Komatsu the alternative to Caterpillar?

Company presentation

Komatsu Ltd. is one of the world's leading manufacturers of construction and mining machinery, headquartered in Tokyo, Japan. Founded in 1921, the company has developed into a global corporation and is now active in over 140 countries.

Core business and main products

Komatsu's core business is the production and sale of construction and mining equipment. The broad product portfolio includes

- Hydraulic excavators

- wheel loaders

- bulldozers

- Dump trucks

- forestry machines

- Industrial machines such as grinding machines and press brakes

Komatsu also offers comprehensive financing solutions and aftermarket services.

Mission and vision

Under the guiding principle "Creating value together", Komatsu pursues the goal of shaping a sustainable future in which people, companies and the environment thrive in harmony through technological innovation and advances in manufacturing.

Foundation and early years

Komatsu was founded in 1921 by Meitaro Takeuchi in the city of Komatsu, Japan, with the aim of providing new jobs for the local community after the closure of a nearby copper mine.

Business model & core competencies

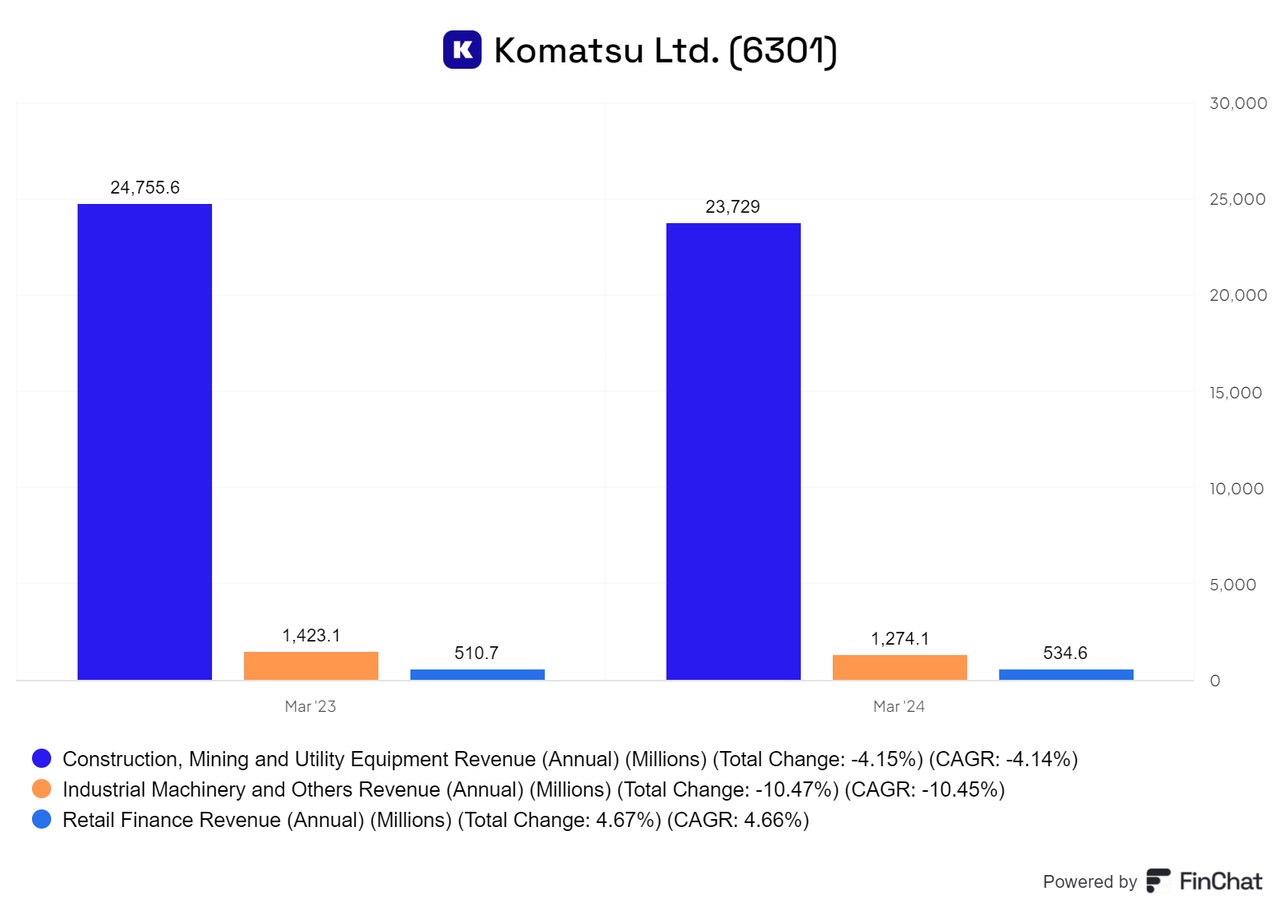

Komatsu relies on a diversified business model with multiple revenue streams:

- Construction and mining equipment

- Industrial machinery and other products

- Financial services

Competitive advantages

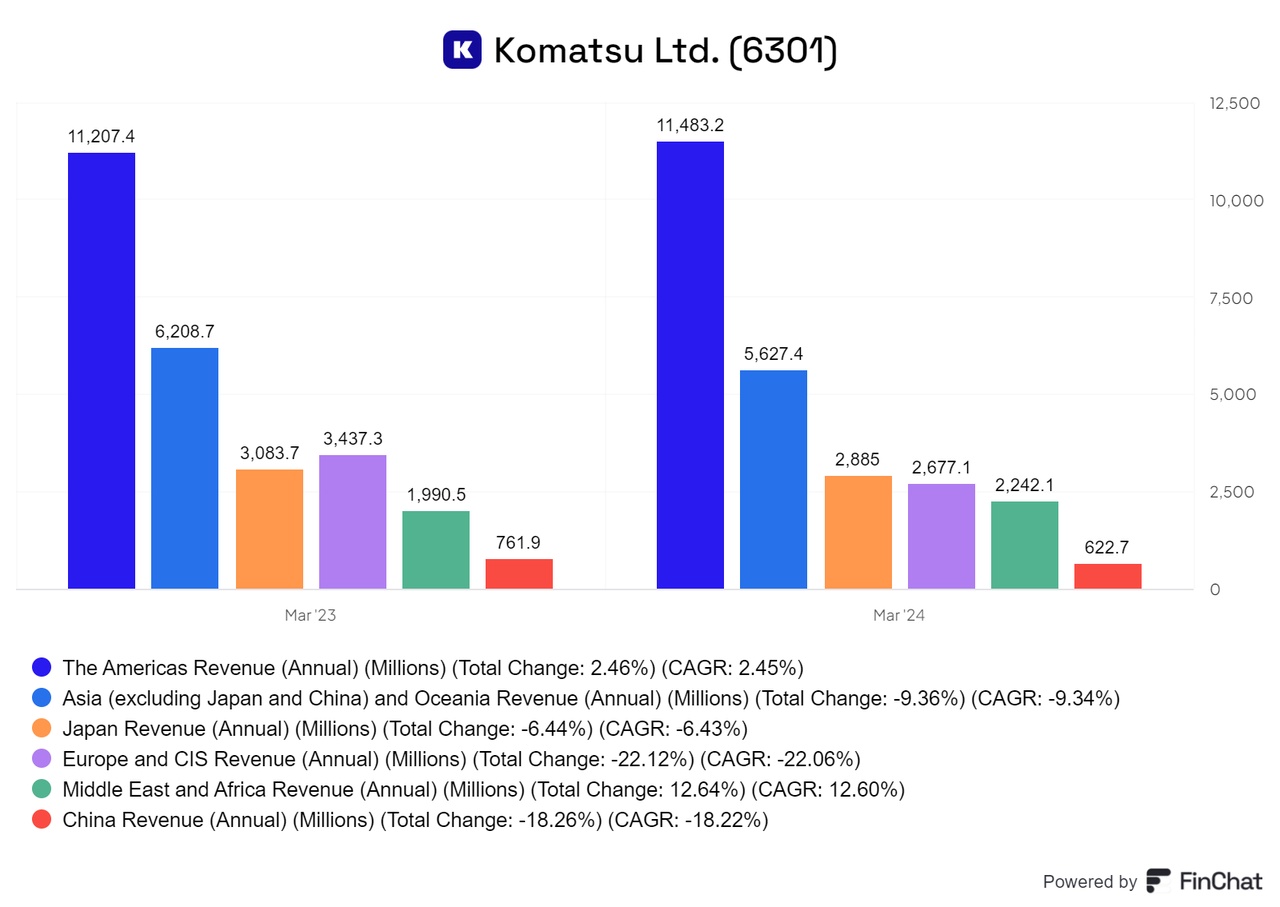

- Global presence and strong market position, particularly in Asia and America

- Comprehensive product portfolio for various industrial sectors

- Focus on innovation, especially in the field of autonomous and electric machines

- Strong production capacities with 25 production sites worldwide

(America is the most important market and twice as large as Asia. The other regions also contribute to sales and are largely equally represented. Most regions are in decline).

Future prospects & strategic initiatives

Komatsu is investing heavily in intelligent construction machinery and autonomous mining trucks. Ambitious development projects include underwater electric bulldozers and lunar excavators.

Market position & competition

As the world's second largest construction machinery manufacturer, Komatsu competes with companies such as:

- $CAT (+0.57%) (USA)

- Volvo Construction Equipment

- $HTCMY Construction Machinery (Japan)

Total Addressable Market (TAM)

The global construction equipment market is estimated at USD 171.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6% between 2024 and 2032, driven by infrastructure investments and urbanization in emerging markets. Komatsu is well positioned to capitalize on this growth, particularly in the key markets of Asia and the Americas.

Share performance

$6301 (+0.36%) Komatsu is listed in the Nikkei 225 Index and has achieved a TR of 91% (13.8% CAGR) over the past 5 years. Caterpillar is at 193% TR and thus clearly outperformed.

For the development (company figures), a better view and more, check out the free blog: https://topicswithhead.beehiiv.com/p/komatsu-die-alternative-zur-caterpillar

Conclusion

We don't need to beat around the bush: Caterpillar was clearly the better stock, made clear decisions and showed a superior performance. This is especially true when calculated in dollars or euros, where Komatsu has made just 20% over 5 years (excluding dividends), but this does not mean that Komatsu is not a good stock. There is a change going on in Japan, including at Komatsu, where companies are rethinking and adjusting their capital allocation. As a result, management is increasingly focusing on share buybacks, dividend increases and improved capital efficiency. This is also indicated by Komatsu's management.

With these measures, the stock can perform significantly better than it has in the past, assuming the company stays the course. Even if the figures are worse overall, they still show an increase, and in some areas capital efficiency is above 10%. The problem in general is, albeit "only" the yen.

Komatsu's EV-to-EBITDA ratio is about half that of Caterpillar, which means Komatsu can catch up here, and by unusual measures. In other words, expectations are lower, which represents an opportunity to exceed them.

In addition to the positive trend in the industry, there are also other interesting topics. The yen is significantly weaker than the US dollar, which is causing some stocks to underperform, but this could change.

If more capital is withdrawn from the balance sheet, this is beneficial for shareholders and puts less pressure on the key figures. It makes you better on a dollar basis. What has happened recently could be beneficial for foreign investors.

The share is cheap, which is justified, but offers plenty of scope for further growth.

So who might be interested in the stock? It could be attractive to those who believe in long-term growth and a solid strategy. Investors who are prepared to tolerate waiting and who are betting on a possible capital allocation and dividend increases will find interesting potential in this share. For those hoping for a stabilization of the yen against the dollar and positive market developments in Japan, Komatsu could also be a choice worth considering. For everyone else, Caterpillar is clearly the better stock.

What does this mean for me? I am actually looking for a cheap alternative to Caterpillar, and Komatsu would be ideal. However, the yen is extremely weak at the moment, which makes it less attractive. That's why I'm holding back for the time being.

An entry would make sense for me if the management has actively shown that it is improving the balance sheet and deploying capital more efficiently. A recovery in the yen/dollar exchange rate would also be crucial.

However, if both factors improve, an entry would be interesting for me. Basically, there is nothing significant wrong with the company itself.