Nevada Lithium Resources - $NVLH (-0.29%)

Securing America's Clean Energy Future

The Second Lithium Energy Revolution Starts Now!

Nevada Lithium Resources Inc. is a Canadian-based mineral exploration and development company. The company is engaged in the acquisition, exploration, evaluation and development of mineral properties. It is focused on the exploration and development of the Bonnie Claire project in the Sarcobatus Flat, Nye County, Nevada. It covers an area of approximately 18,300 acres. The project is located approximately 125 miles northwest of Las Vegas, Nevada. The Bonnie Claire project is prospective for sedimentary lithium and lithium brines. Nevada Lithium Corp is a wholly owned subsidiary of the Company.

Apparent tagline from the company: Nevada Lithium Resources believes in the future of lithium. In the 1990s, the world turned to clean energy lithium batteries. These batteries now consume over 70% of the world's lithium production. Electric vehicle sales are on the rise. EV batteries consume even more lithium, so lithium demand is growing rapidly.

EV automakers around the world are looking for a secure and stable supply of lithium for their batteries. Lithium from the U.S., such as the Bonnie Claire project in Nevada, could be an ideal source for U.S. electric vehicle manufacturers such as Tesla, GM and Ford. Nevada Lithium Resources owns 50% of the Bonnie Claire project. Iconic Minerals owns the other 50% of the Bonnie Claire project.

About the Bonnie Claire Project

Powermag.com wrote in November 2020 that the U.S. currently produces 2% of its required lithium. If demand increases, a domestic source will be successful.

The project covers 18,300 acres of land and 18,372 million Kg of lithium carbonate equivalent

Extraction method -> Drilling, Mass to be extracted 3,407.3 tons

Lithium Industry (General)

Electric vehicles (EV) are here. The production of lithium for the batteries they use is one of the world's newest and most important industries. China currently dominates the market. The rest of the world, including the U.S., is now responding to secure its lithium supply.

The Bonnie Claire project in Nevada is well positioned to take advantage of preferential treatment from the U.S. government. Importantly, Canadian companies like Nevada Lithium Resources are the only non-U.S. entities that qualify as domestic U.S. sources of lithium.

43% Jump in electric vehicle (EV) sales in 2020 despite global pandemic

274% Projected global electric vehicle production growth from 2020 to 2024

$1.5B value of global EV market by 2025

400% Growth in global lithium production required to meet growing demand.

Next Energy Revolution

Lithium's first energy revolution began in the 1990s.

At that time, lithium-ion (Li-ion) batteries became the focus of consumer electronics worldwide.

Today, lithium batteries power virtually all portable electronic devices. Together, they consume over 70% of the world's lithium production.

- 71% of the world's lithium goes to battery production

- 14% goes to ceramics and glass

- 15% goes to greases, powders and other applications

But the second lithium revolution is already creating far greater demand for lithium around the world.

That's because batteries for electric vehicles (EVs) are much larger and therefore consume much more lithium than all other Li-ion batteries combined.

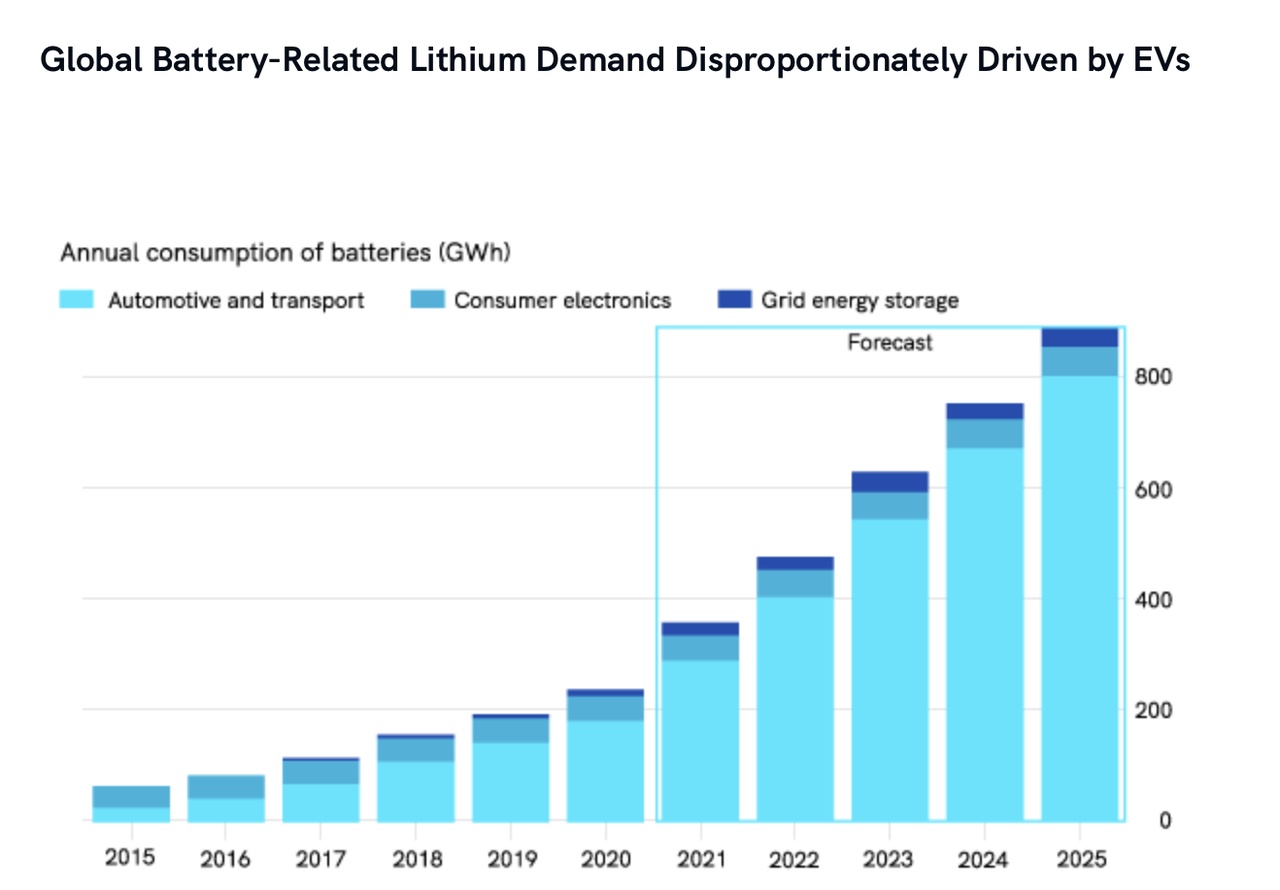

Global battery-related lithium demand is disproportionately driven by electric vehicles (attached image, source: HS Markit)

And the EV revolution has just begun. Annual global production of electric vehicles is forecast to increase 274% by 2024 over 2020 figures, while the market for electric vehicles will reach $1.5 trillion by 2025.

At the forefront of the EV revolution are North American automakers.

Tesla

Sold nearly 500,000 electric vehicles in 2020, more than any other automaker. The all-electric company is now focused on launching a $25,000 electric vehicle to reach its goal of 20 million annual electric vehicle sales.

GM

Announced in early 2021, the company plans to sell only zero-emission cars and trucks by 2035 and invest $27 billion in electric vehicles from 2021 to 2026. To reflect the company's new focus on electric vehicles, it has even changed its logo.

Ford

With plans to spend at least $22 billion on electric vehicles from 2016 to 2025, nearly double its previous commitment.

Meanwhile, all other top automakers have aggressive commitments to expand their EV offerings:

Jaguar, Landrover

The plan is to have the first Land Rover EV on the market as early as 2024, with an electric version of every model it makes available from 2030.

BMW

plans to expand beyond its current EV models, which include the BMW i3, where EVs account for 15% to 25% of sales.

Volkswagen

Plans to spend about $40 billion on EVs over the next 5 years, with a target of 20% to 25% of total EV sales by 2030.

Toyota

Plans to sell more than 5.5 million electric vehicles by 2030.

Nissan

Plans to expand beyond ~500,000 EV sales to date to meet near-term goal of 1 million EV sales by 2022.

Honda

Plans to electrify 66% of global car sales by 2030.

Hyundai

Plans to sell 1 million electric vehicles per year by 2025.

Kia

Plans for EV sales to account for 25% of its global vehicle sales by 2029.

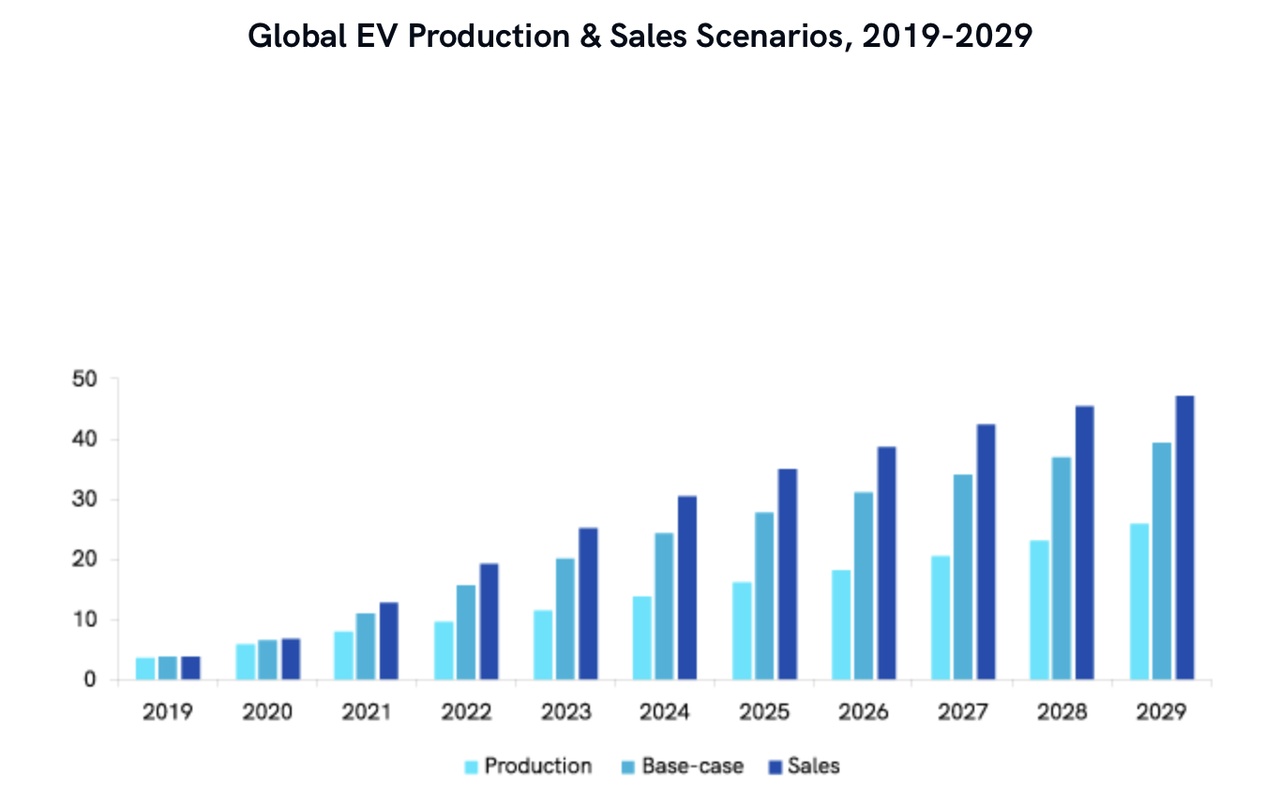

For this reason, Roskill forecasts strong growth in global electric vehicle production and sales in the near term.

Global electric vehicle production and sales scenarios, 2019-2029. (see image source: Roskill)

Requirements

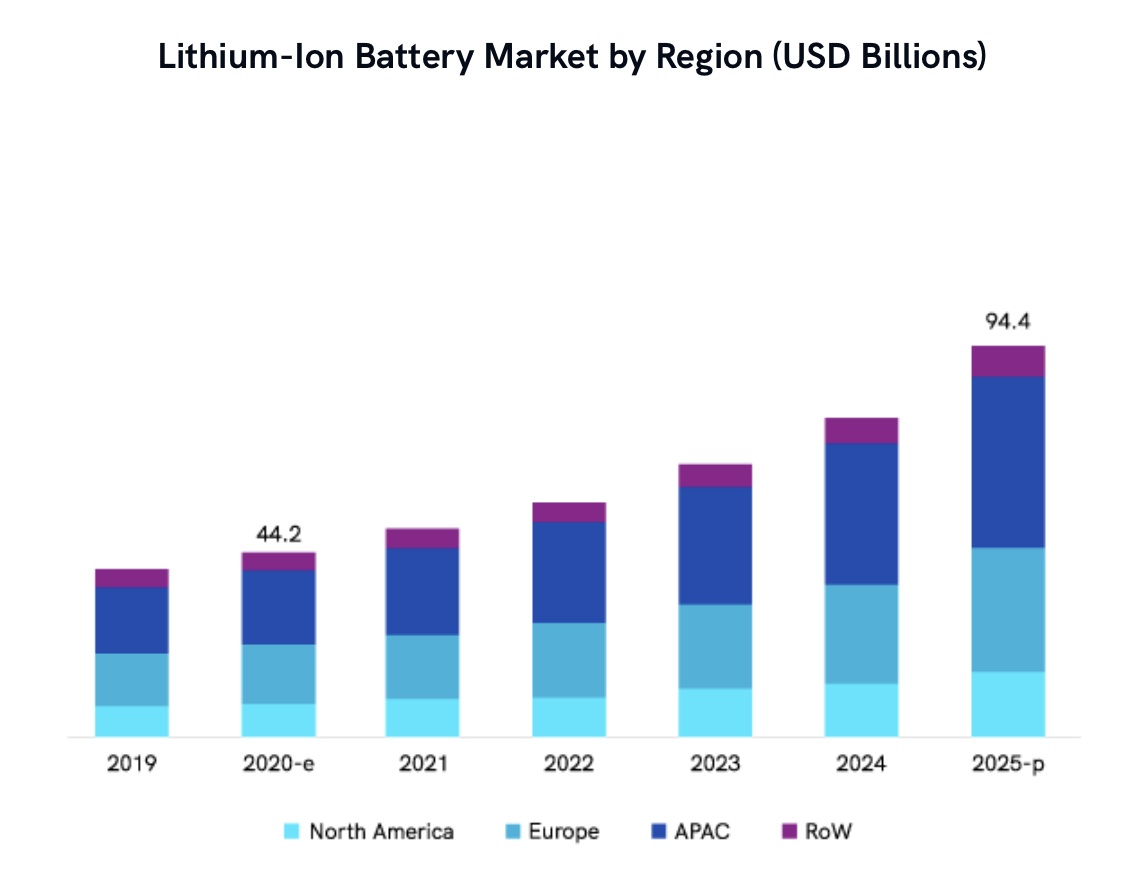

Global lithium-ion battery market size to grow to USD 94.4 billion by 2025, at a CAGR of 16.4%.

Lithium-ion battery market by region (USD billion). (See image, source: MarketsandMarkets analysis).

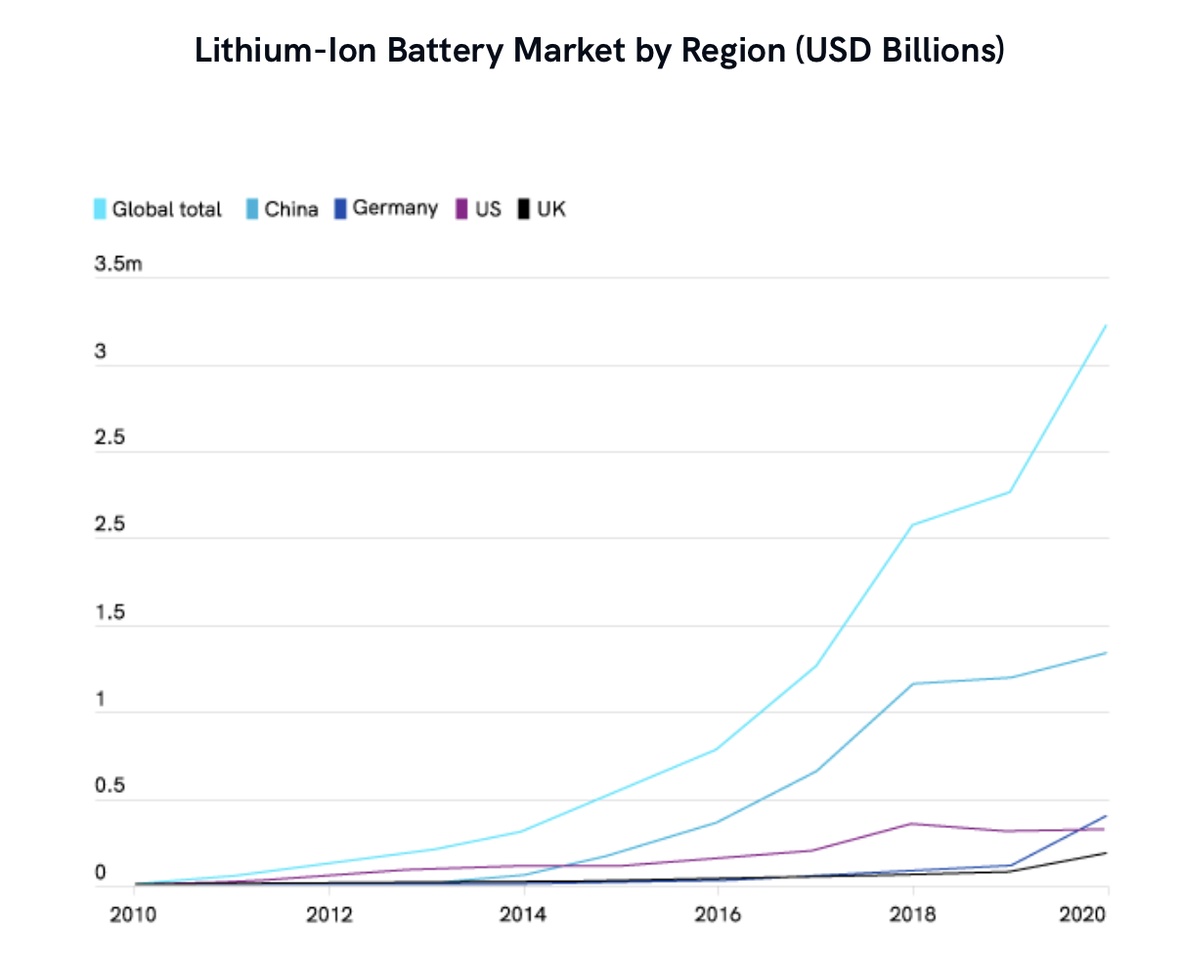

While overall global car sales slumped by 20% in 2020, electric vehicle sales grew by as much as 43%.

This rapid adoption of electric vehicles is being driven by stricter emissions regulations and rising consumer demand, which has led manufacturers to develop new models that enable longer ranges.

Lithium-ion battery market by region (USD billion). (See image, source: www.ev-volumes.com)

World leaders are also driving increased adoption of electric vehicles, with promises of a "green recovery" from the pandemic.

Countries in major economies are planning to end sales of fossil-fuel vehicles within very short deadlines, including the United Kingdom, which is bringing forward its ban from 2040 to 2030:

- By 2030: UK, Germany, Israel, India

- By 2035: Netherlands, Norway, Sweden

- By 2040: France, Ireland

North American "colonels" are also getting in on the EV revolution:

U.S. President Biden plans to build 500,000 electric charging points across the country and introduce a $7500 tax credit for electric vehicle purchases.Canadian Prime Minister Trudeau announced a CAD 590 million investment in a single Ford plant for electric vehicle manufacturing in the fourth quarter of 2020.

With continued increases in electric vehicle manufacturing and sales, Roskill's Lithium Outlook points to strong growth in lithium demand of 18% per year through 2030

To meet this demand, $50 billion will need to be invested in lithium over the next 15 years, according to energy consultancy Wood Mackenzie.

Supplies

As global demand for electric vehicles grows, North American automakers are looking to regionalize their supply chain for greater safety and sustainability.

Fortunately, the U.S. represents one of the largest lithium resources in the world and tremendous potential to provide massive lithium supplies that are domestic and safe.

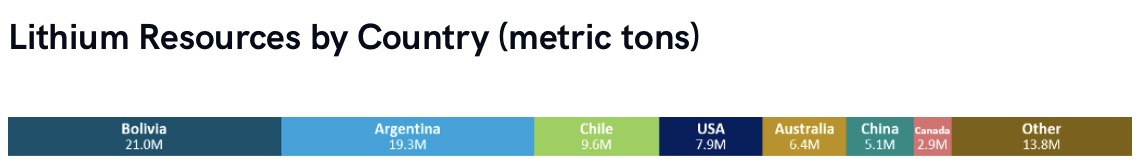

Lithium resources by country (metric tons).

Bolivia 21.0M

Argentina 19.3M

Chile 9.6M

USA 7.9M

Australia 6.4M

China 5.1M

Canada 2.9M

Others 13.8M

(Image attached again, source: USGS Mineral Commodities Summary, 2021)

The domestic industry is actively working to bring America's abundant lithium resources to an ever-growing market. Nevada continues to lead this progress, including:

Albemarle

Announcing plans in the first quarter of 2021 to invest $30 million to $50 million to double the capacity of its Silver Peak mine in Nevada, the only lithium-producing mine in the United States.

Lithium America

Its Thacker Pass lithium mine in Nevada hosts one of America's largest known lithium resources and is expected to have a mine life of 46 years, with production expected to begin in late 2022.

Tesla

Secured rights to approximately 8500 acres in Nevada, home of the Gigafactory lithium battery production complex, where the company intends to produce lithium from clay deposits.

Bonnie Claire hosts significant lithium potential from lithium-bearing sediments and is one of the largest lithium deposits in North America. In addition, large portions of the project remain to be explored, including lithium brine targets.

The sediment-based Bonnie Claire mineralization is a potential key advantage over other Nevada projects because it is not tied to the clay that hosts much of the lithium in the state, which can be more difficult and costly to process.

I am currently invested and am convinced Nevada Lithium will go to the Moon faster than Greencoat. 😅 Nevertheless, I enjoy my view from my office in the wind turbine over the North Sea 😉

#unternehmen

#aktie

#pennystocks

#ukw

Sources:

www.institut-seltene-erden.de / Roskill

www.usgs.gov / mineral-commodity-summaries

www.researchandmarkets.com / MarketsandMarkets analysis