Depot review July 2024 - A red month with a conciliatory last trading day

After a long, positive period, July brings another significant loss for my portfolio and is the worst month of the year to date, just ahead of April.

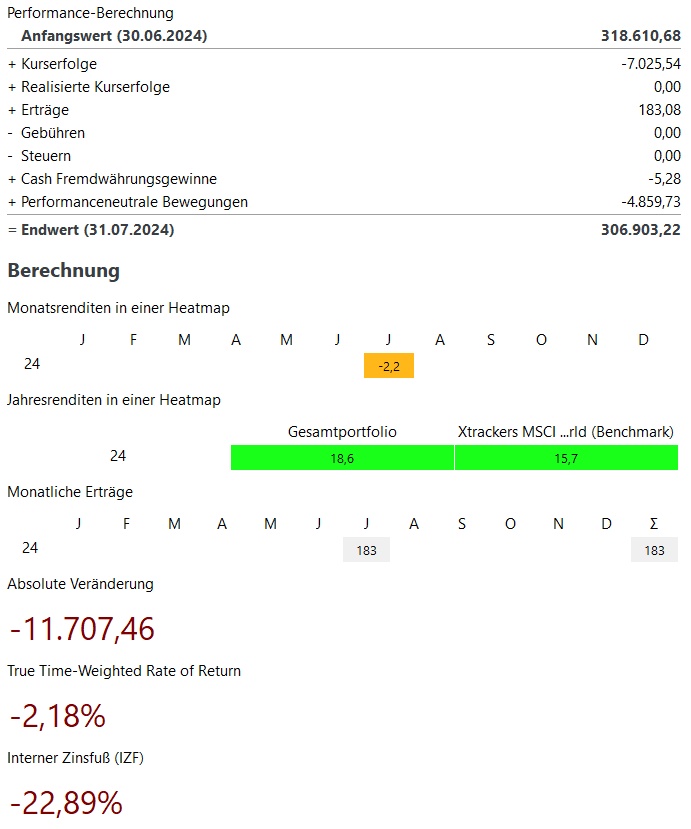

Monthly view:

In total, July was -2,2%. This corresponds to price losses of ~7.000€.

However, as the previous month of June alone brought a return of +5%, the weak performance in July is not a major problem and the portfolio is still significantly higher than at the beginning of June, for example.

Winners & losers:

On the winners' side looks correspondingly poor this month. Bitcoin and Lockheed Martin are ahead with +500€ each. In 3rd-5th place are Unilever, Sartorius and ThermoFisher, three stocks that have tended to be on the losing side in recent months and years.

On the losers' side in July are mainly the winners of recent months. Above all Crowdstrikewhich mainly made negative (media) headlines in July. A loss of over €3,000 was recorded here. But the long-runner NVIDIA also ran out of steam this month with a loss of € -1,700. With Alphabet, Microsoft and ASML three other well-known tech high-flyers followed, each of which lost €1,000 in July.

The performance-neutral movements in July were -€5,000 despite investments, as I had to withdraw cash for private reasons. Nevertheless, I bought for ~€1,400 in July.

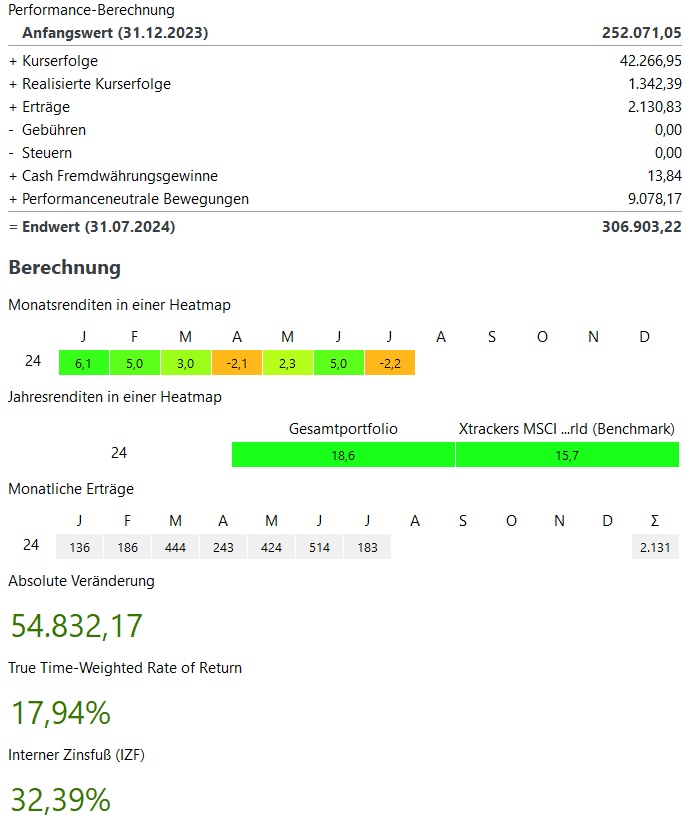

Current year:

My performance in the current year is +18,6% and thus above my benchmark, the MSCI World with 15.7%.

In total, my portfolio currently stands at ~307.000€. This corresponds to an absolute growth of ~56,000€ in the current year 2023. ~42.000€ of this comes from price increases, ~2.100€ from dividends / interest and ~9.000€ from additional investments.

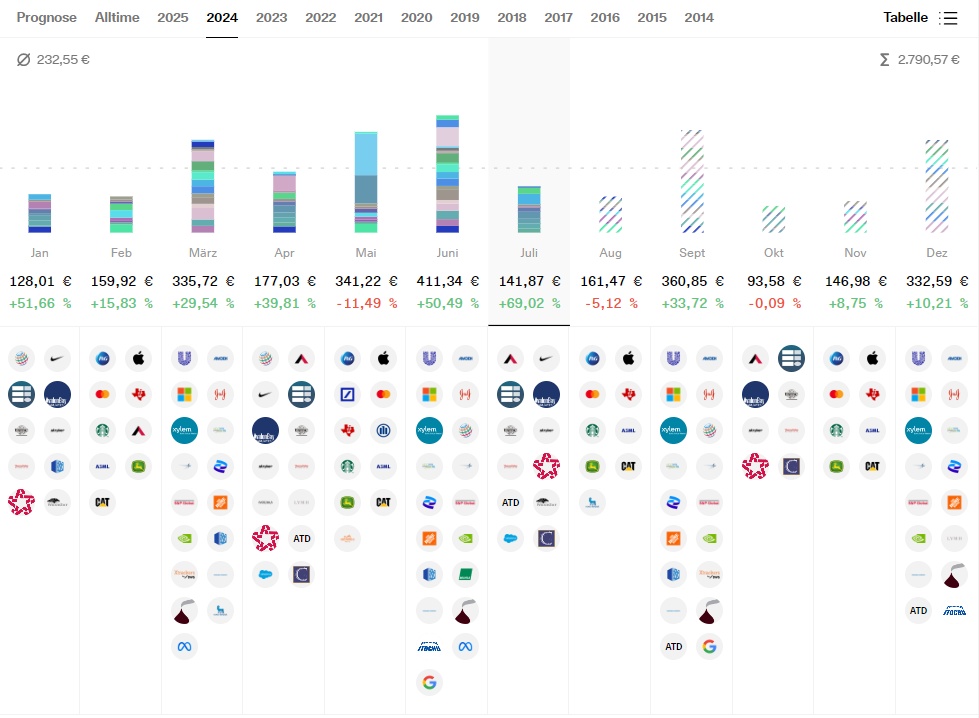

Dividend:

- Dividends in June were 70% above the previous year at ~€140

- Of course, this was not only due to the usual dividend increases and acquisitions, but above all to an ETF that paid out ~€30 for the first time in July. In addition, Salesforce again paid a dividend of just under €7

- Without these two "new payers", it would only be an increase of +25%, which also roughly corresponds to the expected growth rate for the year as a whole

- In the current year, the dividends after 7 months are +24% over the first 7 months of 2023 at ~1.680€.

Buys & sells:

- I bought in July for approx. 1.400€

- As always, my savings plans were executed:

- Blue chipsNovo Nordisk $NVO (-2.14%) LVMH $MC (-1.36%) Home Depot $HD (+3.24%) Apple $AAPL (+0.52%) Microsoft $MSFT (+0.08%) Nike $NKE (+3.29%) Starbucks $SBUX (+2.42%) Stryker $SYK (+1.66%) Texas Instruments $TXN (+0.59%)

GrowthCrowdstrike $CRWD (+2.94%) MercadoLibre $MELI (+2.47%)

ETFsMSCI World $XDWD Nikkei 225 $XDJP and the WisdomTree Global Quality Dividend Growth $GGRP- Crypto: Bitcoin $BTC and Ethereum $ETH

- Sales there were none in July

Target 2024:

My goal for this year is to reach €300,000 in my portfolio. Due to the extremely positive market performance this year, my portfolio currently stands at ~€310,000. Even though I am in a worse position than at the end of June with ~€320,000 after the negative July and the larger cash withdrawal, I am still optimistic that I will meet and beat my target for the year.

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy