Good day getquin community,

today I would like to introduce you to the company $RMS (+0.35%) Hermès. I will not only talk about the company Hermès, but also about the market environment and the competition. I will try to make the whole thing as structured as possible and as understandable as possible. Feel free to post your questions, suggestions and ideas for improvement in the comments. I can't guarantee for the correctness, so if there are any mistakes please note them as well. The analysis is about 1500 words long and according to an online tool it supposedly takes 15 to 20 minutes to read this text, so feel free to get a coffee before you start reading ☕.

The slightly longer and more detailed version is available here https://www.einzelaktien.com/blog/hermes-international-aktienanalyse

Table of contents

- General

- Taxes

- Categorization according to Peter Lynch

- The most important key figures

- Rule of 40

- Sharpe ratio

- Correlation

- Max Drawdown (maximum loss)

- View on the past

- Openness and honesty of the company

- Animal welfare

- Well-being of employees

- Locations

- Market environment

- Moat

- Conclusion

General

Hermès International was founded in Paris in 1837 and quickly specialized in high-quality leather goods. In the meantime, their product range mainly consists of Luxury fashion items. The product ranges are leather goods, silk and cashmere scarves, ties, perfume, shoes, gloves, hats, blankets, pillows, bracelets/bracelets and also interior design and stationery.

Taxes

Since Hermès is located in France, withholding tax is applicable. Unfortunately, this withholding tax is somewhat opaque. In 2021, the statutory withholding tax deduction on French dividend payments was probably 26.5% (as high as 28% in 2020). However, under certain conditions, people who do not reside in France have a reduced tax ratewhich reduces this to 12,8% can be reduced. For this, however, one must submit the form 5000-DE or form 5001-DE. According to my research at DKB, this advance exemption costs around 12€ for 3 years. It is best to do your own research on this, as I cannot guarantee the accuracy. I pack you here times two links to the topic in addition.

https://aktiengram.de/quellensteuer-frankreich-reduzieren/

Categorization according to Peter Lynch

In order to compare different companies in the best possible way, it is advantageous to categorize them. Although Hermès International already pays a dividend and therefore has more the typical characteristics of a steadily growing stock, I still include it in the category of high-growth stocks, even though such companies typically do not yet pay a dividend, but rather focus on growth. Why I see it as a high-growth company will become clear in the next step.

The most important key figures

P/E RATIO 2021: 66,35

P/E RATIO 2022: 46,09

Dividend yield 2021: 0,52%

Dividend yield 2022: 0,90%

CAGR December 31, 2011 to February 28, 2023: 18,43%

Employees: 19700

Source: https://www.finanzen.net/aktien/herm%C3%A8s-aktie

In the year the dividend per share was €4.55. In 2021, it will already be €8.

Sales:

Hermès sales have steadily increased from 2004 to 2021 with a slight decrease in 2020 but an even greater increase in 2021, making Hermès the fourth largest French fashion brand in 2021.

Operating profit:

Operating profit more than doubled from 2016 (1.696 billion) to 2021 (3.530 billion).

Rule of 40

The Rule of 40 is a key performance indicator, or benchmark, that is used for high-growth companies used (here again shows why the categorization is important) and is intended to give an indication of whether a company is doing well or not. IMPORTANT. It is only an indication and not a guarantee of success or growth.

Here I link times the contribution of @TheAccountant89

https://app.getquin.com/activity/laOUVhfFDI?lang=de&utm_source=sharing

The Rule of 40 = Sales Growth + Free Cash Flow Margin

29.17% + 25.78% = 54.95%, so as you can see, higher than 40, which is a good sign.

Or

Rule of 40 = Sales growth + EBITDA margin

29.17% + 43.22% = 72.39%, i.e. also above 40 and even significantly so.

Sharpe ratio

The Sharpe ratio indicates the risk-return ratio. In general, a value above 0.5 is considered good. The Sharpe ratio of Hermès has a value of 0.75 from December 31, 2011 to February 28, 2023.

Correlation

Correlation describes a relationship between two or more characteristics, i.e. in this example whether the price of the Hermès share is equal or even opposite to the S&P 500 behaves. A value of 1 would mean that both prices are exactly the same. A value of -1 means that they are opposite and virtually mirrored. The correlation of Hermès against the S&P 500 is 0,54.

Max Drawdown (maximum loss)

The maximum drawdown, i.e. the maximum loss of the Hermès share, amounts to -40,28%. Here everyone must decide for themselves where the personal pain threshold lies and whether one panics at a loss of 40.28% or not.

A look at the past

While looking at the past is no guarantee of success in the future, I think it's still worth a look. If on December 31, 2011. 10000$ in Hermès stock on December 31, 2011, that investment would be worth a whopping 66148$ Value.

Openness and honesty of the company

For me, the openness of the company is a not entirely unimportant factor and also a criterion which Warren Buffett takes into account. Hermés has its own website especially for investors, where all data and key figures are disclosed. Even the compensation of the Executive Chairmains is published regularly. In addition, Hermès deals openly with issues such as the impact on the climate and also pursues strict goals in this area. For example, Hermès aims to switch to 100% renewable energies by 2030. Biodiversity and animal welfare are also addressed. For me, this openness and honesty is a very clear plus point. How openly Hermès deals with mistakes will probably become apparent at some point.

Animal welfare

Since many of the products are made of leather, I think it is important to include this aspect as well. Hermés also deals openly with this issue. As of 2021 95% of the leather used is a by-product of the food industry. 92% of the hides used are sourced in Europe under strict regulations.

Employee well-being

In 2021, 4761 employees were newly hired worldwide, including 587 in France. 44% of employees have been with the company for less than 5 years with the company, which also shows how significant the growth is. 95% of employees work full time and the Staff turnover (total number of redundancies/average group workforce) in 2021 is 1,38%.

In February 2022, the Group paid all Group employees a bonus of 3000€ + various salary increases. 100% of wages were maintained during the lockdown. 13000 employees were eligible for the fifth Free Share Plan in 2019 and each received 24 shares.

Hermès ranked first in the Financial Times Diversity Leader Ranking in the Humpact Grand Prix Emploi France.

Hermès even states on their website how many employees have been injured at work and is very open about the issue.

Locations as of 2021

- Asia 124 stores

- Europe 105 stores

- Americas 57 stores

- Middle East 10 stores

- Australia and Oceania 7 stores

Market environment

In the following, we will now take a look at the market field and go into various key figures and statistics.

In the first step we look at the percentage growth of the market value of various apparel brands from the year 2021 to the year 2022.

A loss in market value was achieved, for example, by the brands Victoria's Secret (-3%) and Zara (-2%) posted losses.

A significant increase in market value in the market value of the following brands:

- Louis Vuitton + 58% $LVMUY (+0%)

- Fila + 34%

- Hermès + 16%

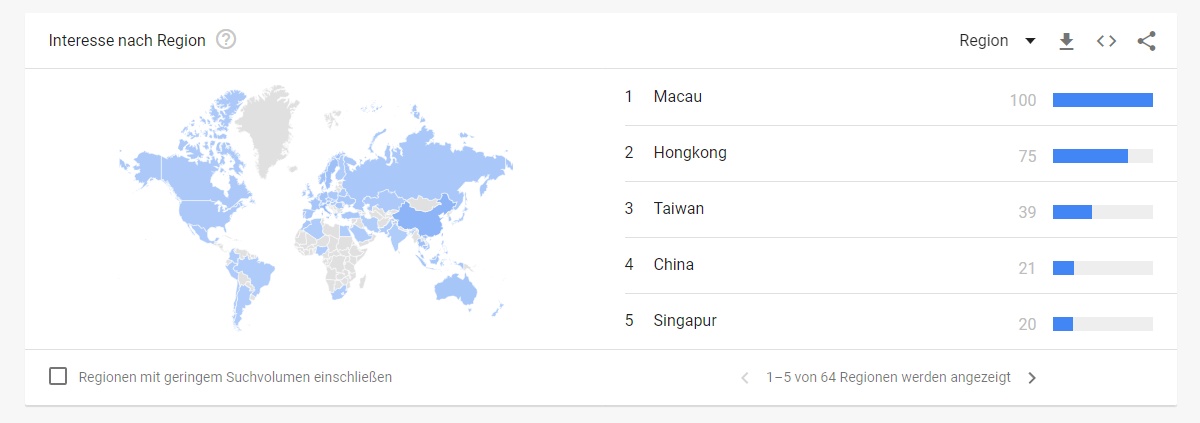

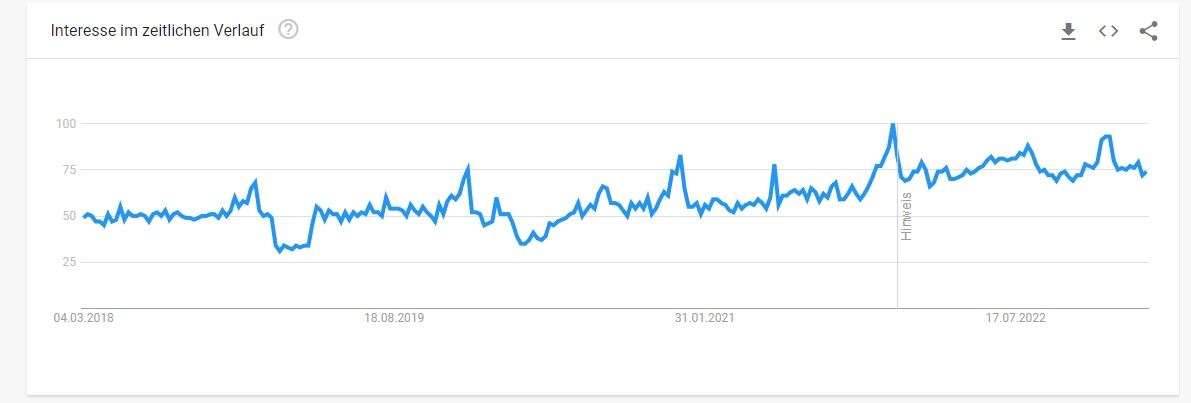

If we now look at the search behavior for Hermés, we can see here a more or less steady increase over the last 5 years. (See pictures). We also see that the greatest interest comes from Asia.

Moat

Last but not least, let's take a look at whether Hermés has a so-called moat, which gives it a decisive advantage over the competition.

Hermès' strategy is relatively simple and consists of three pillars

- Creation

- craftsmanship

- exclusive distribution network

Hermès puts a lot of emphasis on making high-quality, long-lasting products and has been passing on their knowledge for six generations. In doing so, they focus on creative freedom and on their 6000 craftsmen. Each new leather goods workshop is a stand-alone architectural project with around 300 jobs. Vertical integration through partnerships and acquisitions supports the development strategy in terms of materials as well as techniques and know-how . More than 58% of production is integrated and 78% are located in France.

Hermés relies on an exclusive omnichannel distribution networkwhich it says has proved its worth during the pandemic. Each of the individual stores has a personalized selection of products to exceed the specific expectations of customers. In total Hermés is present in 45 countries countries.

Hermés focuses on an exciting concept of entrepreneurial spirit and independence. Every year two podiums are organized where the different collections are presented. The store managers then choose independently from these collections which of the products should be available in their store. From my point of view, this is a very smart move, as the local store manager can best assess his location-specific customers and thus is most likely to know which products are well received and which are not.

Conclusion

I find the concept of Hermés very well thought out. I particularly like the openness and honesty of the group. The figures and the growth also speak for the share. From my point of view, they think in a solution-oriented way and try to move with the times. Whether you want to invest in a company that uses leather is something everyone has to decide for themselves, and whether that could still become a problem for Hermés due to the whole environmental and animal welfare movements is probably written in the stars.

Sources:

https://finance.hermes.com/en/strategy

https://finance.hermes.com/en/climate

https://trends.google.de/trends/explore?date=today%205-y&q=%2Fm%2F0_rbk5p

https://www.finanzen.net/aktien/herm%C3%A8s-aktie

https://www.google.com/finance/quote/HMI:ETR?hl=de

Feel free to check out my blog if you feel like it.

$RMS (+0.35%)

$LVMUY (+0%)

$VSCO (+0.3%) #luxus