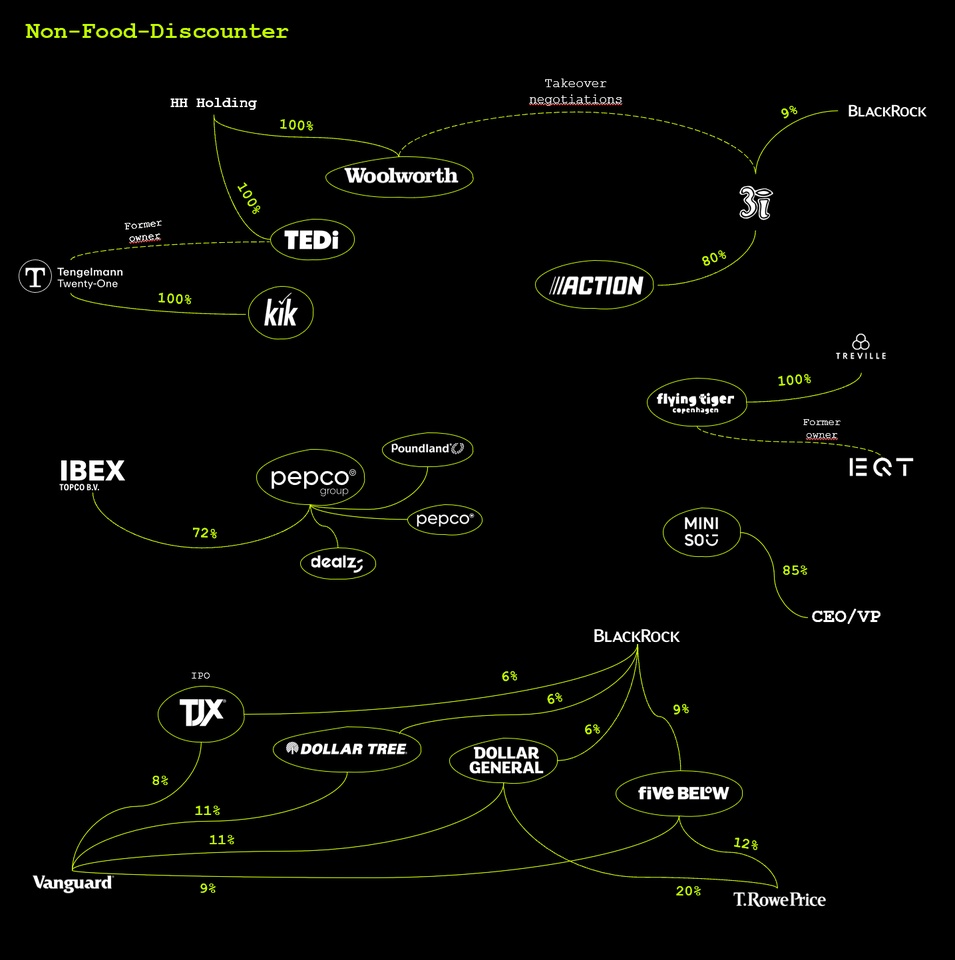

Listed non-food discounters (direct and indirect investment)

🧵 1

Last week, I read that non-food consumer spending at retailers such as Action, Tedi and Woolworth rose from €2.6 billion to €3.2 billion in Germany between the first half of 2022 and 2024. Lidl, Aldi and co. are losing more and more market share in this area.

This was enough to make me take a closer look at the industry.

The chart shows the individual relationships between the companies and any investors.

Let's start with #action let's start with The non-food discounter Action increased its turnover in the first half of 2024 by 20.1 percent year-on-year to 6.2 billion euros. Action now has a total of 2,685 stores in 12 different countries with 17.3 million customers. The company plans to open a further 330 stores this year alone.

Action itself is not listed on the stock exchange, so it is all the more exciting that the private equity company $III (+0%) (3i Group) holds around 80% of Action. Of course, 3i also holds stakes in other companies, but the Action stake accounts for around 72%. Action is therefore 3i's most important investment. The share price has also risen by 70% in the 1-year performance. 🚀

Interesting fact: The owner holding of Woolworth (by the way, they also own Tedi) is currently pushing for a sale of #woolworth and the only remaining bidder is the 3i Group. Having Action and Woolworth in one portfolio would be a huge market share!

Blackrock also has a stake of around 9% in the 3i Group itself.