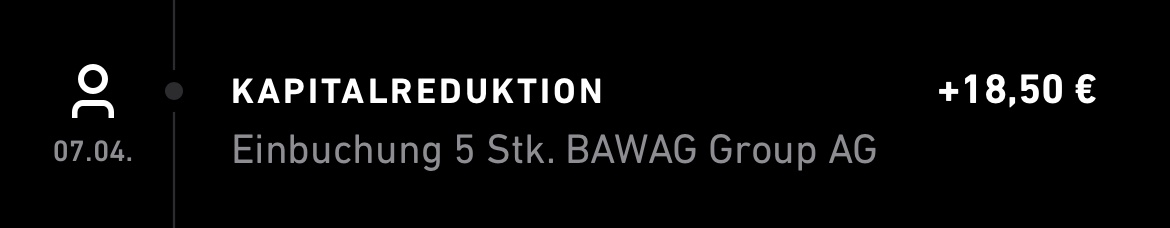

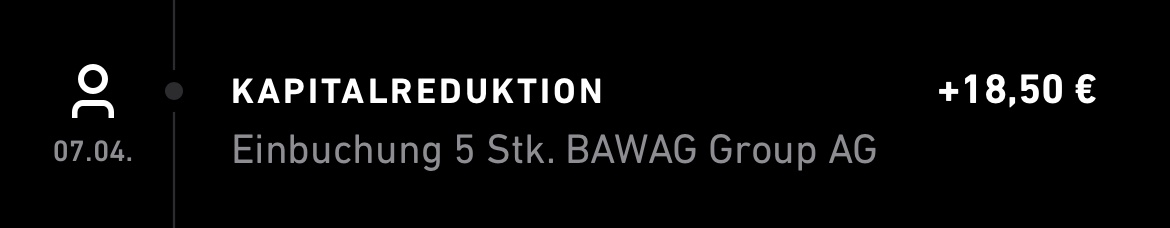

I wanted to know from you why I received a dividend for the share $BG (-1.59%) Dividend have received but according to my calculation no taxes had to pay. I have read that for residents of Austria no taxes are due but I am not 😅.

I wanted to know from you why I received a dividend for the share $BG (-1.59%) Dividend have received but according to my calculation no taxes had to pay. I have read that for residents of Austria no taxes are due but I am not 😅.