All good things come in threes. November was the second-best November since I started investing. December was also the second best December. And what follows in January? The second-best January for me since August 2013, of course.

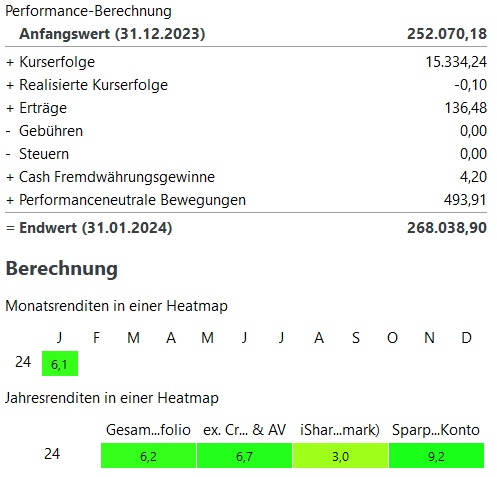

January saw a performance of +6,1%. Only January 2015 was even better with +6.7%.

Compared to my benchmark (MSCI World), this was an extremely good start to 2024. The MSCI World had "only" gained 3% in January.

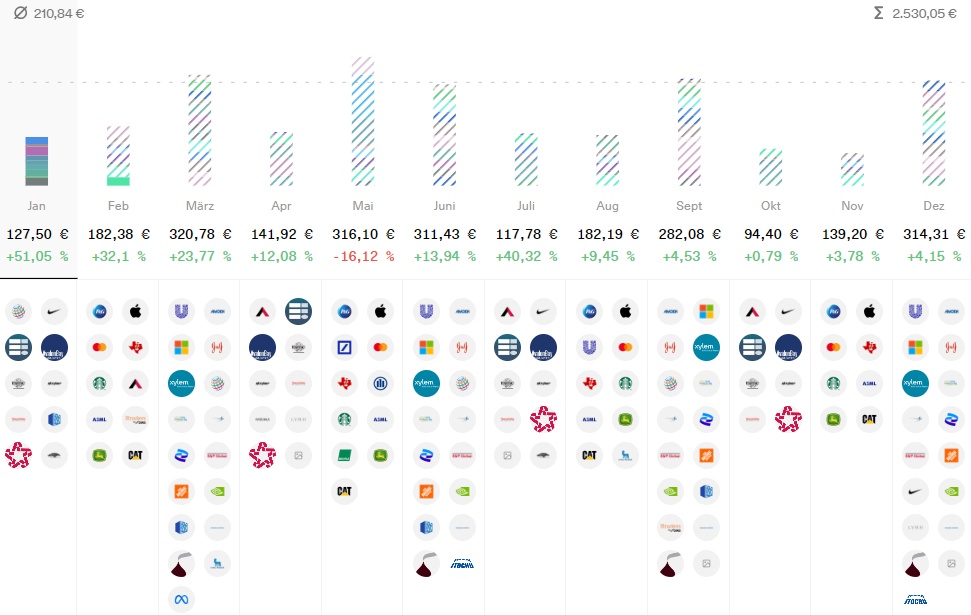

On the winning side were once again the usual suspects in January. The strongest position was once again NVIDIA $NVDA (+2.01%)

with a gain of over €3,000.

The following positions were also occupied by the usual suspects with Palo Alto Networks $PANW (-2.12%) ASML $ASML (-1.59%) Microsoft $MSFT (-1.05%) and Crowdstrike $CRWD (+2.85%)

On the losers' side, there is also little new: In addition to Encavis $ECV (-0.06%) and Block $SQ (+1.31%) the main loser here is of course China with my China ETF $MCHS (-0.07%)

However, the China ETF only accounts for ~2% of my portfolio in total. That's why I'm continuing to look at it for the time being. However, I have not made any additional purchases via a savings plan since January. For me, this is a classic hold position at the moment.

In January, I invested a total of ~1.300€ in total. As already mentioned in my 2023 portfolio statement, I will have to reduce my investments in 2024 for the time being, at least in the first half of the year. The reason for this is some private expenses.

As I also had to use some of my cash reserves for this, I only added ~€500 net to my assets.

Focusing purely on this key figure, January was one of the worst months in years - but monthly investments should pick up again in the second half of 2024 at the latest.

Purchases & sales:

- As mentioned, I bought in January for ~1.300€

- As always, my savings plans were executed:

- Blue ChipsNovo Nordisk $NOVO B LVMH $MC (-0.25%) Apple $AAPL (+1.34%) Home Depot $HD (+1.1%) Microsoft $MSFT (-1.05%) Nike $NKE (-6.85%) Starbucks $SBUX (-1.55%) Texas Instruments $TXN (-0.01%) Stryker $SYK (+1.48%)

- GrowthCrowdstrike $CRWD (+2.85%) MercadoLibre $MELI (+2.5%)

- ETFsMSCI World $XDWD Nikkei 225 $XDJP and the WisdomTree Global Quality Dividend Growth $GGRP

- CryptoBitcoin $BTC and Ethereum $ETH

- Sales there were none in January

In total, my portfolio now stands at ~268.000€. This corresponds to an absolute increase of ~€16,000 in January. ~15.000€ of this comes from price gains, ~140€ from dividends / interest and ~500€ from additional investments.

In absolute figures, January was the best month ever with the above-mentioned ~€15,000 price gains. I normally have to go to work for ~4 months to earn this money!

Dividend:

- The dividends in January were +37% above the previous year at ~€115

- Nike had a very unfavorable dividend policy last year and this year. The fourth dividend payment unfortunately only came in January. As a result, Nike paid out 3x in 2023 and will pay out 5x this year. In order to achieve better comparability, I recorded the dividend in December in Portfolio Performance as usual. If I had recorded the dividend in January, the growth would even be +50%

- The announcement of a dividend at Meta is also exciting $META (-2.23%)

- The big tech companies are generating endless cash flows, so it is only a matter of time before this money has to flow to shareholders. That leaves only Amazon $AMZN (+0.26%) and Alphabet $GOOG (+1.03%) as Microsoft and Apple have been paying dividends for a long time now

- I am curious to see whether these two companies will soon follow the Meta example and become dividend payers

With the continued very positive outlook for Big Tech, I am optimistic that the target for this year (€300,000 by the end of 2024) should definitely be achievable. Even if I have to significantly reduce my investments compared to the last few years.

What are your favorites for this year?

After 2023 clearly belonged to NVIDIA, Meta, Novo Nordisk and Eli Lilly, I wonder who the big winners will be in 2024?

If you look at January, these stocks are once again at the top.

In my view, however, this cannot continue for the whole year and there will certainly be other winners.

Where do you see exciting long-term opportunities for the rest of the year?

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy

#tech