ABB Q3 2024

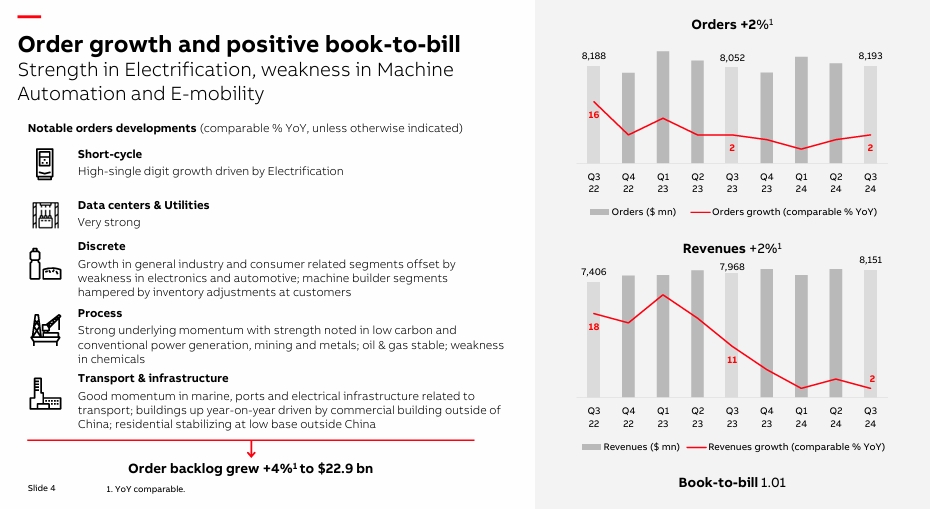

ABB's financial report for the third quarter of 2024 reflects a balanced mix of growth and challenges across its businesses. The company reported a 2% year-on-year increase in orders and revenue, with orders rising to $8,193 million and revenue to $8,151 million. The operating EBITA margin improved significantly by 160 basis points to 19.0%.

Positive developments:

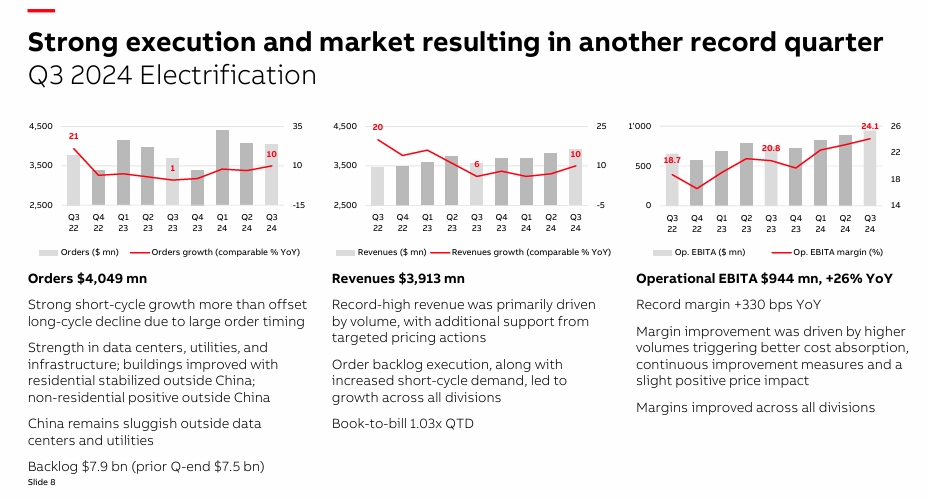

Electrification segmentThis segment delivered a strong performance with a 10% increase in both orders and sales. The operating EBITA margin reached a new high of 24.1%, an increase of 330 basis points compared to the previous year. This success was supported by higher volumes and continuous improvement measures.

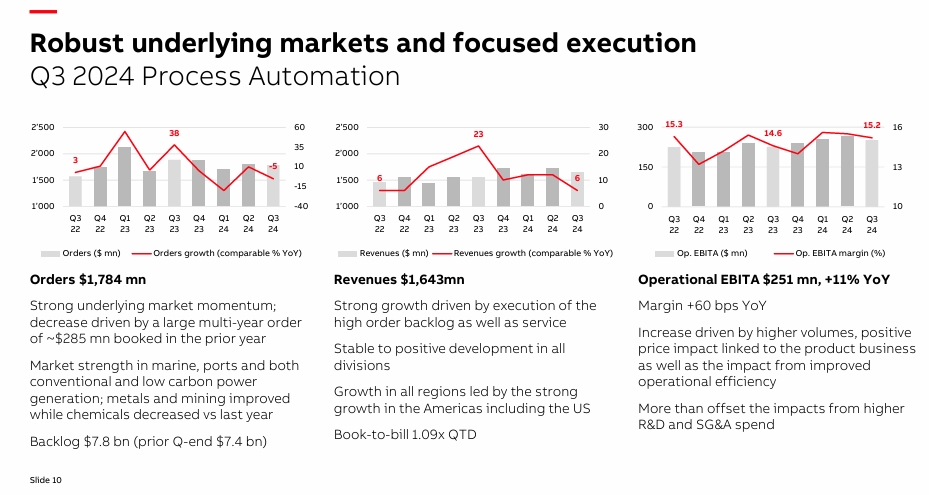

Process automationDespite a 5% decline in orders, sales rose by 6%, driven by stable customer activity and positive price effects. The operating EBITA margin was 15.2%, which is the third consecutive quarter in which the margin has been above 15%.

Sustainability effortsABB achieved an impressive 17% reduction in CO₂e emissions compared to the previous year, underlining the company's commitment to sustainability.

Challenges:

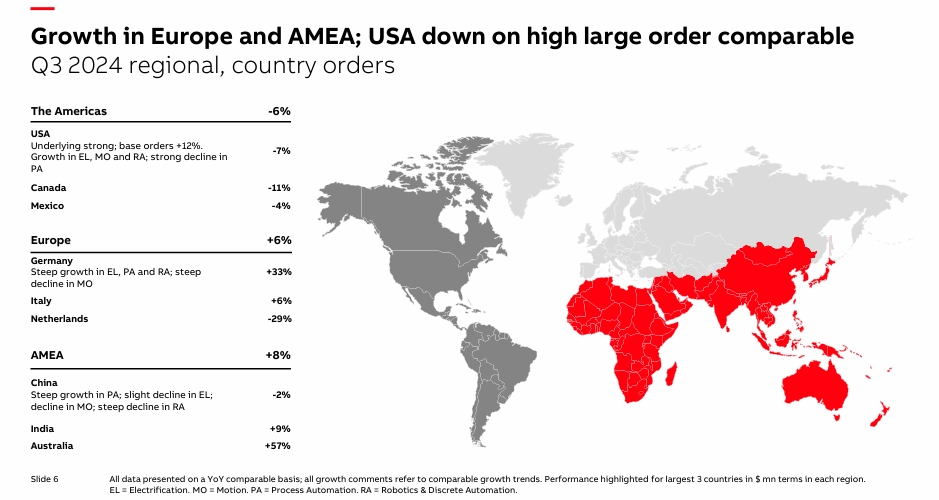

Regional performance: In the US in particular, an important market in the Americas, orders fell by 6%. This is partly due to the high level of large comparable orders from the previous year.

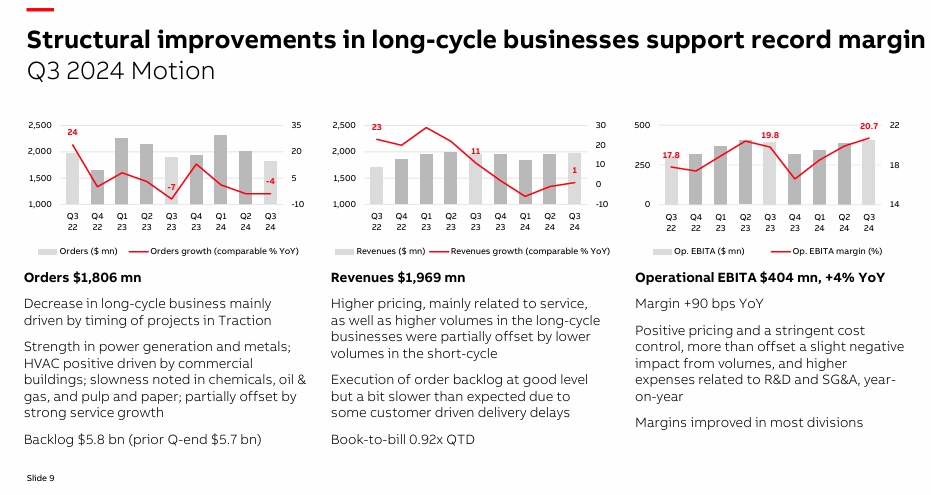

Motion segment: Orders fell by 4%, mainly due to the timing of project orders, particularly in the rail business. Nevertheless, the operating EBITA margin improved by 90 basis points to 20.7%.

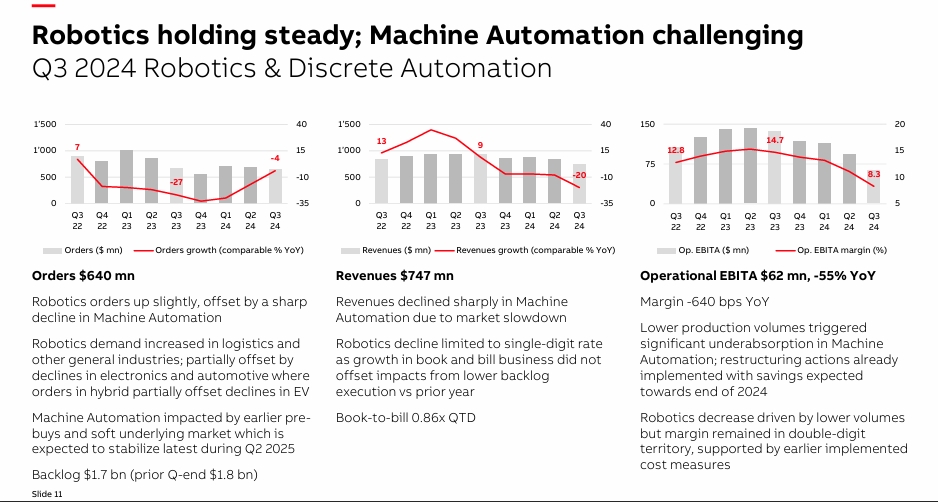

Robotics & Discrete AutomationThis segment faced challenges and contributed to lower sales growth than expected.

Outlook:

For the fourth quarter of 2024, ABB expects comparable revenue growth in the low to mid single-digit range, but with a negative book-to-bill ratio and a lower operating EBITA margin compared to the previous quarter. For the full year 2024, the company expects a positive book-to-bill ratio, comparable sales growth of less than 5% and an operating EBITA margin slightly above 18%.

Overall, ABB remains focused on driving growth and profitability through the "ABB Way" operating model, integrating M&A activities into the corporate culture and striving for a high return on capital employed (ROCE). Earnings, however, were rather disappointing.