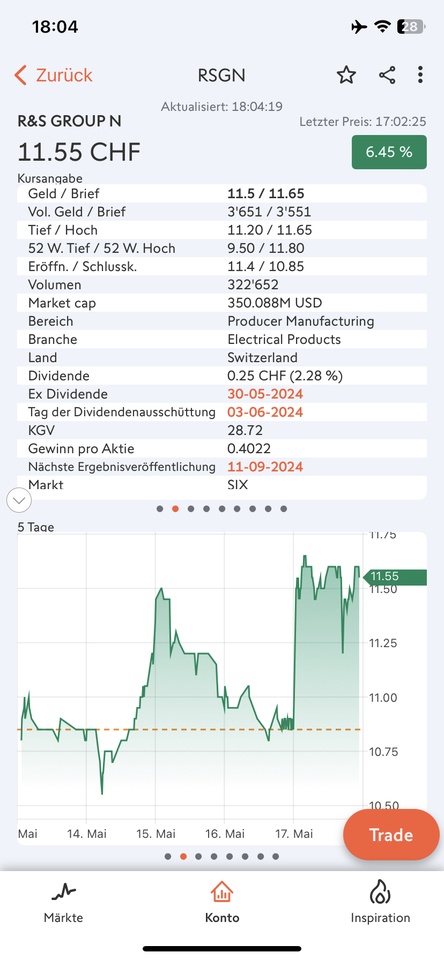

R&S Group (+6.9% to CHF 11.60): Attack on new record high after higher outlook

First of all: I have no idea why the price here is, unfortunately, not up to date.

The R&S Group is optimistic and this has an impact on the share price. At a time when other industrial groups are holding back with their outlooks or even cutting their guidance due to the uncertain global economic situation, the Basel-based transformer manufacturer is simply raising its own forecast. And this is the second time this year - the Group only raised its guidance in January. The annual figures for 2023 then impressed with a strong increase in sales and profit, and now the start to the year has apparently also been more than successful. R&S reports an order backlog of over CHF 200 million at the end of April and a book-to-bill ratio of 1.3, which indicates more than fully utilized capacity. In addition to a higher outlook for 2024, the medium-term targets have also been raised. Analysts are also positive, but the consensus must now be improved, particularly with regard to the new EBIT margin guidance, according to UBS. ZKB also admits that the market slowdown they had expected has not yet materialized. However, investors should bear in mind the overhang of shares on the sell side due to "existing shareholders willing to exit" after the end of the lock-up period in December 2024. But perhaps they are still waiting to see whether the shares will surpass the previous record high of CHF 11.80.

Source: AWP, no liability

Screenshot Swissquote