Big data and AI: from vision to reality

Inflation, recession, interest rate policy: while many investors may be unsettled by current developments, two megatrends are continuing their unstoppable path - big data and artificial intelligence.

Find out in the following article how these growth areas of digitalization are changing our lives and how you can benefit from the growth of these future markets with targeted thematic ETFs.

___________________________

Big data and artificial intelligence are among the most important megatrends of our time. What sounded like visions of the future just a few years ago is increasingly becoming reality today. A vivid example: a US company recently presented humanoid robots that not only perform simple tasks, but could soon make autonomous decisions in complex environments. What once seemed like science fiction is now becoming tangible and seems to be gaining speed. Although artificial intelligence (AI) is not a new concept, technological advances have noticeably accelerated its development in recent years.

Some people may ask themselves in their own workplace whether the hype surrounding artificial intelligence is really justified. After all, the efficiency gains from a few AI-suggested or language-optimized emails do not provide a quantum leap in everyday working life. But while the changes may still seem subtle in some areas, the true breakthrough of AI is already clearly evident in other sectors. In healthcare in particular, we are seeing how big data and artificial intelligence can revolutionize entire processes. By analyzing huge amounts of data, AI systems can now make precise diagnoses. This not only saves time and money, but can also save lives.

The exponential progress of modern processor chips also plays a decisive role here. Microchips double their performance roughly every two years - a development that makes it possible for AI systems to be so powerful today. A modern graphics card now has more computing power than a supercomputer 20 years ago. These technological leaps form the foundation for many of the groundbreaking applications we see today.

Of course, not everyone is affected by these advances to the same extent. Many may only notice small changes in their everyday lives - such as an optimized working environment or more efficient processes. But investors have the opportunity to participate in these major developments via the stock market, regardless of how much they affect their own everyday lives.

For those who do not want to search for the most promising companies themselves, so-called thematic ETFs offer an easier way to participate in the potential of megatrends. These ETFs bundle companies that focus specifically on promising technologies such as AI and big data. The rise in the global offering of thematic funds shows that these products are enjoying great popularity: while there were only 110 such funds in 2016, the number had increased sixfold to over 650 by 2023.

Xtrackers also offers investors the opportunity to benefit specifically from the megatrends of global digitalization.

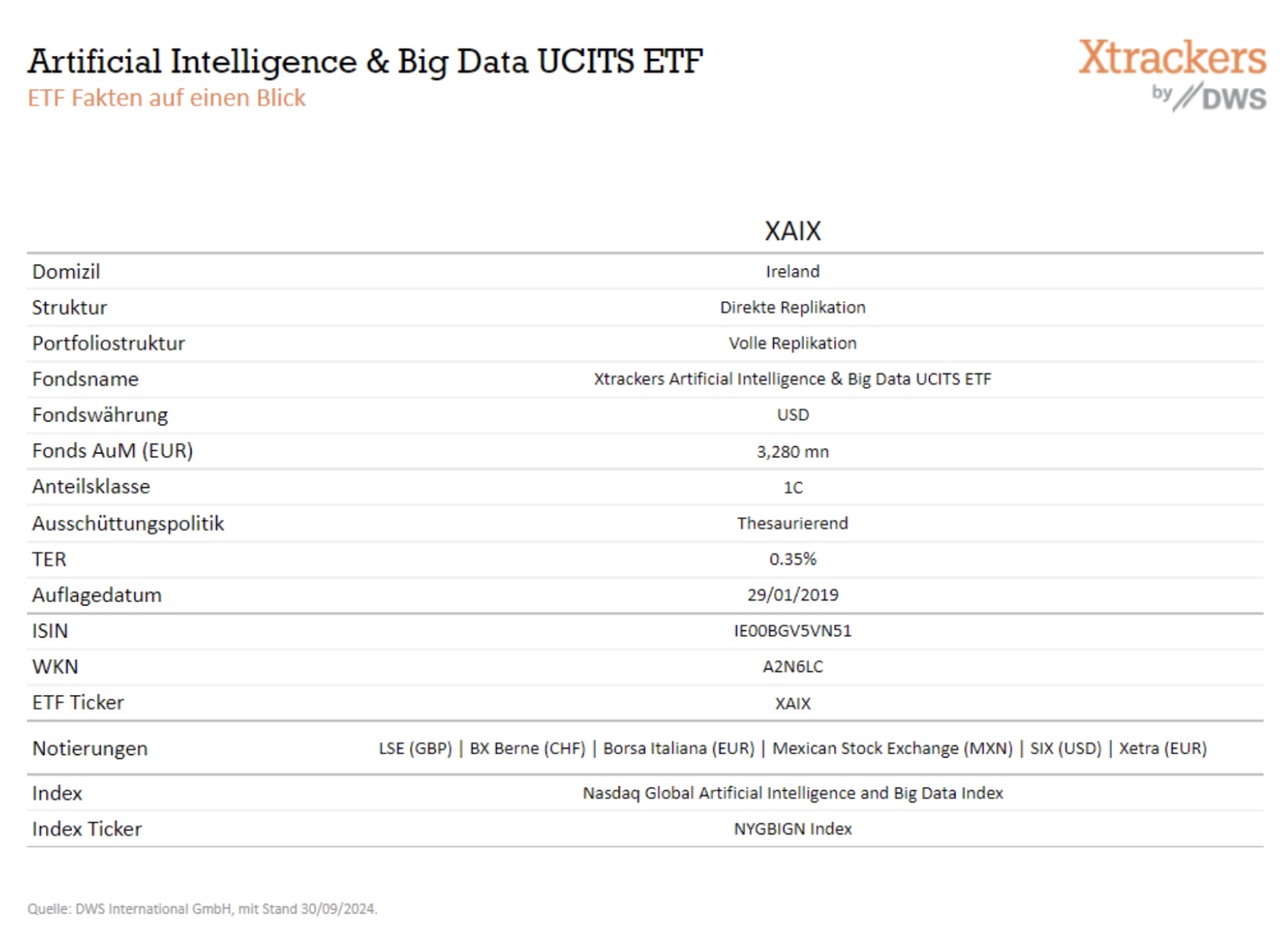

The Xtrackers Artificial Intelligence & Big Data ($XAIX) (+0.11%) already manages a fund volume of almost 3.5 billion euros. Investors can invest in companies that deal with artificial intelligence, big data and cybersecurity - from small innovators to global technology giants. Around 83% of the ETF portfolio is invested in the USA, the center of technological innovation (as of November 2024).

For investors who already hold a broadly diversified ETF portfolio but are also looking for targeted exposure to AI and big data, the ETF listed could be considered as an addition to the existing portfolio.

For more information, please visit our website: Xtrackers.de

****************

Product risks:

The funds are not capital protected. The value of your investment may fall as well as rise. Past performance is not a reliable indicator of future performance. The fund has exposure to less economically developed countries (also known as emerging markets), which are associated with greater risks than developed economies. Political unrest and economic downturns are more likely to occur and may affect the value of your investment. The value of an equity investment depends on a number of factors, including market conditions, current economic conditions, industry, geographic region and political events. The Fund focuses on a single or small number of sector(s), industry(ies) or type(s) of company and performance may not reflect the performance of broader markets. The Fund invests in small and mid-capitalization companies. This may entail higher risks compared to investments in larger capitalization companies. The shares may be less liquid and more exposed to price fluctuations (or volatility), which may affect the value of your investment. The fund is subject to currency risk. Currency markets can be very volatile. Sharp price fluctuations can occur on currency markets within very short periods of time and may result in a loss on your investment.

IMPORTANT NOTES

All opinions expressed reflect current views, which are subject to change without notice. Forecasts are based on assumptions, estimates, opinions and hypothetical models or analyses that may prove to be incorrect or inaccurate. Past performance is not a reliable indicator of future performance.

DWS International GmbH, 28.10.2024, CRS: 103353