Servus together,

Today I would like to introduce you to 3i Group PLC.

I became aware of them through their involvement in a previous company where I worked. I have already acquired positions earlier this year, and am considering further expansion with a minimum holding period of 5-7 years.

3i Group PLC

3i Group PLC is a British Beteiligungsgesellschaftcompany, which is listed on the Londoner Börse listed, and is represented in the FTSE 100 stock exchange. Today, the 3i Group (3i "Invest in industrie") is one of the largest publicly traded Private-Equity-companies in the world. In the Buy-out-sector, 3i focuses on majority investments in companies with an enterprise value between 100 and 500 million euros which are active in the sectors of Dienstleistungen, Gesundheitswesen, Konsumgüter and industrial goods. Since 2010, the 3i Group has made over 40 new investments and 250 bolt-on acquisitions in approximately 30 countries[1], [2].

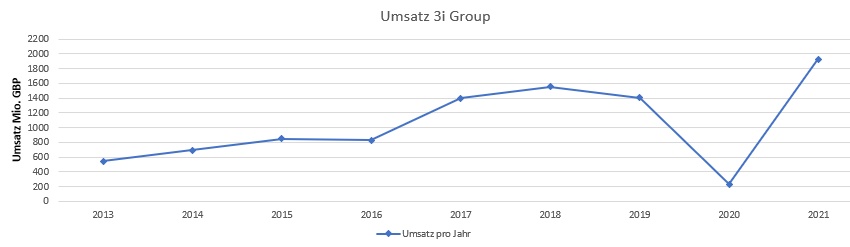

Sales

Since 2013, investors have increased 3i Group's revenue from and GBP 546 million to approximately GBP 1,931 million, a constant increase of ~354%.[3]

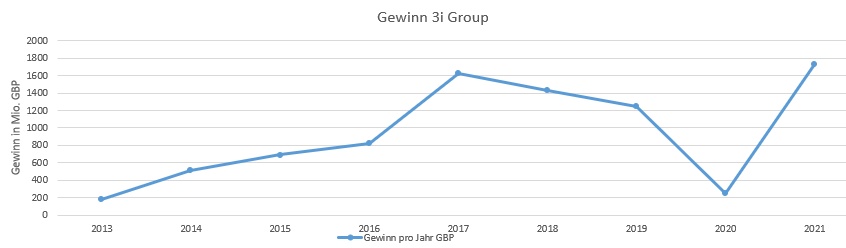

Earnings

Profit also speaks for itself, with an increase from GBP 183 million in 2013 to GBP 1,726 million in 2021, representing a percentage increase of ~943%.[3]

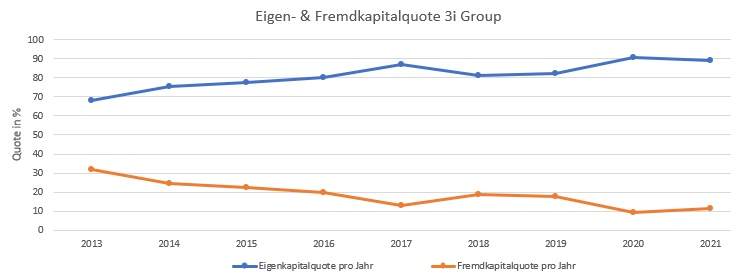

Equity / debt ratio

Since I personally like to follow Warren Buffet's lead, these two ratios also speak to this company for me.

While the equity ratio has increased from 68.04% to 88.68% from 2013 to 2021, the debt ratio has conversely decreased from 31.96% in 2013 to 11.32% in 2021.[3]

Return on investment

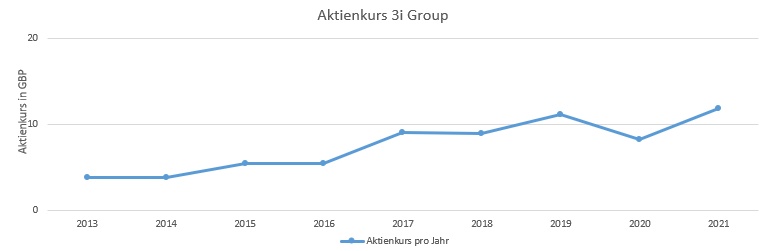

Share Price:

3i Group's share price has increased by approximately 314%~ since 2013 from GBP3.79 in 2013 to GBP11.87 in 2021.

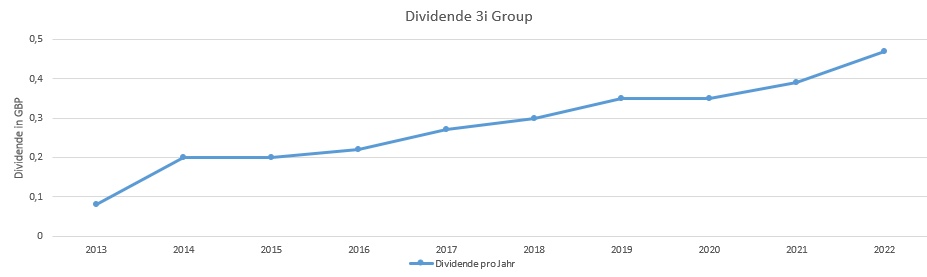

Dividend:

Since 2013, the dividend has increased consistently each year from GBP0.08 to GBP0.39 in 2021, an increase in the dividend of ~488% in 2021. As measured by the share price, the yield has experienced an increase of ~132% from 2.53% to 3.34% in 2021. On average, the annual dividend yield as measured by the share price was ~4.01% between 2013-2021.[4]

P/E = 6

Conclusion

Besides the impressive performance of 3i Group, I am particularly attracted by its diversified and promising portfolio in various industries.

Also interesting to mention are the shareholders among the top 10 shareholders of 3i Group: Blackrock ~8%, Artemis ~5%, USB 4% as well as Vanguard with around ~3%.[5].

I have already acquired positions here at the beginning of the year.

If the share price continues to fall, I will further increase the position in 3i Group.

Reason: For me, the company promises a constant increase in sales and profits, as well as a positive growth outlook for the share price and steadily increasing dividends.

As a further positive aspect, I see the high equity ratio and low debt ratio, as well as the shareholders among the top 10 shareholders.

All in all, I consider the company to be currently undervalued with high growth and buy-hold potential.

I look forward to your feedback, and if necessary to further opinion on this company. 😊

Sources:

[1]: https://www.3i.com/about-us/our-business-at-a-glance/

[2]: https://www.3i.com/portfolio?sector=®ion=&business_line=2274&q=

[3]: https://www.boerse.de/fundamental-analyse/3I-Group-Aktie/GB00B1YW4409

[4]: https://www.finanzen.net/dividende/3i

[5]: https://m-de.marketscreener.com/kurs/aktie/3I-GROUP-PLC-625143/unternehmen/