𝗞𝘂𝗿𝘀𝗴𝗲𝘄𝗶𝗻𝗻 𝗼𝗱𝗲𝗿 𝗗𝗶𝘃𝗶𝗱𝗲𝗻𝗱𝗲?

𝗞𝘂𝗿𝘀𝗴𝗲𝘄𝗶𝗻𝗻 𝘂𝗻𝗱 𝗗𝗶𝘃𝗶𝗱𝗲𝗻𝗱𝗲!

...𝗼𝗱𝗲𝗿: 𝘄𝗮𝗿𝘂𝗺 𝗶𝗰𝗵 𝗗𝗶𝘃𝗶𝗱𝗲𝗻𝗱𝗲𝗻 𝗺𝗮𝗴 𝗧𝗘𝗜𝗟 𝟮

another look into the 𝘾𝙞𝙩𝙞 𝙂𝙡𝙤𝙗𝙖𝙡 𝙒𝙚𝙖𝙡𝙩𝙝 𝙄𝙣𝙫𝙚𝙨𝙩𝙢𝙚𝙣𝙩𝙨 𝙊𝙐𝙏𝙇𝙊𝙊𝙆 2022.

Why does Citi think dividends are more important today than ever in the current market situation?

👉 Negative real interest rates have increased the importance of dividends in performance-oriented portfolios.

👉 With global dividend yields trading above bonds, Citi believes equities will generate a much larger share of total returns in a diversified portfolio. (actually logical)

👉 Citi recommends companies whose dividends have grown a consistent over time. (should be a criterion mMn anyway when choosing dividend stocks).

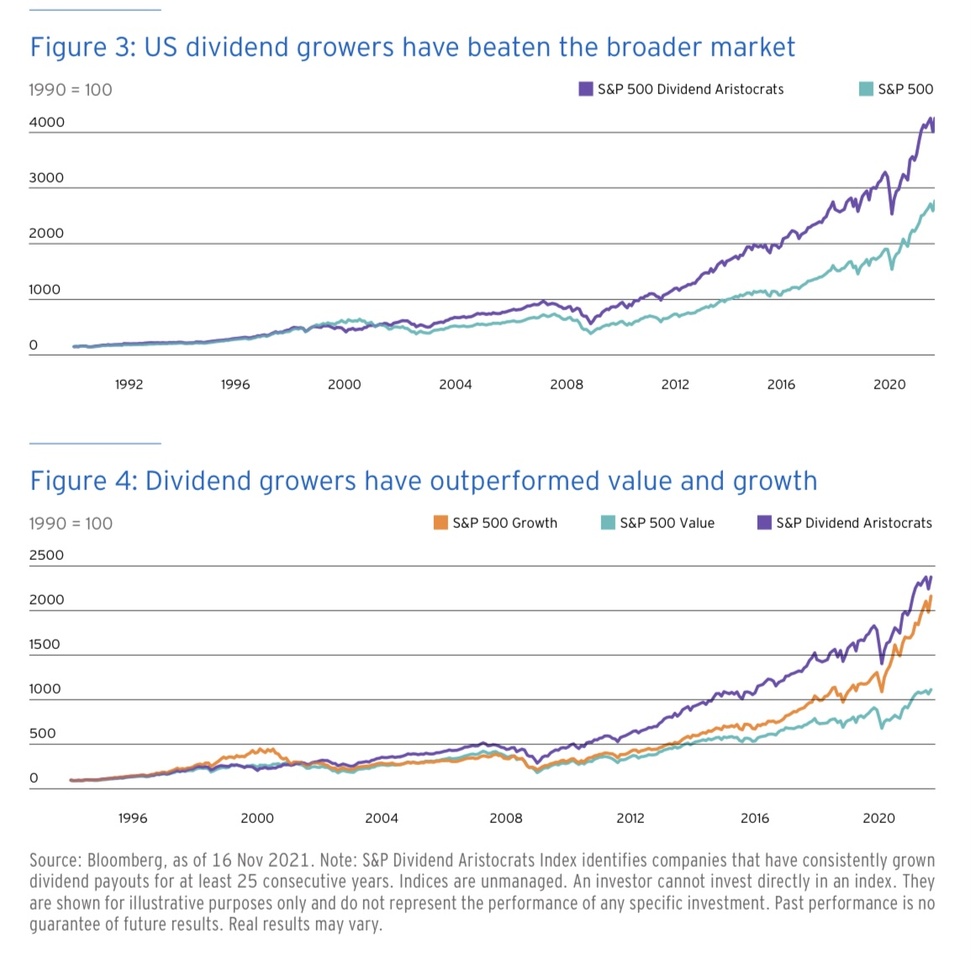

👉 These "dividend growth stocks" not only provide yields, but have often outperformed the broader stock market. (see the images for more)

👉 Dividend growth stocks are especially common in healthcare, consumer staples, and semiconductors.

The power of dividend reinvestment is underappreciated. While past performance is not indicative of future performance, Citi sees a potential opportunity to generate further higher returns by investing in a select group of companies that have a long track record of growing their dividends.

By consistently increasing distributions to shareholders over time - even during periods of recessions and expansions - such companies demonstrate their ability to grow profits over time. This, in turn, suggests 𝗱𝗮𝘀𝘀 𝗱𝗶𝗲𝘀𝗲 "𝗗𝗶𝘃𝗶𝗱𝗲𝗻𝗱𝗲𝗻𝘄𝗮𝗰𝗵𝘀𝘁𝘂𝗺𝘀𝘂𝗻𝘁𝗲𝗿𝗻𝗲𝗵𝗺𝗲𝗻" 𝗽𝗼𝘁𝗲𝗻𝘇𝗶𝗲𝗹𝗹 𝗵𝗼𝗲𝗵𝗲𝗿𝗲 𝗚𝗲𝘀𝗮𝗺𝘁𝗿𝗲𝗻𝗱𝗶𝘁𝗲𝗻 𝗲𝗿𝘇𝗶𝗲𝗹𝗲𝗻 𝗸𝗼𝗲𝗻𝗻𝗲𝗻.

Over the past 30 years, an investment strategy that invests in dividend growth companies has outperformed the S&P 500 Index as well as its Value and Growth Indices - FIGURES 3 and 4. Although there is less historical data for dividend growth companies outside the U.S., Citi believes that 𝗱𝗶𝗲𝘀𝗲𝗹𝗯𝗲 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝗶𝗲 𝘄𝗲𝗹𝘁𝘄𝗲𝗶𝘁 𝗲𝗶𝗻𝗲 𝗢𝘂𝘁𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 𝗲𝗿𝘇𝗶𝗲𝗹𝗲𝗻 𝗸𝗮𝗻𝗻. The reason is that the fundamental factors that form the basis for dividend growth companies cannot be limited to a specific region or location.

Source Photo/Text: https://www.privatebank.citibank.com/outlook