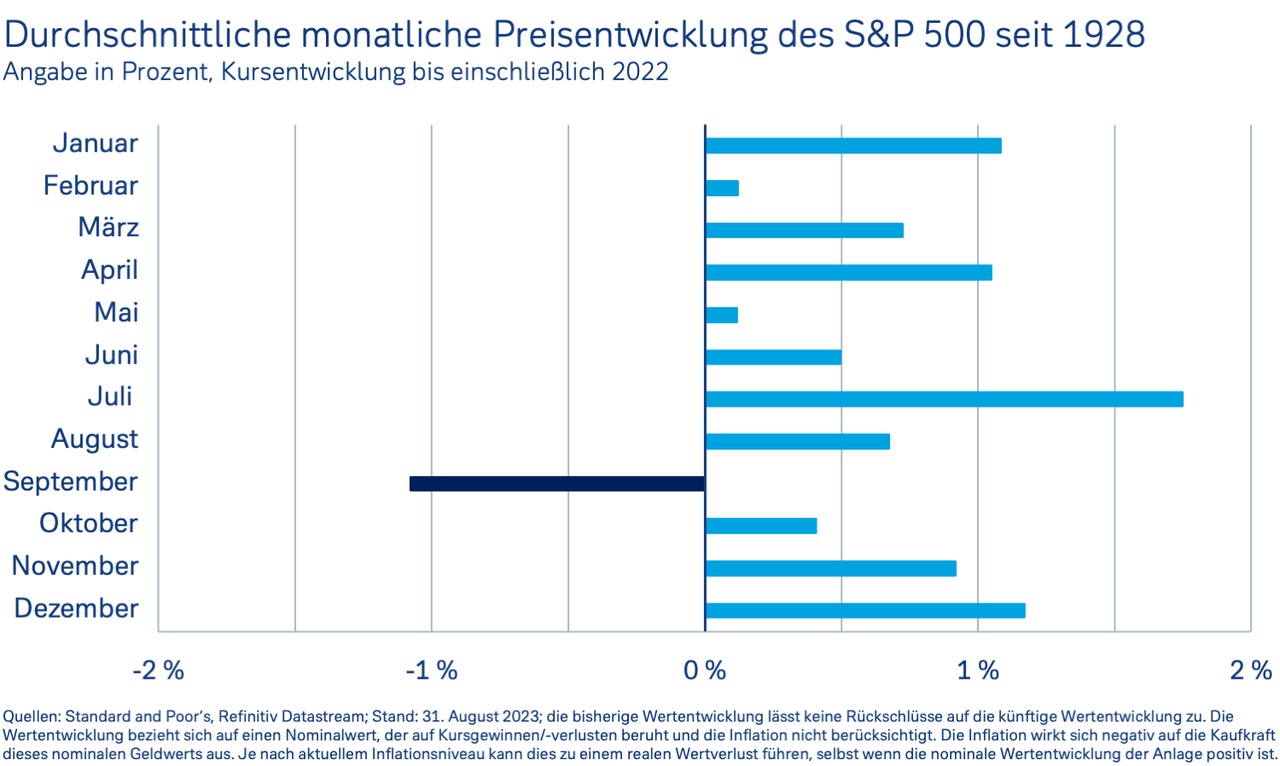

September is now the worst of all stock market months and also the only one with a long-term average negative performance.

In the appendix you will find an analysis of the S&P 500 development from 1928 to 2022. While the months July, December, January and April belong to the best, the S&P 500 loses ~1% in September on a long term average..

Various studies have already looked into this, but have not found any real reasons for this underperformance.

So at least statistically nothing stands in the way of a slight correction in September - Also in my portfolio all 3 September since 2020 were negative, so let's see what this September will bring.

What do you expect for September?

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy