Preface:

In the following, I would like to present how my portfolio has developed over the course of 2024.

This includes

1) my strategic orientation

2)Return on the portfolio.

The main topics are:

- Moving away from individual stocks

- Entry into gold and bitcoin

- Factor investing

Finally, I will give my own thoughts on how to proceed.

The main changes to my portfolio that have led

to my current strategy are presented below using a short timeline.

timeline:

My timeline

Beginning of 2024

At the beginning of the year, I pursued a 70/30 core satellite

strategy. The 70% ETF core again consisted of STOXX Europe.

MSCI World, Emerging Markets.

The 30% consisted of stocks such as: $CSIQ (-4.26%) , $O (+0.12%) ,$TSM (-1.71%)

$ADM (+0.12%)

$UMI (+0.29%)

$D05 (+2.21%)

$BMW (-2.54%)

$UKW (-2.26%)

$8031 (-1.46%)

$MUV2 (+0.12%)

February

Addition of gold to my portfolio. Target size 10%. Build-up in batches.

The remaining 70/30 strategy therefore only relates to the remaining

90%.

April-June:

Entry into Bitcoin via Trade Republic in several batches

at prices between 50k and 63k.

After exchange with @Epi to the fee schedule at Trade Republic

I sold them there in order to sell Bitcoin on a dedicated crypto exchange.

exchange.

June:

Thanks to @PowerWordChill I got to grips with factor investing. A Gerd Kommer book later, and after some internet research, I decided to

decided to transform my ETF strategy into a factor ETF strategy.

July-August 2024:

Sale of my shares. Concentration on the factor portfolio.

August - September 24:

Renewed build-up of Bitcoin with the aim of making Bitcoin a

a fixed component of the portfolio. Consideration is 5%-10%

of my portfolio.

The idea. Build up an initial position, then make regular

investments of €50 per week with the aim of growing to the target size

to grow to the target size. The rapid rise in October/November led me to

led me to leave it at €50 per week. And individual purchases in

larger tranches at an early stage with a portfolio size of 2.x%.

End of December 2024:

Position size of Bitcoin almost 5%.

I am not yet including Bitcoin in my gold/ETF quota. I'm still running it on the side.

I re-evaluated my factor weighting at the end of the year

and would like to fine-tune it a little. I will briefly present the result in the

following section.

In addition, I have decided to include a small

include a small proportion of real estate stocks. However, this will probably never

part of my strategy worth mentioning and contains - as of today - only

about 3% of my portfolio and only $O (+0.12%) ).

Overall breakdown of my portfolio:

As described above, I do not yet include Bitcoin in my overall strategy

part of my overall strategy so that rebalancing remains easier. This will

change when Bitcoin reaches its target size.

The rest is made up as follows:

ETFs:

$XDEM (+0.43%) 30.3% (MSCI World Momentum)

$XDEB (+0.57%) 10.1% (MSCI World Minimum Volatility)

$XDEV (-0.36%) 10.1% (MSCI World Value)

$ZPRV (+0.32%) 15% (MSCI USA Small Cap Value Weighted)

$ZPRX (-1.08%) 6.5% (MSCI Europe Small Cap Value Weighted)

$PEH (-0.28%) 4.5% (as a quality factor on emerging markets)

$5MVL (-0.06%) 4.5% (Edge MSCI EM Value)

$SPYX (-0.15%) 9% (MSCI EM Small Cap)

Gold

$EWG2 (+0.93%) 10% Gold ETC

Getquin Rewind and own data:

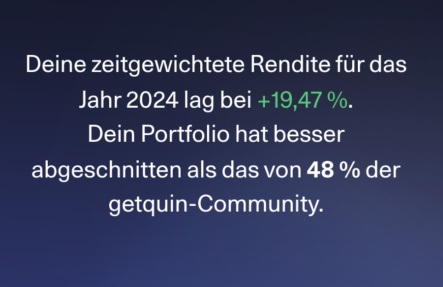

At the end of the post you will find my Getquin Rewind, as I was not able to embed the image in the text:

However, according to my own calculations, this cannot be correct.

My portfolio volume at the start of the year was around €103,500 with a return of €16,693. This would correspond to a total return of 19.2%. However, we are not yet talking about a time-weighted return, as my invested capital has roughly doubled over the course of the year. I therefore estimate my TTWROR to be higher.

My own thoughts and outlook:

I do not expect any major changes in strategy over the next few years. At some point, a strategy will have to be established. If necessary, I will make some adjustments to this strategy.

This includes the fact that I am dissatisfied with the costs of the emerging markets factor ETFs. So far, however, I intend to live with it. Should I

stumble across better products, I will consider switching. Especially as long as I stay within the tax allowance when switching.

I'll also have to decide how big my Bitcoin holding should ultimately be.

If you've been reading carefully, you'll notice that a lot of money has accumulated in the last year. Big profits, big investments. Due to personal circumstances, I will not maintain these rates in the same style, but will reduce them somewhat. I expect to be able to continue investing around 1.5-2k per month. This means that my financial goals are

with an expected return of 5% adjusted for inflation over many years.

I am half hoping for major setbacks in the near future and the associated favorable entries. However, in view of the impact that minor price jolts have had on society as a whole (thanks to populism), I don't really wish for them.

Do you have any suggestions, questions or comments? Is there anything that particularly interests you?

I am also happy to receive suggestions for improvement for future posts.

Best regards,

Your Smurf

PS: @DonkeyInvestor and me, that's love ❤. And now send me your coins! (So I can reward your next post appropriately).

PPS: I hope someone is interested.