🏢 High-quality REITs in comparison: Realty Income, STAG Industrial and Prologis 🚀

Realty Income: The Monthly Dividend Company®

OverviewRealty Income Corporation ($O (+1.22%) O) is a leading real estate investment trust (REIT) focused on single-tenant real estate. Known as "The Monthly Dividend Company®", Realty Income has provided consistent monthly dividends for over 50 years.

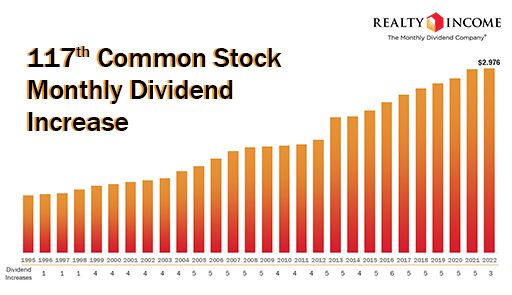

Dividend Growth:

- Steady dividends: Realty Income has increased its dividend 120 times since going public in 1994.

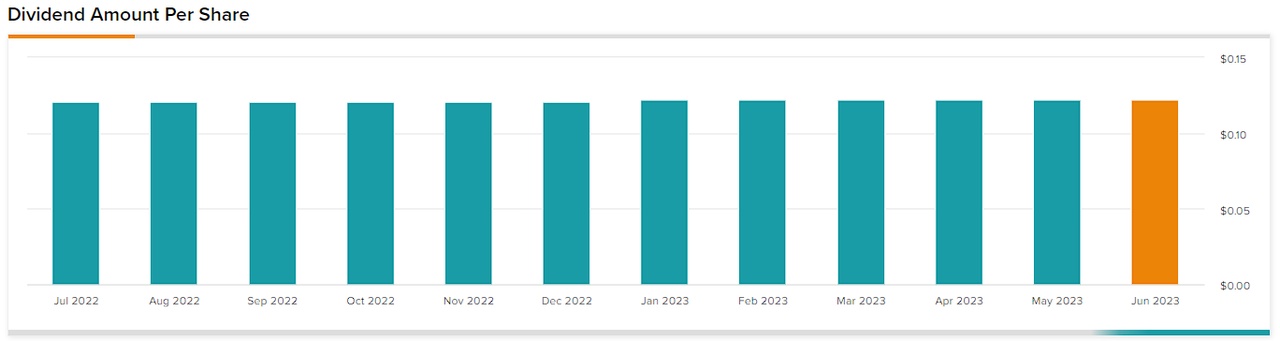

- Monthly payoutRealty Income is one of the few companies to pay monthly dividends, which is particularly attractive for income investors.

Portfolio and expansion:

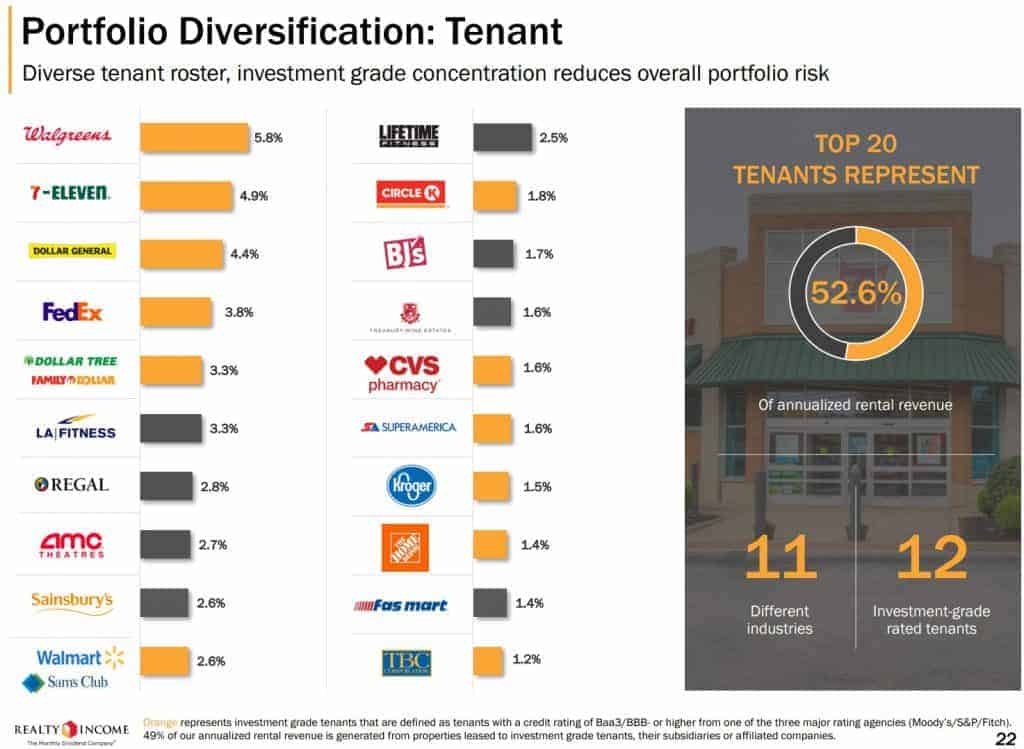

- Diversified portfolioThe company owns over 6,500 properties in 49 US states and Puerto Rico, which are leased to a variety of industries.

- International ExpansionRealty Income has recently taken steps to expand into international markets, including the UK and Europe.

- M&A ActivitiesThe company is very active in mergers and acquisitions (M&A), which helps to expand and diversify the portfolio.

Strength of the company:

- Long-term leasesRealty Income's leases have an average term of 10 to 20 years, which provides stable and predictable income.

- Investment-grade tenantsThe majority of tenants have a high credit rating, which reduces the risk of rental defaults.

Dollar-cost averaging (savings plan)Realty Income is ideal for dollar-cost averaging (DCA). Thanks to the monthly dividends and stable share price performance, investors can regularly invest in the company and thus minimize the risk of market fluctuations.

Long-term yieldSince 2004, Realty Income has achieved an average annual total return of 10.89%. This impressive return demonstrates the company's consistent growth and strength over the years.

Why Realty Income?:

- Stable incomeRealty Income offers a reliable source of income through monthly dividends and long-term rental agreements.

- Diversification: With properties in different sectors and regions, the company offers a broad diversification opportunity for investors.

- Growth potentialExpansion into international markets and an active M&A strategy open up new growth opportunities.

ConclusionRealty Income is a first-class choice for investors seeking stable and growing income. With a diversified real estate portfolio, a focus on high-quality tenants and a strong M&A strategy, the company remains an attractive option in the real estate sector. 📈🏢

STAG Industrial: specialist for industrial real estate

OverviewSTAG Industrial, Inc. ($STAG) is a leading REIT specializing in industrial real estate. The company owns and operates a diversified portfolio of industrial properties in the United States.

Dividend Growth:

- Regular distributionsSTAG pays monthly dividends, which is very attractive for income investors.

- Steady growthThe company has a solid history of dividend increases, reflecting its financial stability and growth.

Portfolio and expansion:

- Industrial specializationSTAG owns over 500 properties, which are mainly rented to individual users in the industrial sector.

- Geographic diversification: The properties are spread across 39 states, which reduces the risk of regional economic fluctuations.

- Active acquisitionsSTAG continuously expands its portfolio through strategic acquisitions to promote growth and increase earnings.

Strength of the company:

- Long-term leasesSTAG's leases have on average a long term, providing stable and predictable income.

- Diversified tenant baseSTAG has a broad range of tenants from different industries, which reduces the risk of rent defaults.

Dollar-cost averaging (savings plan)STAG is also ideal for dollar-cost averaging. The stable monthly dividends and robust performance make it a good choice for regular investment.

Long-term returnSTAG Industrial has delivered a solid total return in recent years, reflecting investor confidence and the strength of the business model.

Why STAG Industrial?:

- Focus on industrial real estateSpecialization in the industrial sector offers stable and growing returns.

- Diversification: A broadly diversified portfolio reduces risk and maximizes earnings opportunities.

- Growth potential: STAG Industrial remains on course for growth through continuous acquisitions and portfolio expansions.

ConclusionSTAG Industrial offers investors the opportunity to benefit from the stability and growth of the industrial real estate market. With a focused portfolio and a solid dividend history, STAG is an attractive option for long-term investors. 📈🏭

Prologis: global market leader for logistics real estate

OverviewPrologis, Inc. ($PLD (+1.28%)) is the world's largest REIT in logistics and industrial real estate. The company owns and operates warehouse and distribution centers in strategic markets around the world.

Dividend Growth:

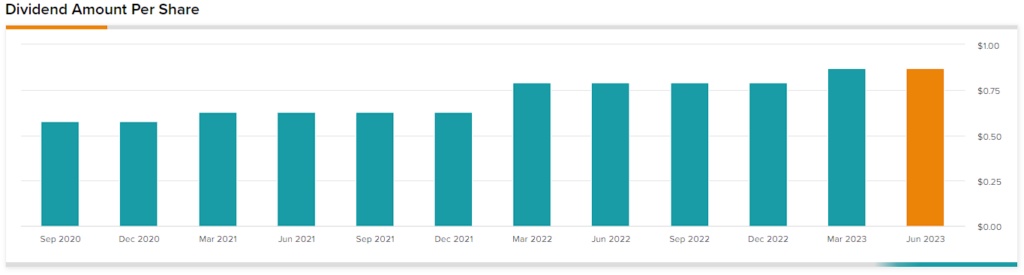

- Steady payoutsPrologis has a long history of dividend increases that reflect financial stability and growth orientation.

- Quarterly dividends: The company pays quarterly dividends, which are attractive to many investors.

Portfolio and expansion:

- Global networkPrologis owns and operates over 4,700 properties in 19 countries, providing unparalleled geographic diversification.

- Strategic markets: Properties are located in major urban areas and close to major transportation hubs, which is ideal for tenants in the e-commerce and logistics sectors.

- Active acquisitions and developmentsPrologis is continuously expanding its portfolio through strategic acquisitions and new developments.

Strength of the company:

- Long-term leasesPrologis secures long-term leases with leading companies in the logistics and e-commerce sector.

- First-class tenant base: Tenants include large multinational companies, which minimizes the risk of rent defaults.

Dollar-cost averaging (savings plan)Prologis is ideal for dollar-cost averaging as it offers stable dividends and strong share price performance. This makes it a good choice for regular investments.

Long-term returnPrologis has delivered an impressive total return over the past decades, reflecting its continued growth and strong market position.

Why Prologis?:

- Global market leaderAs the largest provider of logistics real estate, Prologis offers an unparalleled market presence.

- Geographical diversification: A global portfolio offers stability and reduces the risk of regional fluctuations.

- Growth potentialExpansion into strategic markets and focus on e-commerce real estate opens up new growth opportunities.

ConclusionPrologis is a first-class choice for investors who want to benefit from the dynamics of the global logistics market. With a strong market presence, stable dividends and continuous growth, Prologis remains an attractive option in the real estate industry. 📈🏢

DisclaimerThe information provided is for general information purposes only and does not constitute professional financial or investment advice. All content is provided without warranty of completeness, accuracy, timeliness or fitness for a particular purpose. Any liability for actions based on the information on this site is expressly excluded. For individual advice, please consult a licensed financial advisor. Use of this site is at your own risk.