Hello everyone!

I'm Patrick, 28 years young and work in the IT sector. I've been on the stock market since the beginning of 2023 and have been a silent reader here for most of the time and have enjoyed following the informative contributions of some others. Now I would like you to evaluate my savings plans.

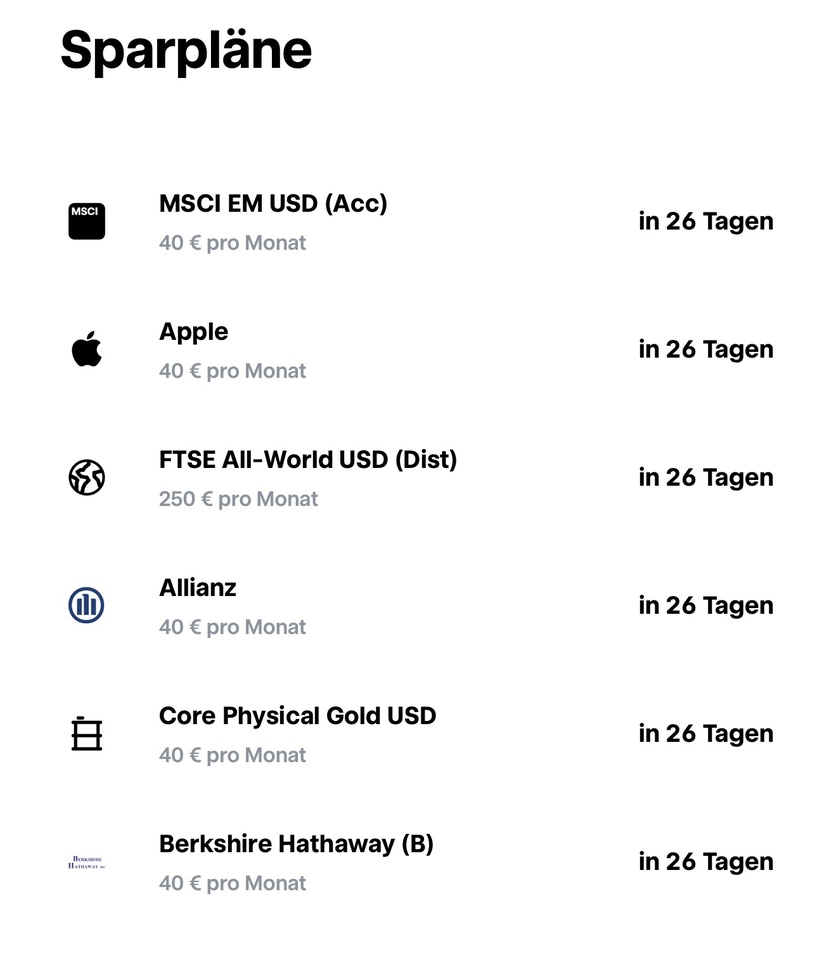

I am pursuing the following strategy $VWRL (-0.08%) and the $XMME (-0.2%) divided into 80/20. and three quality stocks: $BRK.B (+0.26%) ,$AAPL (+0.21%) and $ALV (-0.3%) - and finally gold: $WGLD (+0.49%)

I still buy individual stocks during the month. Depending on the market and the available capital.

What do you think? The aim is to continue to regularly invest all available funds in order to receive a nice dividend in the long term.

ps: I have just transferred my portfolio to TR, so I can't finalize and post this yet.