👁️ Carl Zeiss Meditec AG: The share that catches the eye 🔍 Part 1:https://getqu.in/oDGSmr/

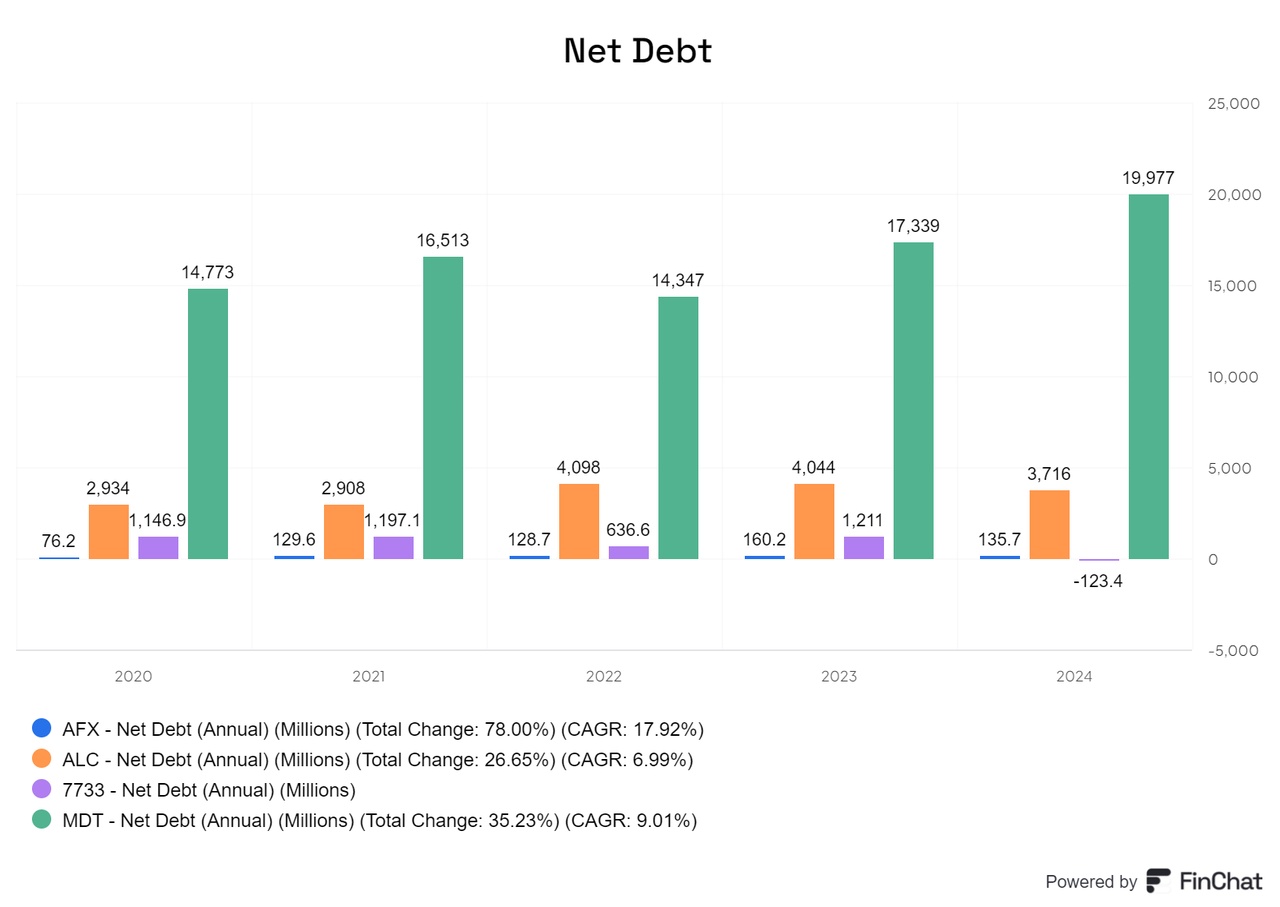

If we look at the net debt, we see that Olympus actually has negative net debt. In contrast, the net debt of Carl Zeiss Meditec AG is declining compared to the previous year.

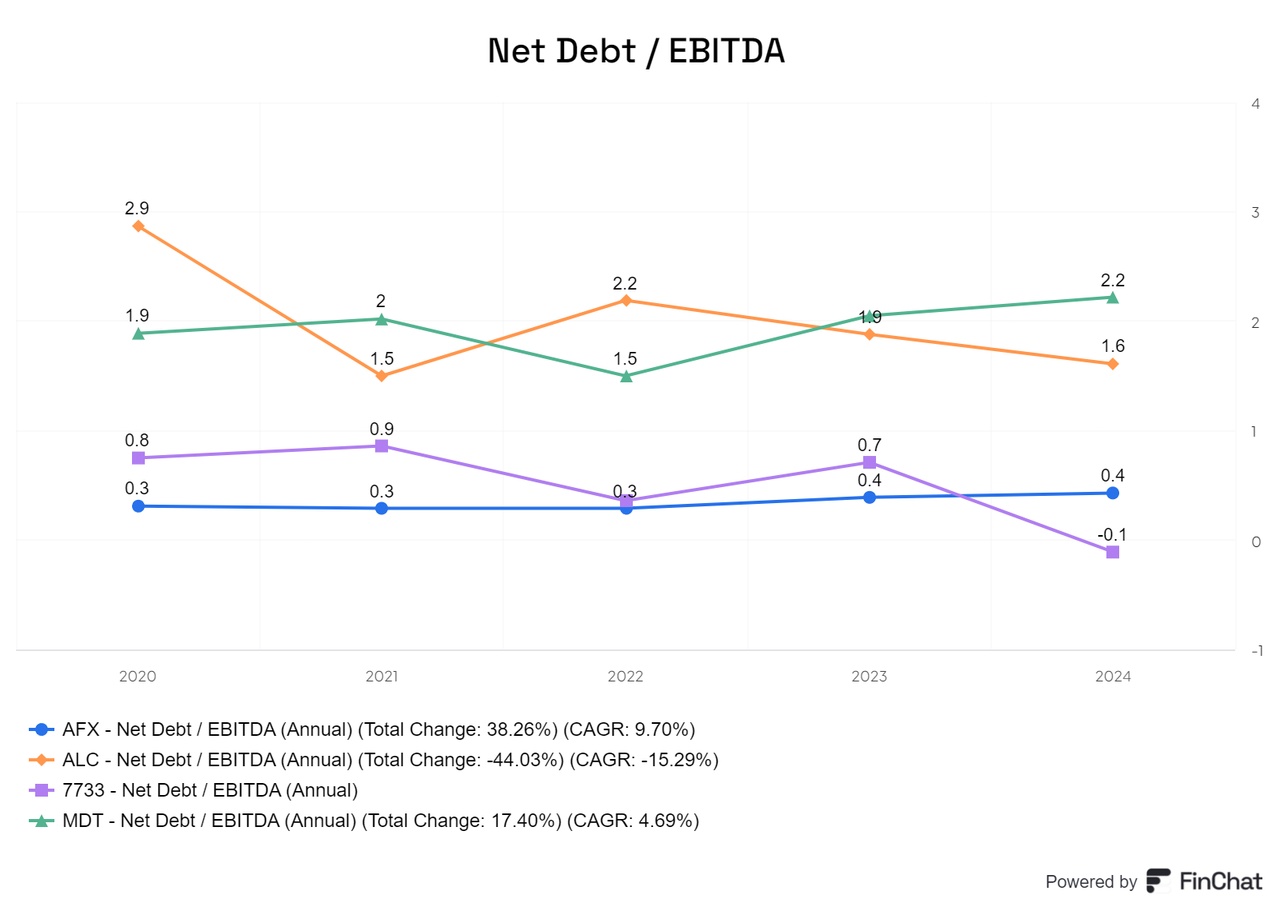

In the ratio of net debt to EBITDA, Carl Zeiss Meditec AG performs very well, while Olympus even has negative debt. However, all companies are below the value of 3.

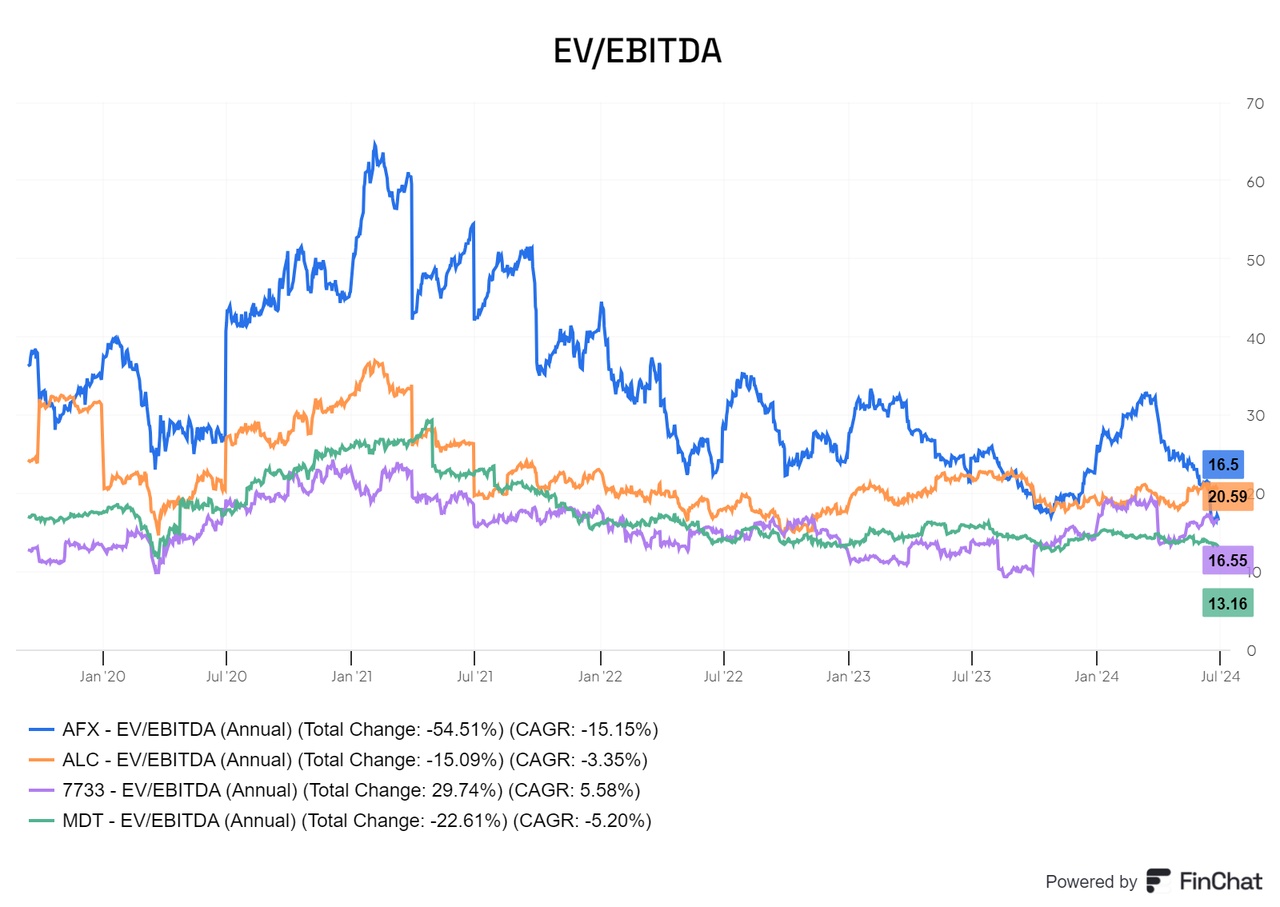

In the ratio of EV to EBITDA, Carl Zeiss Meditec AG is in the middle, while Medtronic is actually the most favorable company. However, one should always be careful with companies with further growth potential, as a low valuation does not necessarily provide a complete picture of future development.

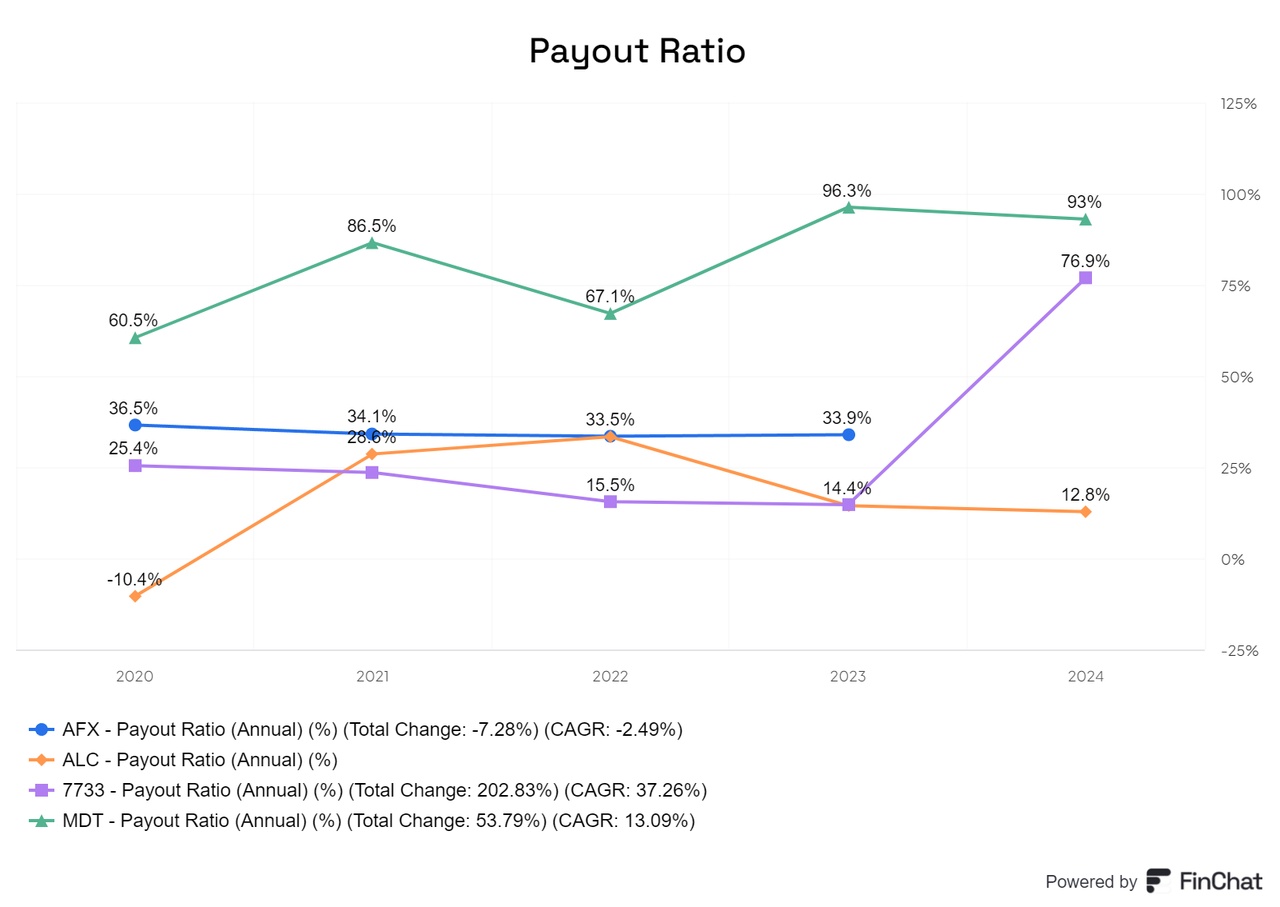

The dividend payout ratio $AFX (+0.38%) is kept relatively constant and is fortunately below 50%, which can be seen as positive. The values of the other companies are either very low, which is acceptable, or clearly too high.

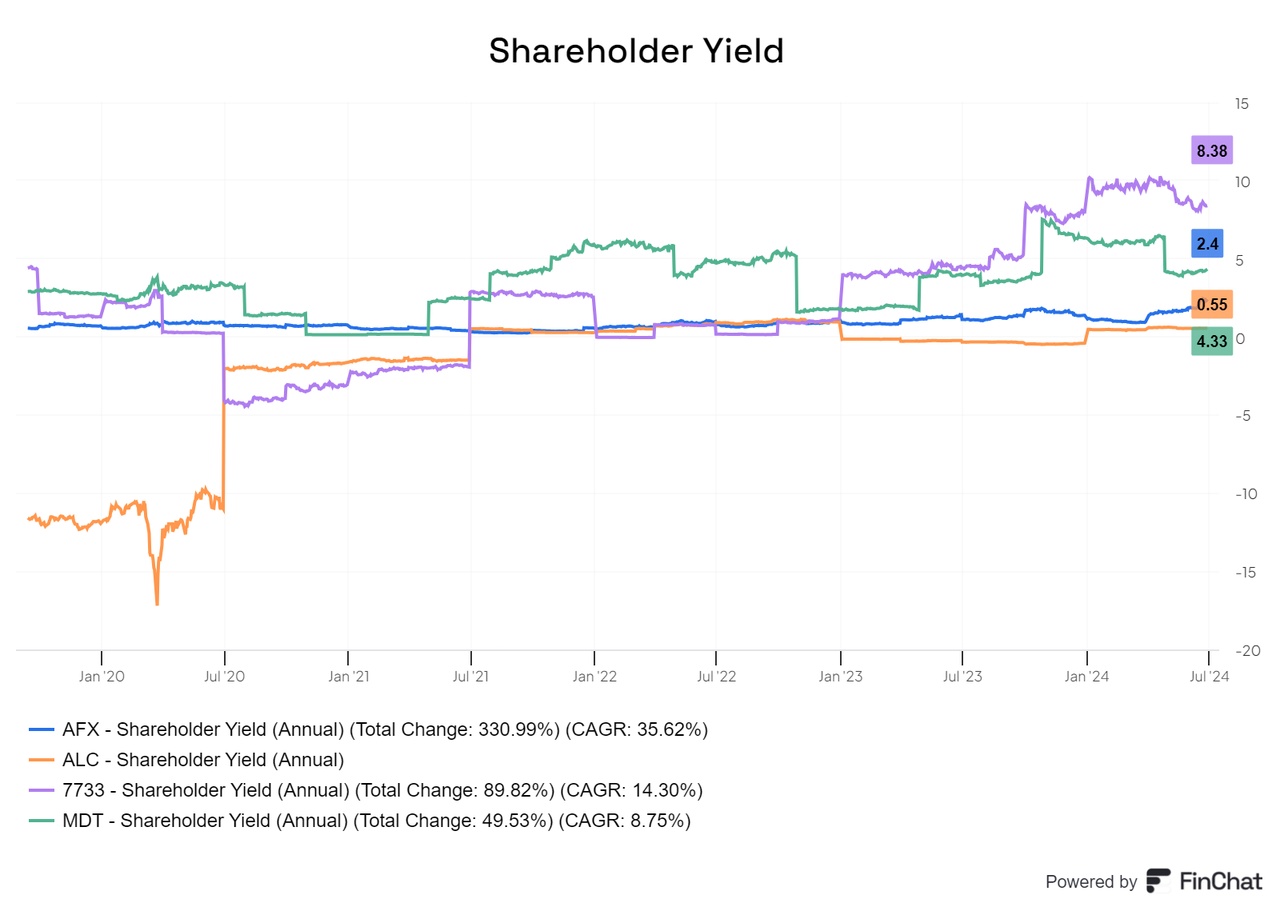

The current shareholder yield of Carl Zeiss Meditec AG is 2.4%. Compared to the other companies, this value is rather average.

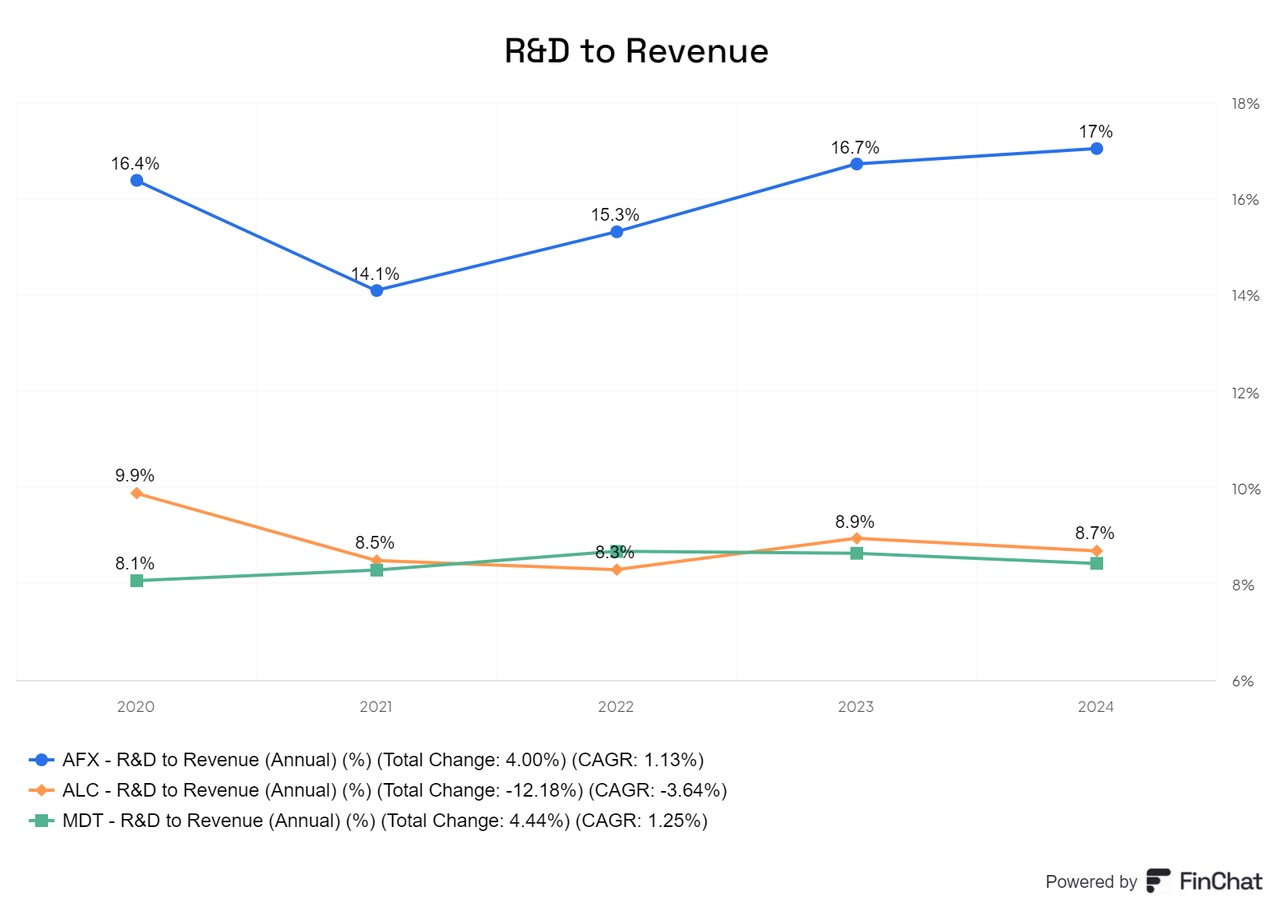

The ratio of research and development (R&D) to sales at Carl Zeiss Meditec AG is relatively high compared to the other companies. This is due to the fact that the other companies are significantly larger and, despite the relatively smaller figures, the absolute R&D expenditure is also higher. Despite these differences, and particularly in view of the challenges in China, this high ratio should be viewed positively. A company that continuously invests in research and development shows a clear focus on innovation and improvement.

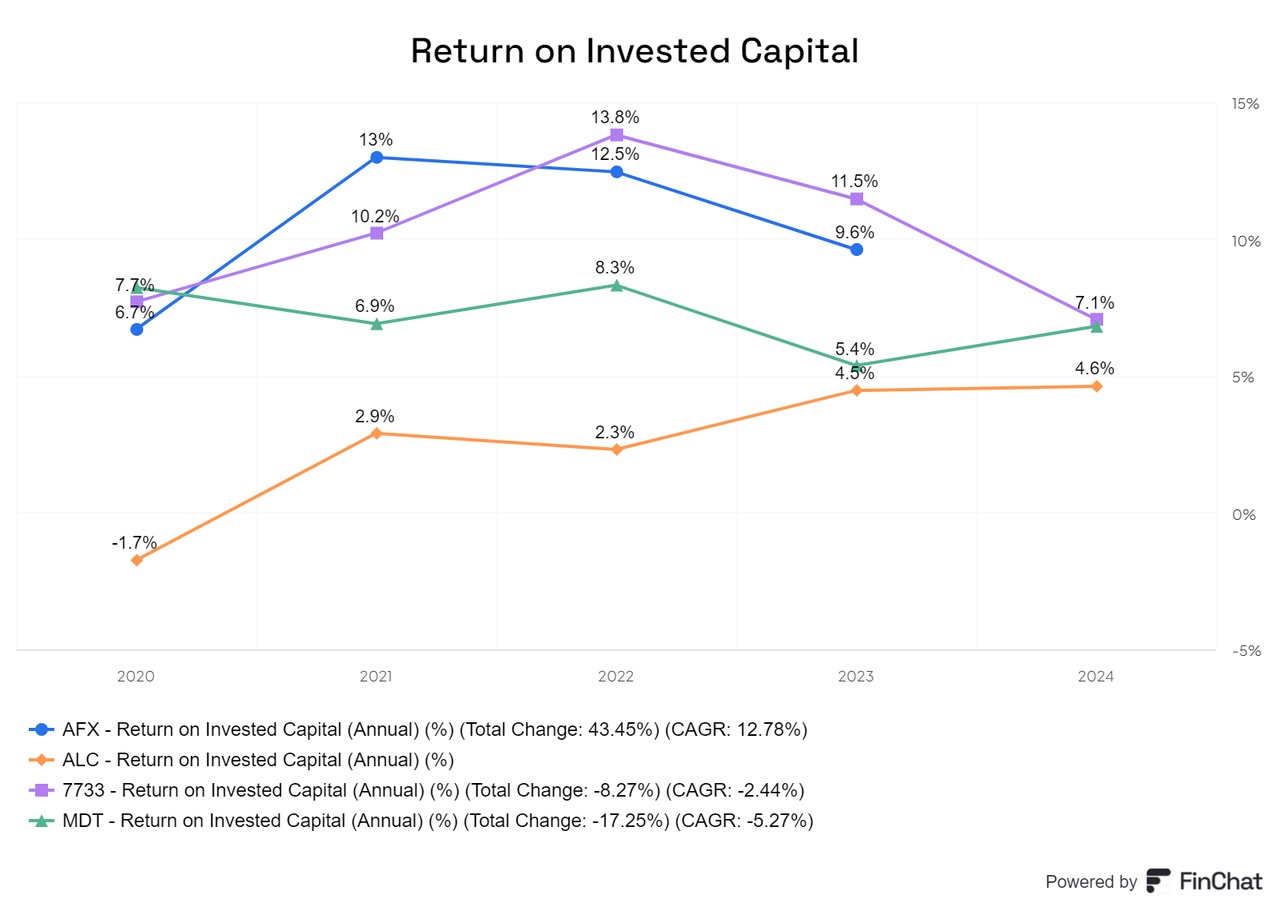

Carl Zeiss Meditec AG's ROIC is slightly higher than that of its competitors. However, it is essential that this ratio is above 10% in order to remain competitive and ensure solid profitability.

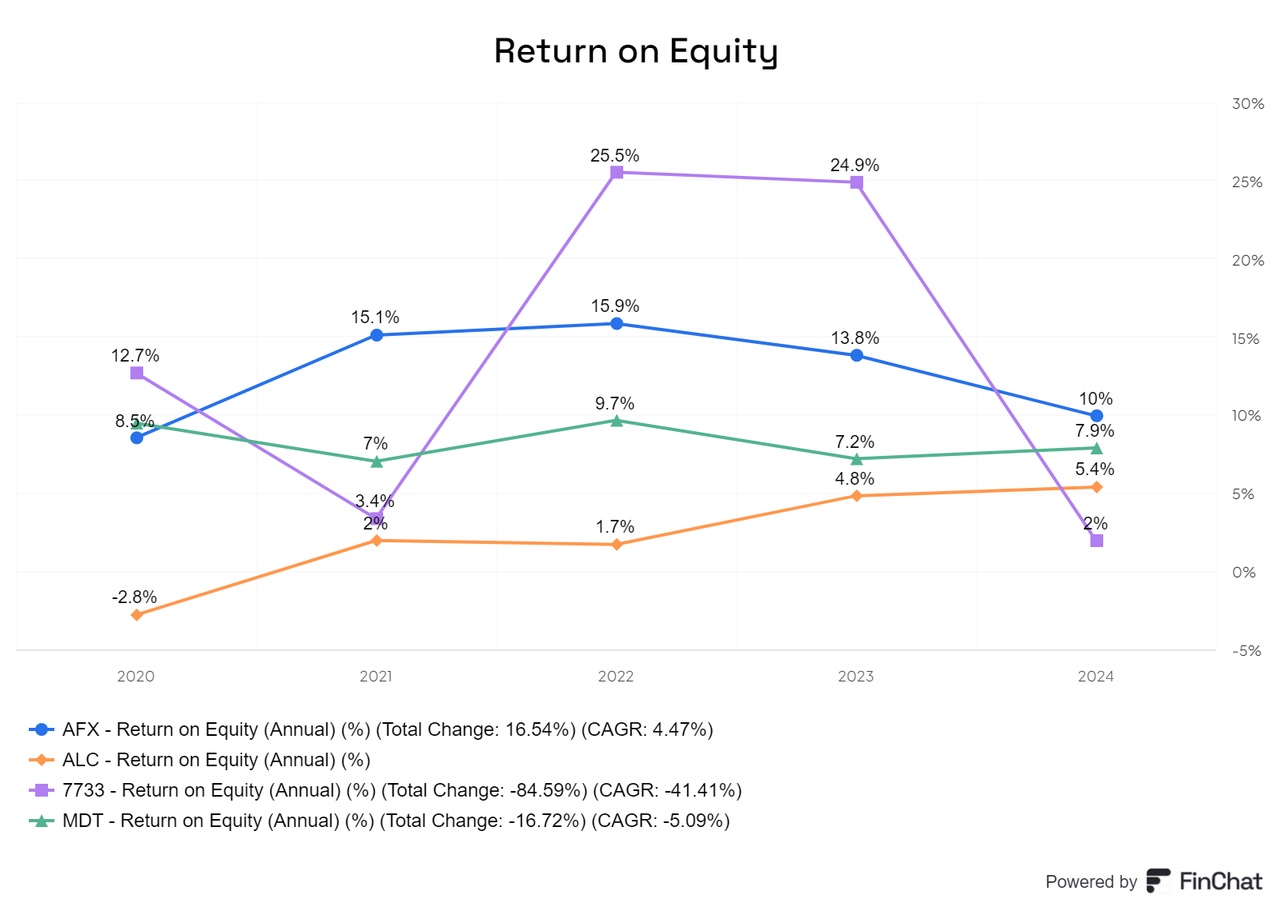

Carl Zeiss Meditec AG's ROE is the best among the companies compared.

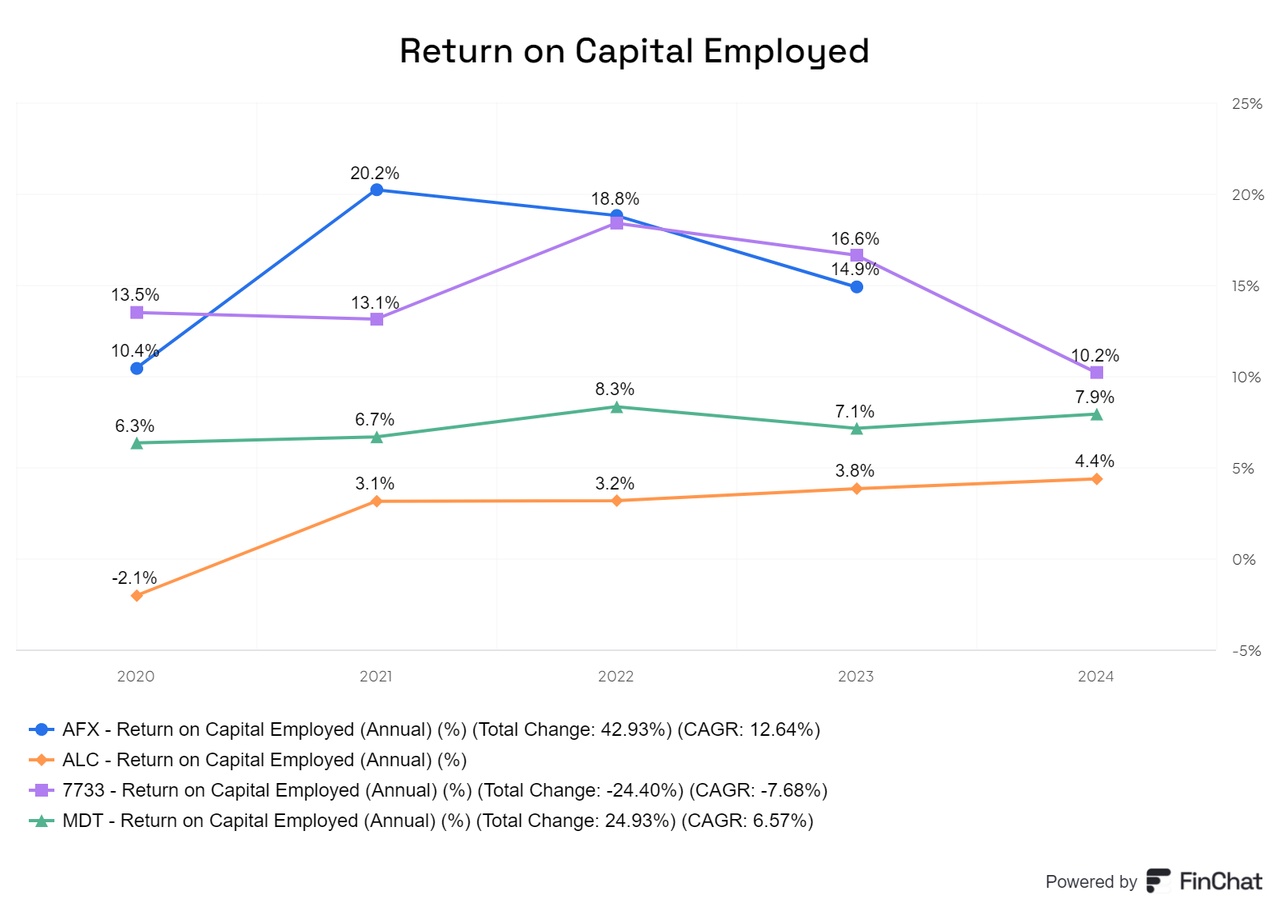

Carl Zeiss Meditec AG's ROCE, although declining, remains the best compared to its peers.

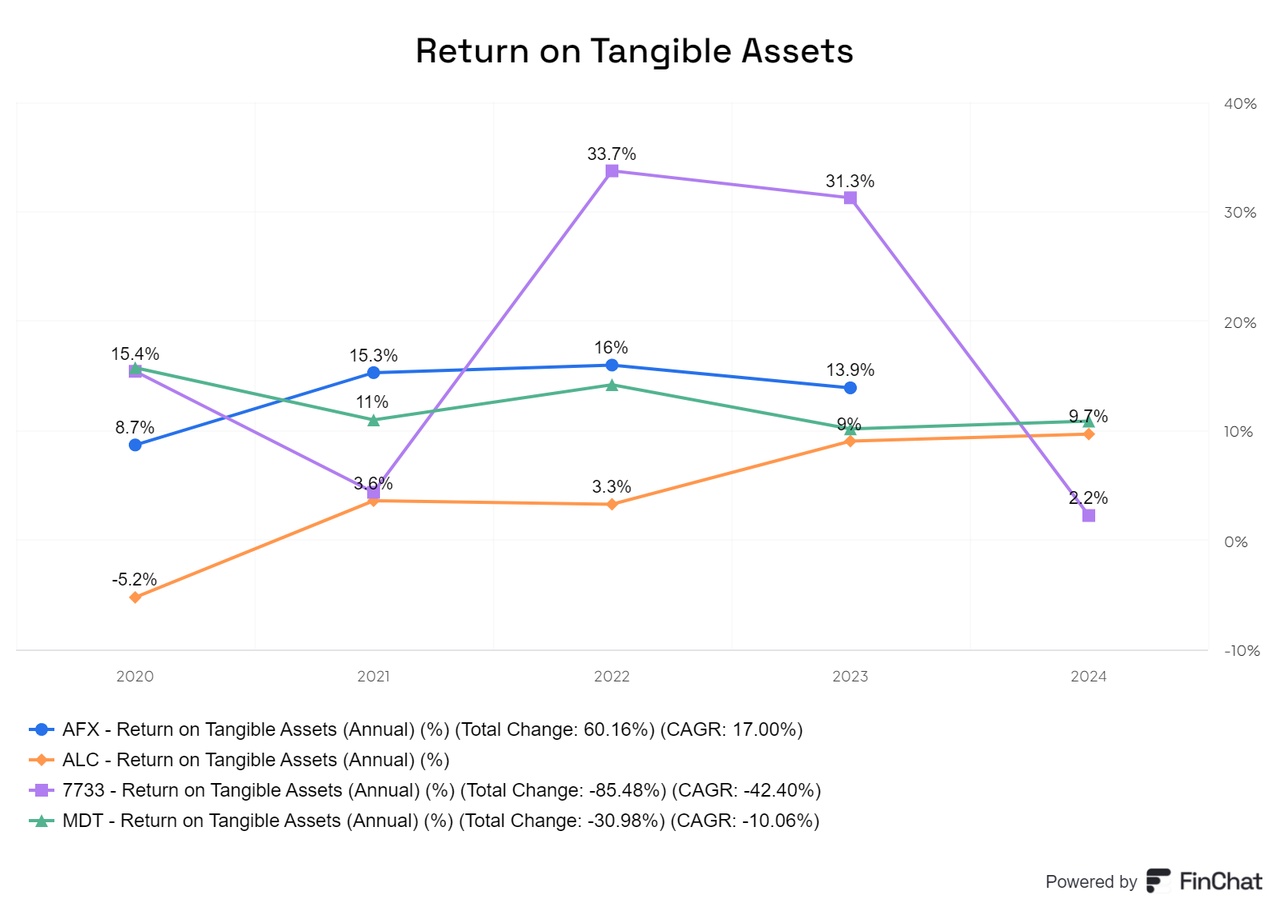

The same applies to ROTA: Even if it is declining, Carl Zeiss Meditec AG remains the leader here compared to its competitors.

Conclusion

Although the share price and performance of Carl Zeiss Meditec AG leave much to be desired, this is not necessarily due to the company itself. Carl Zeiss Meditec AG is the market leader in ophthalmology and a strong competitor in the field of microsurgery. It is a top company that may currently be cheaper than it was a few months ago.

The low sales performance in the USA is regrettable and is mainly due to the management. The risk in Asia, especially in China, is also very high. The fact that the company is based in Germany does not help much. Nevertheless, with Carl Zeiss Meditec AG you get an excellent company that is supported by the Carl Zeiss Foundation - unfortunately, the other Carl Zeiss divisions of the same name that are supported by the Carl Zeiss Foundation are not listed on the stock exchange. Therefore, investors can only invest in Carl Zeiss Meditec AG and not directly in the other divisions of the Carl Zeiss Group.

The close connection to the Carl Zeiss brand brings a high level of recognition, particularly in Germany, and in special cases this can also lead to more favorable capital conditions. Overall, Carl Zeiss Meditec AG is following the trends in robotics and geriatric medicine and is well positioned to continue its success in the future.

Carl Zeiss Meditec AG may not be a must-buy for every investor, but it is definitely a must-have for German investors. Even if you can grumble about some of the figures, the company offers a valuable investment approach due to its strong market position and solid future prospects.