S&P 500 starts 2025 with small weekly loss as materials and consumer stocks weigh

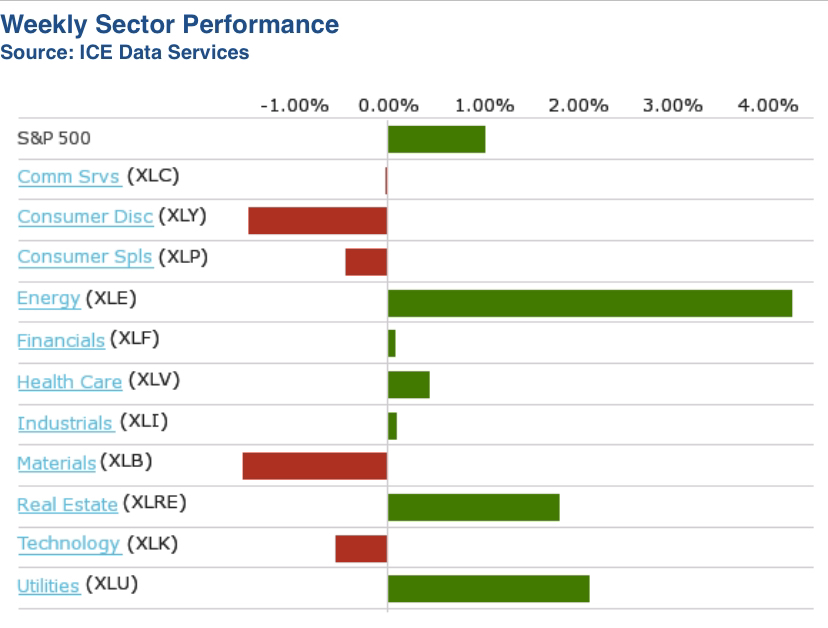

The S&P 500 Index started the new year with a weekly loss of 0.5% as the materials and consumer sectors fell while energy and utilities stocks rose. The index closed Friday's session at 5,942.47 points. The market was closed on Wednesday for the New Year holiday.

On Tuesday, the S&P 500 ended 2024 with an annualized gain of 23%. However, the index fell by 2.5% in December.

Last week, the materials sector recorded the largest decline with a drop of 2.1%, followed by consumer staples with a decline of 1.5% and consumer staples with a loss of 1.4%.

In the materials sector, the shares of PPG Industries (PPG) fell by 5.1%, and Smurfit Westrock (SW) recorded a drop of 3.8 %.

In the consumer goods sector, the shares of Tesla (TSLA) fell 4.9% after the electric vehicle maker announced that vehicle deliveries in 2024 were down year-on-year and fourth-quarter figures missed Wall Street expectations.

In the consumer staples sector, shares of alcohol producers such as Brown-Forman (BF.B) and Molson Coors Beverage (TAP)fell after US Surgeon General Vivek Murthy issued a warning highlighting the direct link between alcohol consumption and an increased risk of cancer and calling for warning labels on alcoholic beverages. Brown-Forman's Class B shares fell 6.6%, while Molson Coors Beverage dropped 4.4%.

The energy sector led the week's winners with a gain of 3.2%, followed by a 1.3% rise in utility stocks.

Devon Energy (DVN) jumped 8.8% after Wolfe Research upgraded its rating on the stock from "peer perform" to "outperform".

Among utilities, the shares of Vistra (VST) rose 16 % after UBS raised its price target for the stock from USD 161 to USD 174.

In the coming week, December labor market data will be in focus, including the monthly employment report from ADP, which is due on Wednesday, and the Labor Department's employment report, which will be released on Friday. Other important data includes November industrial orders (Monday), December consumer credit (Wednesday) and the preliminary consumer confidence index for January (Friday).